China's Leadership Transition

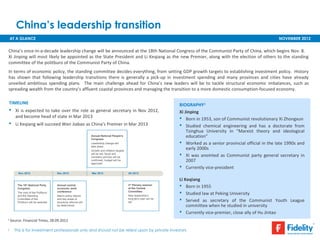

- 1. China’s leadership transition AT A GLANCE NOVEMBER 2012 China’s once-in-a-decade leadership change will be announced at the 18th National Congress of the Communist Party of China, which begins Nov. 8. Xi Jinping will most likely be appointed as the State President and Li Keqiang as the new Premier, along with the election of others to the standing committee of the politburo of the Communist Party of China. In terms of economic policy, the standing committee decides everything, from setting GDP growth targets to establishing investment policy. History has shown that following leadership transitions there is generally a pick-up in investment spending and many provinces and cities have already unveiled ambitious spending plans. The main challenge ahead for China’s new leaders will be to tackle structural economic imbalances, such as spreading wealth from the country’s affluent coastal provinces and managing the transition to a more domestic consumption-focused economy. TIMELINE BIOGRAPHY1 Xi is expected to take over the role as general secretary in Nov 2012, Xi Jinping and become head of state in Mar 2013 Born in 1953, son of Communist revolutionary Xi Zhongxun Li Keqiang will succeed Wen Jiabao as China’s Premier in Mar 2013 Studied chemical engineering and has a doctorate from Tsinghua University in “Marxist theory and ideological Annual National People’s Congress: education” Leadership change will Worked as a senior provincial official in the late 1990s and take place Growth and inflation targets early 2000s will be set, fiscal and monetary policies will be Xi was anointed as Communist party general secretary in confirmed, budget will be 2007 approved Currently vice-president Nov 2012 Dec 2012 Mar 2013 2H 2013 Li Keqiang The 18th National Party Congress: Annual central economic work 3rd Plenary session of the Central Born in 1955 conference: Committee: The core of the Politburo and the Standing Macro policy stance New leadership’s Studied law at Peking University Committee of the Politburo will be selected and key areas of structural reforms will long-term plan will be set Served as secretary of the Communist Youth League be determined committee when he studied in university Currently vice-premier, close ally of Hu Jintao 1 Source: Financial Times, 28.09.2012 1 This is for investment professionals only and should not be relied upon by private investors

- 2. China’s leadership transition AT A GLANCE NOVEMBER 2012 ECONOMIC CHALLENGES AHEAD The new leaders are poised to inherit the weakest economic growth since Deng Xiaoping headed the leadership three decades ago. In the wake of asset bubbles and inflation battles, the central economic issue now is for government to guide the economy to a reasonably safe landing and then focus on spreading wealth. Major tasks: to curb state enterprises, boost access to credit for private companies, raise domestic consumption, support rural incomes. The young, cheap labour pool that has supported China’s manufacturing expansion is ending; new leadership will need to manage rising wages without sparking another round of inflation or pricing Chinese labour out of markets amid increased competition from frontier Asian economies. THE RECENT BACKDROP CHINA GDP STABILISES AS TRANSITION CONTINUES Based on past experience, many China watchers are expecting fresh 160,000 18 stimulus to accompany the leadership change to aid the “feel-good” China GDP (Hundreads of millions Chinese Yuan) . China GDP (LHS) factor and bolster certain sections of the economy. However, any such 140,000 China GDP quarterly yoy % change (RHS) 16 announcements will likely be carefully calibrated, particularly in the 120,000 wake of recent evidence suggesting China’s economy has begun to 14 GDP quarterly yoy % change stabilise. China’s services industries rebounded in October from the 100,000 12 slowest expansion in at least 19 months, adding to manufacturing gains 80,000 that indicate China’s economy is recovering. The purchasing managers’ 10 index rose to 55.5 in October from 53.7 in the previous month, 60,000 according to the national Bureau of Statistics and China Federation of 40,000 8 Logistics and Purchasing2. The data followed two previous reports 6 indicating a pick-up in manufacturing activity. In October it was 20,000 announced that China GDP grew 7.4% in Q3 from a year earlier, only - 4 slightly down from 7.6% in Q2. Q3 2002 Q3 2003 Q3 2004 Q3 2005 Q3 2006 Q3 2007 Q3 2008 Q3 2009 Q3 2010 Q3 2011 Q3 2012 2 Source: Bloomberg news, 05.11.2012 Source: Datastream, data as at 30.09.2012 2 This is for investment professionals only and should not be relied upon by private investors

- 3. China’s leadership transition AT A GLANCE NOVEMBER 2012 Putting the latest economic data to one side, China’s new leadership is not expected to deviate too much from the already announced 12th 5-year plan – what we are likely to get in the next few years is some real flesh on the bone. Namely more detail on how China plans to reorient the economy from exports to consumption, how it plans to redirect spending from fixed assets (currently around 50% of GDP) to consumption, and how it aims to maintain social harmony amid rapid urbanization and increasing political awareness from a tech-savvy public. Other challenges include supporting services-oriented growth and strengthening the private provision of pensions and health care. Key areas of the 12th Five-Year Plan: Economic restructuring Accepting a lower annual growth rate of around 7% (from 7.5% in the 11th plan) Creating a balanced economy Shifting from the export-led sectors to increasing domestic consumer demand by increasing wages Development of Strategic Emerging Industries Industrial catch-up Social balancing Narrowing the urban-rural income gap Regional development Improving people's livelihoods Environmental protection Energy saving Improving environmental quality Developing new energy sources 3 This is for investment professionals only and should not be relied upon by private investors

- 4. China’s leadership transition AT A GLANCE NOVEMBER 2012 KEY POLITICAL ISSUES TO WATCH More scrutiny than ever on this leadership change as Chinese people use the power of the internet and social networking to discuss events, question government decisions, and debate policy. Bo Xilai scandal in the run-up to election put the spotlight on alleged corruption in high places, increased the stakes and intrigue surrounding the struggle for power among China’s elite. Increasingly complex political debate between neoliberals – who want to take China further down an economic liberalization path, neo-Maoists – who want to strengthen the state and break the “cozy” ties between state-owned enterprises and China’s affluent elite, and so-called neo- Confucians – who would like to give China a softer, more ethics-driven voice in the modern world. Increasingly difficult foreign policy decisions, including how to secure continued access to the energy resources needed to drive China’s rapid growth, growing tensions with Asian neighbours such as Japan and Korea over disputed islands, and how to react to the US move to strengthen its security focus on the Asia Pacific region. CHINA EQUITY INDEX PERFORMANCE EQUITY MARKET 7000 Mainland China stocks continue to trade near Shanghai Composite Index 6000 historically low valuations of around 9-10 times 200-day moving average next year’s expected earnings. 5000 Removal of leadership uncertainty could see Index level 4000 market rally as implementation of 5-Year Plan 3000 gathers steam. 2000 Consumer sector likely to benefit as China 1000 continues transition away from export dependence to a domestic consumption-driven economic 0 model. 2005 2006 2007 2008 2009 2010 2011 2012 Source: Bloomberg, data as at 05.11.2012 4 This is for investment professionals only and should not be relied upon by private investors

- 5. China’s leadership transition AT A GLANCE NOVEMBER 2012 “China’s leadership change is an historic event, and one that I think will help further cement China’s place among the World’s great economic powers. The leadership issue and the subsequent infighting among potential candidates has been more public than ever before. This gave the impression of political uncertainty and has been a strong headwind to performance of the Chinese market this year. As uncertainty over political leadership has dragged, many local authorities have waited on the sidelines and have not implemented economic policies announced at the last Five-Year Plan. I believe the conclusion to this contest will remove the political shackles that have been holding back the markets and we will also see a pick-up in the implementation of the Five-Year Plan. Furthermore, I think the new leadership will be willing to accept lower GDP growth as it will focus on quality rather than quantity of GDP growth. This means a continued focus on the domestic consumer and further enforces structural growth opportunities in consumer-related stocks. Overall, I see this event as positive for the Chinese market, and believe that there are many companies with strong fundamentals, which have been indiscriminately punished by political uncertainty, trading at attractive valuations. Martha Wang, Portfolio Manager, Fidelity China Focus Fund “China’s upcoming leadership change is a hot topic, but all of the candidates have already been pre-elected and I do not anticipate any surprises. I expect more scholars to join the think tank and further financial and private sector reforms. In general, I think that this political change will be relatively gradual and nothing drastic will take place as China’s economic agenda is always guided by the Five-Year Plan. Going forward, more focus will be placed on the acceleration of urbanization and income re-distribution. Overall, I believe that a more pro-consumption policy will be in place to drive domestic demand and, as a result, consumer sectors will continue to benefit.” Raymond Ma, Portfolio Manager, Fidelity China Consumer Fund This document is provided for information purposes only. This document is intended only for the person or entity to which it is provided. It must not be reproduced or circulated to any other party without prior permission of Fidelity. This document does not constitute a distribution, an offer or solicitation to engage the investment management services of Fidelity, an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction or country where such distribution or offer is not authorised or would be contrary to local laws or regulations. Fidelity makes no representations that the contents are appropriate for use in all locations, or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries, or by all investors or counterparties. All persons and entities accessing the information do so on their own initiative and are responsible for compliance with applicable local laws and regulations and should consult their professional advisers. This document may contain materials from third parties which is supplied by companies that are not affiliated with any Fidelity entity ("Third Party Content"). Fidelity has not been involved in the preparation, adoption or editing of such third party materials and does not explicitly or implicitly endorse or approve such content. Any opinions or recommendations expressed on third party materials are solely those of the independent providers, not of Fidelity. Third Party Content is provided for informational purposes only, and Fidelity shall not be liable for any loss or damage arising from your reliance upon such information. Fidelity is not authorised to manage or distribute investment funds or products in, or to provide investment management or advisory services to persons resident in, the mainland China. FIL Limited and its subsidiaries are commonly referred to as Fidelity. Fidelity only gives information about its products and services. Any person considering an investment should seek independent advice on the suitability or otherwise of a particular investment. Fidelity, Fidelity Worldwide Investment, the Fidelity Worldwide Investment logo and F symbol are trademarks of FIL Limited. 5 This is for investment professionals only and should not be relied upon by private investors

- 6. China’s leadership transition AT A GLANCE NOVEMBER 2012 “China’s leadership change is an historic event, and one that I think will help further cement China’s place among the World’s great economic powers. The leadership issue and the subsequent infighting among potential candidates has been more public than ever before. This gave the impression of political uncertainty and has been a strong headwind to performance of the Chinese market this year. As uncertainty over political leadership has dragged, many local authorities have waited on the sidelines and have not implemented economic policies announced at the last Five-Year Plan. I believe the conclusion to this contest will remove the political shackles that have been holding back the markets and we will also see a pick-up in the implementation of the Five-Year Plan. Furthermore, I think the new leadership will be willing to accept lower GDP growth as it will focus on quality rather than quantity of GDP growth. This means a continued focus on the domestic consumer and further enforces structural growth opportunities in consumer-related stocks. Overall, I see this event as positive for the Chinese market, and believe that there are many companies with strong fundamentals, which have been indiscriminately punished by political uncertainty, trading at attractive valuations. Martha Wang, Portfolio Manager, Fidelity China Focus Fund “China’s upcoming leadership change is a hot topic, but all of the candidates have already been pre-elected and I do not anticipate any surprises. I expect more scholars to join the think tank and further financial and private sector reforms. In general, I think that this political change will be relatively gradual and nothing drastic will take place as China’s economic agenda is always guided by the Five-Year Plan. Going forward, more focus will be placed on the acceleration of urbanization and income re-distribution. Overall, I believe that a more pro-consumption policy will be in place to drive domestic demand and, as a result, consumer sectors will continue to benefit.” Raymond Ma, Portfolio Manager, Fidelity China Consumer Fund This document is provided for information purposes only. This document is intended only for the person or entity to which it is provided. It must not be reproduced or circulated to any other party without prior permission of Fidelity. This document does not constitute a distribution, an offer or solicitation to engage the investment management services of Fidelity, an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction or country where such distribution or offer is not authorised or would be contrary to local laws or regulations. Fidelity makes no representations that the contents are appropriate for use in all locations, or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries, or by all investors or counterparties. All persons and entities accessing the information do so on their own initiative and are responsible for compliance with applicable local laws and regulations and should consult their professional advisers. This document may contain materials from third parties which is supplied by companies that are not affiliated with any Fidelity entity ("Third Party Content"). Fidelity has not been involved in the preparation, adoption or editing of such third party materials and does not explicitly or implicitly endorse or approve such content. Any opinions or recommendations expressed on third party materials are solely those of the independent providers, not of Fidelity. Third Party Content is provided for informational purposes only, and Fidelity shall not be liable for any loss or damage arising from your reliance upon such information. Fidelity is not authorised to manage or distribute investment funds or products in, or to provide investment management or advisory services to persons resident in, the mainland China. FIL Limited and its subsidiaries are commonly referred to as Fidelity. Fidelity only gives information about its products and services. Any person considering an investment should seek independent advice on the suitability or otherwise of a particular investment. Fidelity, Fidelity Worldwide Investment, the Fidelity Worldwide Investment logo and F symbol are trademarks of FIL Limited. 5 This is for investment professionals only and should not be relied upon by private investors