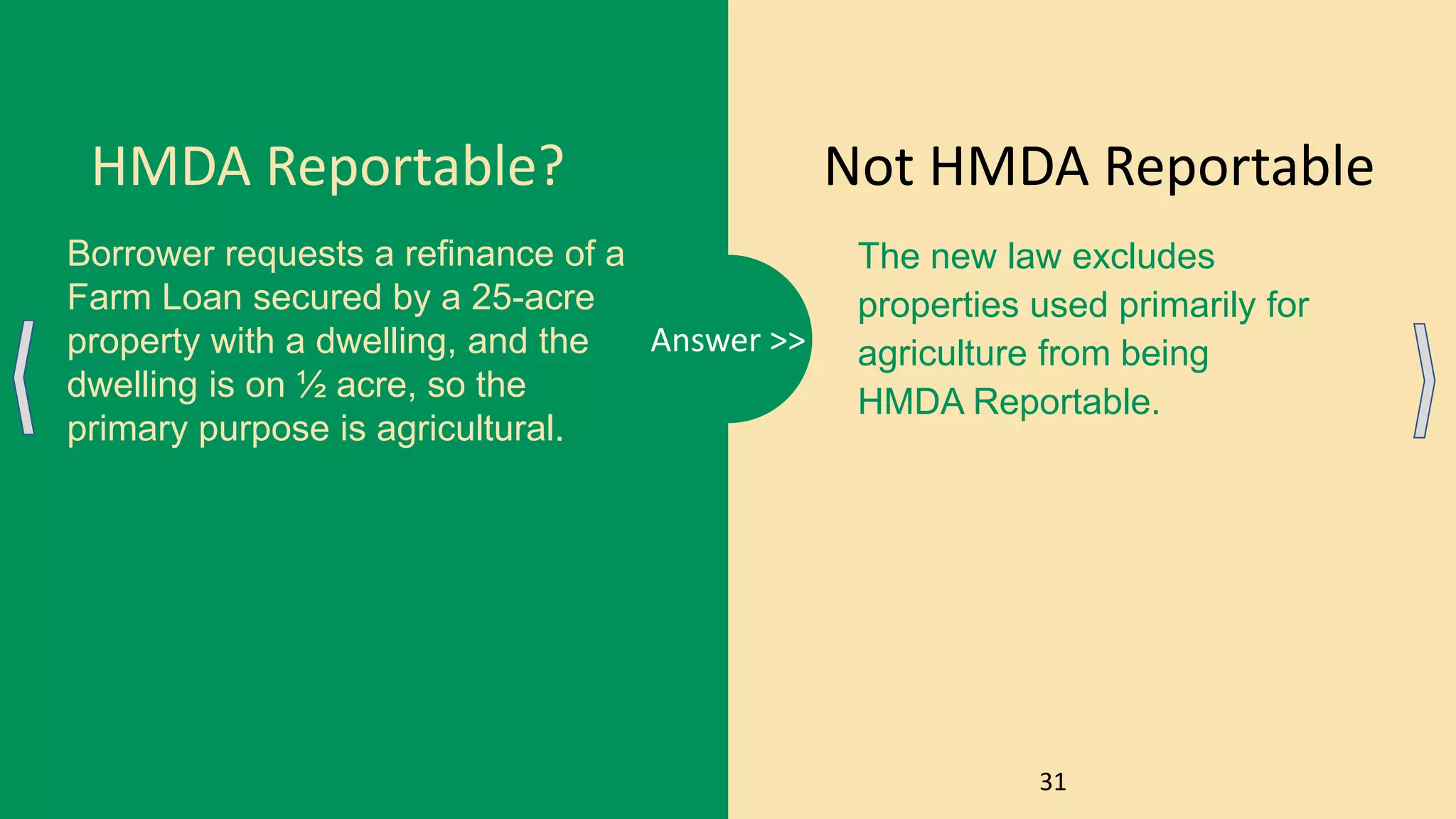

The document outlines the requirements under the Home Mortgage Disclosure Act (HMDA) which mandates lending institutions to report specific mortgage lending data. A loan application is HMDA-reportable if it is secured by a lien on a dwelling, serves one of the defined purposes (purchase, remodel, refinance), and is not excluded by certain criteria. Various examples illustrate what qualifies as HMDA-reportable versus non-reportable loans based on the nature of the dwelling and the loan's purpose.