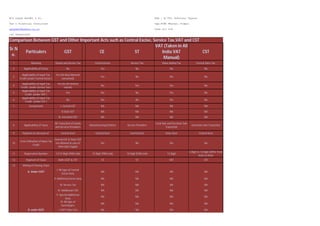

Comparison Between GST and Other Important Acts

- 1. M/s Dipak Gandhi & Co. Add : A-705, Kohinoor Vayona Tax & Financial Consultant Opp.PCMC Bhavan, Pimpri gdipak09@yahoo.co.in Pune 411 018 +91 9960410281 Comparison Between GST and Other Important Acts such as Central Excise, Service Tax,VAT and CST Sr.N o. Particulers GST CE ST VAT (Taken in All India VAT Manual) CST 1 Meaning Goods and Service Tax Central Excise Service Tax Value Added Tax Central Sales Tax 2 Applicability of Excise No Yes No No No 3 Applicability of Input Tax Credit (under Central Excise ) Yes (On Raw Material consumed) Yes No No No 4 Applicability of Input Tax Credit (under Service Tax ) Yes (to the limited extent) No Yes No No 5 Applicability of Input Tax Credit (under VAT ) Yes No No Yes No 6 Applicability of Input Tax Credit (under CST ) No No No No No 7 Components I. Central GST NA NA NA NA II.State GST NA NA NA NA III. Interated GST NA NA NA NA 8 Applicability of Taxes All Transction of Goods and Services Providers Manufacturing Entitites Service Providers Local Sale and Purchase Sale Transction Interstate Sale Transction 9 Payment on Account of Central Govt Central Govt Central Govt State Govt Central Govt 10 Cross Utilisation of Input Tax Credit Central GST & State GST not allowed in case of Interstate Supply No No No No 11 Registration Number 13/15 Digit (PAN Link) 15 Digit (PAN Link) 15 Digit (PAN Link) 12 Digit 6 Digit to 12 Digit (Differ from state to State 12 Payment of Taxes Both CGST & CST CE ST VAT CST 13 Mixing of Existing Taxes A. Under CGST I. All type of Central Excise Duty NA NA NA NA II. Additional Excise duty NA NA NA NA III. Service Tax NA NA NA NA IV. Additional CVD NA NA NA NA V. Special Additional Duty NA NA NA NA VI. All type of Surchargers NA NA NA NA B. under SGST I. VAT/ Sales Tax NA NA NA NA

- 2. M/s Dipak Gandhi & Co. Add : A-705, Kohinoor Vayona Tax & Financial Consultant Opp.PCMC Bhavan, Pimpri gdipak09@yahoo.co.in Pune 411 018 +91 9960410281 Comparison Between GST and Other Important Acts such as Central Excise, Service Tax,VAT and CST Sr.N o. Particulers GST CE ST VAT (Taken in All India VAT Manual) CST II. Entertainment Tax NA NA NA NA III. Luxury Tax NA NA NA NA IV. Taxes of Games NA NA NA NA V. Entry Tax / Octroi NA NA NA NA 14 Not consider in GST I. Purchase Tax NA NA NA NA II. Stamp duty NA NA NA NA III. Vehicle Tax NA NA NA NA IV. Electricity Duty NA NA NA NA 15 Rate of Taxes 18% (Subject to Finalisation) 12.50% 14.50% Differ from state to State 0% to 5% (as the Case) 16 Rate of Taxes on Export 0% NIL NIL NIL NIL 17 Payment of IGST After Adjusting of IGST,SGST & CGST NA NA NA NA 18 Payment of SGST & CGST within 20 days after completing Tax Period NA NA NA NA 19 Date of Payment within 20 days after completing Tax Period within 30 days after completing Tax Period within 30 days after completing Tax Period within 30 days after completing Tax Period within 30 days after completing Tax Period 20 Status of Existing ACT NA Merged in GST Merged in GST Merged in GST Merged in GST 21 Applicable of ITC on Inter state Transctions Yes NA NA NA NA 22 GST Invoice Invoice format as per Local VAT ACT NA NA NA NA 23 Periodicity of Payment Monthly Monthly Monthly Monthly to Half yearly (As the case) Monthly 24 Benefits of GST I. Greater Tax Revenues NA NA NA NA II. No Cascading Effect NA NA NA NA III. Boost in Interstate Trade NA NA NA NA IV. Lower Inflation NA NA NA NA V. Higher Growth NA NA NA NA 25 Applicability of Statutory Forms NA NA NA NA Yes 26 Refund of Tax Within 2 Years After completion of Assessment After completion of Assessment After completion of Assessment Adjusted Against VAT 27 Applicability of Returns Monthly Monthly Monthly Monthly Monthly 28 Reversal of Tax Liability before filling of Return Yes Yes Within 6 Months Within 6 Months

- 3. M/s Dipak Gandhi & Co. Add : A-705, Kohinoor Vayona Tax & Financial Consultant Opp.PCMC Bhavan, Pimpri gdipak09@yahoo.co.in Pune 411 018 +91 9960410281 Comparison Between GST and Other Important Acts such as Central Excise, Service Tax,VAT and CST Sr.N o. Particulers GST CE ST VAT (Taken in All India VAT Manual) CST 29 Filling of Monthly Return within 20 days after completing Tax Period within 30 days after completing Tax Period within 6 Months after completing Tax Period within 30 days after completing Tax Period within 30 days after completing Tax Period 30 Filling of Annual Return at the end of Financial Year At the end of Accounting Year At the end of Accounting Year At the end of Accounting Year At the end of Accounting Year 31 Assessment Proceedings I. Assessment I. Assessment I. Assessment I. Assessment I. Assessment II .First Appeal at First Appellate Authority II . Appeal at Appellate Authority II . Appeal at Appellate Authority II . Appeal at Appellate Authority II . Appeal at Appellate Authority III. National GST Appellate Tribunal IV. Appelalte Tribunal IV. Appelalte Tribunal IV. Appelalte Tribunal IV. Appelalte Tribunal IV .Second Appeal at Appellate Authority V. Appeal to High Court V. Appeal to High Court V. Appeal to High Court V. Appeal to High Court VI. Appeal to High Court VI. Appeal to Supreme Court VI. Appeal to Supreme Court VI. Appeal to Supreme Court VI. Appeal to Supreme Court VII. Appeal to Supreme Court Note : This is Only for Information and Better understanding of GST