Sample Family Office Real Estate Study 2019

•Download as PPTX, PDF•

1 like•264 views

Sample parts of the 2019 FORE Study

Report

Share

Report

Share

Recommended

Recommended

Detailed overview of Square's IPO including its funding history, business operations, financial performance, public company comparables and relevant industry transactionsFT Partners Research: Square Completes its IPO Raising $243 million

FT Partners Research: Square Completes its IPO Raising $243 millionFT Partners / Financial Technology Partners

Demand for alternative assets remains strong as investors and plan sponsors seek asset diversification, higher yields, and uncorrelated returns. As a result, alternatives are a clear bright spot in the asset management industry. Despite significant headwinds, successful alternative asset managers are growing while many traditional asset managers have or are considering moving into the space. A similar trend is playing out among investment service providers -- traditional servicers are expanding their capabilities to include alternatives. As demand grows for alternative assets, a new FinTech ecosystem is developing to help investors, investment managers, and service providers to access new asset classes and manage their investments and operations with new data, software, and platforms.FT Partners Research: FinTech Meets Alternative Investments - Innovation in a...

FT Partners Research: FinTech Meets Alternative Investments - Innovation in a...FT Partners / Financial Technology Partners

Detailed overview of First Data's IPO including its funding history, business operations, financial performance, public company comparables and relevant industry transactionsFT Partners Research: First Data IPO - Post Quiet Period Review

FT Partners Research: First Data IPO - Post Quiet Period ReviewFT Partners / Financial Technology Partners

More Related Content

What's hot

Detailed overview of Square's IPO including its funding history, business operations, financial performance, public company comparables and relevant industry transactionsFT Partners Research: Square Completes its IPO Raising $243 million

FT Partners Research: Square Completes its IPO Raising $243 millionFT Partners / Financial Technology Partners

Demand for alternative assets remains strong as investors and plan sponsors seek asset diversification, higher yields, and uncorrelated returns. As a result, alternatives are a clear bright spot in the asset management industry. Despite significant headwinds, successful alternative asset managers are growing while many traditional asset managers have or are considering moving into the space. A similar trend is playing out among investment service providers -- traditional servicers are expanding their capabilities to include alternatives. As demand grows for alternative assets, a new FinTech ecosystem is developing to help investors, investment managers, and service providers to access new asset classes and manage their investments and operations with new data, software, and platforms.FT Partners Research: FinTech Meets Alternative Investments - Innovation in a...

FT Partners Research: FinTech Meets Alternative Investments - Innovation in a...FT Partners / Financial Technology Partners

Detailed overview of First Data's IPO including its funding history, business operations, financial performance, public company comparables and relevant industry transactionsFT Partners Research: First Data IPO - Post Quiet Period Review

FT Partners Research: First Data IPO - Post Quiet Period ReviewFT Partners / Financial Technology Partners

What's hot (20)

Small hedge Funds and the Shrinking Prime Brokerage Business

Small hedge Funds and the Shrinking Prime Brokerage Business

Everything You Need to Know about Preemptive Rights

Everything You Need to Know about Preemptive Rights

The changing face of the American Investor: Tools, Advice, and Do It Yourself...

The changing face of the American Investor: Tools, Advice, and Do It Yourself...

Ladder Capital - Investor Presentation (March 2021)

Ladder Capital - Investor Presentation (March 2021)

The Investment Opportunities behind Special-Purpose Acquisition Companies

The Investment Opportunities behind Special-Purpose Acquisition Companies

FT Partners Research: Square Completes its IPO Raising $243 million

FT Partners Research: Square Completes its IPO Raising $243 million

FT Partners Research: FinTech Meets Alternative Investments - Innovation in a...

FT Partners Research: FinTech Meets Alternative Investments - Innovation in a...

The Intersection of Construction & FinTech 10.06.20

The Intersection of Construction & FinTech 10.06.20

Overview for Prospective PSM Solar Tax Equity Investors

Overview for Prospective PSM Solar Tax Equity Investors

Robert Kinnun – Proactive Advisor Magazine – Volume 4, Issue 9

Robert Kinnun – Proactive Advisor Magazine – Volume 4, Issue 9

FT Partners Research: First Data IPO - Post Quiet Period Review

FT Partners Research: First Data IPO - Post Quiet Period Review

Similar to Sample Family Office Real Estate Study 2019

Similar to Sample Family Office Real Estate Study 2019 (20)

Mercer Capital's Value Matters™ | Issue 1 2015 | Managing Private Company Wea...

Mercer Capital's Value Matters™ | Issue 1 2015 | Managing Private Company Wea...

Governance mechanisms for unlisted family businesses

Governance mechanisms for unlisted family businesses

Mercer Capital's Value Matters™ | Issue No. 2, 2018

Mercer Capital's Value Matters™ | Issue No. 2, 2018

Mercer Capital's Value Matters™ | Issue No. 2 2018

Mercer Capital's Value Matters™ | Issue No. 2 2018

Equity vs Value - Women in Blockchain & Finance Insights

Equity vs Value - Women in Blockchain & Finance Insights

The 15 Owner-Related Business Principles of Warren Buffett

The 15 Owner-Related Business Principles of Warren Buffett

Recently uploaded

Recently uploaded (20)

9990771857 Call Girls in Dwarka Sector 1 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 1 Delhi (Call Girls) Delhi

M3M The Line Brochure - Premium Investment Opportunity for Commercial Ventures

M3M The Line Brochure - Premium Investment Opportunity for Commercial Ventures

TENANT SCREENING REPORT SERVICES How Tenant Screening Reports Work

TENANT SCREENING REPORT SERVICES How Tenant Screening Reports Work

Cheap Rate ✨➥9711108085▻✨Call Girls In Malviya Nagar(Delhi)

Cheap Rate ✨➥9711108085▻✨Call Girls In Malviya Nagar(Delhi)

Greater Vancouver Realtors Statistics Package April 2024

Greater Vancouver Realtors Statistics Package April 2024

Best Deal Virtual Space in Satya The Hive Tata Zudio 750 Sqft 1.89 Cr All inc...

Best Deal Virtual Space in Satya The Hive Tata Zudio 750 Sqft 1.89 Cr All inc...

9990771857 Call Girls Dwarka Sector 9 Delhi (Call Girls ) Delhi

9990771857 Call Girls Dwarka Sector 9 Delhi (Call Girls ) Delhi

Retail Center For Sale - 1019 River St., Belleville, WI

Retail Center For Sale - 1019 River St., Belleville, WI

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

David Litt Foreclosure Specialist - Your Partner in Real Estate Success

David Litt Foreclosure Specialist - Your Partner in Real Estate Success

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

2k Shots ≽ 9205541914 ≼ Call Girls In Sainik Farm (Delhi)

2k Shots ≽ 9205541914 ≼ Call Girls In Sainik Farm (Delhi)

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

Sample Family Office Real Estate Study 2019

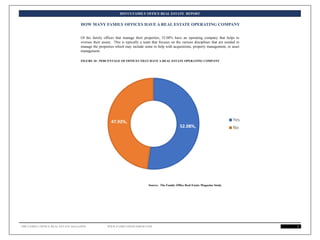

- 1. 2019 US FAMILY OFFICE REAL ESTATE REPORT 1 HOW MANY FAMILY OFFICES HAVE A REAL ESTATE OPERATING COMPANY 52.08%, 47.92%, Yes No Source: The Family Office Real Estate Magazine Study FIGURE 10 : PERCENTAGE OF OFFICES THAT HAVE A REAL ESTATE OPERATING COMPANY Of the family offices that manage their properties, 52.08% have an operating company that helps to oversee their assets. This is typically a team that focuses on the various disciplines that are needed to manage the properties which may include some to help with acquisitions, property management, or asset management. THE FAMILY OFFICE REAL ESTATE MAGAZINE WWW.FAMILYOFFICEREM.COM

- 2. 2019 US FAMILY OFFICE REAL ESTATE REPORT 2 HOW FAMILY OFFICES INVEST INTO REAL ESTATE 28.40% 29.01% 40.74% 1.85% Only in your own deals As the GP As the LP I don't invest in Direct Real Estate HOW A FAMILY OFFICE HAVE THEIR REAL ESTATE ASSETS MANAGED 26.67% 19.05% 54.29% We manage our real estate internally We use outside managers we use both FIGURE 8: HOW INVESTMENTS ARE MADE INTO DIRECT DEALS (more than one choice could be made) FIGURE 9: USE OF REAL ESTATE MANAGEMENT Over the last few years, direct investing has been on the rise with family offices from private equity to venture capital to real estate. This trend is continuing with 40.74% of family offices investing only as the LP. 29.01% investing only as the GP and 28.40% only investing in their deals. As all boats rise in a rising tide, the question is what will happen when the market turns and goes back into a recession, which will happen one day. Will these family offices have done the proper due diligence to weather the storm, or will family offices start to look at funds again that provide professional management with a diversified portfolio. We believe many family offices will. Family offices that created their wealth in real estate, or has an internal platform will manage their real estate internally. However, when the resources are not available to manage them themselves, they will turn to third parties to help. The exception is properties that are nearby where they live. Source: The Family Office Real Estate Magazine Study Source: The Family Office Real Estate Magazine Study THE FAMILY OFFICE REAL ESTATE MAGAZINE WWW.FAMILYOFFICEREM.COM

- 3. 2019 US FAMILY OFFICE REAL ESTATE REPORT 3 THE MOTIVATION BEHIND WHY FAMILY OFFICES INVEST INTO REAL ESTATE BEYOND RETURNS (multiple answers were permitted) 0.0% 20.0% 40.0% 60.0% 80.0% Location Costs Opportunities to invest directly Level of control Tax benefits Liquidity Level of diversification Legal security Understanding of the laws and… Opportunity to partner with other… Opportunity to make a positive social… Ability to create generational wealth Other 38.2% 5.8% 61.7% 47.0% 55.8% 8.8% 52.9% 2.9% 14.7% 26.4% 17.6% 76.4% 2.9% Source: The Family Office Real Estate Magazine Study Family offices want to use real estate to create generational wealth (76.4%) but also enjoy being able to invest directly into real estate (61.7%) This is due to the ability to understand precisely what they are investing into and to have some control. Family offices do understand that real estate is an integral part of a portfolio as it provides diversification provides tax benefits. FIGURE 14: MOTIVATION TO INVEST INTO REAL ESTATE THE FAMILY OFFICE REAL ESTATE MAGAZINE WWW.FAMILYOFFICEREM.COM