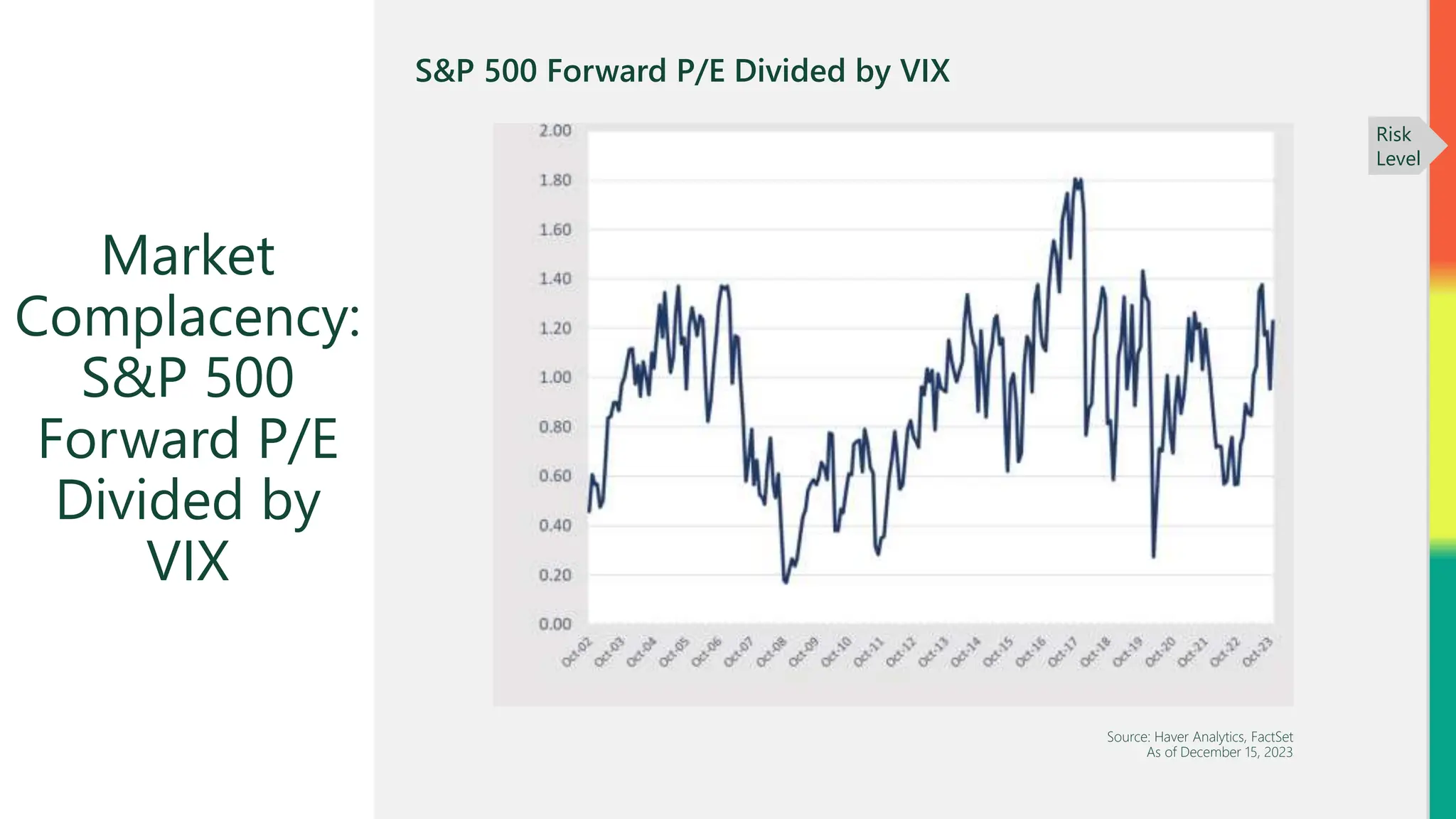

The December 2023 market risk update highlights ongoing recession risks, with historical correlations between recessions and market downturns. It notes a significant rise in margin debt and market complacency, indicating potential vulnerabilities as the economy continues to expand. The document emphasizes the importance of monitoring these indicators as we approach 2024 amidst an evolving economic landscape.