Blackstone cairo causa solferino

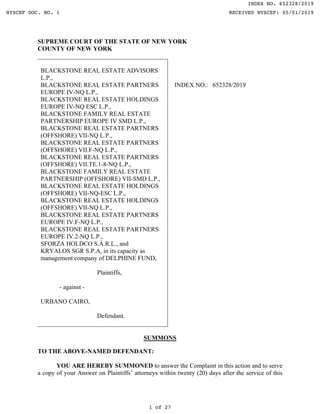

- 1. SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK BLACKSTONE REAL ESTATE ADVISORS L.P., BLACKSTONE REAL ESTATE PARTNERS EUROPE IV-NQ L.P., BLACKSTONE REAL ESTATE HOLDINGS EUROPE IV-NQ ESC L.P., BLACKSTONE FAMILY REAL ESTATE PARTNERSHIP EUROPE IV SMD L.P., BLACKSTONE REAL ESTATE PARTNERS (OFFSHORE) VII-NQ L.P., BLACKSTONE REAL ESTATE PARTNERS (OFFSHORE) VII.F-NQ L.P., BLACKSTONE REAL ESTATE PARTNERS (OFFSHORE) VII.TE.1-8-NQ L.P., BLACKSTONE FAMILY REAL ESTATE PARTNERSHIP (OFFSHORE) VII-SMD L.P., BLACKSTONE REAL ESTATE HOLDINGS (OFFSHORE) VII-NQ-ESC L.P., BLACKSTONE REAL ESTATE HOLDINGS (OFFSHORE) VII-NQ L.P., BLACKSTONE REAL ESTATE PARTNERS EUROPE IV.F-NQ L.P., BLACKSTONE REAL ESTATE PARTNERS EUROPE IV.2-NQ L.P., SFORZA HOLDCO S.À.R.L., and KRYALOS SGR S.P.A, in its capacity as management company of DELPHINE FUND, Plaintiffs, - against - URBANO CAIRO, Defendant. INDEX NO.: 652328/2019 SUMMONS TO THE ABOVE-NAMED DEFENDANT: YOU ARE HEREBY SUMMONED to answer the Complaint in this action and to serve a copy of your Answer on Plaintiffs’ attorneys within twenty (20) days after the service of this INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 1 of 27

- 2. 2 Summons, exclusive of the date of service (or within thirty (30) days after the service is complete if this Summons is not personally delivered to you within the State of New York); and in case of your failure to appear or answer, judgment will be taken against you by default for the relief demanded therein. New York County is designated as the place of trial pursuant to CPLR § 503. Dated: New York, New York April 22, 2019 TO: Urbano Cairo Via Tamburini Pietro 10 20123 Milano, Italy Respectfully submitted, /s/ Lamina Bowen ____________________ Lamina Bowen KIRKLAND & ELLIS LLP 601 Lexington Avenue New York, New York 10022 Telephone: (212) 446-4800 Facsimile: (212) 446-4900 Email: lamina.bowen@kirkland.com Counsel to Plaintiffs Blackstone Real Estate Advisors L.P., Blackstone Real Estate Partners Europe IV-NQ L.P., Blackstone Real Estate Holdings Europe IV-NQ ESC L.P., Blackstone Family Real Estate Partnership Europe IV SMD L.P., Blackstone Real Estate Partners (Offshore) VII-NQ L.P., Blackstone Real Estate Partners (Offshore) VII.F-NQ L.P., Blackstone Real Estate Partners (Offshore) VII.TE.1-8-NQ L.P., Blackstone Family Real Estate Partnership (Offshore) VII-SMD L.P., Blackstone Real Estate Holdings (Offshore) VII-NQ-ESC L.P., Blackstone Real Estate Holdings (Offshore) VII-NQ L.P., Blackstone Real Estate Partners Europe IV.F-NQ L.P., Blackstone Real Estate Partners Europe IV.2- NQ L.P., Sforza Holdco S.à.r.l., and Kryalos SGR S.p.A, in its capacity as management company of Delphine Fund INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 2 of 27

- 3. SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK BLACKSTONE REAL ESTATE ADVISORS L.P., BLACKSTONE REAL ESTATE PARTNERS EUROPE IV-NQ L.P., BLACKSTONE REAL ESTATE HOLDINGS EUROPE IV-NQ ESC L.P., BLACKSTONE FAMILY REAL ESTATE PARTNERSHIP EUROPE IV SMD L.P., BLACKSTONE REAL ESTATE PARTNERS (OFFSHORE) VII-NQ L.P., BLACKSTONE REAL ESTATE PARTNERS (OFFSHORE) VII.F-NQ L.P., BLACKSTONE REAL ESTATE PARTNERS (OFFSHORE) VII.TE.1-8-NQ L.P., BLACKSTONE FAMILY REAL ESTATE PARTNERSHIP (OFFSHORE) VII-SMD L.P., BLACKSTONE REAL ESTATE HOLDINGS (OFFSHORE) VII-NQ-ESC L.P., BLACKSTONE REAL ESTATE HOLDINGS (OFFSHORE) VII-NQ L.P., BLACKSTONE REAL ESTATE PARTNERS EUROPE IV.F-NQ L.P., BLACKSTONE REAL ESTATE PARTNERS EUROPE IV.2-NQ L.P., SFORZA HOLDCO S.À.R.L., and KRYALOS SGR S.P.A, in its capacity as management company of the DELPHINE FUND, Plaintiffs, - against - URBANO CAIRO, Defendant. INDEX NO.: 652328/2019 COMPLAINT Plaintiffs Blackstone Real Estate Advisors L.P. (“Blackstone”), Blackstone Real Estate Partners Europe IV-NQ L.P., Blackstone Real Estate Holdings Europe IV-NQ ESC L.P., Blackstone Family Real Estate Partnership Europe IV SMD L.P., Blackstone Real Estate Partners INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 3 of 27

- 4. 2 (Offshore) VII-NQ L.P., Blackstone Real Estate Partners (Offshore) VII.F-NQ L.P., Blackstone Real Estate Partners (Offshore) VII.TE.1-8-NQ L.P., Blackstone Family Real Estate Partnership (Offshore) VII-SMD L.P., Blackstone Real Estate Holdings (Offshore) VII-NQ-ESC L.P., Blackstone Real Estate Holdings (Offshore) VII-NQ L.P., Blackstone Real Estate Partners Europe IV.F-NQ L.P., Blackstone Real Estate Partners Europe IV.2-NQ L.P. (collectively, the “Blackstone Entities”), Sforza Holdco S.à.r.l. (“Sforza”), and Kryalos SGR S.p.A (“Kryalos”), in its capacity as management company of the Delphine Fund (“Delphine”; Blackstone, the Blackstone Entities, Sforza, and Kryalos collectively referred to as “Plaintiffs” or the “Purchasing Group”) bring the following action seeking monetary relief against Defendant Urbano Cairo and allege as follows: NATURE AND SUMMARY OF THE ACTION 1. By this action, Plaintiffs seek redress for Defendant Urbano Cairo’s malicious interference with Plaintiffs’ nearly completed sale of certain properties to a third party—properties Plaintiffs purchased more than five years ago from a company, RCS Media Group S.p.A. (“RCS”), that Mr. Cairo now controls today. Mr. Cairo is the Chairman, Chief Executive Officer and controlling shareholder of RCS. He took control of RCS in 2016, as the result of a hostile takeover. 2. In 2013, years before Mr. Cairo seized control of RCS, Plaintiffs purchased from RCS, following a broad and lengthy sales process conducted by RCS and its advisors, certain commercial buildings in Milan, Italy (the “Properties”), and Plaintiffs leased the Properties back to RCS (collectively, the “2013 Transaction”). At the time of the 2013 Transaction, Mr. Cairo owned less than 3% of RCS and was not a member of RCS’s Board of Directors, nor was he part of management of RCS. 3. Two years after the 2013 Transaction, RCS vacated a majority of the Properties. Thereafter, Plaintiffs invested substantial funds in renovating and improving the vacated portions INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 4 of 27

- 5. 3 of the Properties, and, over time and with significant efforts, Plaintiffs attracted new commercial anchor tenants to bring the Properties to full occupancy. 4. Having substantially increased the value of the Properties over the past five years (during which period RCS never complained about the 2013 Transaction), Plaintiffs sought in 2018 to sell their interests in the Properties. In this connection, and after a process of several months, Plaintiffs entered into a letter of interest on June 14, 2018 to sell their interests in the Properties to a prospective purchaser, Allianz Real Estate GmbH (“Allianz”). Plaintiffs and Allianz had agreed on all material terms for the sale of Plaintiffs’ interests in the Properties, and, as of July 2018, Plaintiffs and Allianz were on a path to closing the contemplated sale. 5. Plaintiffs’ contemplated sale of their interests in the Properties to Allianz was reported in the media on July 10, 2018. Three days later, on July 13, after learning that Plaintiffs were nearing consummation of a sale of their interests in the Properties, Mr. Cairo claimed for the first time that the 2013 Transaction is somehow “null and void” and should be unwound, slandering Plaintiffs’ title to the Properties and interfering with Plaintiffs’ contemplated transaction to sell their interests in the Properties to Allianz. Following Mr. Cairo’s assertion of these false and malicious claims, Allianz has indicated that it will not go forward with the transaction unless and until such claims are withdrawn. 6. Mr. Cairo’s claim that the 2013 Transaction should now be voided and title to the Properties returned to RCS is malicious and absolutely baseless, and his conduct here is purely extortive. As Mr. Cairo, a substantial RCS shareholder at the time, well knows, the sales process for the Properties undertaken in 2013 by RCS’s prior management team was a competitive bidding contest initiated and conducted by RCS and its legal and financial advisors, wherein RCS solicited offers from at least 30 real estate investors, including the Blackstone Entities and many other INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 5 of 27

- 6. 4 investment firms based in New York. Over a period of several months in 2013, RCS received numerous offers, negotiated increases in proposed purchasing prices (including from Plaintiffs), and ultimately elected to sell to Plaintiffs because, according to RCS, Plaintiffs presented “the most attractive bid” that was “substantially in line with the valuation by a leading real estate advisor.” And, RCS’s sale process for the Properties in 2013 was not only guided by highly sophisticated financial and legal advisors, but it was actively led by RCS’s experienced and engaged management team and Board of Directors and was overseen and monitored by the company’s esteemed Board of Statutory Auditors. The notion that Plaintiffs somehow defrauded or coerced RCS into selling them the Properties has not even a whisper of factual or legal support. 7. In response to RCS’s and Mr. Cairo’s efforts to extort Plaintiffs, among other things, Plaintiffs sent a letter on November 8, 2018 to Mr. Cairo and the other RCS board members demanding that Mr. Cairo disavow his statements challenging the legitimacy of Plaintiffs’ interest in the Properties. In that November 8th letter, Plaintiffs warned that unless Mr. Cairo’s statements were immediately disavowed, Plaintiffs would commence an action in New York seeking redress for this slanderous and extortive conduct. The next day, November 9, 2018, after receiving Plaintiffs’ letter promising the commencement of a lawsuit in New York, RCS rushed to initiate an arbitration in Milan against Plaintiff Kryalos, seeking a declaration that the 2013 Transaction was void. Shortly thereafter, on November 20, 2018, Plaintiffs filed suit against RCS in this Court seeking redress for RCS’s conduct in maliciously interfering with Plaintiffs’ nearly contemplated sale of the Properties, as well as for RCS’s multiple breaches of contract. (Index No. 655790/2018.) Since the commencement of these legal proceedings, Mr. Cairo has only doubled down on his efforts to slander Plaintiffs’ title in the Properties and interfere with Plaintiffs’ ability to sell the Properties. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 6 of 27

- 7. 5 8. Blackstone, including the Blackstone Entities and its other affiliates, is a large, regulated, and long-term New York-based investor with investments worldwide that has fiduciary obligations to its investors—some of the world’s largest and most reputable pension plans, sovereign wealth funds, and public and private endowments. It is on behalf of these highly institutional beneficiaries that the Blackstone Entities make investments. For example, the investment in the Properties by the Blackstone Entities was ultimately made by, among others, New York-based pension funds, universities, and other institutions, as investors in the funds controlled by the Blackstone Entities. It is therefore ultimately on behalf of these investors that Plaintiffs seek redress for Mr. Cairo’s malicious and extortive conduct. 9. Plaintiffs’ action against RCS in this Court is in its early stages. It is Plaintiffs’ intention to request that this action be consolidated with their action against RCS. 10. Plaintiffs, and their investors, have already incurred damages in the form of legal and other expenses arising from Mr. Cairo’s misconduct. Should Plaintiffs’ sale of their interests in the Properties be further delayed, or worse, should Plaintiffs lose the opportunity to sell their interests in the Properties, the damages caused by Mr. Cairo, both economic and reputational, will exponentially increase. 11. Accordingly, by this action, Plaintiffs seek compensatory damages, as well as punitive damages, for the substantial injury caused by Mr. Cairo’s tortious conduct in maliciously and slanderously interfering with Plaintiffs’ efforts and expectancy to complete the sale of their interests in the Properties. JURISDICTION AND VENUE 12. This Court has personal jurisdiction over Defendant Mr. Cairo pursuant to CPLR § 301. Mr. Cairo transacts substantial business within the State of New York, purposefully avails himself of the benefits and privileges of conducting business in the State of New York, and is INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 7 of 27

- 8. 6 expected to be physically present in New York for business during the week of April 21, 2019, when he will be served with a copy of the Summons and Complaint. 13. It has been publicly reported that Mr. Cairo will be traveling to New York during the week of April 21, 2019 to meet with potential investors and American media publishers. Mr. Cairo’s trip was publicized in the Italian media, which speculated that Mr. Cairo’s visit could reflect increased business activity in the United States for Mr. Cairo and RCS. Plaintiffs intend to serve Mr. Cairo with a copy of the Summons and Complaint after he arrives in New York. 14. Service of process on an individual physically present in New York “is a time- honored basis for the exercise of in personam jurisdiction.” Vincent C. Alexander, Practice Commentaries to CPLR § 301 (2010). Defendant’s physical presence at the time of service grants this Court general jurisdiction over him. 15. This Court also has personal jurisdiction over Mr. Cairo pursuant to CPLR § 302(a)(3). Plaintiffs are in a business relationship with Allianz, and Plaintiffs were near consummating a sale of their interests in the Properties to Allianz. Mr. Cairo intentionally and tortiously interfered with Plaintiffs’ business relationship with Allianz by contriving claims and threatening frivolous legal action to impede the contemplated sale of the Properties—in an attempt to extort Plaintiffs. The claims in this Complaint also therefore arise from Mr. Cairo’s tortious interference. Mr. Cairo’s tortious interference is causing injury to the Blackstone Entities in New York by impeding the proposed sale of Plaintiffs’ interests in the Properties and damaging the Blackstone Entities’ reputation in the New York financial industry. Mr. Cairo, who upon information and belief earns a substantial portion of his income per year through international commerce, was aware that his interference would have consequences for the Blackstone Entities, INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 8 of 27

- 9. 7 both economically and reputationally, in New York. This Court therefore has jurisdiction to hear Plaintiffs’ claims against Mr. Cairo for his tortious conduct causing injury within New York. 16. Venue is proper in this Court pursuant to CPLR § 503, as the Plaintiff Blackstone Entities reside in New York County. Moreover, a significant portion of the events leading to the claims in this Complaint occurred in New York, and Defendant’s tortious conduct caused substantial injury here. THE PARTIES 17. Plaintiff Blackstone is a Delaware limited partnership, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone is an investment firm specializing in equity investments in real property throughout the world. Blackstone is a subsidiary of The Blackstone Group L.P., also based in New York, which is one of the leading investment firms in the world. 18. Plaintiff Blackstone Real Estate Partners Europe IV-NQ L.P. is a limited partnership incorporated in the Cayman Islands, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Real Estate Partners Europe IV-NQ L.P. indirectly owns 75.6% of the share capital in Plaintiff Sforza, which is the 100% owner of the units of Delphine (which owns and holds the Properties). 19. Plaintiff Blackstone Real Estate Holdings Europe IV-NQ ESC L.P. is a limited partnership incorporated in the Cayman Islands, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Real Estate Holdings Europe IV-NQ ESC L.P. indirectly owns 0.400% of the share capital in Plaintiff Sforza. 20. Plaintiff Blackstone Family Real Estate Partnership Europe IV SMD L.P. is a limited partnership incorporated in the Cayman Islands, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Family Real Estate Partnership Europe IV INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 9 of 27

- 10. 8 SMD L.P. indirectly owns 0.667% of the share capital in Plaintiff Sforza. 21. Plaintiff Blackstone Real Estate Partners (Offshore) VII-NQ L.P. is a Delaware limited partnership, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Real Estate Partners (Offshore) VII-NQ L.P. indirectly owns 6.067% of the share capital in Plaintiff Sforza. 22. Plaintiff Blackstone Real Estate Partners (Offshore) VII.F-NQ L.P. is a Delaware limited partnership, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Real Estate Partners (Offshore) VII.F-NQ L.P. indirectly owns 7.933% of the share capital in Plaintiff Sforza. 23. Plaintiff Blackstone Real Estate Partners (Offshore) VII.TE.1-8-NQ L.P. is a Delaware limited partnership, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Real Estate Partners (Offshore) VII.TE.1-8-NQ L.P. indirectly owns 5.533% of the share capital in Plaintiff Sforza. 24. Plaintiff Blackstone Family Real Estate Partnership (Offshore) VII-SMD L.P. is a limited partnership incorporated in Alberta, Canada, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Family Real Estate Partnership (Offshore) VII- SMD L.P. indirectly owns 0.200% of the share capital in Plaintiff Sforza. 25. Plaintiff Blackstone Real Estate Holdings (Offshore) VII-NQ-ESC L.P. is a limited partnership incorporated in Alberta, Canada, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Real Estate Holdings (Offshore) VII-NQ-ESC L.P. indirectly owns 0.200% of the share capital in Plaintiff Sforza. 26. Plaintiff Blackstone Real Estate Holdings (Offshore) VII-NQ L.P. is a limited partnership incorporated in Alberta, Canada, with its principal offices at 345 Park Avenue, 31st INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 10 of 27

- 11. 9 Floor, New York, NY 10154. Blackstone Real Estate Holdings (Offshore) VII-NQ L.P. indirectly owns 0.200% of the share capital in Plaintiff Sforza. 27. Plaintiff Blackstone Real Estate Partners Europe IV.F-NQ L.P. is a limited partnership incorporated in Delaware, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Real Estate Partners Europe IV.F-NQ L.P. indirectly owns 2.067% of the share capital in Plaintiff Sforza. 28. Plaintiff Blackstone Real Estate Partners Europe IV.2-NQ L.P. is a limited partnership incorporated in the Cayman Islands, with its principal offices at 345 Park Avenue, 31st Floor, New York, NY 10154. Blackstone Real Estate Partners Europe IV.2-NQ L.P. indirectly owns 1.133% of the share capital in Plaintiff Sforza. 29. Plaintiff Sforza is a private limited liability company, incorporated under the laws of Luxembourg, with its registered office at 2-4 rue Eugène Ruppert, L-2454 Luxembourg, Grand Duchy of Luxembourg. Sforza is wholly owned by the Plaintiff Blackstone Entities. Sforza wholly owns the units of the investment fund Delphine and, along with the other Plaintiffs, was a party to the 2013 Transaction. 30. Plaintiff Kryalos is a sole shareholder company, incorporated under the laws of Italy, with its registered office at Via Brera no. 3 – 20121 Milan, Italy. Kryalos is the legal representative of Delphine and manages the real property that was involved in the 2013 Transaction. Delphine is a closed-end alternative real estate investment fund, organized under the laws of Italy. Delphine is the direct owner of the Properties and is wholly owned by Plaintiff Sforza. Plaintiff Kryalos is Delphine’s designated legal representative under Italian law. Delphine was a party to the 2013 Transaction. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 11 of 27

- 12. 10 31. Defendant Urbano Cairo is a citizen of Italy. Mr. Cairo began his career working for former Italian prime minister and media magnate Silvio Berlusconi and his family holding company Fininvest S.p.A. (“Finivest”). In connection with his work with Fininvest, Mr. Cairo was criminally charged by Italian prosecutors with false accounting, false invoicing, money laundering and tax evasion. As a result of a plea, Mr. Cairo received a 19-month suspended sentence with probation of five years. Following his dismissal from Fininvest, Mr. Cairo set up his own media business. Mr. Cairo is currently the Chairman and controlling shareholder of Cairo Communication S.p.A., a media and publishing conglomerate based in Milan, Italy. In turn, Cairo Communication owns a 60% stake in fellow media and publishing company RCS. Mr. Cairo has had control of RCS since August 2016, when he seized control of the company in a hostile takeover. BACKGROUND I. RCS DETERMINES TO MARKET THE PROPERTIES FOR SALE AND CONDUCTS A ROBUST SALES PROCESS. 32. In 2012, the then-leadership of RCS, supported by financial and legal advisors, including investment bank Credit Suisse, crafted a strategic plan (the “Development Plan”) to be executed over the following three years. RCS’s three-year Development Plan included, among other things, initiatives to pursue sales of various non-core assets, including certain magazines and real estate assets—in order for the company to focus on its core businesses, digital offerings, and overall company efficiency. 33. In June 2013, RCS agreed on a transaction to sell 14 of the magazines it owned. Also in June 2013, RCS signed a loan agreement with several banks, including Unicredit S.p.A., BNP Paribas, and Intesa Sanpaolo S.p.A., for €600 million. And, in July 2013, RCS successfully completed a rights offering for €410 million that reduced the company’s leverage and extended its INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 12 of 27

- 13. 11 debt maturity profile by several years. Leading Italian corporations—including FIAT, Mediobanca, Pirelli, and Intesa Sanpaolo—participated in RCS’s July 2013 rights offering. These capital structure transactions with major banks and corporations reflected broad confidence in RCS’s business and prospects in advance of the 2013 Transaction, which was not agreed upon until several months after the company’s successful execution of these transactions. 34. The Development Plan also called for RCS to seek to sell certain principally non- core commercial properties it owned in Milan, including the Properties. The Properties consist of three interconnected commercial buildings (Blocks 1, 2, and 3), which today house multiple businesses and commercial tenants—including RCS, which occupies a portion representing 38% of the Properties’ total lettable area. In connection with the Development Plan’s directive to sell the non-core Properties, RCS retained Banca IMI S.p.A. (“Banca IMI”) as its financial advisor. Banca IMI is one of Italy’s leading financial institutions, active in investment banking, mergers and acquisitions, real estate, structured finance, and capital markets, and Banca IMI operates at a global level. 35. The marketing and sales process for the Properties spanned over a year. In connection with this process, and as reflected in press releases issued by RCS, RCS and Banca IMI utilized a number of independent appraisers for property valuations of the Properties, and Banca IMI initiated contacts with over 30 potential real estate investors from across the globe, including several in New York, seeking prospective purchasers for the Properties. 36. RCS and Banca IMI conducted a widespread marketing campaign as to the Properties. They began the sales and bidding process by sending “teasers” to at least 30 potential investment firms, seeking to spark interest in the Properties. RCS then moved forward with entering into non-disclosure agreements with at least 20 potential purchasers (including several in INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 13 of 27

- 14. 12 New York, including J.P. Morgan, Morgan Stanley, Och-Ziff, Cerberus, Carlyle, and Blackstone). Additionally, RCS and Banca IMI sent a 30-page informational memorandum about the Properties, as well as bid process letters, to at least 20 real estate investment firms (including several based in New York). 37. As a result of these efforts, RCS received non-binding offers from five potential purchasers interested in acquiring the Properties. II. PLAINTIFFS PURCHASE THE PROPERTIES FROM RCS. 38. After evaluating the five non-binding offers received for the Properties, RCS determined to enter into exclusive negotiations with Blackstone. Blackstone’s initial bid for the Properties, made on July 8, 2013, was €108 million. On July 29, 2013, Blackstone raised its offer to €114 million, and on August 1, 2013, Blackstone raised its offer to €115 million. Blackstone’s offers were not contingent on obtaining financing from outside sources, meaning that Blackstone would be able to proceed with the transaction without delay. Based on Blackstone’s August 1 bid, on August 7, 2013, RCS agreed to the continuation of exclusive negotiations with Blackstone. 39. Following a period of due diligence and further negotiations, on November 13, 2013, RCS issued a press release announcing that RCS and Blackstone had entered into a preliminary agreement for the sale of the Properties for €120 million. The press release noted that the sale of the Properties to Blackstone “conclude[d] a long and comprehensive process, which was examined in various board meetings, and was approved on November 5, 2013.” The press release further detailed the sales process for the Properties, including RCS’s and Banca IMI’s approaches to 30 real estate investors, the use of property valuations by independent appraisers, and the receipt of non-binding offers from five bidders. Finally, RCS’s November 13 press release pronounced the offer by Blackstone as “the most attractive bid,” explained that the €120 million sale price to be paid by Blackstone was “substantially in line with the valuation by a leading real INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 14 of 27

- 15. 13 estate advisor for” RCS, and noted that the price to be paid was higher than the carrying value of the Properties on RCS’s books. 40. As noted in RCS’s press release, RCS and Sforza entered into the Preliminary Asset Purchase Agreement (the “APA”) on November 13, 2013. Sforza is an entity that was created for the purpose of purchasing the Properties, and 100% of the shares of Sforza are owned indirectly by the Blackstone Entities. The APA contemplated RCS and Sforza, or a designee of Sforza, entering into final sale and purchase agreements (the “SPAs”) for the Properties and RCS entering into lease agreements for certain substantial areas of the Properties. Additionally, the APA contemplated Sforza leasing back the Properties to RCS for varying lease lengths (two years for 62% of the lettable area and nine years for 38% of the lettable area). 41. On or about December 23, 2013 and March 6, 2014, RCS entered into the SPAs for the Properties with Delphine—Sforza’s wholly owned designee—thereby completing the sale of the Properties contemplated by the APA. The SPAs included the transfer of title of the Properties from RCS to Delphine (then managed by BNP Paribas Real Estate), guarantees by RCS of full ownership of the Properties, and various other provisions, including an Italian choice of law provision, but no arbitration clause. 42. At the same time the SPAs were executed, RCS also entered into a related agreement with the Blackstone Entities (the “Shareholders Agreement”). Under the Shareholders Agreement, the Blackstone Entities agreed, among other things, not to sell the Properties for a period of at least one year following the date of the Shareholders Agreement. The Shareholders Agreement was executed by a New York-based Blackstone executive on behalf of each of the Blackstone Entities. And, RCS agreed in the Shareholders Agreement to direct all notices, requests, or other communications to Blackstone’s New York headquarters. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 15 of 27

- 16. 14 43. At the same time, RCS also entered into lease agreements relating to the Properties with BNP Paribas Real Estate Investment Management Italy (“BNP”), in its capacity as management company for Delphine. BNP has since been replaced by Plaintiff Kryalos as the management company for Delphine. The term of the lease agreement with RCS for Block 2, which comprises 62% of the total Gross Leasable Area of the Properties, was only for two years— significantly shorter than market standard lease terms (and therefore riskier for both Plaintiffs as landlord and for financing banks). 44. In addition to RCS’s sale and leaseback of the Properties being guided by highly sophisticated financial and legal advisors, as well as RCS’s engaged and experienced management and Board of Directors, the 2013 Transaction was also overseen and monitored by RCS’s Board of Statutory Auditors. In Italy, a company’s Board of Statutory Auditors is similar to an internal control and audit committee, except the Board of Statutory Auditors is made up only of independent experts. The Board of Statutory Auditors works to ensure the proper administration and operation of the company according to its code of ethics and relevant Italian law and regulations. 45. At the end of 2013, RCS’s Board of Statutory Auditors issued its mandatory report to RCS’s shareholders, in which the Board of Statutory Auditors detailed its participation in, and supervision of, the 2013 Transaction. Among other things, the Board of Statutory Auditors reported on how it “monitored the various phases of the [2013 Transaction],” “examined the evaluations . . . concerning the ‘market’ value of the [Properties] and the consistency of the purchase offers received by the Company,” and participated in several Board of Directors meetings “in order to ensure that the decision-making process was taking place in the correct manner on the basis of all information and elements for evaluation required to ensure that a reasonable decision INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 16 of 27

- 17. 15 was made in terms of cost-effectiveness, in the best interest of the company.” III. PLAINTIFFS REVITALIZE THE PROPERTIES BY INVESTING IN IMPROVEMENTS AND ATTRACTING NEW TENANTS. 46. When Plaintiffs executed the 2013 Transaction and purchased the Properties, they faced a challenging market environment. Real estate fundamentals in 2013 in Europe, including in Italy, were poor. Vacancy levels in Milan and elsewhere in Italy were well above historical averages. And, confidence in the Italian economy was low. Italy had experienced a protracted recession that continued into 2013, with the country’s Real GDP having contracted by 7% over the previous five years, and unemployment was over 12%. In July 2013, S&P downgraded the rating of Italy’s government debt to BBB, which is just two notches above “junk.” 47. Approximately two years after Plaintiffs acquired the Properties, RCS vacated Block 2 (at the expiration of the two-year leases it entered as part of the 2013 Transaction and with the Properties being non-core to RCS). Block 2 represented approximately 62% of the combined lettable area of the Properties, meaning that RCS’s departure left nearly two-thirds of the Properties unoccupied, non-income producing, and in need of renovation. As a result of RCS vacating Block 2, the net rental income generated by the Properties significantly decreased. 48. Following RCS’s departure from Block 2, Plaintiffs spent over €17 million just on renovating Block 2 of the Properties, including by adding an additional entrance and expanding the height of the building to create viable rental space on an additional floor. These renovations transformed Block 2 from a more challenging single-tenant space into a flexible, multi-tenant space, allowing Plaintiffs to divide Block 2 into three commercial rental units. 49. Following the renovations, Plaintiffs worked diligently to bring in new and reputable anchor tenants. Leasing Block 2 was challenging but, over time and with significant effort, Plaintiffs were successful as they were able to attract three highly reputable commercial INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 17 of 27

- 18. 16 tenants: UBI Banca, Loro Piana, and Cassa Depositi e Prestiti (a subsidiary of the Italian government). These new leases brought the Properties to 100% occupancy and significantly increased the rental income generated by the Properties, thereby significantly increasing the market value of the Properties overall. IV. PLAINTIFFS MARKET THE PROPERTIES FOR SALE FIVE YEARS AFTER THE 2013 TRANSACTION. 50. After having invested substantial resources into renovations and improvements, and having successfully acquired reputable long-term tenants for the newly renovated and fully occupied Properties, Plaintiffs recently began to seek a potential purchaser for their interests in the Properties, nearly five years after the 2013 Transaction. That Plaintiffs would seek to sell the Properties during 2018 was also in accord with the five-year investment horizon, of which Blackstone first informed RCS in its 2013 bid documents. 51. Plaintiffs began marketing the Properties to select investors in early 2018. After preliminary discussions, Allianz emerged as the leading candidate to acquire Plaintiffs’ interests in the Properties. 52. On June 14, 2018, Allianz provided Plaintiffs with a formal letter of interest, proposing an exclusivity period to negotiate Allianz’s acquisition of the interests in the Properties. Plaintiffs accepted Allianz’s proposal on June 22, 2018, establishing an exclusivity period. 53. During the exclusivity period, Plaintiffs and Allianz exchanged multiple drafts of documents for the consummation of a transaction. By early July, Plaintiffs and Allianz had agreed on all material terms and expected to sign a final binding agreement by the end of July or early August, with a closing to occur in September 2018. V. CAIRO MALICIOUSLY INTERFERES WITH PLAINTIFFS’ EFFORTS TO SELL THE PROPERTIES. 54. RCS’s Board of Directors lauded the 2013 Transaction in both the company’s 2013 INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 18 of 27

- 19. 17 Annual Report (issued by the RCS Board of Directors on March 10, 2014) and 2014 Annual Report (issued by the RCS Board of Directors on March 11, 2015). In the 2013 Annual Report, in addition to describing Plaintiffs’ bid as the “most economically and financially attractive,” the Board of Directors also noted that “[t]hanks to [the 2013 Transaction], the Group’s debt is expected to contract compared to December 31, 2013.” And, in the 2014 Annual Report, the RCS Board of Directors described the 2013 Transaction as having had “a positive effect on financial expense trends.” 55. In 2016, Mr. Cairo, via his company Cairo Communication, completed a hostile takeover of RCS. Mr. Cairo is now the Chairman of the Board, Chief Executive Officer, and controlling shareholder of RCS. Mr. Cairo, however, was not a newcomer to RCS in 2016. In July 2013, several months before execution of the 2013 Transaction, Mr. Cairo acquired a 2.8% stake in RCS. RCS’s 2013 Annual Report notes that before the 2013 Transaction was executed, Mr. Cairo wrote to RCS’s Board of Directors and to RCS’s Board of Statutory Auditors raising objections to the contemplated 2013 Transaction. Mr. Cairo’s objections to the 2013 Transaction, however, were not to challenge the validity of the sale or to even suggest that Plaintiffs’ offer was for less than fair market value for the Properties. Rather, according to media reports at the time, Mr. Cairo complained in 2013 that “selling a property today means selling in a low-priced market. We should think of alternatives.” Thus, Mr. Cairo only complained that the timing of the sale was inopportune because the Milan real estate market was depressed in 2013, and he in fact admitted the health of RCS at the time of the 2013 Transaction by suggesting that the company had “alternatives” to selling the Properties. 56. In any event, notwithstanding Mr. Cairo’s comments regarding the timing of, and alternatives to, the proposed sale to Plaintiffs, on November 5, 2013, RCS’s Board of Directors INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 19 of 27

- 20. 18 resolved to execute on the 2013 Transaction, and subsequently RCS took all necessary actions to close the 2013 Transaction. Thereafter, neither RCS nor Mr. Cairo ever communicated to Plaintiffs any objection to the 2013 Transaction (until July 2018). 57. On July 10, 2018, an article appeared in the Italian national daily business newspaper, MF-Milano Finanza, reporting on Allianz’s contemplated purchase of Plaintiffs’ interests in the Properties. MF-Milano Finanza competes with RCS publications. The article reported that the parties were near an agreement whereby Allianz would pay €250 million for Plaintiffs’ interests in the Properties and emphasized the profitable nature of Plaintiffs’ five-year investment in the Properties. 58. On July 13, 2018, three days after publication of the article in MF-Milano Finanza, Mr. Cairo sent a letter to Plaintiffs, on behalf of RCS. This letter claimed that the 2013 Transaction was somehow “null and void” because, according to Defendant, RCS was in financial distress at the time of the 2013 Transaction and there was an imbalance in the terms and conditions, benefits, and returns among the parties to the 2013 Transaction. 59. The timing of Mr. Cairo’s July 13 letter was not coincidental. Upon information and belief, Mr. Cairo was aware that Plaintiffs were nearing a sale of their interests in the Properties—whether that awareness stemmed from the MF-Milano Finanza article or from other earlier sources. As a sophisticated businessman, Mr. Cairo knew before sending the July 13 letter that Blackstone would be compelled to disclose to prospective purchaser Allianz any claims against the title to the Properties, even if those claims were frivolous. 60. Mr. Cairo’s July 13 letter therefore was spurious, malicious, and extortionate, and plainly aimed at slandering Plaintiffs’ title to the Properties and interfering with Plaintiffs’ contemplated sale transaction with Allianz. Mr. Cairo knew the assertions in the July 13 letter INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 20 of 27

- 21. 19 were false at the time the letter was sent. 61. Mr. Cairo has since publicly claimed that July 13 was not the first time he informed Plaintiffs he would to seek to invalidate the 2013 Transaction. Instead, Mr. Cairo claims he somehow notified Plaintiffs of his position by letter in March 2018. This public statement by Mr. Cairo is also patently false, as no letter from either Mr. Cairo or RCS prior to July 13, 2018 suggested that either would question the validity of the 2013 Transaction. Further, it is of little relevance whether Mr. Cairo’s malicious scheme to extort Plaintiffs began in March 2018 or in July 2018. In March and July 2018, both five years after the 2013 Transaction, Mr. Cairo knew that Plaintiffs were soon going to be seeking to sell the Properties to a third party, knew his challenge to the validity of the 2013 Transaction was malicious and baseless, and intended to interfere with such a sale and do damage to Plaintiffs. 62. Plaintiffs were compelled to immediately inform their prospective purchaser, Allianz, of Mr. Cairo’s July 13 letter and his malicious and slanderous claims. Allianz justifiably has since taken the position that it will not consummate the purchase of Plaintiffs’ interests in the Properties until Mr. Cairo’s claims are withdrawn or otherwise resolved. Plaintiffs have already incurred damages due to the delay in consummating a transaction to sell Plaintiffs’ interests in the Properties, as well as damages in the form of legal and other professional fees expended to address the consequences of Mr. Cairo’s spurious claims. Plaintiffs’ damages, both economic and reputational, will increase exponentially if Mr. Cairo’s misconduct causes Plaintiffs’ sale of their interests in the Properties to be further delayed or causes Plaintiffs to lose the opportunity to sell their interests in the Properties to Allianz and to realize a return on investment for Plaintiffs’ investors. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 21 of 27

- 22. 20 63. After July 13, Plaintiffs had numerous communications with Mr. Cairo, requesting that he disavow his claim that the 2013 Transaction is null and void. Those communications proved to be futile. On November 8, 2018, undersigned counsel for Plaintiffs emailed a letter to Mr. Cairo and other members of RCS’s Board of Directors, once again requesting that Mr. Cairo and RCS withdraw their spurious claims and stating that Plaintiffs would commence a lawsuit in a New York court seeking declaratory relief and damages if Mr. Cairo and RCS did not take such ameliorative actions by November 13, 2018. 64. On November 9, 2018, in response to undersigned counsel’s November 8 letter and in an effort to be “first-filed,” RCS rushed to commence an arbitration in Milan seeking a determination that the 2013 Transaction is null and void. On November 20, 2018, Plaintiffs commenced an action against RCS in this Court (Index No. 655790/2018). 65. On November 21, 2018, Reuters published a story entitled “RCS Mediagroup already challenged property sale to Blackstone in March - source.” The article describes statements attributed to an unnamed “source” who said that Mr. Cairo and RCS actually first informed Plaintiffs of Defendant’s position that the 2013 Transaction was void in March, not July, 2018. Upon information and belief, Mr. Cairo is the unnamed “source” in the article. There is, of course, no one else who could have provided this information (which was entirely false) other than Mr. Cairo. Mr. Cairo made these statements to one or more reporters to further damage Plaintiffs’ collective ability to sell the Properties by suggesting that Plaintiffs negligently delayed to inform prospective purchasers of the Properties about Mr. Cairo’s baseless claims regarding the validity of the 2013 Transaction. Such an assertion is patently false, is utterly defamatory as to Blackstone and all Plaintiffs, and further demonstrates the ongoing nature of Mr. Cairo’s interference with Plaintiffs’ prospects for selling the Properties. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 22 of 27

- 23. 21 COUNT I Tortious Interference with Prospective Business Relations 66. Plaintiffs repeat the allegations contained in the preceding paragraphs as if fully set forth herein. 67. Plaintiffs had the real expectancy of prospective business relations with Allianz for the sale of Plaintiffs’ interests in the Properties. The basic terms of the contemplated sale were set forth in, among other writings, the provisions of the letter of interest between Plaintiffs and Allianz. Plaintiffs thus had a real expectancy that Plaintiffs and Allianz would enter into an economically advantageous business relationship. 68. Upon information and belief, Mr. Cairo maliciously and intentionally interfered with Plaintiffs’ prospective business relations with Allianz using dishonest, unfair, and improper means. 69. Upon information and belief, Mr. Cairo was aware of Plaintiffs’ intention to sell the Properties during 2018 and aware of Plaintiffs’ impending plans to sell their interests in the Properties to Allianz and deliberately asserted a frivolous right to void the 2013 Transaction in an attempt to slander title and impede the sale of the Properties by inducing Allianz and other prospective purchasers not to enter into a transaction, even though Mr. Cairo knew he had no legal basis to claim that the 2013 Transaction is now void, five years after its consummation. Knowing that Plaintiffs were in negotiations for the sale of the Properties with Allianz, Mr. Cairo challenged the validity of the 2013 Transaction and falsely challenged the veracity of Plaintiffs, both in letters to Plaintiffs and in public statements. This interference was conducted in a malicious, wrongful, and improper manner. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 23 of 27

- 24. 22 70. Upon information and belief, but for Mr. Cairo’s malicious interference with Plaintiffs’ prospective business relations with Allianz and other prospective purchasers, Plaintiffs would be in a position to move forward with the transaction to sell their interests in the Properties. 71. As a direct and proximate result of Mr. Cairo’s malicious and intentional actions, Plaintiffs have suffered economic harm, including, without limitation, the incurrence of legal fees and other expenses to address Mr. Cairo’s spurious claims. Plaintiffs also face the loss of revenues Plaintiffs would have derived had Plaintiffs consummated the sale of Plaintiffs’ interests in the Properties. Plaintiffs also face the incurrence of reputational damage stemming from Mr. Cairo’s misconduct—based on Plaintiffs’ inability to close on the contemplated transaction and to provide Plaintiffs’ investors with a return on their investment in the Properties. 72. Accordingly, Plaintiffs have suffered damage as a result of Mr. Cairo’s intentional interference with Plaintiffs’ prospective business relations in an amount to be proven at trial, but in any event an amount no less than $500,000 (the monetary threshold for the New York County Commercial Division). 73. Mr. Cairo’s tortious acts were of an egregious and morally culpable nature. 74. Accordingly, awards of compensatory damages and punitive damages to Plaintiffs from Mr. Cairo are justified, in amounts to be determined at trial. COUNT II Slander of Title 75. Plaintiffs repeat the allegations contained in the preceding paragraphs as if fully set forth herein. 76. Mr. Cairo has deliberately cast doubt on the validity of Plaintiffs’ title to the Properties. In letters to Plaintiffs (that Plaintiffs were obligated to share with Allianz, a prospective purchaser of the Properties), Mr. Cairo, as Chairman of RCS, asserted a frivolous right to void the INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 24 of 27

- 25. 23 2013 Transaction that transferred the rights and interest in the Properties to Plaintiffs. Mr. Cairo’s assertions, five years after the consummation of the 2013 Transaction, were made maliciously and with a reckless disregard for Plaintiffs’ rightful title to the Properties. 77. Upon information and belief, Mr. Cairo was aware of Plaintiffs’ impending plans to sell their interests in the Properties to Allianz. Mr. Cairo further knew that if it challenged Plaintiffs’ title to the Properties, Plaintiffs would be obligated to notify Allianz of such claims and that Allianz, like any prospective purchaser, would likely refrain from finalizing a transaction with Plaintiffs to purchase the Properties unless and until RCS’s claim to title is withdrawn or otherwise resolved. 78. But for Mr. Cairo’s false assertions that disparaged Plaintiffs’ title to the Properties, Plaintiffs would be in a position to move forward with the transaction to sell their interests in the Properties to Allianz for an agreed-upon, substantial price. 79. As a direct and proximate result of Mr. Cairo’s malicious and intentional actions, Plaintiffs have suffered economic harm, including, without limitation, the incurrence of legal fees and other expenses to address Mr. Cairo’s spurious claims. Plaintiffs also face the loss of revenues Plaintiffs would have derived had Plaintiffs consummated the sale of Plaintiffs’ interests in the Properties. Plaintiffs also face the incurrence of reputational damage stemming from Mr. Cairo’s misconduct—based on Plaintiffs’ inability to close on the contemplated transaction and to provide Plaintiffs’ investors with a return on their investment in the Properties. 80. Accordingly, Plaintiffs have suffered damage as a result of Mr. Cairo’s slander of Plaintiffs’ title to the Properties in an amount to be proven at trial, but in any event an amount no less than $500,000 (the monetary threshold for the New York County Commercial Division). 81. Mr. Cairo’s tortious acts were of an egregious and morally culpable nature. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 25 of 27

- 26. 24 82. Accordingly, awards of compensatory damages and punitive damages to Plaintiffs from Mr. Cairo are justified, in amounts to be determined at trial. PRAYER FOR RELIEF WHEREFORE, Plaintiffs pray that this Court enter judgment in their favor on their claims for relief set forth above and award them relief, including, but not limited to, the following: (i) Entry of an order against Defendant Urbano Cairo for all monetary damages Plaintiffs have suffered as a result of the wrongful conduct alleged herein, in an amount to be determined at trial, but not less than $500,000; (ii) Entry of an order against Defendant Urbano Cairo for punitive damages, in an amount to be determined at trial; and (iii) Such other and further relief as the Court deems just and proper. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 26 of 27

- 27. 25 Dated: New York, New York April 22, 2019 Respectfully submitted, /s/ Lamina Bowen _______________________ Lamina Bowen KIRKLAND & ELLIS LLP 601 Lexington Avenue New York, New York 10022 Telephone: (212) 446-4800 Facsimile: (212) 446-4900 Email: lamina.bowen@kirkland.com Counsel to Plaintiffs Blackstone Real Estate Advisors L.P., Blackstone Real Estate Partners Europe IV-NQ L.P., Blackstone Real Estate Holdings Europe IV-NQ ESC L.P., Blackstone Family Real Estate Partnership Europe IV SMD L.P., Blackstone Real Estate Partners (Offshore) VII-NQ L.P., Blackstone Real Estate Partners (Offshore) VII.F-NQ L.P., Blackstone Real Estate Partners (Offshore) VII.TE.1-8-NQ L.P., Blackstone Family Real Estate Partnership (Offshore) VII-SMD L.P., Blackstone Real Estate Holdings (Offshore) VII-NQ-ESC L.P., Blackstone Real Estate Holdings (Offshore) VII-NQ L.P., Blackstone Real Estate Partners Europe IV.F-NQ L.P., Blackstone Real Estate Partners Europe IV.2- NQ L.P., Sforza Holdco S.à.r.l., and Kryalos SGR S.p.A, in its capacity as management company of the Delphine Fund. INDEX NO. 652328/2019 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 05/01/2019 27 of 27