Competition Law - Norway: The year in review

- 1. 1 Chapter XX NORWAY Odd Stemsrud 1 I OVERVIEW i Statutory provisions and public enforcers The main statutory provisions in Norway are enshrined in the Competition Act of 2004 (CA). The substantive provisions of the CA mirror Articles 101 and 102 TFEU and Articles 53 and 54 EEA Agreement by prohibiting first, cartels and anticompetitive agreements, and secondly, abuse of a dominant position. Norway is not a member of the European Union, but it is party to the EEA Agreement. Thus, Norway has implemented the EU and EEA competition rules and internal market rules, and has a state aid regime similar to that of EU Member States (Article 61 EEA Agreement mirrors Article 107 TFEU). The main public enforcer of the CA is the Norwegian Competition Authority (NCA). Decisions adopted by the NCA can be appealed to the Competition Appeals Tribunal prior to being brought before the Norwegian appellate courts. The Competition Appeals Tribunal was established as of 1 April 2017. The NCA is not a formal member of the European Competition Network, although having informal points of contact. The Nordic countries entered into an enhanced cooperation agreement in September 2017. The public enforcers of the provisions of the EEA Agreement are, in addition to the NCA, the European Commission and the European Free Trade Association (EFTA) Surveillance Authority (ESA). ESA is particularly important in relation to enforcement of the state aid provisions and Article 59 EEA Agreement (the award of special or exclusive rights – mirroring Article 106 TFEU). Decisions adopted by ESA can be challenged before the EFTA Court. Due to the case allocation rules of the EEA Agreement, ESA does not deal with merger cases or cartel cases affecting EU Member States. ii NCA enforcement: 2017 overview and 2018 outlook In 2017, the NCA adopted in total four decisions: two cartel prohibition decisions, one prohibition decision against a notified merger and one decision for breach of the merger standstill obligation. The NCA has one major pending abuse of dominance case, being against Telenor (the incumbent) in the telecom sector. 1 Odd Stemsrud is a partner at Advokatfirmaet Grette AS.

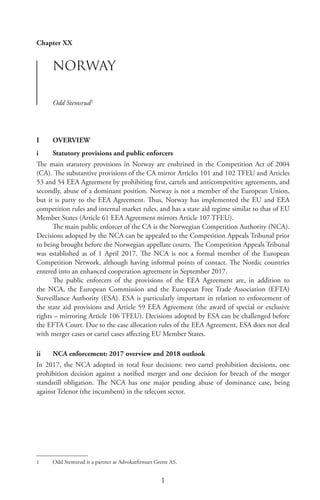

- 2. Norway 2 Public enforcement of the NCA 2014–2017 2014 2015 2016 2017 Mergers – notifications 89 96 97 99 Mergers – interventions 3 5 3 1 Mergers – breach of standstill 5 2 0 1 Section 10 decisions (cartel provision) 0 2 1 2 Section 11 decisions (abuse of dominance) 0 0 0 0 Section 9e (challenges of public regulations) 0 0 0 0 Dawn raids 6 1 1 3 In 2018 the NCA’s enforcement focus, according to instructions from the Ministry of Trade, Fisheries and Industry (Ministry) in the 2018 budget letter, will target on (1) personal criminal sanctions as a real threat, (2) enforcing abuse of dominance cases and (3) monitoring competition in the grocery sector. The reason behind (1) and (2) is the hitherto absence of enforcement of the relevant provisions. The reason behind (3) is that the Norwegian grocery sector is allocated between a few large chains. Moreover, due to the Norwegian customs regime for foodstuffs, it has proven challenging for foreign grocery chains to penetrate the Norwegian market. ESA enforcement: 2017 overview ESA adopted 14 state aid decisions related to Norway in 2017, covering, inter alia, environmental aid, regional aid and services of general economic interest aid. With regard to enforcement priorities, it should be noted that Regulation 2015/1589, establishing a possibility to prioritise state aid complaint cases, has yet to be incorporated into the EEA Agreement. ESA adopted no competition law decisions in 2017. However, it is currently undertaking two major investigations: a in parallel to the NCA, ESA has one major pending abuse of dominance case against Telenor in the telecom sector pursuant to Article 54 EEA; b ESA opened antitrust proceedings pursuant to Article 53 EEA Agreement in the Norwegian financial sector in October 2016, including against the major banks and the key trade organisation (Finance Norway). ESA is in practical terms to some extent ‘a second NCA for Norway’; that is, the EFTA and EEA States are Iceland and Liechtenstein, in addition to Norway. Thus, ESA’s focal point is often (markets in) Norway, in contrast to the European or global competition scope of the European Commission. iii Global public enforcement against Norwegian entities In the global arena one case has stood out in recent years: the Maritime Car Carrier case. In this case, relating to the pure car truck carrier industry, investigations have been opened in all major global jurisdictions, including the EU, the US and Japan. Two Norwegian shipping companies, Wilh Wilhelmsen Logistics (WWL) and Höegh Autoliners, have been subject to the investigations. The former company has filed for leniency and been fined in several

- 3. Norway 3 jurisdictions. The latter has, to date, only been fined in the US. The European Commission adopted its decision on 21 February 2018, imposing a fine of €207 million on WWL. This is the largest ongoing cartel case with Norwegian addressees. iv Private enforcement On the legislative side, Directive 2014/104/EU on antitrust damages actions has yet to be incorporated into the EEA Agreement and implemented into Norwegian law. This is due to institutional issues that are unlikely to be solved in the near future. However, existing general Norwegian law mirrors roughly the provisions of the Directive. The key private enforcement case currently pending in Norwegian courts is the Kristoffersen case. In this case, the world-renowned slalom skier Henrik Kristoffersen is challenging the sporting community framework in relation to the scope of an athlete’s economic rights pursuant to EU and EEA law. The case addresses novel issues on a European level, and is currently pending before the EFTA Court. The most interesting ongoing damages action case is the case between Nye Kystlink and Color Group, currently pending before the Appellate Court with a reference to the EFTA Court in Case E-10/17 on certain questions related to limitation. The litigation case has surfaced in the wake of the EFTA Surveillance Authority’s decision in Case 59120 of 14 December 2011. The decision identified an infringement by Color Group and Stroemstad municipality of Articles 53 and 54 EEA related to long-term exclusive harbouring rights. The novel issue in the case is related to the EFTA Surveillance Authority contemplating, for the first time, providing the national court with information from the decision not made available to the interested parties. Based on basic principles of due process it would be difficult for the national court when rendering a judgment to draw on facts not made available to the parties. II CARTELS The substantive cartel provision in Section 10 of the CA mirrors Article 101 TFEU and Article 53 EEA Agreement, except for the criterion related to effect on trade between EEA States. Thus, Section 10 CA prohibits agreements and concerted practices that have an anticompetitive object or actual or potential restrictive effects on competition. Judgments of the European Union Court of Justice (EUCJ) and the EFTA Court are directly relevant legal sources in the interpretation and application of the provision. The leniency policy pursuant to the CA is similar to that of Regulation 1/2003 in the EU, including the possibility of obtaining a marker: a the first applicant may be granted full immunity from administrative fines; b the second company may be granted a 30 to 50 per cent reduction; c the third company may be granted a 20 to 30 per cent reduction; and d subsequent companies may be granted a reduction in fines of up to 20 per cent. In contrast to the EEA Agreement provisions, cartel behaviour in breach of the CA can also trigger criminal sanctions, including fines and ultimately imprisonment of individuals, in theory of a duration of up to six years in aggravating circumstances. On the one hand, criminal sanctions have yet to be applied in a cartel case in Norway, not to mention criminal sanctions against individuals. On the other, the NCA adopted specific guidelines in 2016 on criteria when they will consider reporting an individual offence to the public prosecution’s office, and

- 4. Norway 4 the instructing ministry has requested the NCA to consider imposing criminal sanctions on individuals in future cases. The leniency programme is not available to individuals. However, it is possible to anonymously inquire at the NCA about whether they will request criminal sanctions against individuals as a prejudgment decision. There is a settlement procedure available pursuant to the CA mirroring that of Regulation 1/2003, possibly reducing an administrative fine by 10 per cent. The provision entered into force in 2016 and has yet to be applied. i Significant cases The NCA adopted two cartel decisions in 2017. Publishers case – exclusionary conduct 2 In a decision of 22 March 2017, the NCA fined four publishers for illegal collusion with fines totalling 32 million Norwegian kroner. The four publishers account for the majority of books supplied to Norwegian consumers. The NCA found that the cooperation between the publishers had the purpose of restricting competition in the mass market for books. This market includes retail outlets for books that are not traditional bookstores, such as kiosks, grocery stores and petrol stations. There are only two main distributors in this market in Norway, Interpress and Bladcentralen, the latter distributor being jointly owned by the four publishers. The publishers boycotted Interpress, with the effect that books were supplied only to Bladcentralen, the distributor owned by the publishers. Three of the four publishers have initiated a court review of the decision. The NCA conducted a new dawn raid on the said publishers in January 2018 in a case concerning a possible illegal exchange of sensitive information related to the joint venture Bokbasen AS. The joint venture is a distribution platform for e-books in Norway. The EFTA Surveillance Authority is in parallel investigating the Norwegian exemption from the CA related to the possibility to set fixed prices for books for an initial period after publication. El Proffen case – bid rigging3 The collusion in this case took place in the spring of 2014 and was related to a public tender for the maintenance of electrical installations in public schools. Five members of El Proffen, a large chain of independent electricians, cooperated on the tender by submitting a joint bid on the invitation from the chain office, irrespective of the fact that each member could have offered on the tender. Thus, the (independent) members agreed on prices instead of competing to submit the best offer. In a decision of 4 September 2017, the NCA imposed fines totalling approximately 18 million Norwegian kroner on the chain – El Proffen – and the five members that participated in the joint bid. The decision has not been appealed. Dawn raids The NCA carried out two cartel dawn raids in 2017, in June in the market for alarm and security services, and in December in the market for waste and waste treatment in Mid-Norway. The investigations are ongoing. There is no information in the public domain 2 NCA decision V2017-18 of 22 March 2017. 3 NCA decision V2017-21 of 7 September 2017.

- 5. Norway 5 on additional ongoing cartel cases in Norway enforced by the NCA (i.e., cases where a statement of objection has been published or cases where there public information on dawn raids has been conveyed). The key court case – ‘by object’ restriction: the Ski Taxi judgment (Supreme Court and EFTA Court)4 In a judgment of 22 June 2017, the Norwegian Supreme Court dismissed an appeal from two taxi companies relating to a decision by the NCA concerning the submission of joint bids in a tender procedure related to the provision of patient transport services. In its decision, the NCA had concluded that two taxi companies were competitors and that the submission of a joint bid constituted a restriction of competition by object in breach of Section 10 CA. The judgment touched on an issue of principle: whether cooperation between competitors that takes place openly regarding the procuring authority can constitute a ‘by object’ restriction. The Supreme Court requested an advisory opinion from the EFTA Court on this issue. The EFTA Court found: While the disclosure of the joint nature of the bids to the contracting authority may be an indication that the parties did not intend to infringe the prohibition on agreements between undertakings, that, in itself, is not a prerequisite for determining whether an agreement may be considered a restriction of competition by object. ii Trends and outlook For several years, the NCA’s enforcement resources have to a large degree focused on merger control. However, cartel enforcement has not been limited to leniency cases. On the contrary, most recent cartel cases in Norway have been complaint cases related to collusion by way of bid rigging in local markets. III ANTITRUST: RESTRICTIVE AGREEMENTS AND DOMINANCE Section 10 of the CA mirrors Article 101 TFEU and Article 53 EEA Agreement. Moreover, Section 11 of the CA mirrors Article 102 TFEU and Article 54 EEA Agreement. Thus, Section 11 CA prohibits a company’s unilateral abuse of a dominant position.5 Judgments of the EUCJ and the EFTA Court are directly relevant legal sources in the interpretation and application of the provisions. Regarding public enforcement tools, the CA includes the possibility of commitment decisions mirroring that of Regulation 1/2003 in the EU. i Significant cases Four ongoing cases from 2017 merit mention. 4 HR-2017-1229-A of 22 June 2017 and advisory opinion in EFTA Court case E-3/16, Ski Taxi SA, Follo Taxi SA og Ski Follo Taxidrift AS v. the Norwegian Government of 22 December 2016. 5 The provision also prohibits abuse of collective dominance as that concept is enshrined in EU and EEA competition law.

- 6. Norway 6 Trustly antitrust case – financial sector On 25 October 2016, ESA opened proceedings against DNB, Nordea, Finance Norway and BankID for suspected breaches of Article 53 EEA Agreement.6 ESA will investigate whether these members of the Norwegian banking community engaged in concerted practices aimed at blocking a new market entrant, the Swedish company Trustly, from providing a new e-payments service in Norway. At present, Norwegian consumers are unable to benefit from a new service that is now available in most other EEA countries. ESA will investigate whether there are valid reasons for this under the EEA competition rules. The substance of the case fits with the implementation of the Payment Services (PSD2) Directive in 2018, pursuant to which it is likely that foreign e-payment service providers such as Trustly will obtain market access. The investigations are ongoing. Telenor abuse cases – telecom NCA case On 23 November 2016, the NCA sent a statement of objections to Telenor. The NCA is considering imposing a fine of 906 million Norwegian kroner on Telenor, the highest fine ever in Norway. The case relates, in essence, to an alleged abuse by Telenor of its dominant position by engaging in conduct that impeded the entry of a third mobile network in Norway. From 2007 onwards, Network Norway and Tele2 established such a network. During the roll-out phase, Telenor was required to provide them with access to its network in areas where the third network was not yet present. The conduct amounted to two separate alleged abuses: the first abuse is in regards to Telenor’s conditions for giving Network Norway access to its network when the third network was under construction, and the second abuse is in regards to the fact that Telenor entered into exclusive supply agreements with four mobile operators, reducing the ability of the third network to retain customers. ESA case On1February2016,ESAsentastatementofobjectionstoTelenor.ThecaseconcernsTelenor’s conduct in three Norwegian markets: the market for wholesale mobile access and origination services, the market for mobile broadband services to residential customers and the market for mobile communications services to business customers. ESA takes the preliminary view that Telenor’s pricing of access and origination services at the wholesale level likely impeded competing offers in the market for mobile broadband services to residential customers. In the market for mobile communications services to business customers, ESA is concerned that clauses in Telenor’s contracts have impeded competition by making it very difficult for its customers to switch provider and by making it overly expensive for competitors to capture customers from Telenor. Widerøe case – aviation On 7 June 2016, ESA opened formal proceedings against Widerøe’s Flyveselskap to investigate whether it has infringed Article 54 EEA Agreement (abuse of dominance).7 Widerøe is an airline that operates public service obligations (PSO) routes in Norway. For safety reasons, 6 ESA decision 195/16/COL of 25 October 2016. 7 ESA decision 099/16/COL of 6 June 2016.

- 7. Norway 7 a satellite-based approach system (called SCAT-1) is installed at several regional airports in Norway. At the airports where this system is installed, it is required that the aircraft has SCAT-1 on-board equipment installed to operate the PSO routes. ESA is investigating whether Widerøe may have abused a dominant position by refusing to supply an essential component of the system to other operators, thereby impeding market access. Dawn raids The NCA conducted a dawn raid at the premises of the brewery Ringnes in January 2017. The aim of the investigation is to establish whether Ringnes has abused its dominant position in breach of Section 11 CA. The case involves Ringnes’ operations regarding the sale of beer to eateries in Norway. No further details have been made public. ii Trends and outlook The NCA has yet to adopt a decision pursuant to Section 11 CA (abuse of dominance), a provision introduced into Norwegian law by the entering into force of the CA in 2004, which has not later been settled or quashed by the courts. (Two major cases that were settled or quashed are the SAS case of 2005 and the Tine case of 2011.) Thus, it is safe to say that the enforcement of abuse of dominance cases by the NCA is low. ESA has successfully enforced the similar provision of the EEA Agreement (Article 54) on several occasions, of particular note in the Posten case of 2010 (fines of approximately €11 million) and the Color Line case of 2013 (fines of approximately €19 million). With regard to the application of Section 10 to vertical agreements, it could be noted that the NCA has not adopted any such decision after the entering into force of the CA in 2004. IV SECTORAL COMPETITION: MARKET INVESTIGATIONS AND REGULATED INDUSTRIES i Market liberalisation The government’s efforts on liberalisation are aimed at particular two markets: rail passenger transport services and air navigation services. Rail passenger transport services ThemarketpillaroftheEUFourthRailwayPackagewillmakeitcompulsoryforEEAcountries to open the market for domestic passenger services by December 2019, while competitive tendering for PSO will be obligatory in the majority of cases from December 2023. The government has already ‘unbundled’ train operations and infrastructure management, and has initiated the deregulation of the Norwegian market by way of placing various routes on tender through a phasing-in period from 2017 to 2022. Air navigation services The government has conveyed, although not particularly forcefully, that the markets for air navigation services will be liberalised. They have also stated that the incumbent service provider and owner of most of the airports in Norway, Avinor, may await the introduction of remote towers prior to placing the services on competitive tendering. Thus, it may take many years before the market is opened to other air navigation service providers.

- 8. Norway 8 ii Regulated industries As in other EEA countries, as pursuant to EU and EEA secondary legislation, electronic communications (including telecom), the power industry and the postal sector are subject to additional sector-specific competition rules. The enforcement of these provisions did not raise particularly noteworthy issues in 2017. iii Trends and outlook Grocery sector As previously mentioned, in 2018 the NCA shall particularly focus on competition in the grocery sector. The background to this can be found in the fact that the Norwegian grocery sector is apportioned between a very few large chains with the attendant high risk of sub-optimal competition. Moreover, due to the Norwegian customs regime for foodstuffs, it has proven challenging for foreign grocery chains to penetrate the Norwegian market. Private versus public entities – competition on the merits Norway has a very large public sector. On the governmental level, a commissioned report on competition between private and public entities was published 23 January 2018. The topic of public commercial entities is not as controversial in Norway as it is in many other countries. It has yet to be decided by the government whether it will adopt changes to the current legislation in this regard in addition to the requirements of general EU and EEA state aid law (i.e., to shield private commercial operations from being stifled by state-owned enterprises). V STATE AID Although not part of the EU, Norway has a state aid regime similar to that of EU Member States (i.e., Article 61 EEA Agreement mirrors Article 107 TFEU). Thus, the EEA Agreement prohibits state aid in order to prevent distortions of competition and negative effects on trade. The prohibition is, however, subject to exemptions, recognising that government intervention can be necessary to correct market failure and for other purposes. To benefit from these exemptions the government must, as a rule, notify aid measures to ESA for prior approval. Aid measures may be implemented without prior approval when they comply with the General Block Exemption Regulation (GBER) or other specific rules. The main piece of Norwegian legislation on state aid, in addition to the main parts of the EEA Agreement having been incorporated into Norwegian law, is the State Aid Act of 1992. All procedural rules and the EEA block exemptions have been implemented into Norwegian law as part of the State Aid Act. Similar to the EU model, ESA may request that illegal and incompatible state aid is recovered from Norwegian beneficiaries. ESA has substantial resources enabling it to monitor the Norwegian market. Regarding ESA enforcement versus European Commission enforcement, there is, however, one key difference: Regulation No. 734/2013 has, for institutional reasons, yet to be incorporated into the EEA Agreement. Thus, ESA’s competences follow from the previous regulation, Regulation No. 659/99. The effects are, inter alia, that ESA cannot prioritise complaint cases in the same degree as the European Commission; nor can ESA request market information pursuant to the rules of Regulation No. 734/2013. That said, most cases are in any event notification cases that ESA has to handle within the applicable deadlines.

- 9. Norway 9 Moreover, a key observation from a factual perspective is that ESA is only monitoring Norway, Iceland and Liechtenstein, enabling ESA to allocate significant resources to the Norwegian market. In addition, Norway has a public affairs sector that in relative terms is much larger than that of most other countries. With regard to private enforcement, national courts are empowered to enforce, inter alia, the state aid standstill provision and the block exemption provisions. However, private enforcement of the state aid framework has so far been limited in Norway. i Significant cases ESA adopted 14 state aid cases related to Norway in 2017, in addition to 43 Norwegian notifications pursuant to the GBER not requiring any ESA decision. All cases were notification cases (i.e., cases notified for the approval of legal aid). Conversely, ESA did not open any formal proceedings in 2017 based on a complaint. The main areas for state aid in Norway are regional aid, aid to promote and make environmental friendly solutions competitive, aid to CO2 capture technology related to oil and gas exploration, and aid to shipping in the form of a special tax regime. To this end, four significant cases from 2017 are as follows. Tax reductions on zero-emission vehicles In a decision of 19 December 2017, ESA approved a (new) period of state aid for zero-emission vehicles in Norway through several tax exemptions:8 it approved a zero VAT rating for electric cars for a period of three years. The zero VAT rating alone amounts to 3.2 billion Norwegian kroner annually. It also approved also other state aid measures for electric cars, including an exemption from annual vehicle tax and registration tax, for a period of six years. Further, zero VAT rating and other tax exemptions were approved for a period of six years for hydrogen cars. Carbon capture and storage The goal of the government’s carbon capture and storage (CCS) strategy is to realise at least one full-scale CCS demonstration project by 2020, and Norway allocated up to 360 million Norwegian kroner to CCS studies in 2017. CCS will reduce CO2 emissions as it enables oil and gas installations to capture emissions stemming from their production and store such CO2 underground. In a decision of 16 March 2017, ESA approved aid to concept and Front-End Engineering and Design studies related to CCS technology.9 In a decision of 8 August 2017, the ESA approved a three-year extension of Norway’s aid scheme for the carbon capture testing centre at Mongstad.10 The total operating budget of the centre is estimated to be 805 million Norwegian kroner, of which up to 652 million Norwegian kroner is granted as aid over three years by the state entity Gassnova. Based on the west coast of Norway, Technology Centre Mongstad is a unique facility for large-scale testing and qualification of CO2 capture technologies. ESA first approved aid to the project in 2008 for a five-year period, and the project became operational in 2012. The new approval runs until August 2020, and the expected participants are Statoil, Shell and Total. 8 ESA decision 228/17/COL of 19 December 2017. 9 ESA decision 045/17/COL of 16 March 2017. 10 ESA decision 146/17/COL of 8 August 2017.

- 10. Norway 10 Tonnage tax scheme In a decision of December 2017, ESA approved a (new) 10-year special tax regime for shipping in Norway.11 The Norwegian scheme exempts maritime transport from the usual corporate tax rate. Instead, ship owners pay taxes based on ship weight, resulting in a significantly reduced rate comparable to the tonnage tax of other jurisdictions, notably the international shipping markets. The new scheme will be valid from 1 January 2018 until 31 December 2027 and has an approximate yearly value of 200 million Norwegian kroner. The new scheme has been revised, taking in windmill farm vessels while introducing some limitations for bareboat chartering. Petroleum tax reimbursement case The ESA is currently in an informal investigation phase related to parts of the Norwegian petroleum tax scheme (i.e., the reimbursement system for exploration costs). Due to the extraordinary returns on production of petroleum resources, oil companies are subject to an additional special tax. In 2017, the ordinary company tax rate was 24 per cent and the special tax rate was 54 per cent, generating a marginal Norwegian petroleum tax rate of 78 per cent. The reimbursement system for exploration costs was introduced to reduce entry barriers and encourage economically viable exploration activity. Under the system, companies that are making a loss may choose between requesting an immediate refund of the tax value of exploration costs from the taxation authorities and carrying forward the losses to a later year when the company has a taxable income. If a company chooses the immediate payment option, the exploration costs cannot be deducted from income in later tax assessments. Based on a complaint, ESA is currently investigating whether the system could include illegal state aid. ii Trends and outlook With regard to enforcement priorities, Regulation 2015/1589, transferring a possibility on ESA to prioritise state aid cases, has yet to be incorporated into the EEA Agreement. However, ESA has in an unofficial capacity stated that it will, within the existing legal framework, not prioritise small cases not affecting competition in the marketplace to any appreciable degree: it will, inter alia, not prioritise complaint cases related to public sales of minor properties allegedly at below market price. AnothertrendistheincreaseduseofGBERblock-exemptedaid.Norwayhasmadeactive use of the GBER, with 36 block-exempted aid measures in 2016 and 43 block-exempted aid measures in 2017. The purpose of the GBER, introduced in 2014, is that only larger, more distortive and complex cases will remain subject to prior notification and detailed scrutiny by ESA. Within the scope of the GBER, the requirement is that larger aid awards are published on a publicly available website, and certain schemes require an evaluation plan under which ESA conducts monitoring exercises. The focus of individually notified aid is on regional aid to Norway’s outermost regions, aid to support the shift from being an oil and gas-producing country, and aid to support environmentally friendly choices. 11 ESA decision 214/17/COL of 14 December 2017.

- 11. Norway 11 Many European countries provide aid to promote the use of renewable energy in households. In Norway, however, renewable energy already accounts for 99 per cent of the total electricity production (mostly hydropower: almost 50 per cent of Europe’s hydropower capacity is in Norway) Thus, this is not a focus of aid in Norway. The agricultural sector is aid-intensive in Norway. This sector (as well as the fisheries sector) is, however, not covered by the EEA Agreement. Thus, agricultural aid in Norway is monitored only by national political control. VI MERGER REVIEW Section 18 et seq of the CA requires that concentrations meeting certain thresholds are notified to the NCA. Thus, concentrations where the undertakings concerned have a combined annual turnover in Norway exceeding 1 billion Norwegian kroner must be notified, unless only one of the undertakings concerned has an annual turnover in Norway exceeding 100 million Norwegian kroner. Since the CA entered into force in May 2004, the NCA has intervened in 43 cases, of which 15 concentrations have been prohibited. The procedure pursuant to the CA reflects roughly the EU Merger Regulation, albeit with substantially shorter pre-notification discussions. The main features are as follows: Phase I lasts 25 working days. A standard standstill prohibition applies until approval. There is no deadline for notifying a concentration. Concentrations that are unlikely to affect competition may be notified by a short-form notification, with market share thresholds mirroring the Directorate-General for Competition Short Form CO. The notion of a ‘concentration’ mirrors that of the EU Merger Regulation, and the same holds true for the substantive test: the significant impediment of effective competition test. The Competition Authority publishes a notice of all notified concentrations on its website. During 2017, the NCA received 99 merger notifications, of which four went to Phase II and one triggered an intervention by way of a prohibition decision. In addition, the NCA adopted one decision related to breach of the standstill provision. Although Norway is not an EU Member State, it is covered by the one-stop shop of a Form CO filing to the European Commission pursuant to the EUMR.Two key particularities are that turnover in Norway (EFTA) is not relevant for the assessment of the European Commission’s jurisdiction, and the European Commission’s jurisdiction only covers products and services covered by the EEA Agreement (Article 8). Thus, exceptions include, inter alia, agricultural products, which may require a separate filing in Norway if national jurisdictional thresholds are met.12 There are also additional EEA and EFTA particularities in relation to the referral procedures between the European Commission and the NCA. i Significant cases Telecom: Telia/Phonero – Phase II clearance Telia’s contemplated acquisition of Phonero was notified to the NCA on 11 November 2016. Telia and Telenor (the incumbent) are by far the two largest players in the Norwegian market for mobile telecommunication services. In the segment of mobile telecommunication services to business customers, however, Phonero is a successful player that has gained considerable 12 See, e.g., the decision in M.7015, Bain Capital/Altor/Ewos, Section 4 Paragraph 8.

- 12. Norway 12 market share. Thus, the NCA’s preliminary view was that the concentration raised various theories of harm related to the fact that Phonero would no longer be a separate competitive force. The NCA found in the end that the Telia/Phonero concentration would lead to cost savings for Phonero that will in turn benefit costumers. Thus, the NCA ultimately approved the concentration on 3 April 2017. Shipping: Eimskip/Nor Lines – blocked On 3 April 2017, the NCA adopted a decision to prohibit the proposed acquisition of Nor Lines by Icelandic Eimskip.13 The contemplated acquisition involved the two largest players in the market for shipping frozen fish from Northern Norway to Northern Europe. The parties’ customers are fish producers who procure shipping services for their frozen fish. The majority of the frozen fish is exported. The market for transportation of frozen fish with reefer vessels from Northern Norway to Northern Europe has a low number of market players. Thus, the NCA adopted the position that the contemplated acquisition would have significantly impeded effective competition in this market. Against that background, the NCA blocked the decision. In a later unrelated decision of 28 August 2017, the NCA approved the acquisition of activities associated with Nor Lines by Samskip. Other cases In a decision of 20 January 2017, the appellate body (at the time still the Ministry) confirmed a prohibition decision of the NCA of 15 September 2016 blocking the acquisition of Dolly Dimple’s Norge by Umoe Restaurants. The NCA found, that the concentration would lead to a significant restriction of competition in the markets of restaurants and takeaways, both nationally and in 20 local markets. This was confirmed by the Ministry. The case demonstrates the Norwegian authorities’ hitherto focus on small markets, product-wise (here, pizza), as well as geographically. The notification of a joint venture (Nordic Port Services) between Greencarrier Shipping Logistics, DFDS Logistics and Seafront Group, notified on 20 September 2017, was withdrawn by the parties in January 2018. The withdrawal was based on a statement from the NCA conveying its preliminary view that it intended to block the concentration due to the transaction’s impediment of competition in markets related to the port terminal services of sea containers. ii Trends and outlook Prior to 1 April 2017, merger decisions could be appealed to the Ministry, with a possibility for the Council of State to adopt decisions in cases touching on interests of major society significance. As of 1 April 2017, all appeals are lodged at the Competition Appeals Tribunal, and the prerogative of the Council of State has been repealed. The NCA has for many years focused on competition in local markets, which has led to a higher number of prohibition decisions than in comparable jurisdictions with a more neutral focus. The same focus has led the NCA to have one of the highest global ratios of prohibition decisions compared to the number of launched Phase II investigations: for 13 NCA decision V2017-19 of 3 April 2017.

- 13. Norway 13 example, in 2016 (97 merger cases) a Phase II investigation was launched in three cases, and all three cases ended with a prohibition decision. It remains to be seen whether this approach will be endorsed by the (new) Competition Appeals Tribunal. The NCA adopted revised best practice guidelines on the handling of merger cases in December 2017. Pre-notification discussions are used more often than previously. Most of the NCA’s internal enforcement resources are allocated to merger control, with the effect that complex cases under Sections 10 and 11 (Articles 101 and 102 TFEU cases) are usually not subject to an in-depth investigation. VIII CONCLUSIONS The most significant issue in relation to public enforcement of the competition rules in Norway in 2017 was the establishment of the Competition Appeals Tribunal. The Tribunal consists of competition law experts, and any subsequent appeals, in practice, will most likely address general legal forms rather than complex assessments of competition economics and law. No changes to the CA are expected in 2018. On merger control, the NCA has retained its focus on local markets, which likely will continue to generate several outright prohibition decisions in cases raising concerns. It remains to be seen whether the NCA’s approach will be endorsed by the (new) Competition Appeals Tribunal. The most significant issue in relation to public enforcement of the state aid rules is the increased use of block-exempted aid pursuant to the GBER. Regarding private enforcement, the highest-profile current case in Norway is the Henrik Kristoffersen case, which is currently pending before the EFTA Court.

- 14. Norway 14 ODD STEMSRUD Advokatfirmaet Grette AS Odd Stemsrud is a partner at Advokatfirmaet Grette and head of the firm’s EU and competition practice. He has advised on some of the largest competition and state aid matters involving Norwegian companies for 20 years. These include merger control at the European Commission, including global coordination, global cartel matters, as well as advice in EEA matters at the EFTA Surveillance Authority (ESA). He regularly assists clients with private enforcement at national courts, and he also has litigation experience from the European Court of Justice and the EFTA Court. Odd is recognised in various international legal guides as a ‘go to guy’ on competition and state aid. Of the current high-profile cases related to Norway he is, inter alia, legal counsel for Henrik Kristoffersen in a key private enforcement case, coordinating global counsel for Höegh Autoliners Holdings in the global PCTC cartel case and counsel for the complainant, Trustly, in an antitrust case related to e-payments and exclusionary conduct by the Norwegian financial sector. Furthermore, he assists Flytoget (operator) and Entur (through-ticketing service provider) in the liberalisation process of passenger transport by rail and LFV, the main Swedish provider, in the liberalisation of the air navigation services markets. He is a contributor to the Antitrust Committee of the International Bar Association and the American Bar Association’s Section of Antitrust Law. ADVOKATFIRMAET GRETTE AS Filipstad Brygge 2 0114 Oslo Norway Tel: +47 480 121 94 odst@grette.no www.grette.no