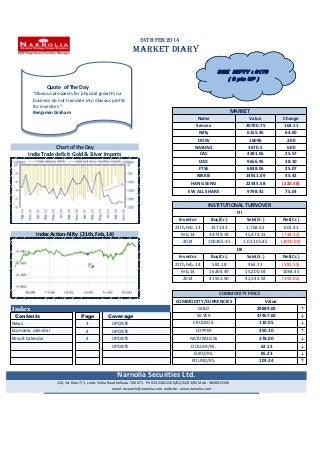

See the Chart of India Trade deficit Gold & Silver Imports in Narnolia Securities Limited Market Diary 24.02.2014

- 1. 24TH Feb 2014 MARKET DIARY SGX NIFTY : 6170 ( 8 pts UP ) Quote of The Day "Obvious prospects for physical growth in a business do not translate into obvious profits for investors." Benjamin Graham MARKET Value 20700.75 6155.45 16095 3670.5 4381.06 Change 164.11 64.00 2.00 6.00 25.57 DAX FTSE NIKKIE HANG SENG 9656.95 6838.06 14911.09 22345.58 38.10 25.07 45.42 (222.58) EW ALL SHARE Chart of the Day India Trade deficit Gold & Silver Imports Name Sensex Nifty DOW NASDAQ CAC 9798.41 75.04 INSTITUTIONAL TURNOVER FII Investor Buy(Cr.) Sale(Cr.) Net(Cr.) 21th,Feb, 14 2371.43 1,768.02 603.41 Feb,14 2014 Index Action-Nifty (21th, Feb, 14) 34739.19 100305.45 35,473.31 1,02,305.45 (734.12) (2000.00) DII Investor Contents News Economic calendar Result Calendar Page 3 Coverage UPDATE 4 UPDATE 4 UPDATE UPDATE Sale(Cr.) Net(Cr.) 21th,Feb, 14 Feb,14 2014 Index Buy(Cr.) 582.18 16264.49 41952.90 963.73 15,200.04 42,343.92 (381.55) 1064.45 (391.02) COMMODITY PRICE COMMODITY/CURRENCIES Value GOLD 29889.00 SILVER 47467.00 CRUDEOIL 110.05 ↑ ↓ ↓ COPPER NATURALGAS 450.10 378.00 ↑ ↓ DOLLAR/RS. EURO/RS. POUND/RS. 62.13 85.23 103.34 ↓ ↓ ↑ Narnolia Securities Ltd. 124, 1st floor 7/1, Lords Sinha Road Kolkata -700071. Ph 033-22821500/01/02/03/04 Mob : 9830013196 email: research@narnolia.com, website : www.narnolia.com

- 2. Derivative Research NIFTY SNAPSHOT Nifty Spot Nifty Feb 2013 Future 6155.45(+64) 6161 Nifty Mar 2013 Future Nifty Feb 2013 Open Interest 6194 13972750 Nifty Mar 2013 Open Interest 7 DMA of Spot Nifty 21 DMA of Spot NIfty 50 DMA of Spot Nifty VOLATILITY INDEX (VIX) PUT CALL RATIO 3759550 6085 6085 6085 GRAPH 14.04(-1.12) 1.22 Nifty (Feb Series) Option OI Distribution: Index Outlook Activity of Nifty (Feb Series) Strike CALL OI % Chng 5800 223300 -9.5 5900 476800 -8.2 6000 1704750 -30.7 6100 3451700 -20.1 6200 5143900 -6.8 6300 4662850 -2.3 Fresh Long Seen In (Rising OI -Rising Price) Scrip OI OI ch% GODREJIND 6,80,000 16.8 ULTRACEMCO 9,63,625 11.6 AXISBANK 56,41,000 11.3 VOLTAS 106,84,000 10.2 HCLTECH 41,17,250 8.9 PCR (OI) RISING STOCK T1 PFC 1.2 JSWSTEEL 0.8 MCDOWELL-N 0.5 TATAMOTORS 1.2 ICICIBANK 0.8 FIIs Activity (Fig in Cr) Segment PUT OI Buy Sell Net % Chng 3174350 4893300 10801950 6340550 2162250 -9.6 -27.9 -5.5 21.2 5.5 612350 -9.3 CMP Ch% 268.3 1795.5 1189.8 123.7 1538.3 T2 1.1 0.7 0.5 1.1 0.7 0.4 5.6 2.9 2.9 4.4 INDEX FUTURE INDEX OPTION STOCK FUTURE STOCK OPTION TOTAL 1,255 12,323 1,874 1,145 16,596 Fresh Shorts Seen In: (Rising OI -Falling Price) Scrip OI OI ch% BHARTIARTL 173,02,000 19.9 HDIL 327,36,000 12.2 CIPLA 95,82,000 10.7 JSWENERGY 86,32,000 8.6 RCOM 539,66,000 7.8 PCR (OI) FALLING STOCK T1 OFSS 0.2 GRASIM 0.6 HEROMOTOCO 0.3 ADANIPOWER 0.5 RCOM 0.4 1,573 12,307 2,199 1,172 17,250 CMP (319) 16 (325) (26) (654) Ch% 288.2 41.3 369.3 50.0 111.5 T2 0.3 0.7 0.4 0.6 0.5 -2.9 -0.1 -0.5 -0.3 -4.9

- 3. Markets Snapshot Top Price Performers Top Performers Top Performers 1D % Change Top Performers 1W % Change LLOYDSTEEL 20.00 TANEJAERO 48.94 1M GLOBOFFS % Change IBIPL 19.41 DHARSUGAR 38.77 RMCL 90.98 GEOMETRIC RSYSTEMS 16.98 16.72 DATAMATICS JINDALSWHL 32.05 29.83 SPECTACLE AVANTI 87.21 85.90 DHARSUGAR 15.05 MPSLTD 29.67 RSYSTEMS 70.92 111.61 Worst Price Performers Worst Performers 1D % Change Worst Performers 1W % Change Worst Performers 1M % Change SUNDARAM (19.82) SOUISPAT (26.40) MARG (44.32) STRAUSIND (10.29) SUNDARAM (23.28) ALLSEC (35.47) ASIANTILES (9.85) WARRENTEA (22.55) MONNETISPA (33.89) SOUISPAT (9.80) COROENGG (22.41) REISIXTEN (33.64) BIRLACOT (9.09) GEODESIC (21.64) RADHEDE (33.46) Top News : • Jindal Steel and Power Mgt Guideline : Company expects the company’s total steel capacity, both in India and overseas, to increase around 8 million tonne as compared to current 3 million tonne by the end of the fiscal. Company expects the total capacity to go about 2,800 MW, after the commissioning of three units of 600 Mega Watts. The last unit of JPL will get commissioned in another three-four months, which means that in the next 6-7 months, our total JPL capacity will go to 3,500 MW . • Bajaj Finserv Mgt Guideline : The finance company has seen the stress increasing in the autos sector due to the slowdown seen in the sector. The company is now restricting the quality of its customers it gives loans to combat the increasing stress levels . • Elder Pharma Mgt Guideline : Company is planning to come out with series of new products, especially line of in-license products and brand extension . Elder recently sold one of its key brands, Shelcal, to Torrent pharma. The company is looking for growth in the three core areas, which are nutraceuticals, wound management and antibiotics . The company is looking for growth in the three core areas, which are nutraceuticals, wound management and antibiotics . The company is expecting a domestic turnover in the range of Rs 150-200 crore. Mgt said the move will bring down costs of operation, which will have a positive impact on the margins and expects international revenues, from subsidiaries in the UK and others, in the range of Rs 600-700 crore. The Elder-Torrent deal, priced at Rs 2,004 crore for 30 brands, is expected to be completed in the first half of 2014. The brands sold by Elder include Shelcal, Chymoral, Shelcal CT. These three are Elder’s strongest brands and contribute around 35 percent of the domestic sales • Lupin Mgt Guideline : Lupin expect the company’s Indian business to perform well in Q4FY14 despite a high base. “Historic growth rate for the company has been in range of 18-22 percent . Going ahead margin expansion will not be linear. Mgt expects an eventual 150-200 bps upmove in margins. • IL&FS TRANS in joint venture with Elsamex SA ,wholly owned subsidiary of the company in spain has been awarded a contact by roads department Ministry of transport and communication republic of Botswana under output & performance based Road contracts system ( OPRC ) for a period of 10 year effective Feb 19, 2014 . The total length of the road to be maintained for both the contracts is 267.4 Km for a total value of USD 216.7 million ( 1348.52 crores ) , which are being financed by world bank . • HCL Corp, the holding company for HCL Technologies, denied a Wall Street Journal report that said its founder Shiv Nadar was seeking potential buyers for his $10 billion stake in the company. • Uttam Value Steels would issue preference shares worth Rs 200 crore to strategic investor . The board of directors of the company today has agreed to issue upto 12,90,32,258 equity shares by way of preferential allotment. • As per a CERC order, state power utilities will now compensate Tata Power's Mundra power ultra mega power plant for losses of about Rs 329 crore logged in FY2012-13 in 36 monthly installments while losses notched up between April 2013 and February 2014 will be compensated via a Rs 0.52 per KwH tariff hike over the next 12 months. • NTPC will set up a 1,320 MW power project in Bihar entailing an investment of Rs 9,200 crore. In this regard, a Memorandum of Understanding (MOU) was inked between NTPC, Bihar State Power Generation Company Ltd and Lakhisarai Bijlee Company Private Ltd • U.K. Office for National Statistics said that retail sales fell to -1.5%, from 2.5% in the preceding month whose figure was revised down from 2.6%. Analysts had expected retail sales to fall -1.0% last month. • U.S. Crude Oil Inventories rose to a seasonally adjusted annual rate of 0.973M, from 3.267M in the preceding month. Analysts had expected U.S. Crude Oil Inventories to rise 2.013M last month.

- 4. Result Calendar Q3FY14 Bse Code 500674 504959 520113 532099 505744 500166 500339 513629 Company Name SANOFI Stovec Inds Vesuvius India Database Fin Federal Mogul Goodricke Group RAIN Tulsyan NEC-$ Date 25-Feb-14 25-Feb-14 25-Feb-14 26-Feb-14 26-Feb-14 26-Feb-14 26-Feb-14 26-Feb-14 Bse Code 500530 502180 511371 517140 512205 513063 526299 Company Name Bosch Shree Digvijay-$ Vatsa Corp Moser Baer Vatsa Edu Transfreight Co Mphasis Date 27-Feb-14 27-Feb-14 27-Feb-14 28-Feb-14 28-Feb-14 12-Mar-14 13-Mar-14 Economic Calendar Monday 24-Feb-14 US UK/EURO ZONE INDIA Tuesday 25-Feb-14 Wednesday 26-Feb-14 Thursday 27-Feb-14 Friday 28-Feb-14 S&P/CS Composite-20 HPI y/y , HPI m/m , CB Consumer Confidence , Richmond Manufacturing Index . New Home Sales , Crude Oil Inventories . Core Durable Goods Orders m/m , Unemployment Claims , Durable Goods Orders m/m , Natural Gas Storage . Chicago PMI , Revised UoM Consumer Sentiment , Revised UoM Inflation Expectations , Pending Home Sales m/m . German Retail Sales m/m , German GfK German Consumer Climate , German Import Prices m/m , Nationwide HPI m/m German Ifo Business Climate , CPI y/y Inflation Report Hearings , German Final Prelim CPI m/m , Second Estimate GDP q/q German Unemployment Change , M3 Money , French Consumer Spending m/m , , Core CPI y/y . GDP q/q . , Prelim Business Investment q/q , Index of Supply y/y , Private Loans y/y , Retail PMI . Italian Monthly Unemployment Rate , Net Services 3m/3m , Italian Prelim CPI m/m . Lending to Individuals m/m , CPI Flash Estimate y/y , Unemployment Rate . Foreign Reserves , GDP Growth Rate YoY.

- 5. N arnolia Securities Ltd 402, 4th floor 7/ 1, Lord s Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 em ail: research@narnolia.com , w ebsite : w w w .narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.