ADEX - convencion capsicum 2013: olam

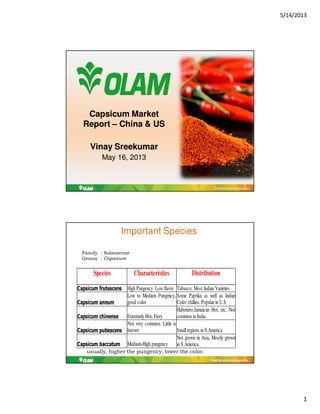

- 1. 5/14/2013 1 Creating value is our business Capsicum MarketCapsicum Market ReportReport –– China & USChina & US VinayVinay SreekumarSreekumar May 16, 2013May 16, 2013 Creating value is our business Important Species usually, higher the pungency, lower the color. Characteristics Distribution Capsicum frutescens High Pungency. Low flavor Tabasco, Most Indian Varieties Capsicum annum Capsicum chinense Extremely Hot, Fiery Capsicum pubescens Smallregions in S.America Capsicum baccatum Medium-High pungency Species Low to Medium Pungency, good color Some Paprika as well as Indian Color chillies. Popular in U.S Habenero,Jamaican Hot, etc. Not common in India. Not very common. Little is known Not grown in Asia, Mostly grown in S.America. Family : Solanaceae Genus : Capsicum

- 2. 5/14/2013 2 Creating value is our business Major ProductsMajor Products: Color, Heat and Flavor: Color, Heat and Flavor Capsicums 20-27 species 100(0)s varieties Paprika - Color Primary Origins: China, Peru, US Secondary: Spain, Israel, Zimbabwe Hot Red Pepper Primary Origins – India, Pakistan, Bangladesh Secondary: Mexico, Africa Mild – Medium Hot Red Pepper Primary Origins – India, China Specialties – Flavor Jalapeno, Chipotle, Ancho, Guajillo, Green Chile & others Origins: Mexico, Peru Creating value is our business Standard Pod Size - generally, smaller the pod size, higher the pungency.

- 3. 5/14/2013 3 Creating value is our business 2012/ 13 Market – Overview Capsicums • Overall Global Production of Paprika is UP Chinese Paprika Production is UP Good US crop Peru – trending low to previous years • Continued Strong Demand Higher than normal growth rate in destination markets Whole Pods, Oleoresin Strong demand Specialties on the rise. • Market Pricing trend is Lower Creating value is our business 2012 Global Production - Paprika 432MM lbs ( 196,000 MT) 61%15% 12% 3% 2% 7% MM lbs China Peru US Europe Africa Others

- 4. 5/14/2013 4 Creating value is our business 2012 Paprika End Usage by Type 49% 33% 17% 1% Ground Oleo Whole Others Creating value is our business 2012 Global Demand by Region ( 190,000 MT) 40% 29% 17% 9% 5% MM lbs US + Canada Europe China Mexico Others

- 5. 5/14/2013 5 Creating value is our business China – Key Market Characteristics • Second largest Capsicum producer in the world. • Largest Paprika producer • High 2012 crop of ~120,000 MT • Large crop of Medium quality ( 160 – 200 ASTA) • High level of transformation – Whole to Crushed/Ground: VAT impact • High favorability among Spanish buyers • Meets EU requirements • Low pricing • High Oleoresin production Creating value is our business SweetPaprika Linear Chili Linear Chili Jinta ChiliYidu Chili Jinta Chili Yidu Chili Jinta Chili Yidu ChiliAmericanRed Chili These areas primarily plant SweetChili, American Red Chili, Yidu Chili, Jinta Chili, and Linear Chili. These areas primarily plants Chaotian Chili in the Hebei, Henan, Guizhou, Yunnan, and Hunan Province. Chili Planting Areas in China

- 6. 5/14/2013 6 Creating value is our businessCreating valueis our business • Main crop varieties include: Chillies in China: Varieties & Overview Chaotian Jinta Paprika Thread chilies Yunnan chilies Yidu American red The difference is ASTA & SHU Creating value is our business Paprika growing – China Basic CropBasic Crop 20122012 KuerleKuerle AkesuAkesu KashiKashi YiliYili// ChangjiChangji In Mou 180,000 Mu 40,000 Mu 16,000 Mu 30,000 Mu % Area 68% 15% 6% 11% County Bohu Yanji Hejing Wensu Baicheng Alaer Shufu Yupehu Zepu Various Area Quality BEST BEST NORMAL NORMAL NORMAL BEST LOW LOW LOW MEDIUN

- 7. 5/14/2013 7 Creating value is our businessCreating value is our business Chiliwhole pod Chiliminced Chilicrushed Powder Chilistring Chiliring Oleoresin Products made from Chili Raw Material Creating value is our business Paprika -Crop Market Segments - China 54% 17% 25% 4% Quantity – 120,000 MT Oleoresin Whole Pods Ground/Crushed Others

- 8. 5/14/2013 8 Creating value is our business Crop Market Segments - China 23% 27% 18% 14% 18% Whole Pods – 20000 MT 24% 15% 37% 9% 15% Crushed/ Ground – 30000 MT Creating value is our business China Paprika – Challenges – 2013 Crop • Lower prices in CY 12 is a major de-motivator for farmers. • Replacement by alternate crops. • Growing region far away from export ports – local transportation, cold storages and processing infrastructure. • High ASTA – captive oleoresin industry – high capacity.

- 9. 5/14/2013 9 Creating value is our business China – Paprika - Benefits • High carry forward of lower ASTA paprika in cold storage. • VAT benefits – more transformation • Availability of seeds Creating value is our business China – 2014 crop forecast • 25% less planting – lower crop • High carry forward of low ASTA product ( 8000 -10,000 MT) • Stable to low prices till Sept 2013 • Prices trending higher from Oct 2013 • More focus on transformation of available stocks.

- 10. 5/14/2013 10 Creating value is our business US – Paprika growing areas Creating value is our business 0 5000 10000 15000 20000 25000 2010 2011 2012 Arizona California New Mexico Texas Unted States 0 50 100 150 200 250 300 350 400 450 500 2010 2011 2012 Arizona California New Mexico texas United States Area Harvested (Acres) Yields Per Acre 0 1000 2000 3000 4000 5000 6000 2010 2011 2012 Arizona California NewMexico texas United States Production (1,000 cwt) US – Capsicums Production Data

- 11. 5/14/2013 11 Creating value is our business US – Paprika Production ( MM lbs) 0 10 20 30 40 50 60 70 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Millones US SW Paprika Production REDS Creating value is our business US – Key Market Characteristics • Large producer of Capsicums – Bell Pepper, Green Chile, Capsicum. • High 2012 crop of ~ 32,000 MT • ASTA medium quality ( 160 – 200 ASTA) • Contract based farming • Fully mechanized operations • Dehydration – Mechanized – Tunnel or Continuous • Lower competitive pricing • Variety management – higher ASTA, disease resistance.

- 12. 5/14/2013 12 Creating value is our business Capsicum Growing - US Crop is planted in March Mature green pods by Aug. Pods begin achieving red color Sept 1., due to carotenoid development Fields are defoliated prior to harvest Creating value is our business Capsicum – US Harvest One time single harvest Fields usually sprayed with sodium chlorate solution to defoliateplants and makes the pods easier to pick All of the New Mexico/Texas/Arizonacrop is now mechanically harvested .

- 13. 5/14/2013 13 Creating value is our business Mechanical Harvest All US crop is now mechanically harvested Creating value is our business Mechanized Dehydration

- 14. 5/14/2013 14 Creating value is our business Capsicum Products - US • Paprika – Ground, Flakes and Whole • Table Capsicums ( Mesa) • Red Pepper – Ground, Flakes & Whole • Chili Blends • Oleoresins – Paprika & Capsicum • Specialty Peppers – Jalapeno, Chipotle, Ancho, Guajilo and others Creating value is our business Consumption of Capsicums 58% 39% 3% TotalCapsicums 160,000 MT Paprika Red Pepper Capsicums- Others Approximately65,000 MT converted and consumed in Wet/Liquid Form.

- 15. 5/14/2013 15 Creating value is our business Analytical Extractable Color (known as ASTA Color) Visible Color (Scan) Pungency Particle Size Moisture WaterActivity (Aw) Bulk Index Adulteration Indicators (Added colors, Contaminants) Base purity of the spice (Rodent Hair & Insect Fragments) Pesticide Residues Microbiological Salmonella Aflatoxin & Ochratoxin as an indicator of poor post harvest management SPC Yeast / Mold Coliform E.Coli Key Quality Attributes for Capsicum Products Creating value is our business US crop - challenges • Weather • Planting size • Yields • Disease pressure • Competing Crops • Carry forward stocks from other origins

- 16. 5/14/2013 16 Creating value is our business US crop - outlook • Smaller 2013 crop compared to 2012 ( 10% drop) • Pricing pressure from other origins • Focus on cost management / mechanization • Pricing increase in new crop Creating value is our business Overall – Global outlook • High carry forward stocks in 2013 Lower pricing through 2013 • Lower planting in 2013 Less available stocks in 2014 Higher pricing for good quality – supply shortage • FSMA, Food safety and quality management critical Farm management – Pesticides Post Harvest management – Toxins

- 17. 5/14/2013 17 Creating value is our business Peru Capsicums to focus on.. • Cost Management initiatives Yield improvement Mechanization of agriculture practices • Agricultural Practices Pesticide control and management • Post Harvest Management Mechanical Drying Reduction of Toxins, Yeast & Mold, SPC Extraneous matter & Insect Fragment control. Creating value is our business Thank you Questions ?