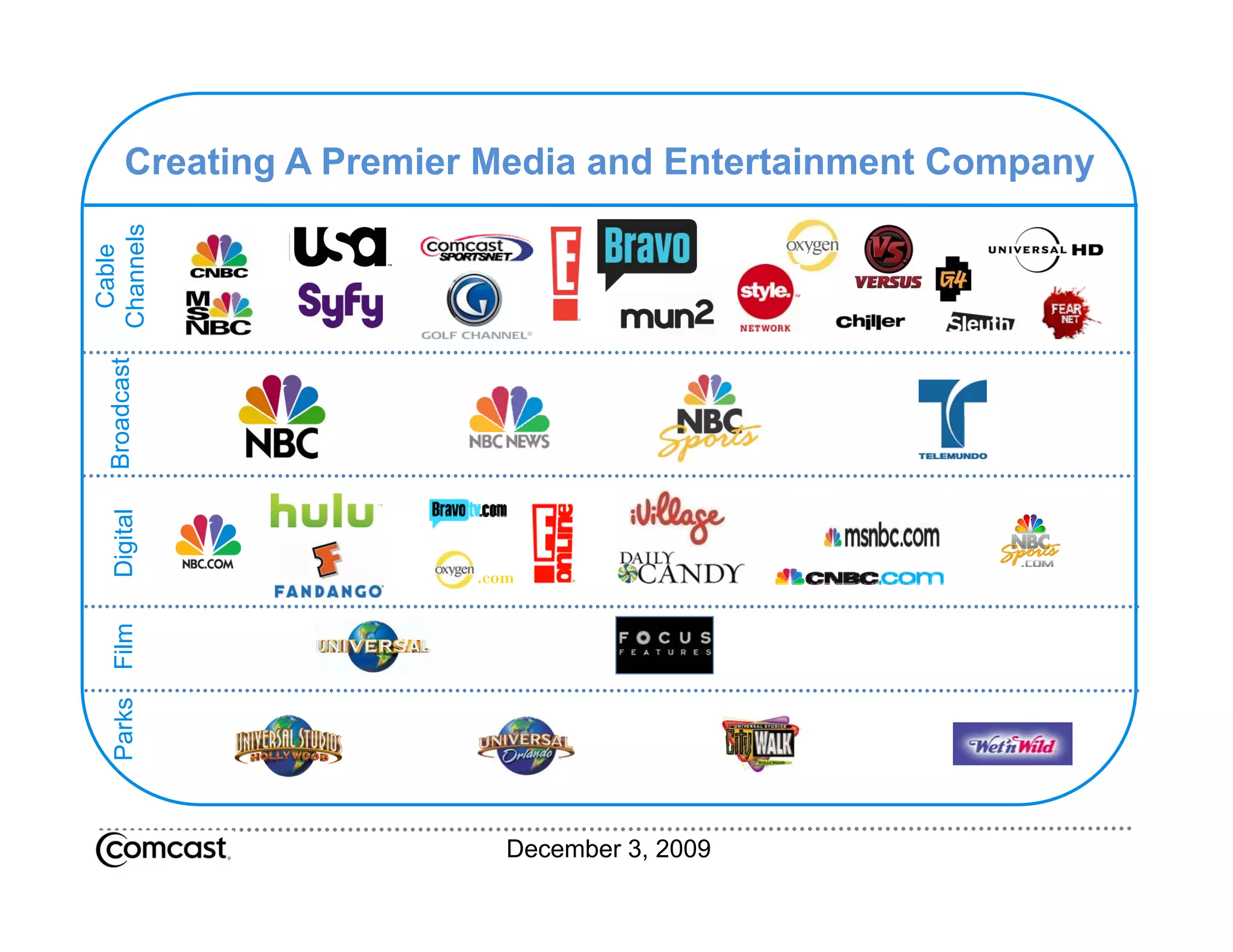

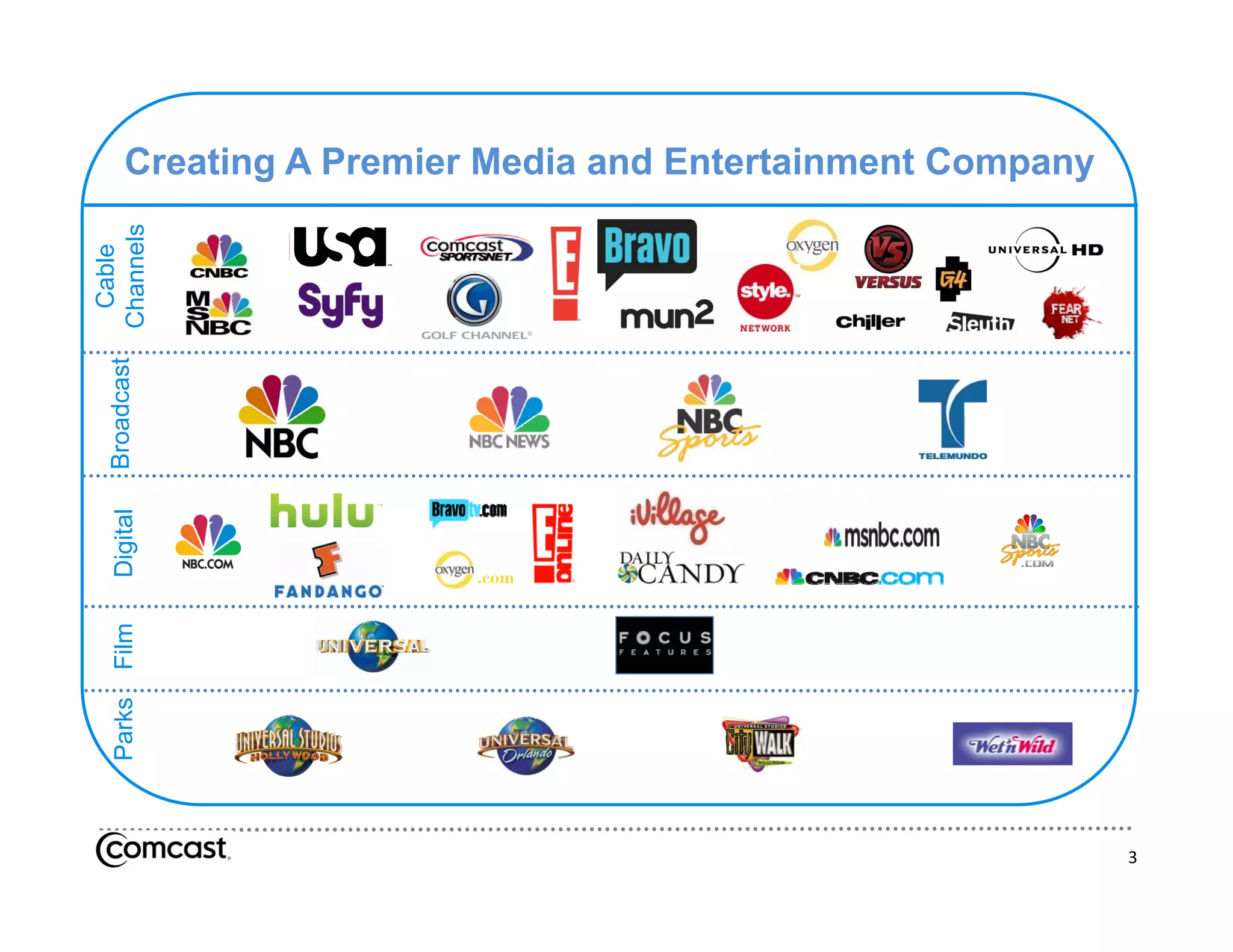

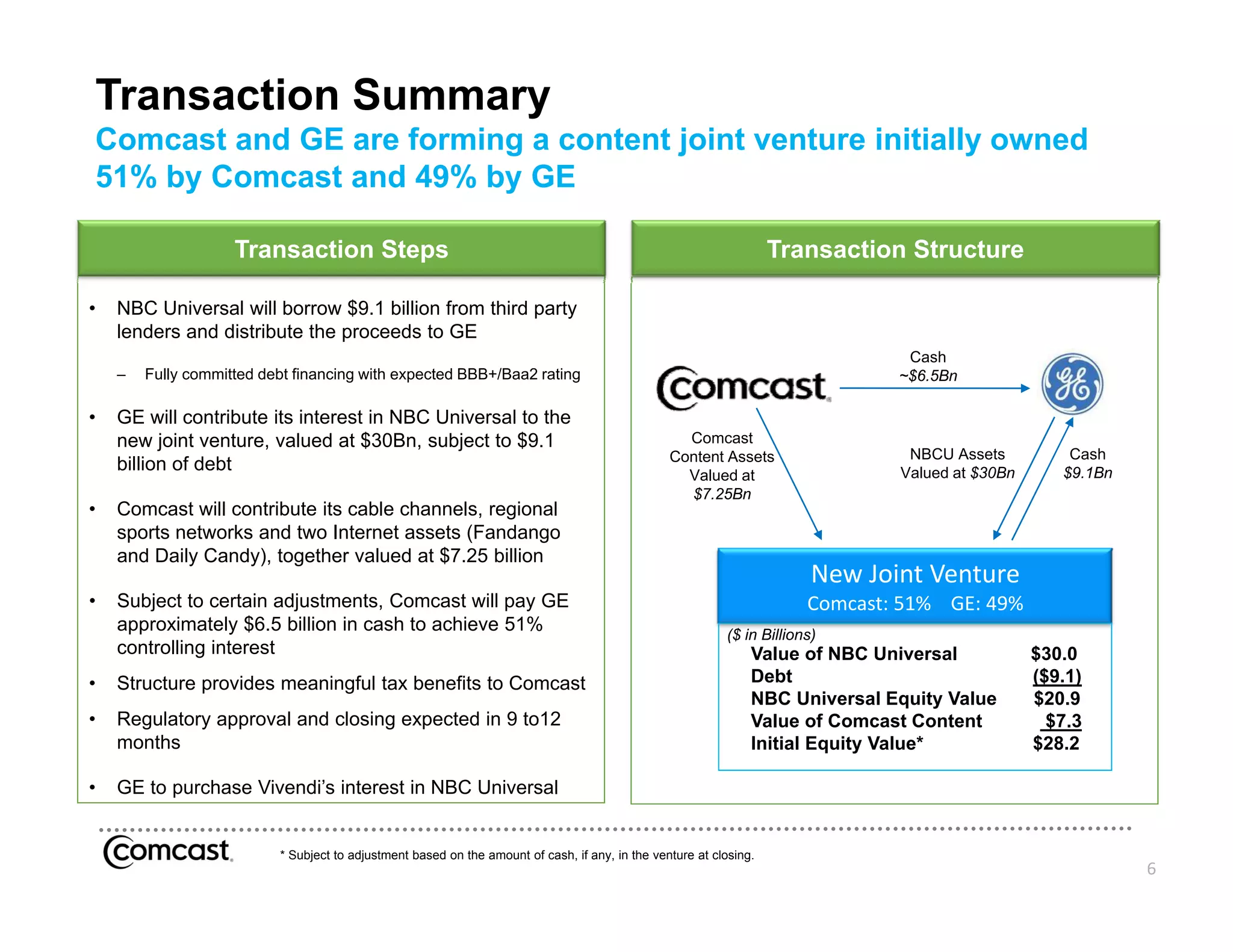

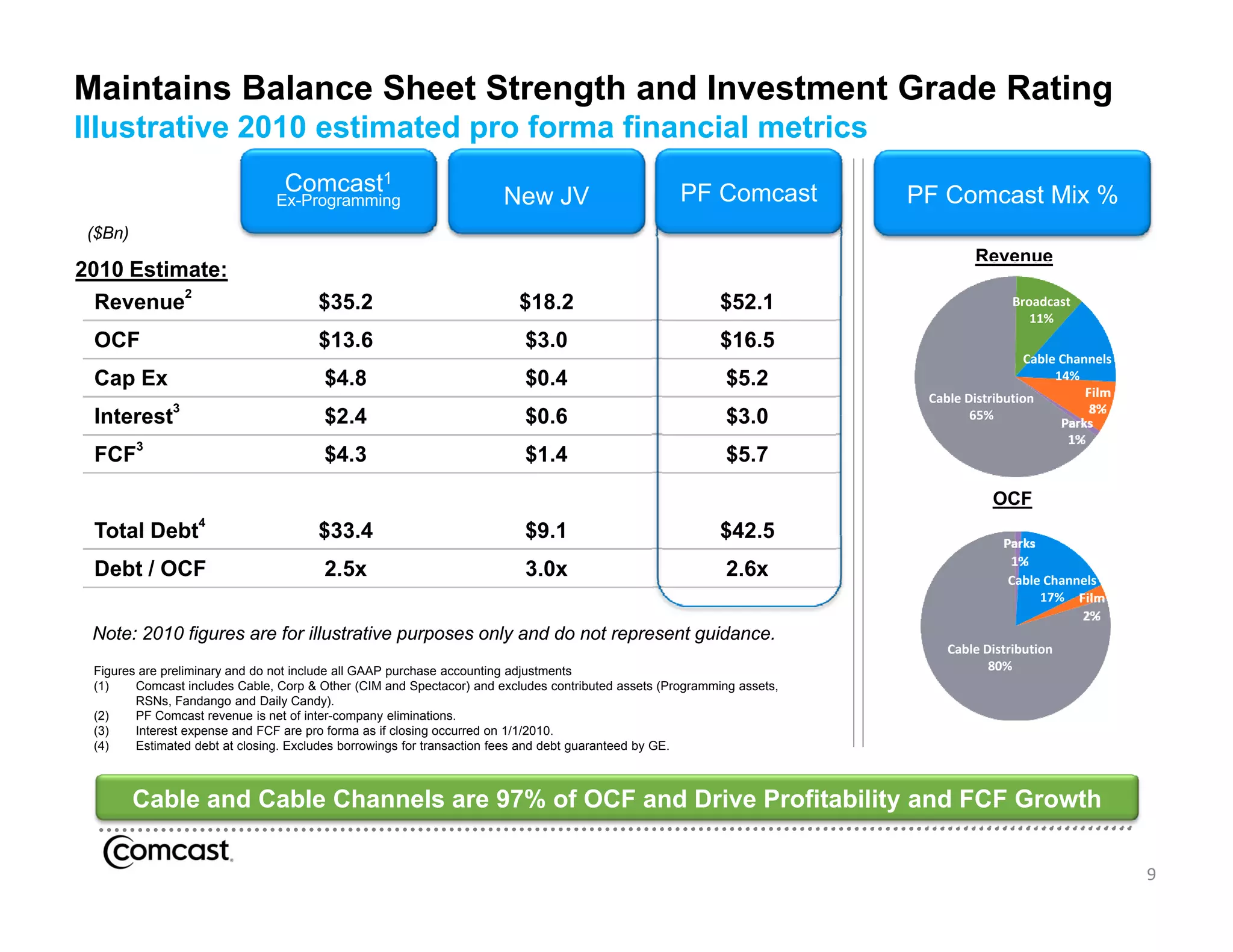

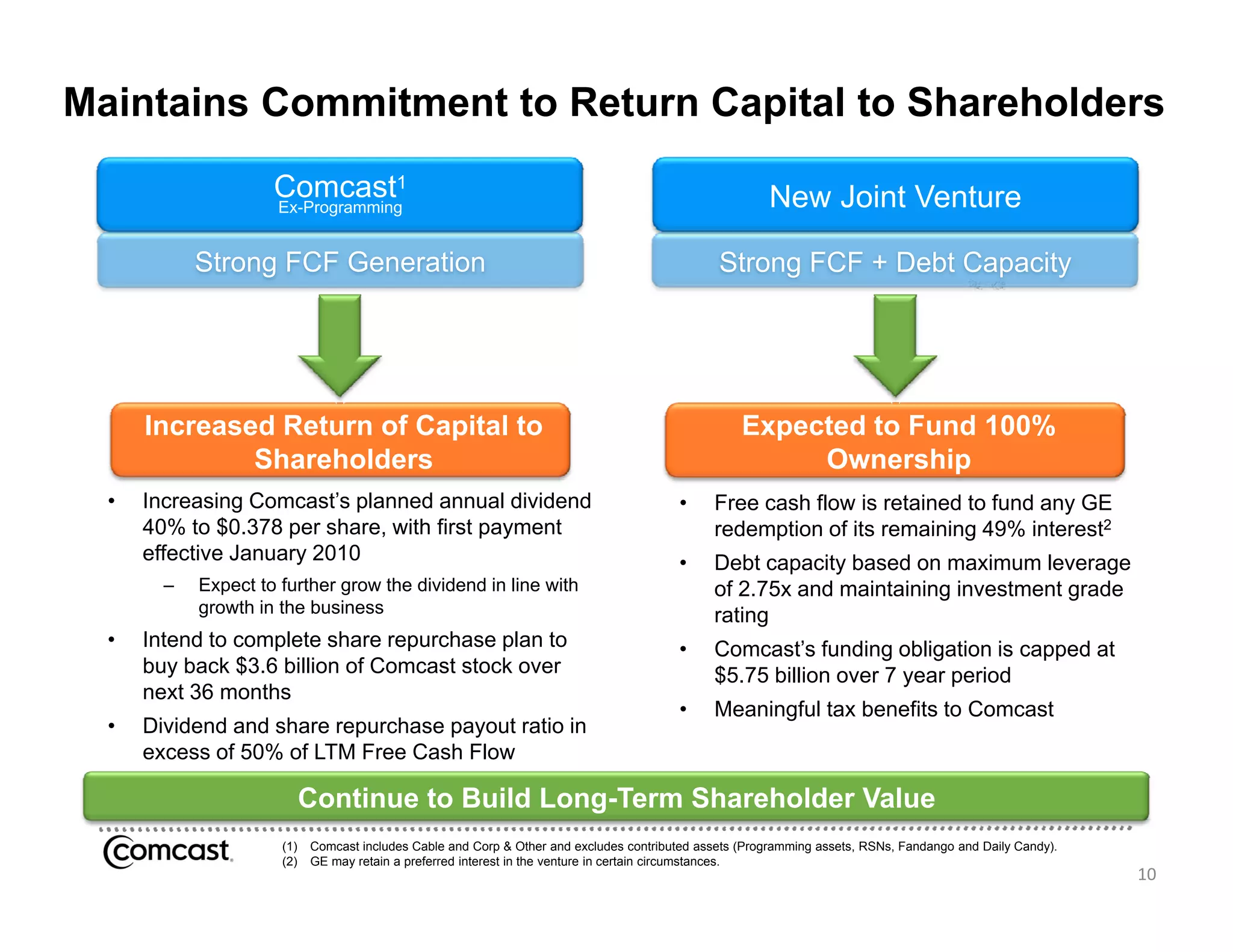

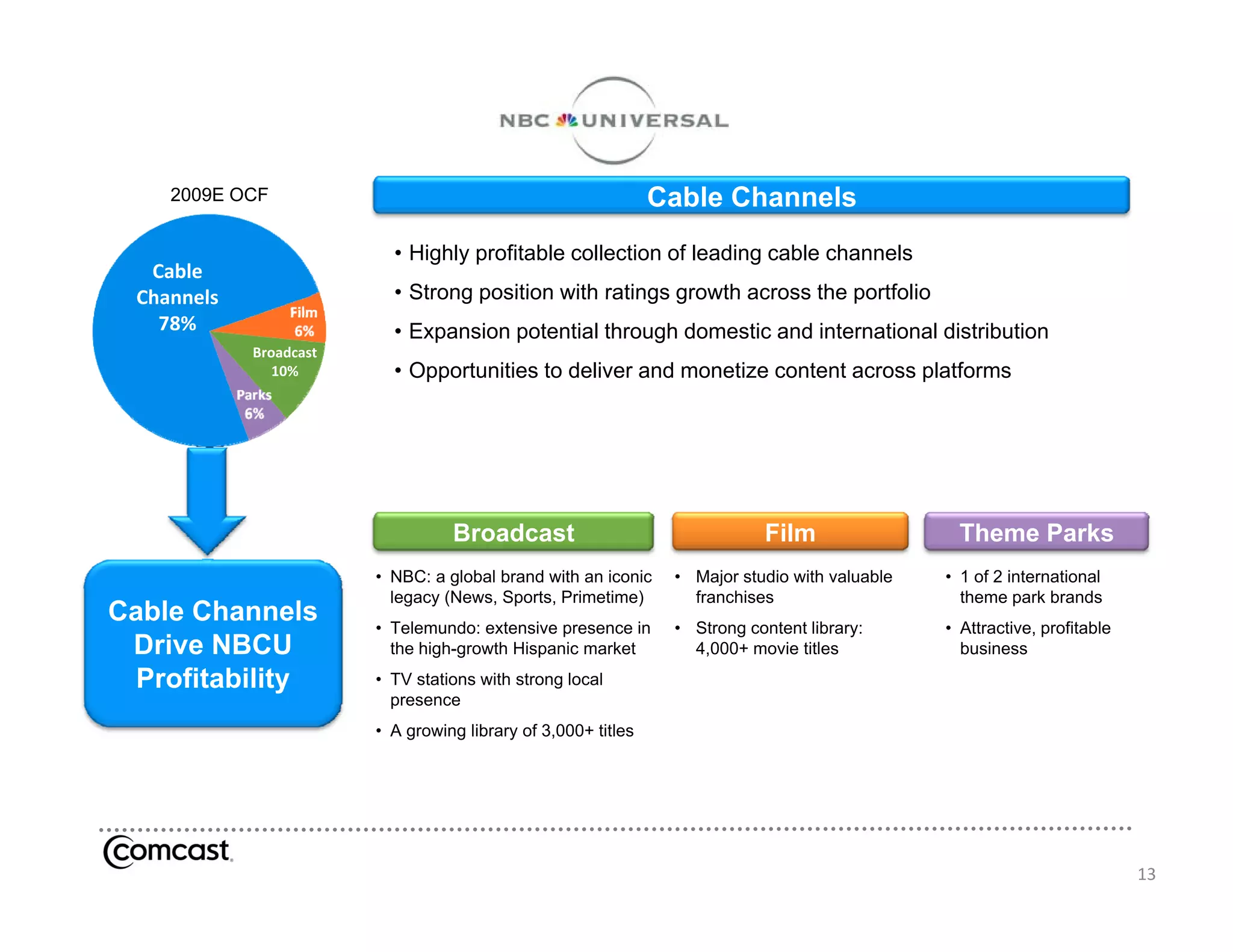

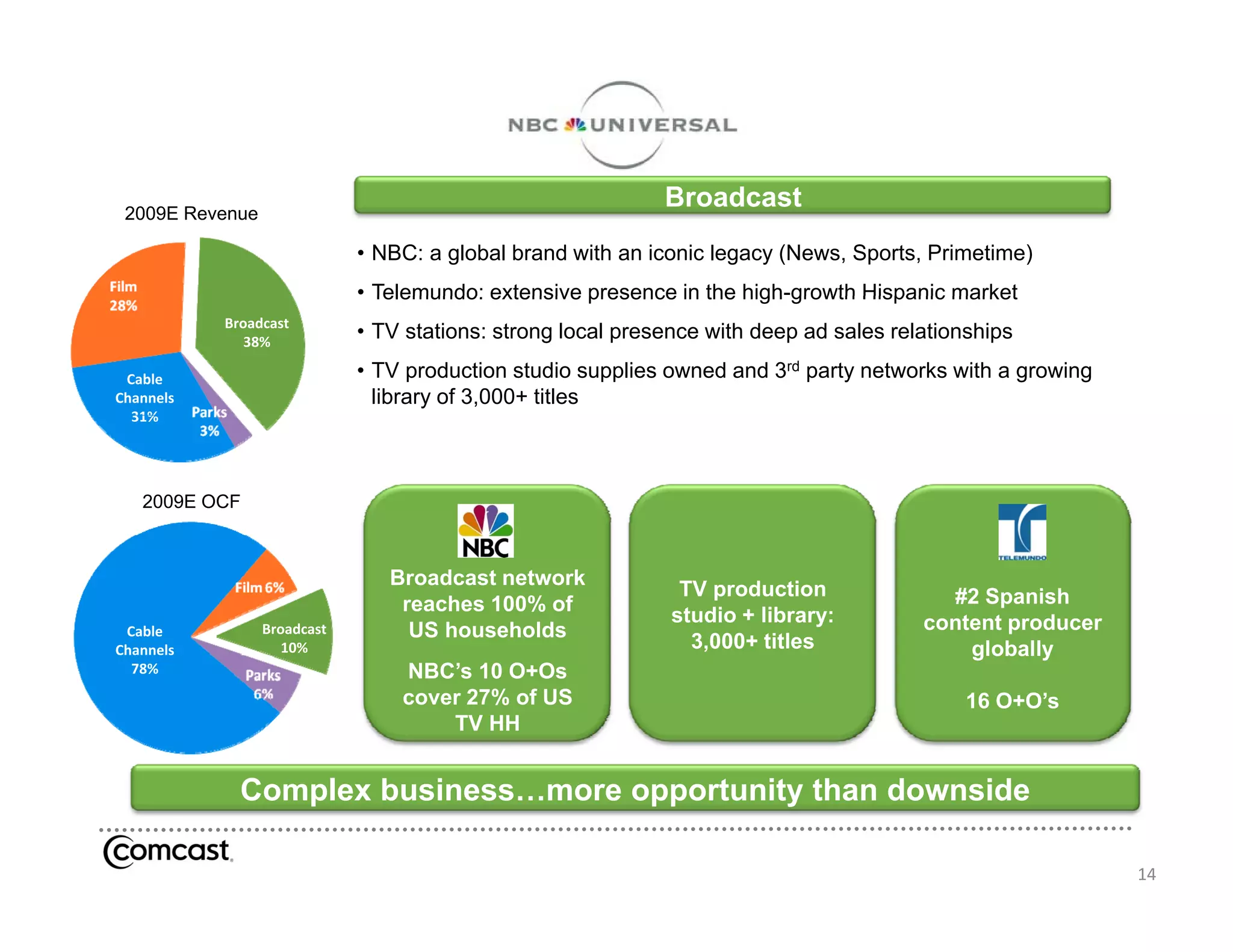

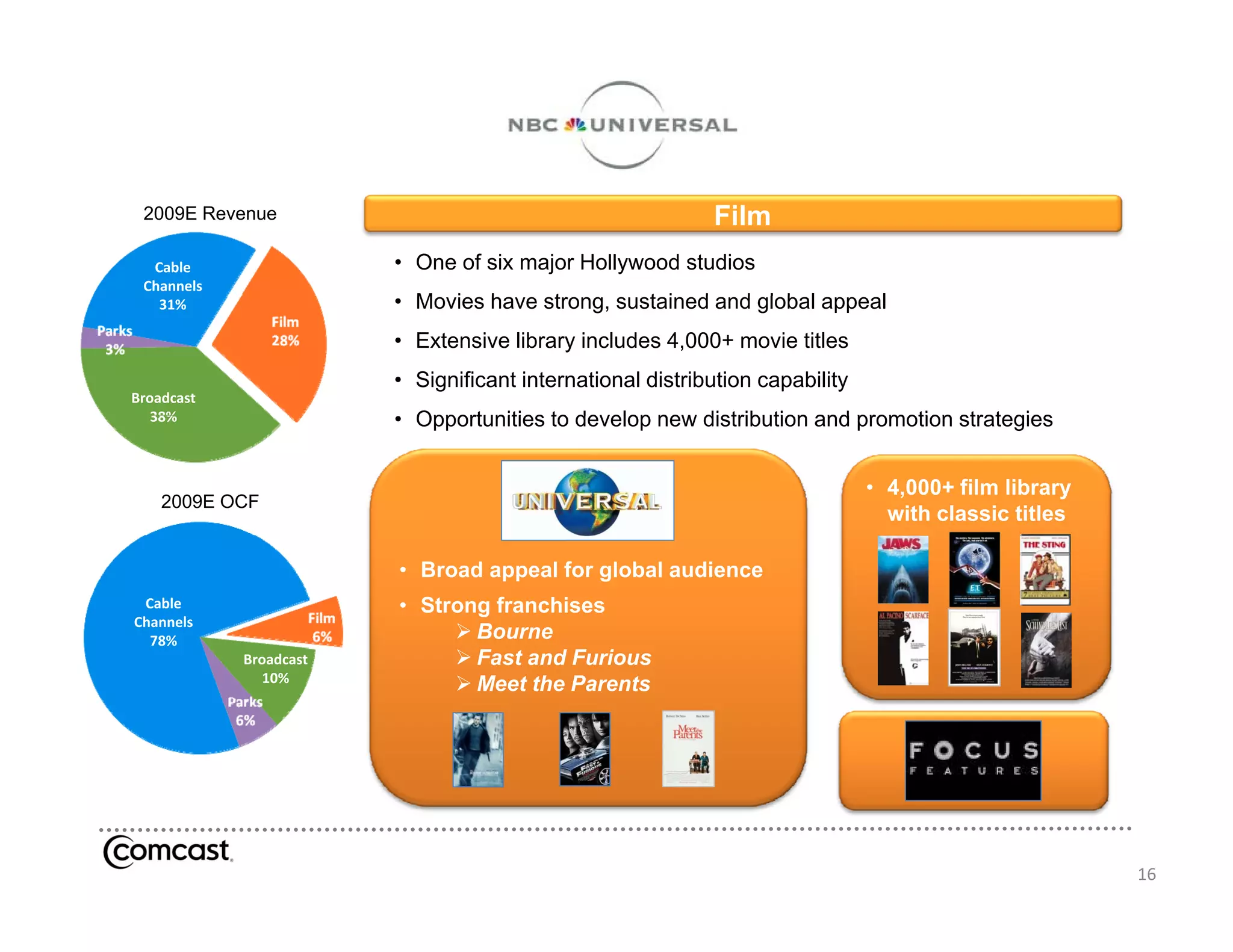

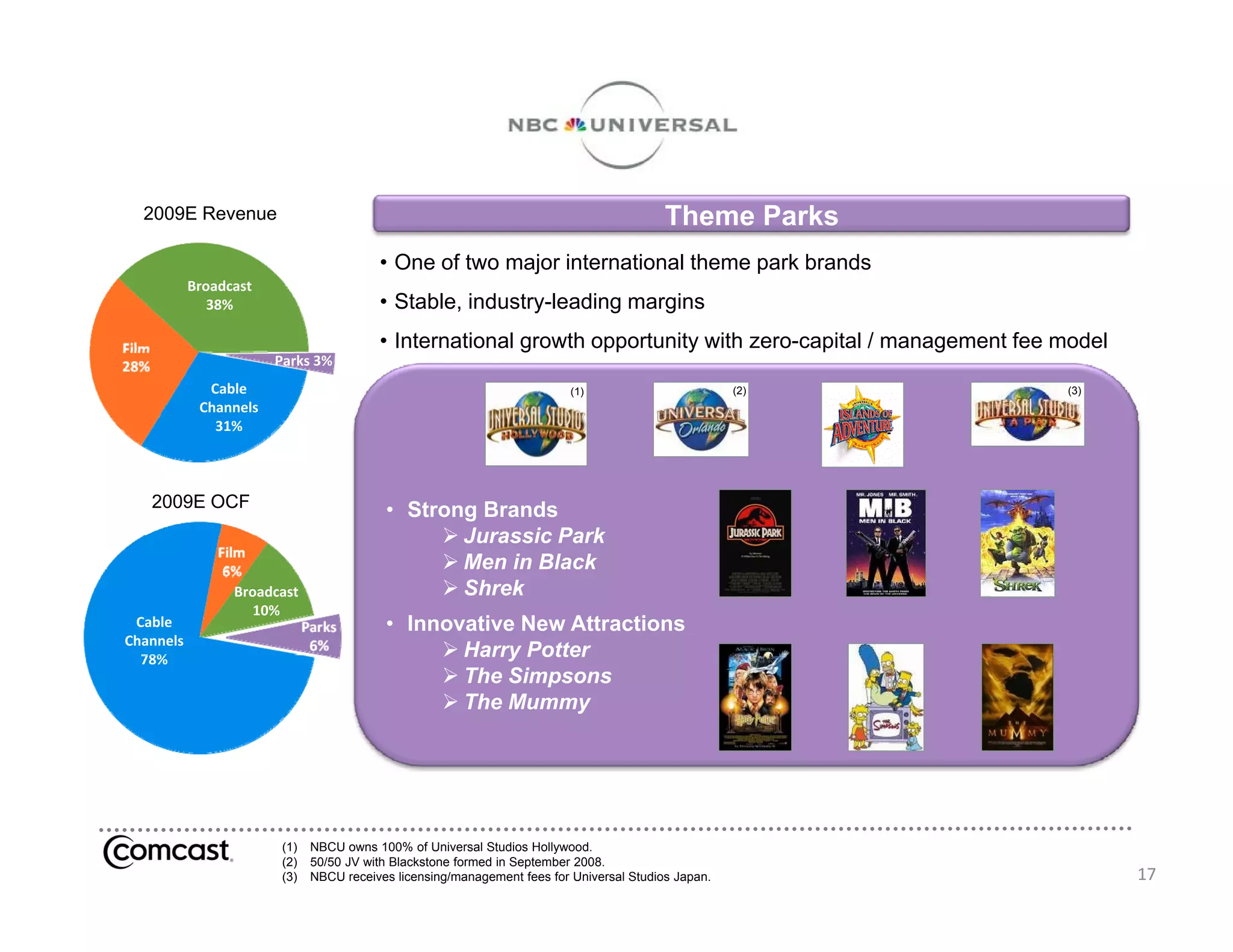

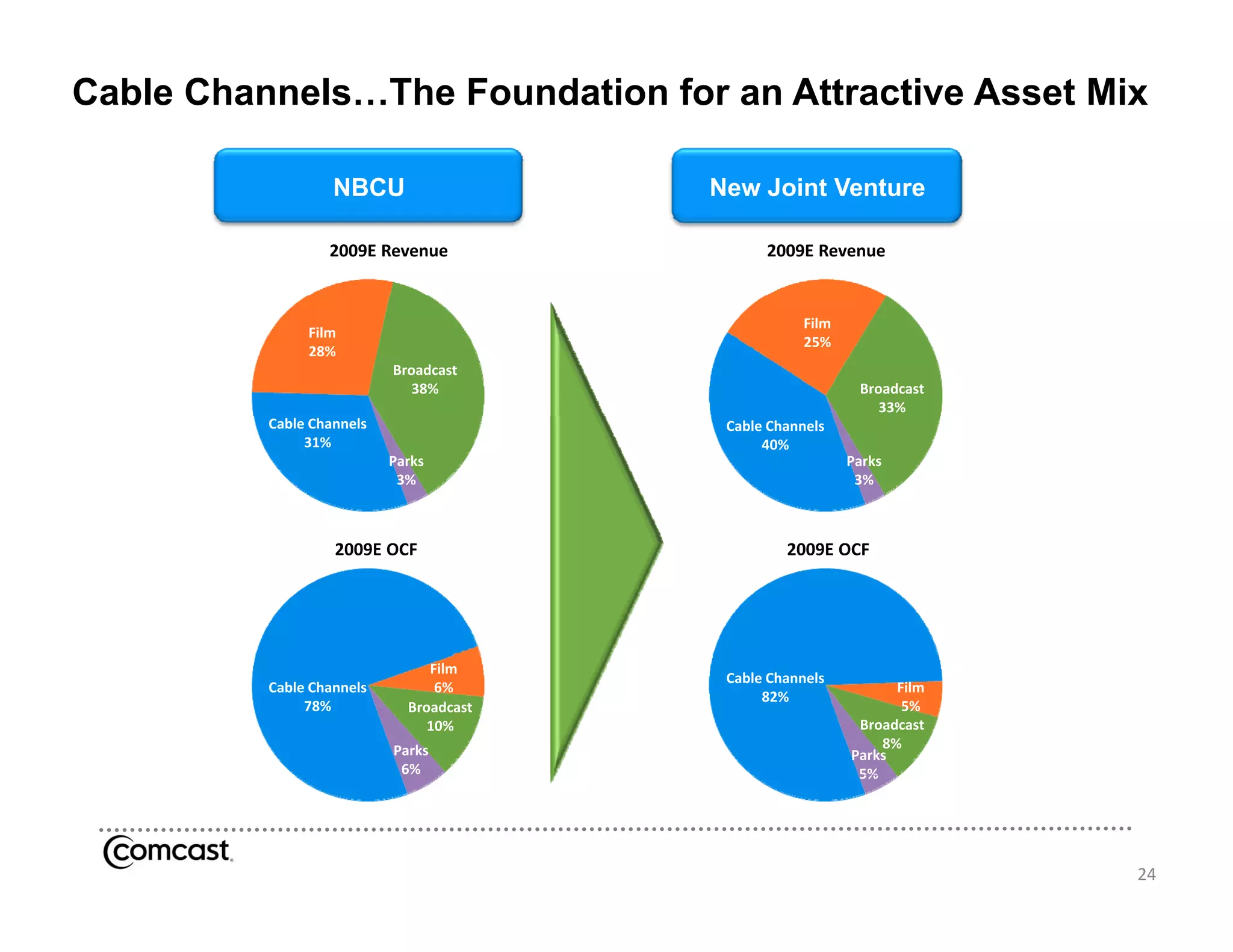

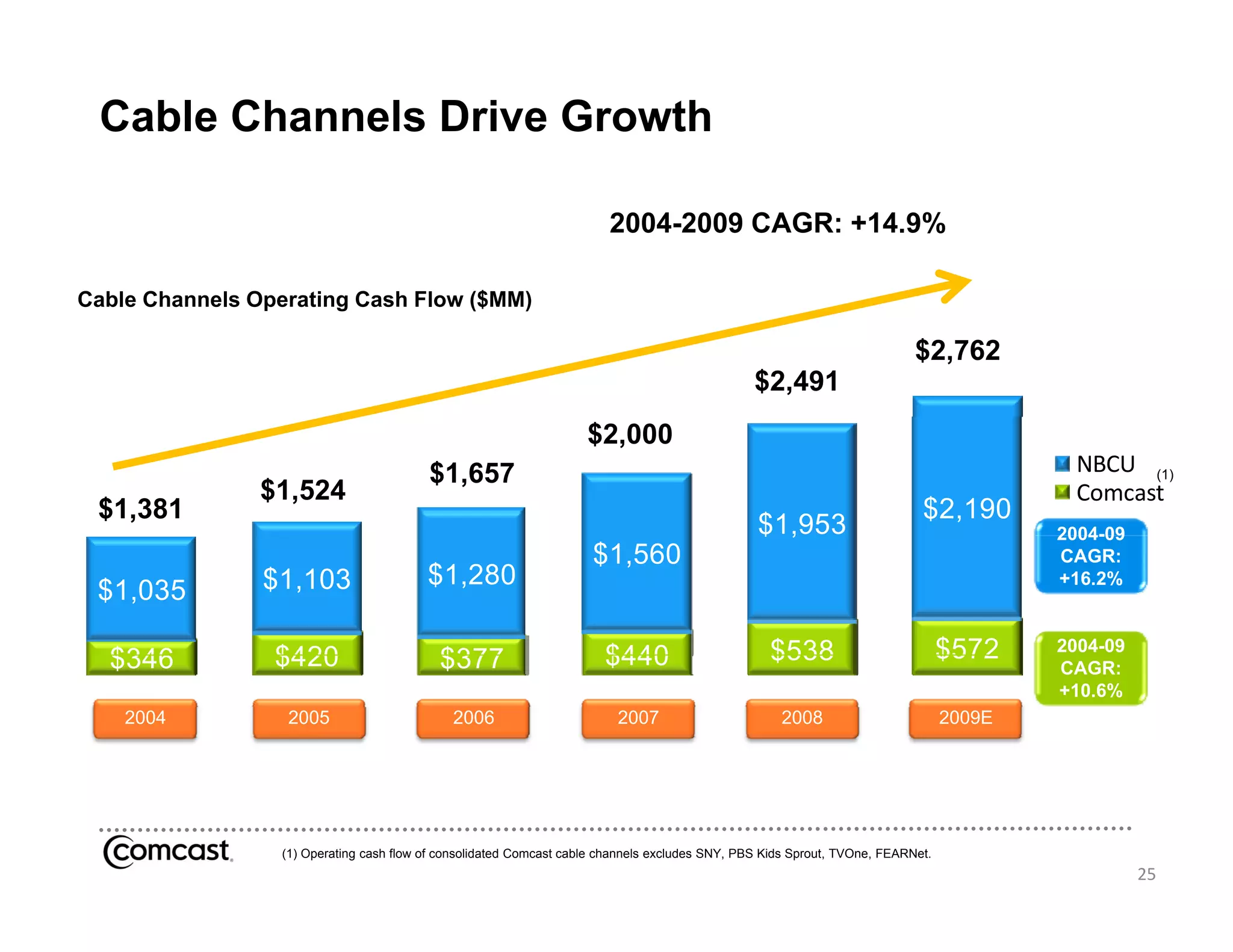

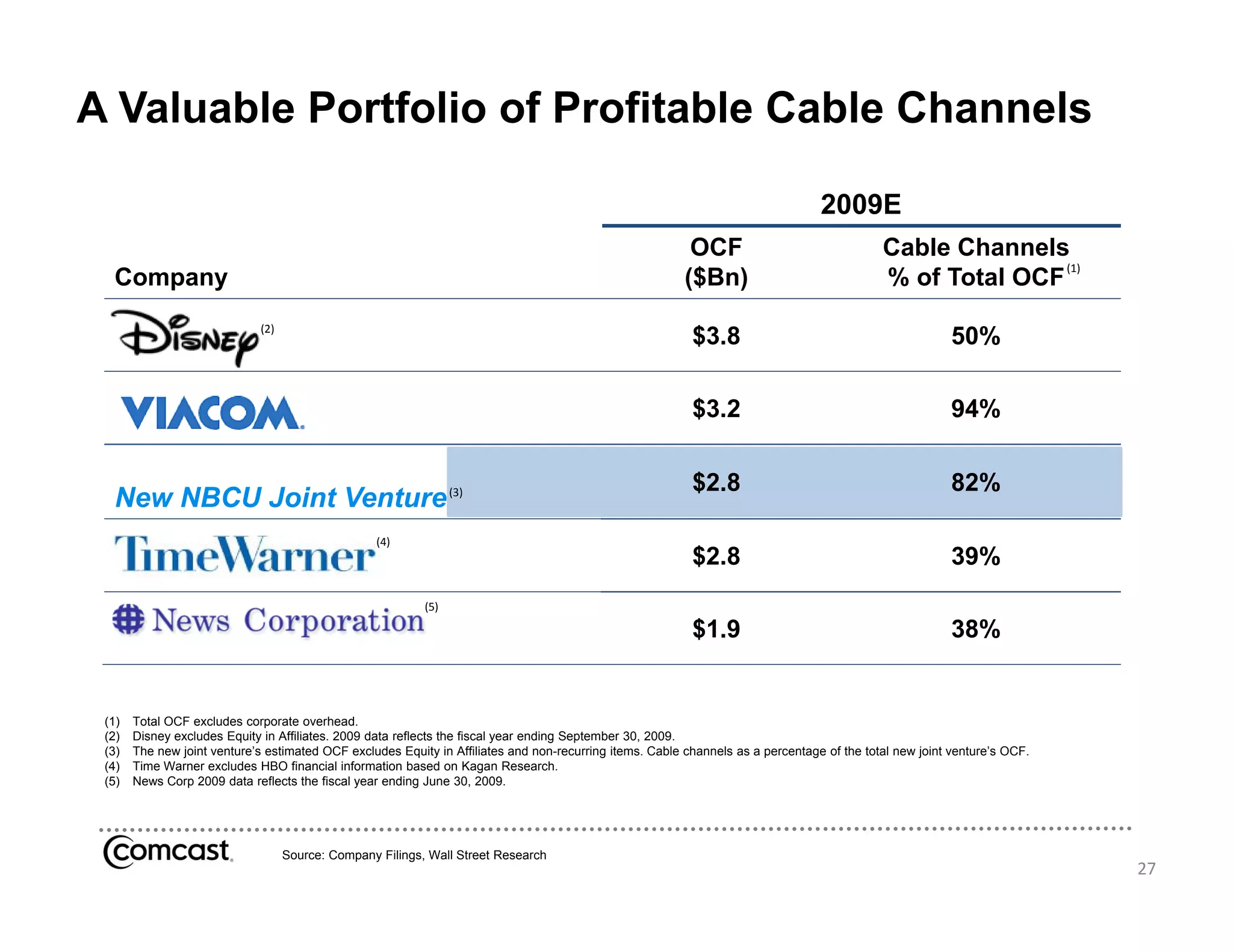

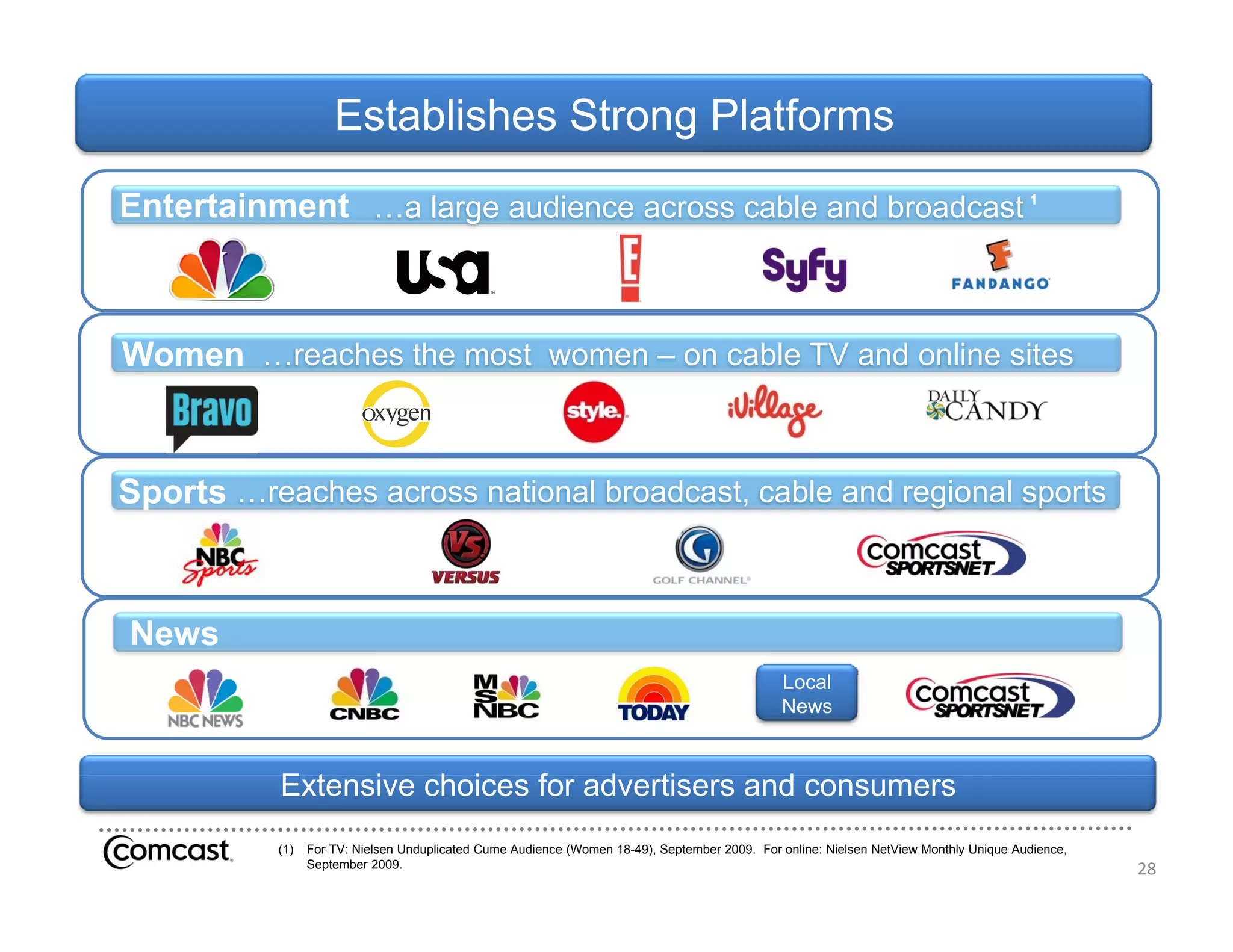

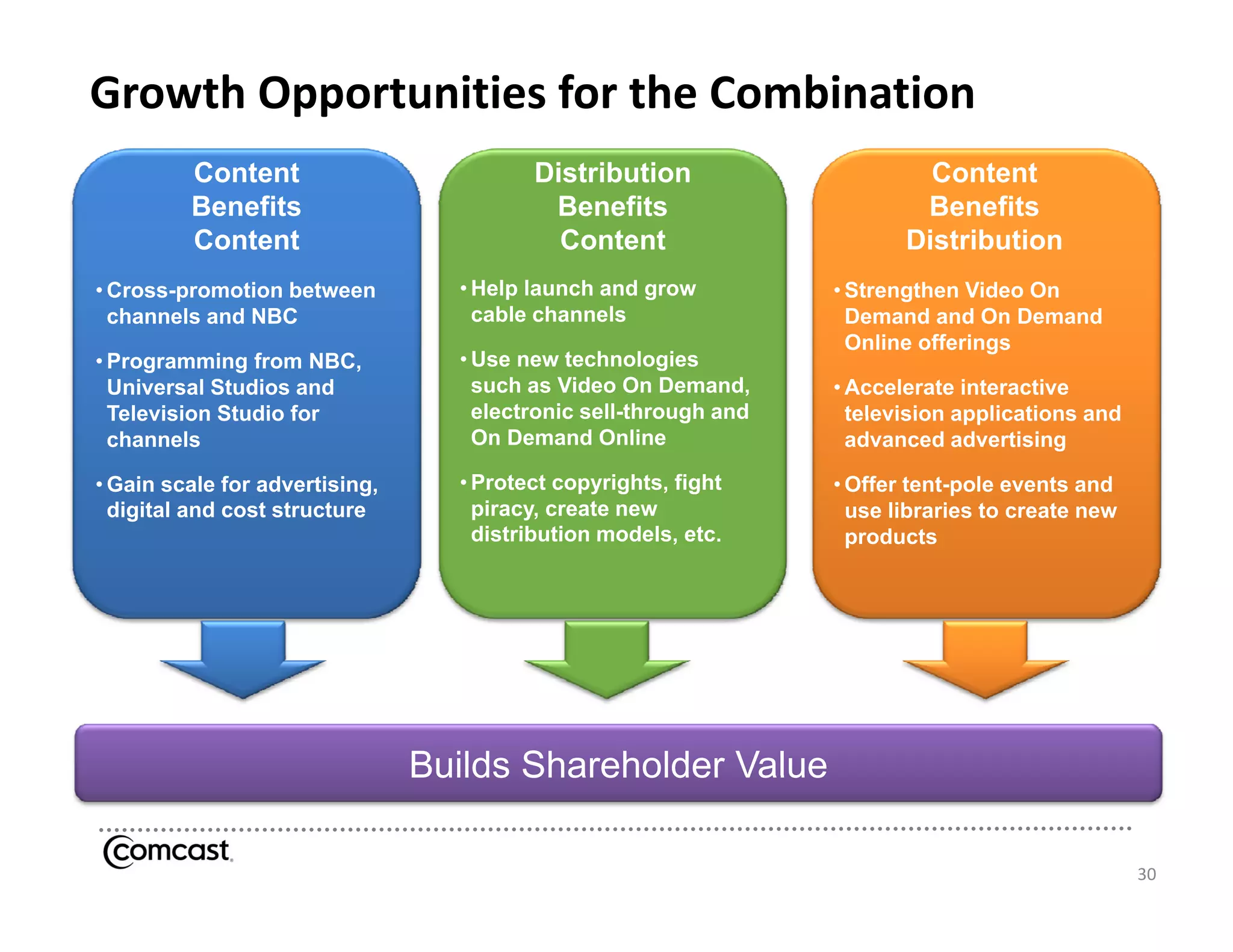

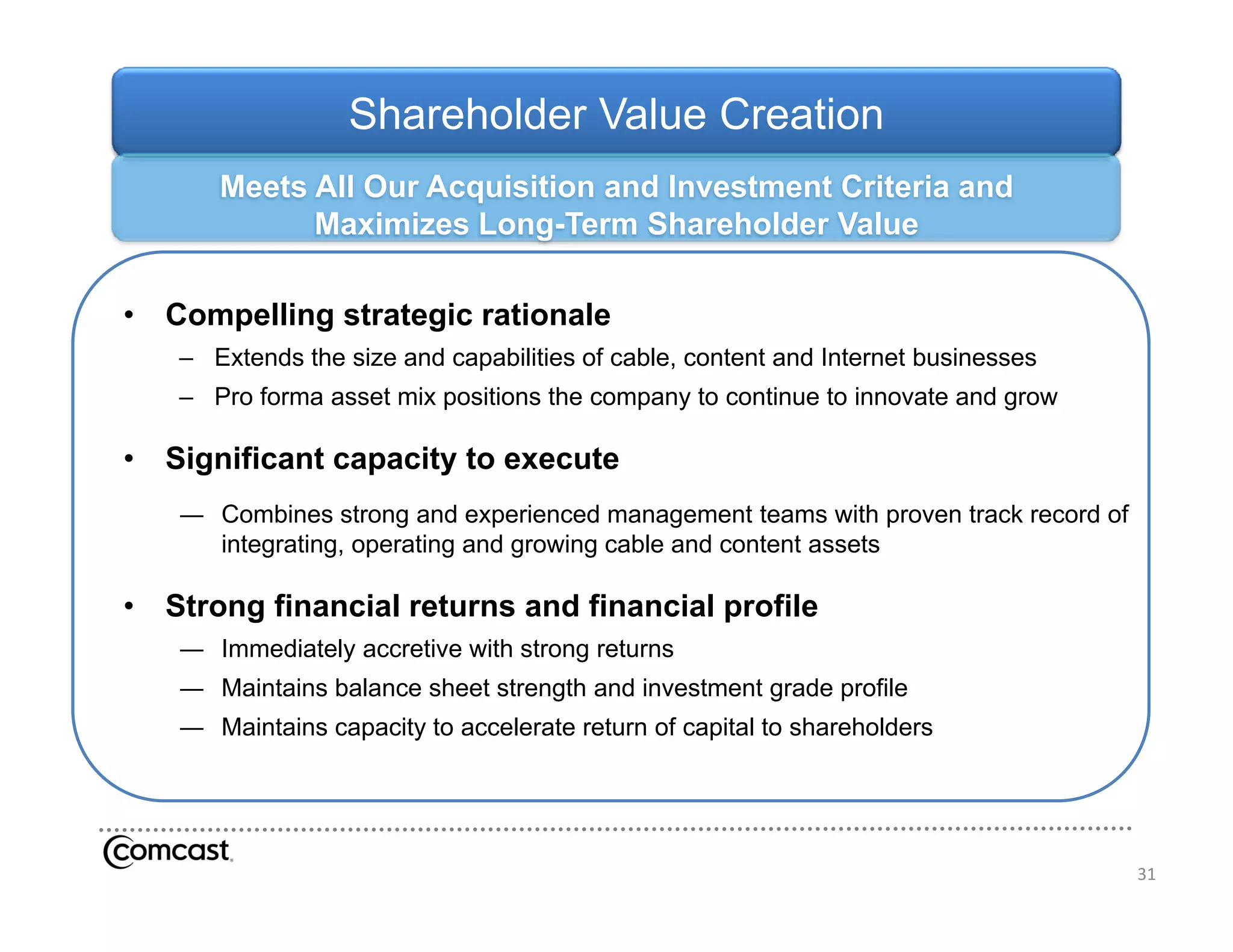

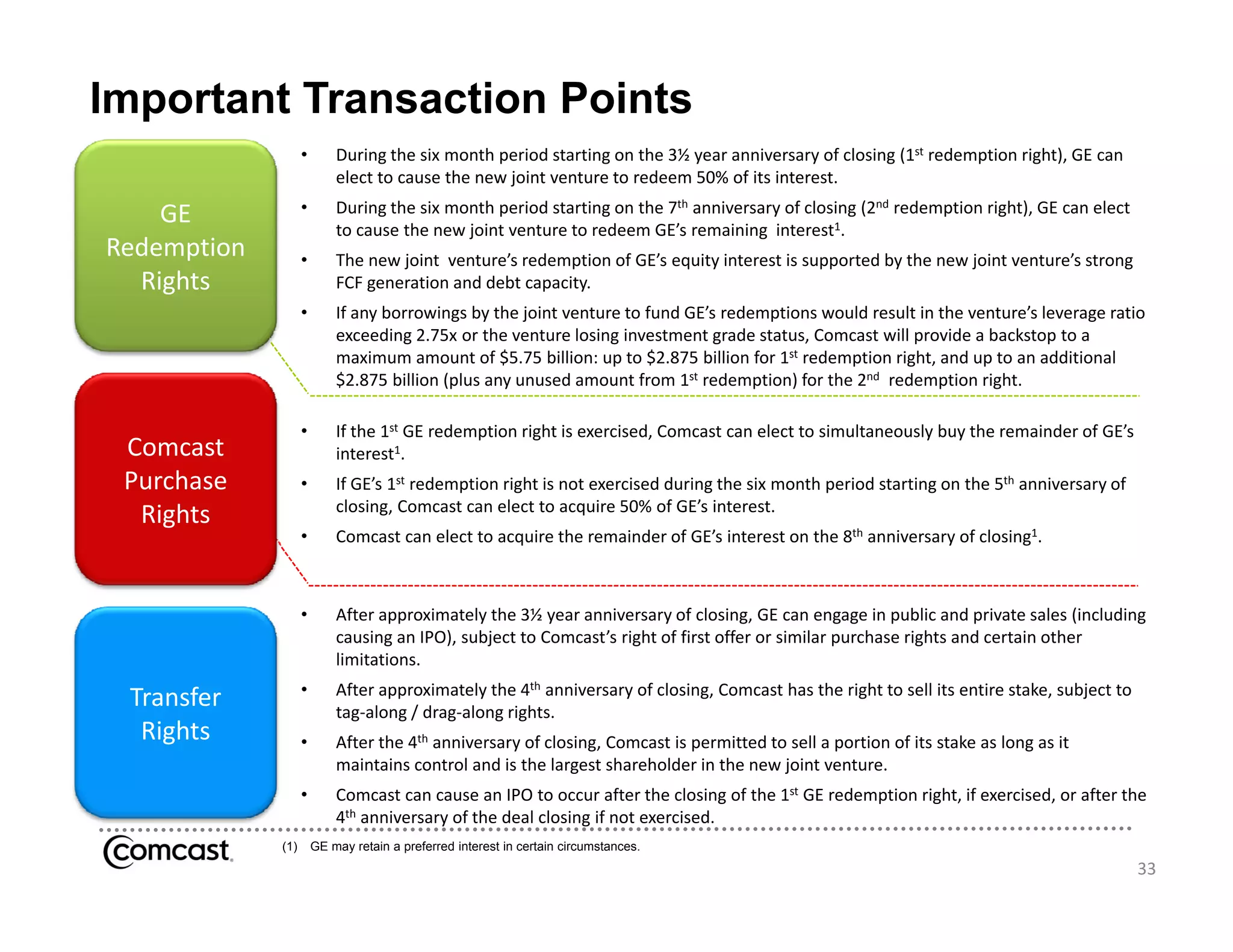

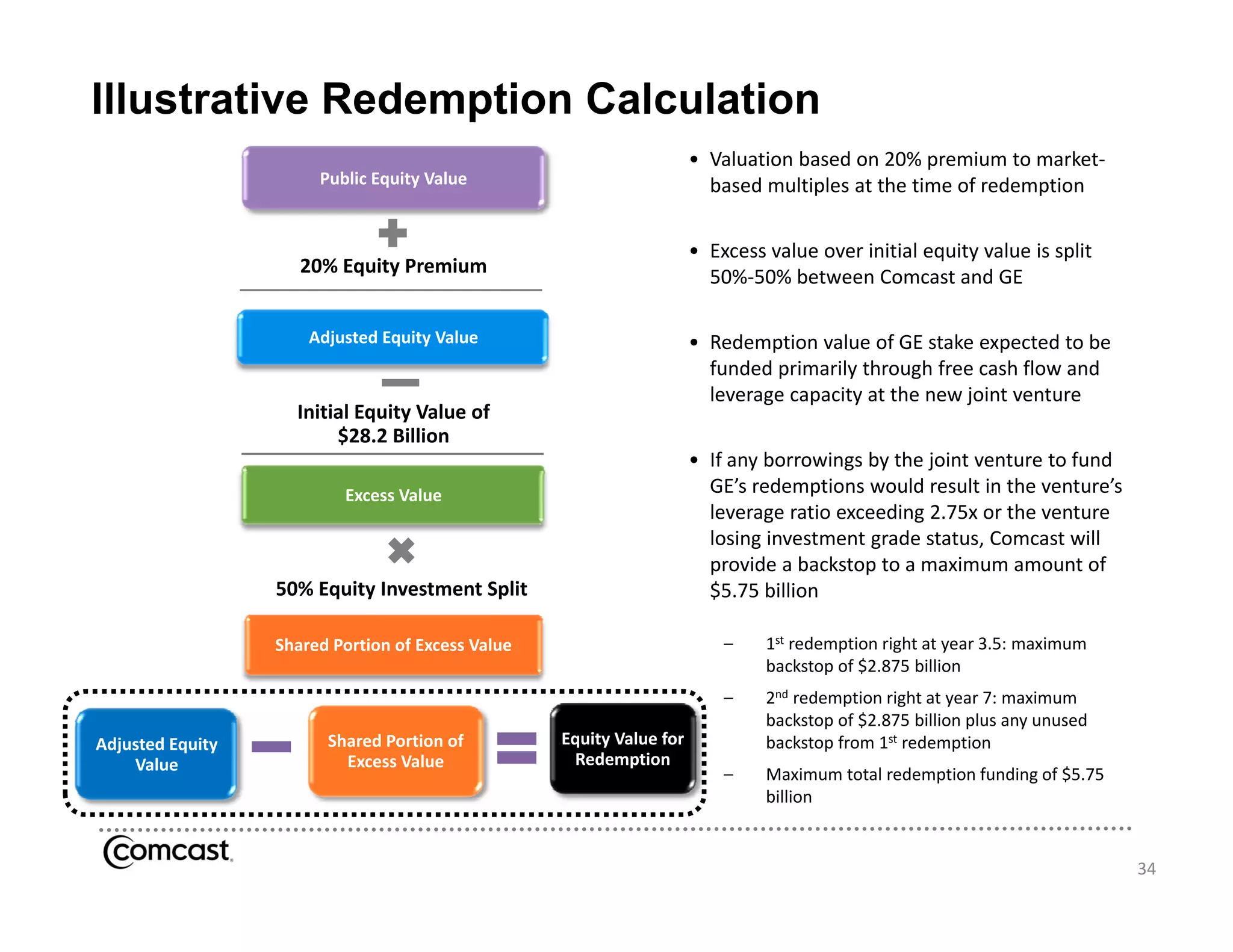

Comcast is creating a premier media and entertainment company through a joint venture with GE. The joint venture will combine Comcast's cable channels, regional sports networks, and digital assets with NBC Universal, bringing together strong content creation and distribution capabilities. The transaction positions the company for continued innovation and growth across cable, broadcast, film, and theme parks. It builds shareholder value through an attractive structure that maintains Comcast's balance sheet strength while providing a 51% controlling ownership. The new joint venture is expected to be financially strong and self-fund the redemption of GE's remaining 49% interest over time.