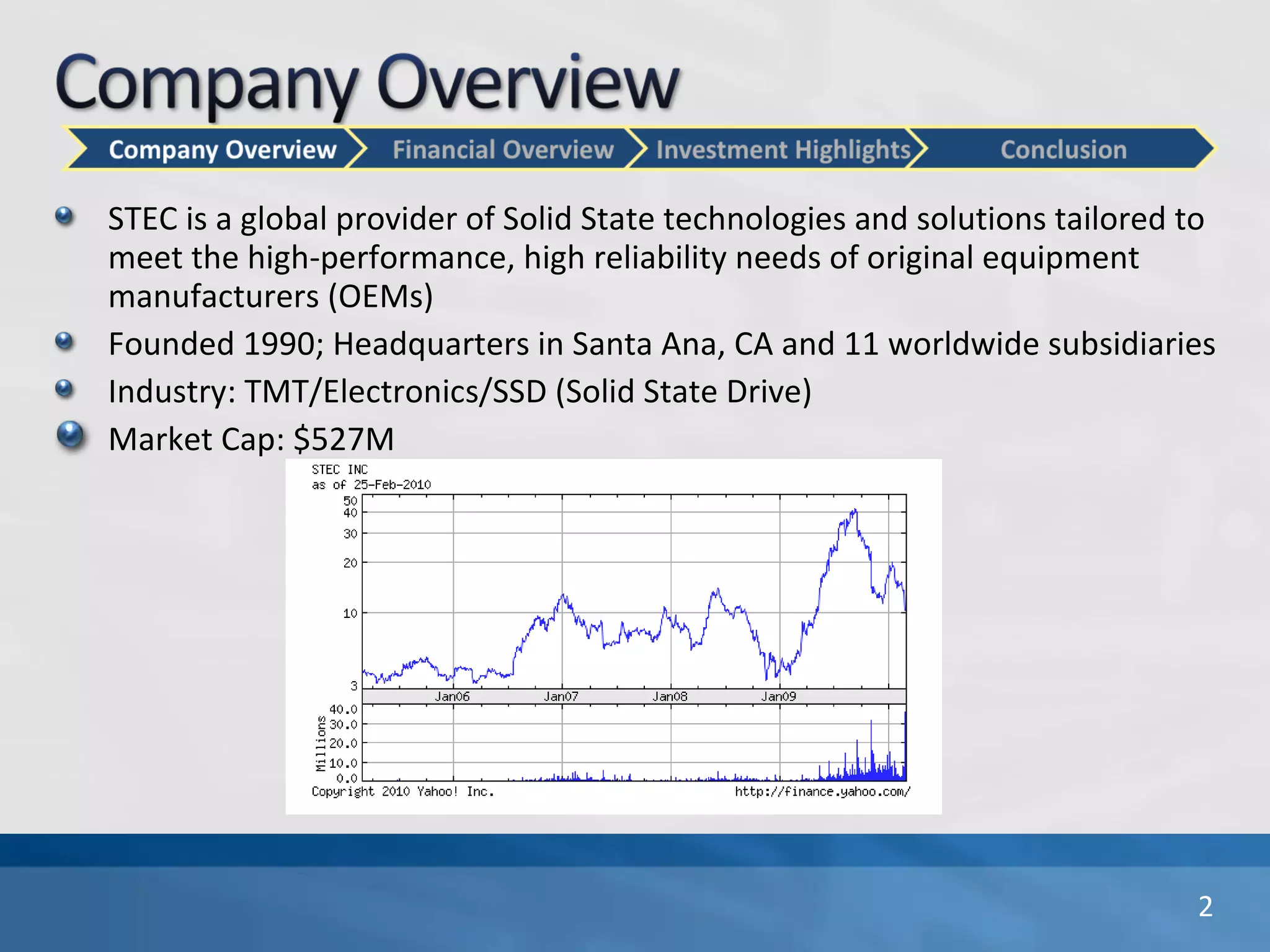

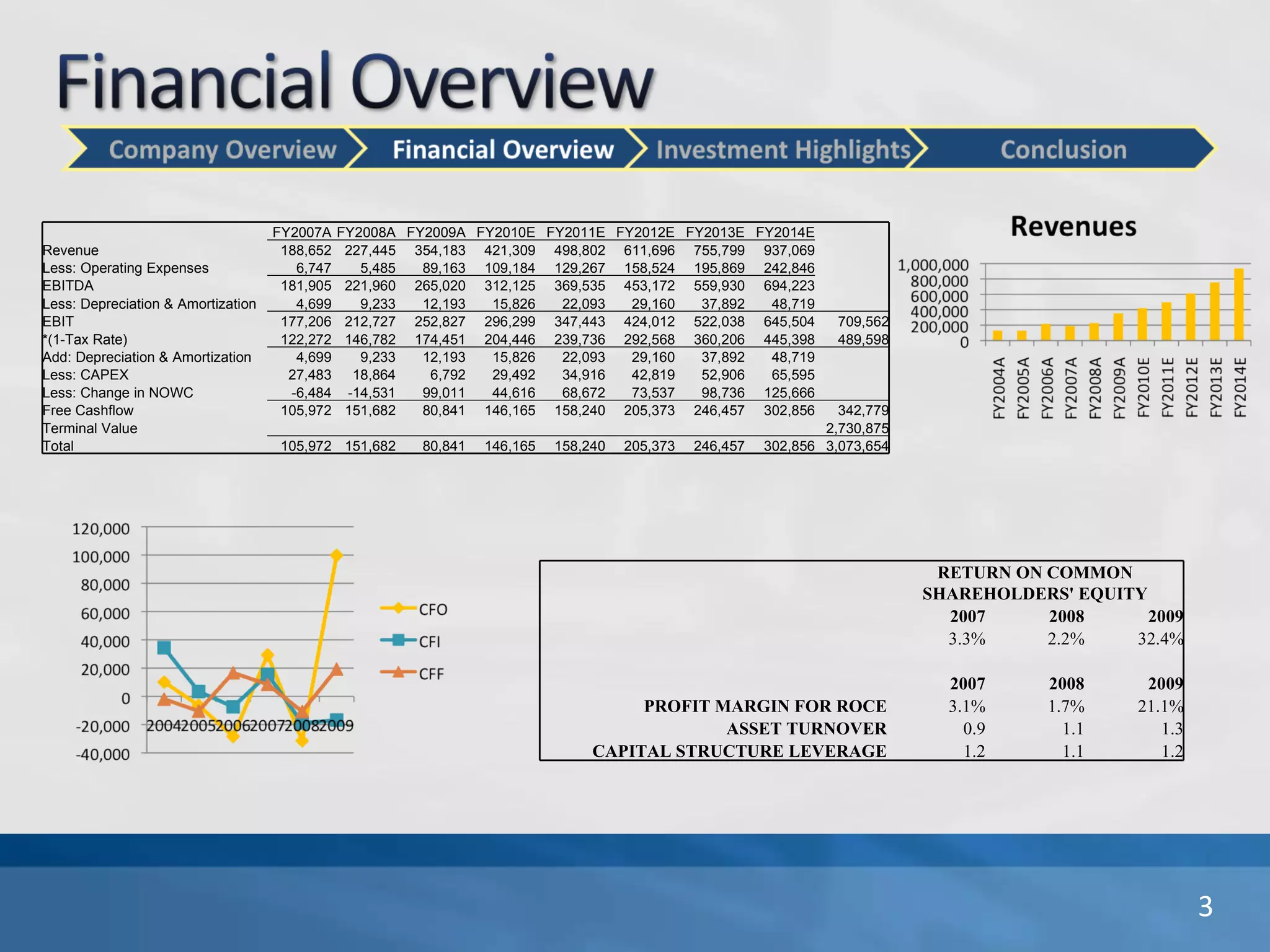

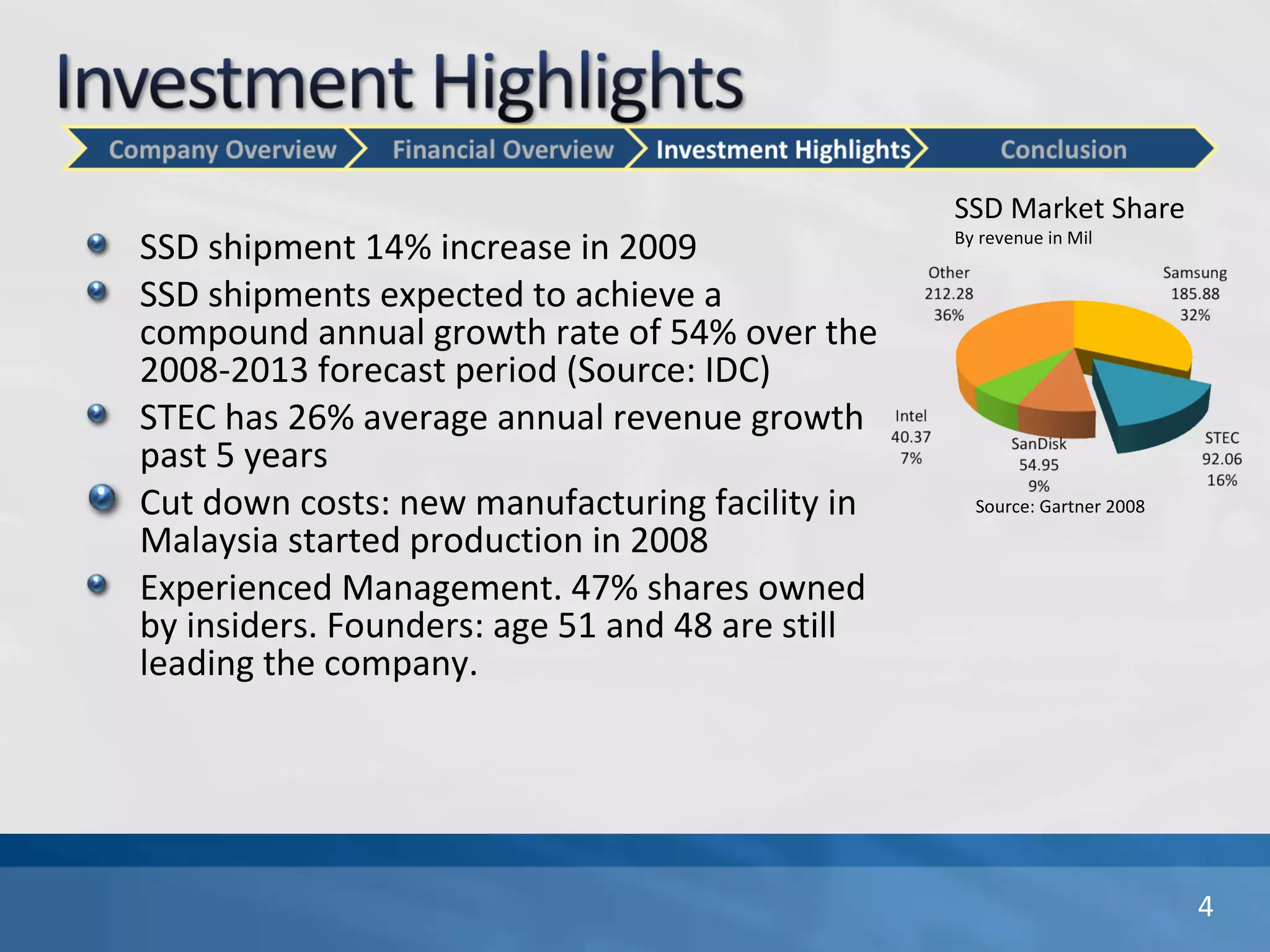

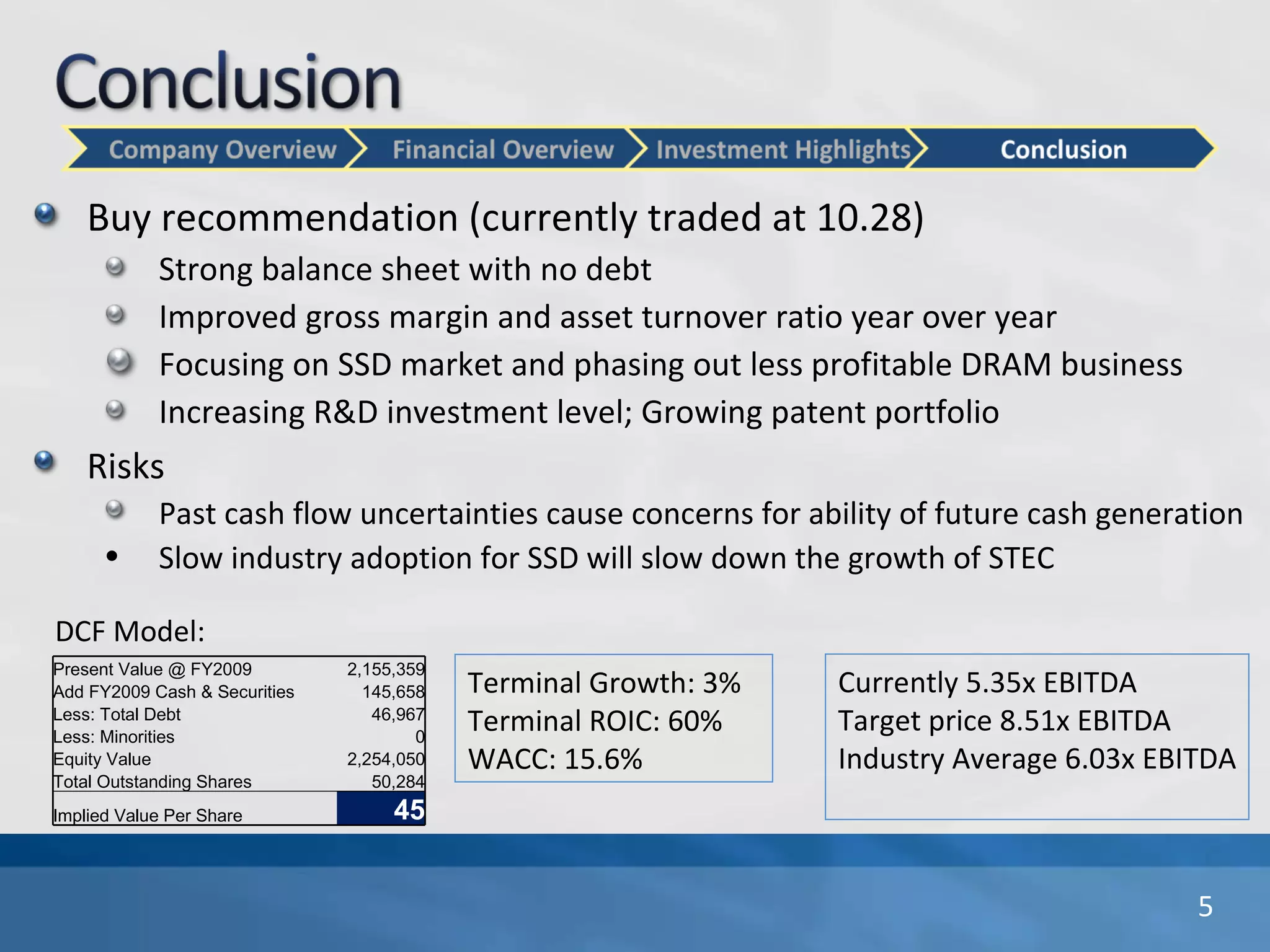

STEC is a global provider of solid state drive (SSD) technologies headquartered in California with 11 worldwide subsidiaries. It has experienced strong revenue growth over the past 5 years averaging 26% annually. A discounted cash flow valuation of STEC estimates the company's present equity value at $2.25 billion or $45 per share, below the current stock price of $10.28, indicating it is undervalued. Risks include uncertainties over maintaining future cash flow growth and slow industry adoption of SSD technology.