More Related Content

Similar to Luis Portfolio (version 1) AZZ (20)

Luis Portfolio (version 1) AZZ

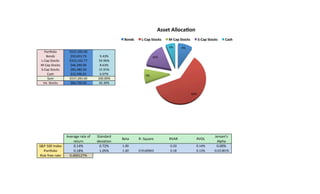

- 1. Portfolio $537,283.00

Bonds $50,653.73 9.43%

L-‐Cap

Stocks $322,162.77 59.96%

M-‐Cap

Stocks $46,390.00 8.63%

S-‐Cap

Stocks $85,480.50 15.91%

Cash $32,596.01 6.07%

Sum $537,283.00 100.00%

Int.

Stocks $84,730.03 26.30%

Average

rate

of

return

Standard

deviation

Beta R-‐

Square RVAR RVOL

Jensen's

Alpha

S&P

500

Index 0.14% 0.72% 1.00 0.20 0.14% 0.00%

Portfolio 0.18% 1.05% 1.40 0.9140963 0.18 0.13% -‐0.01381%

Risk-‐free

rate 0.000127%

9%

60%

9%

16%

6%

Asset

Alloca*on

Bonds

L-‐Cap

Stocks

M-‐Cap

Stocks

S-‐Cap

Stocks

Cash

- 2. -‐2.00000%

-‐1.00000%

0.00000%

1.00000%

2.00000%

3.00000%

4.00000%

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

S&P

500

Luis's

PorTolio

- 3. AZZ

AZZ Incorporate (Heavy Electric Equipment)

Beta:

0.95 EPS:

2.31 P/E:

18.99 DIV

&

Yield:

0.56

(1.30%)

Market Cap 1.12B

Date Price Price change

Dividend

Paid

Shares

Holding

Ending

Balance

Total Difference Daily Difference

9/23/13 Monday $43.67 $0.00 $0.00 1,000 $43,670.00

9/24/13 Tuesday $43.22 -‐$0.45 $0.00 1,000 $43,220.00 ($450.00) ($450.00)

9/25/13 Wednesday $43.17 -‐$0.05 $0.00 1,000 $43,170.00 ($500.00) ($50.00)

9/26/13 Thursday $43.11 -‐$0.06 $0.00 1,000 $43,110.00 ($560.00) ($60.00)

9/27/13 Friday $42.23 -‐$0.88 $0.00 1,000 $42,230.00 ($1,440.00) ($880.00)

9/30/13 Monday $41.86 -‐$0.37 $0.00 1,000 $41,860.00 ($1,810.00) ($370.00)

10/1/13 Tuesday $42.10 $0.24 $0.00 1,000 $42,100.00 ($1,570.00) $240.00

10/2/13 Wednesday $42.19 $0.09 $0.00 1,000 $42,190.00 ($1,480.00) $90.00

10/3/13 Thursday $41.50 -‐$0.69 $0.00 1,000 $41,500.00 ($2,170.00) ($690.00)

10/4/13 Friday $41.28 -‐$0.22 $0.00 1,000 $41,280.00 ($2,390.00) ($220.00)

10/7/13 Monday $40.94 -‐$0.34 $0.00 1,000 $40,940.00 ($2,730.00) ($340.00)

10/8/13 Tuesday $40.30 -‐$0.64 $0.00 1,000 $40,300.00 ($3,370.00) ($640.00)

10/9/13 Wednesday $40.02 -‐$0.28 $0.14 1,000 $40,020.00 ($3,650.00) ($280.00)

10/10/13 Thursday $40.76 $0.74 $0.00 1,000 $40,760.00 ($2,910.00) $740.00

10/11/13 Friday $41.60 $0.84 $0.00 1,000 $41,600.00 ($2,070.00) $840.00

10/14/13 Monday $42.00 $0.40 $0.00 1,000 $42,000.00 ($1,670.00) $400.00

10/15/13 Tuesday $41.79 -‐$0.21 $0.00 1,000 $41,790.00 ($1,880.00) ($210.00)

10/16/13 Wednesday $42.52 $0.73 $0.00 1,000 $42,520.00 ($1,150.00) $730.00

10/17/13 Thursday $43.44 $0.92 $0.00 1,000 $43,440.00 ($230.00) $920.00

10/18/13 Friday $43.81 $0.37 $0.00 1,000 $43,810.00 $140.00 $370.00

10/21/13 Monday $43.54 -‐$0.27 $0.00 1,000 $43,540.00 ($130.00) ($270.00)

10/22/13 Tuesday $44.15 $0.61 $0.00 1,000 $44,150.00 $480.00 $610.00

10/23/13 Wednesday $44.21 $0.06 $0.00 1,000 $44,210.00 $540.00 $60.00

10/24/13 Thursday $44.56 $0.35 $0.00 1,000 $44,560.00 $890.00 $350.00

10/25/13 Friday $44.35 -‐$0.21 $0.00 1,000 $44,350.00 $680.00 ($210.00)

10/28/13 Monday $44.44 $0.09 $0.00 1,000 $44,440.00 $770.00 $90.00

10/29/13 Tuesday $44.46 $0.02 $0.00 1,000 $44,460.00 $790.00 $20.00

10/30/13 Wednesday $44.55 $0.09 $0.00 1,000 $44,550.00 $880.00 $90.00

10/31/13 Thursday $44.90 $0.35 $0.00 1,000 $44,900.00 $1,230.00 $350.00

11/1/13 Friday $44.39 -‐$0.51 $0.00 1,000 $44,390.00 $720.00 ($510.00)

11/4/13 Monday $45.26 $0.87 $0.00 1,000 $45,260.00 $1,590.00 $870.00

11/5/13 Tuesday $44.76 -‐$0.50 $0.00 1,000 $44,760.00 $1,090.00 ($500.00)

11/6/13 Wednesday $44.90 $0.14 $0.00 1000 $44,900.00 $1,230.00 $140.00

11/7/13 Thursday $43.64 -‐$1.26 $0.00 1000 $43,640.00 ($30.00) ($1,260.00)

11/8/13 Friday $44.72 $1.08 $0.00 1000 $44,720.00 $1,050.00 $1,080.00

11/11/13 Monday $44.72 $1.08 $0.00 1000 $44,720.00 $1,050.00 $1,080.00

11/12/13 Tuesday $44.83 $0.11 $0.00 1000 $44,830.00 $1,160.00 $110.00

11/13/13 Wednesday $45.16 $0.33 $0.00 1000 $45,160.00 $1,490.00 $330.00

11/14/13 Thursday $45.41 $0.25 $0.00 1000 $45,410.00 $1,740.00 $250.00

11/15/13 Friday $46.39 $0.98 $0.00 1000 $46,390.00 $2,720.00 $980.00

- 5. Treasury Bond 8.750% 15-AUG-2020 912810EG9

Coupon Rate 8.75% Daily Interest Per Share $0.24

Maturity Date 8/15/20

Coupon Payment Semi-Annual

First Coupon Date 2/15/91

Date Close

Shares

holding

Holding

Days

Accrued

Interest

Ending

Balance

Total

Difference Daily Difference

9/23/13 Monday $1,437.97 35 0 $0.00 $50,328.95

9/24/13 Tuesday $1,440.16 35 1 $8.39 $50,413.99 $85.04 $85.04

9/25/13 Wednesday $1,442.50 35 2 $16.78 $50,504.28 $175.33 $90.29

9/26/13 Thursday $1,442.03 35 3 $25.17 $50,496.22 $167.27 ($8.06)

9/27/13 Friday $1,444.53 35 4 $33.56 $50,592.11 $263.16 $95.89

9/30/13 Monday $1,442.65 35 5 $41.95 $50,534.70 $205.75 ($57.41)

10/1/13 Tuesday $1,442.97 35 6 $50.34 $50,554.29 $225.34 $19.59

10/2/13 Wednesday $1,446.09 35 7 $58.73 $50,671.88 $342.93 $117.59

10/3/13 Thursday $1,445.63 35 8 $67.12 $50,664.17 $335.22 ($7.71)

10/4/13 Friday $1,442.03 35 9 $75.51 $50,546.56 $217.61 ($117.61)

10/7/13 Monday $1,443.28 35 10 $83.90 $50,598.70 $269.75 $52.14

10/8/13 Tuesday $1,440.80 35 11 $92.29 $50,520.29 $191.34 ($78.41)

10/9/13 Wednesday $1,440.20 35 12 $100.68 $50,507.68 $178.73 ($12.61)

10/10/13 Thursday $1,435.20 35 13 $109.08 $50,341.08 $12.13 ($166.61)

10/11/13 Friday $1,439.70 35 14 $117.47 $50,506.97 $178.02 $165.89

10/14/13 Monday $1,439.70 35 15 $125.86 $50,515.36 $186.41 $8.39

10/15/13 Tuesday $1,434.70 35 16 $134.25 $50,348.75 $19.80 ($166.61)

10/16/13 Wednesday $1,434.10 35 17 $142.64 $50,336.14 $7.19 ($12.61)

10/17/13 Thursday $1,443.91 35 18 $151.03 $50,687.88 $358.93 $351.74

10/18/13 Friday $1,444.22 35 19 $159.42 $50,707.12 $378.17 $19.24

10/21/13 Monday $1,442.20 35 20 $167.81 $50,644.81 $315.86 ($62.31)

10/22/13 Tuesday $1,448.44 35 21 $176.20 $50,871.60 $542.65 $226.79

10/23/13 Wednesday $1,451.88 35 22 $184.59 $51,000.39 $671.44 $128.79

10/24/13 Thursday $1,448.91 35 23 $192.98 $50,904.83 $575.88 ($95.56)

10/25/13 Friday $1,449.22 35 24 $201.37 $50,924.07 $595.12 $19.24

10/28/13 Monday $1,449.10 35 25 $209.76 $50,928.26 $599.31 $4.19

10/29/13 Tuesday $1,448.43 35 26 $218.15 $50,913.20 $584.25 ($15.06)

10/30/13 Wednesday $1,451.72 35 27 $226.54 $51,036.74 $707.79 $123.54

10/31/13 Thursday $1,444.22 35 28 $234.93 $50,782.63 $453.68 ($254.11)

11/1/13 Friday $1,440.47 35 29 $243.32 $50,659.77 $330.82 ($122.86)

11/4/13 Monday $1,442.20 35 30 $251.71 $50,728.71 $399.76 $68.94

11/5/13 Tuesday $1,442.14 35 31 $260.10 $50,735.00 $406.05 $6.29

11/6/13 Wednesday $1,441.20 35 32 $268.49 $50,710.49 $381.54 ($24.51)

11/7/13 Thursday $1,444.10 35 33 $276.88 $50,820.38 $491.43 $109.89

11/8/13 Friday $1,433.00 35 34 $285.27 $50,440.27 $111.32 ($380.11)

11/11/13 Monday $1,433.00 35 35 $293.66 $50,448.66 $119.71 $8.39

11/12/13 Tuesday $1,430.10 35 36 $302.05 $50,355.55 $26.60 ($93.11)

11/13/13 Wednesday $1,438.20 35 37 $310.45 $50,647.45 $318.50 $291.89

11/14/13 Thursday $1,439.90 35 38 $318.84 $50,715.34 $386.39 $67.89

11/15/13 Friday $1,437.90 35 39 $327.23 $50,653.73 $324.78 ($61.61)

- 6. $0.00

$100.00

$200.00

$300.00

$400.00

$500.00

$600.00

$700.00

$800.00

Total

Difference

Total

Difference

- 7. Mexico United Mexican STS

Coupon Rate 11% Daily Interest Per Share $0.32

Maturity Date 9/15/16

Fitch Ratings BBB

Coupon Payment Semi-Annual

First Coupon Date 3/15/97

Date Close

Shares

holding

Holding

Days

Accrued

Interest

Ending Balance

Total

Difference

Daily Difference

9/23/13 Monday $1,440.00 35 0 $0.00 $50,400.00

9/24/13 Tuesday $1,440.00 35 1 $11.06 $50,411.06 $11.06 $11.06

9/25/13 Wednesday $1,440.00 35 2 $22.12 $50,422.12 $22.12 $11.06

9/26/13 Thursday $1,440.00 35 3 $33.18 $50,433.18 $33.18 $11.06

9/27/13 Friday $1,440.00 35 4 $44.24 $50,444.24 $44.24 $11.06

9/30/13 Monday $1,440.00 35 5 $55.30 $50,455.30 $55.30 $11.06

10/1/13 Tuesday $1,440.00 35 6 $66.35 $50,466.35 $66.35 $11.06

10/2/13 Wednesday $1,440.00 35 7 $77.41 $50,477.41 $77.41 $11.06

10/3/13 Thursday $1,440.00 35 8 $88.47 $50,488.47 $88.47 $11.06

10/4/13 Friday $1,440.00 35 9 $99.53 $50,499.53 $99.53 $11.06

10/7/13 Monday $1,440.00 35 10 $110.59 $50,510.59 $110.59 $11.06

10/8/13 Tuesday $1,440.00 35 11 $121.65 $50,521.65 $121.65 $11.06

10/9/13 Wednesday $1,440.00 35 12 $132.71 $50,532.71 $132.71 $11.06

10/10/13 Thursday $1,440.00 35 13 $143.77 $50,543.77 $143.77 $11.06

10/11/13 Friday $1,440.00 35 14 $154.83 $50,554.83 $154.83 $11.06

10/14/13 Monday $1,440.00 35 15 $165.89 $50,565.89 $165.89 $11.06

10/15/13 Tuesday $1,440.00 35 16 $176.94 $50,576.94 $176.94 $11.06

10/16/13 Wednesday $1,440.00 35 17 $188.00 $50,588.00 $188.00 $11.06

10/17/13 Thursday $1,440.00 35 18 $199.06 $50,599.06 $199.06 $11.06

10/18/13 Friday $1,440.00 35 19 $210.12 $50,610.12 $210.12 $11.06

10/21/13 Monday $1,440.00 35 20 $221.18 $50,621.18 $221.18 $11.06

10/22/13 Tuesday $1,440.00 35 21 $232.24 $50,632.24 $232.24 $11.06

10/23/13 Wednesday $1,440.00 35 22 $243.30 $50,643.30 $243.30 $11.06

10/24/13 Thursday $1,440.00 35 23 $254.36 $50,654.36 $254.36 $11.06

10/25/13 Friday $1,440.00 35 24 $265.42 $50,665.42 $265.42 $11.06

- 8. VGHCX

Vanguard Health Care Inv. Equity $1,974.04

The investment seeks a favorable long-term total return, through the insurance market. Stocks $50,807.78

Morningstar Style Box: Large Growth

Net Assets: 29.31B

Morningstar Rating ∗∗∗∗

Annual Report Exoense Ratio (net): 0.35%

Front Load: N/A

12b1 Fee: N/A

Annual Holding Turnover: 8.00%

Date Price

Price

change

Dividend

Paid

Shares

Holding

Ending

Balance

Total

Difference

Daily

Difference

9/23/13 Monday $181.46 $0.00 $0.00 273 $49,538.58

9/24/13 Tuesday $180.90 -‐$0.56 $0.00 273 $49,385.70 ($152.88) ($152.88)

9/25/13 Wednesday $180.04 -‐$0.86 $0.00 273 $49,150.92 ($387.66) ($234.78)

9/26/13 Thursday $180.75 $0.71 $0.00 273 $49,344.75 ($193.83) $193.83

9/27/13 Friday $180.87 $0.12 $0.00 273 $49,377.51 ($161.07) $32.76

9/30/13 Monday $180.64 -‐$0.23 $0.00 273 $49,314.72 ($223.86) ($62.79)

10/1/13 Tuesday $182.90 $2.26 $0.00 273 $49,931.70 $393.12 $616.98

10/2/13 Wednesday $182.48 -‐$0.42 $0.00 273 $49,817.04 $278.46 ($114.66)

10/3/13 Thursday $181.26 -‐$1.22 $0.00 273 $49,483.98 ($54.60) ($333.06)

10/4/13 Friday $182.52 $1.26 $0.00 273 $49,827.96 $289.38 $343.98

10/7/13 Monday $180.52 -‐$2.00 $0.00 273 $49,281.96 ($256.62) ($546.00)

10/8/13 Tuesday $178.59 -‐$1.93 $0.00 273 $48,755.07 ($783.51) ($526.89)

10/9/13 Wednesday $178.32 -‐$0.27 $0.00 273 $48,681.36 ($857.22) ($73.71)

10/10/13 Thursday $182.04 $3.72 $0.00 273 $49,696.92 $158.34 $1,015.56

10/11/13 Friday $182.98 $0.94 $0.00 273 $49,953.54 $414.96 $256.62

10/14/13 Monday $183.77 $0.79 $0.00 273 $50,169.21 $630.63 $215.67

10/15/13 Tuesday $182.68 -‐$1.09 $0.00 273 $49,871.64 $333.06 ($297.57)

10/16/13 Wednesday $185.70 $3.02 $0.00 273 $50,696.10 $1,157.52 $824.46

10/17/13 Thursday $186.82 $1.12 $0.00 273 $51,001.86 $1,463.28 $305.76

10/18/13 Friday $186.08 -‐$0.74 $0.00 273 $50,799.84 $1,261.26 ($202.02)

10/21/13 Monday $186.08 $0.00 $0.00 273 $50,799.84 $1,261.26 $0.00

10/22/13 Tuesday $187.25 $1.17 $0.00 273 $51,119.25 $1,580.67 $319.41

10/23/13 Wednesday $186.88 -‐$0.37 $0.00 273 $51,018.24 $1,479.66 ($101.01)

10/24/13 Thursday $187.39 $0.51 $0.00 273 $51,157.47 $1,618.89 $139.23

10/25/13 Friday $187.83 $0.44 $0.00 273 $51,277.59 $1,739.01 $120.12

10/28/13 Monday $188.04 $0.21 $0.00 273 $51,334.92 $1,796.34 $57.33

10/29/13 Tuesday $189.14 $1.10 $0.00 273 $51,635.22 $2,096.64 $300.30

10/30/13 Wednesday $187.62 -‐$1.52 $0.00 273 $51,220.26 $1,681.68 ($414.96)

10/31/13 Thursday $187.58 -‐$0.04 $0.00 273 $51,209.34 $1,670.76 ($10.92)

11/1/13 Friday $188.21 $0.63 $0.00 273 $51,381.33 $1,842.75 $171.99

11/4/13 Monday $188.85 $0.64 $0.00 273 $51,556.05 $2,017.47 $174.72

11/5/13 Tuesday $188.22 -‐$0.63 $0.00 273 $51,384.06 $1,845.48 ($171.99)

11/6/13 Wednesday $188.34 $0.12 $0.00 273 $51,416.82 $1,878.24 $32.76

11/7/13 Thursday $186.18 -‐$2.16 $0.00 273 $50,827.14 $1,288.56 ($589.68)

11/8/13 Friday $188.70 $2.52 $0.00 273 $51,515.10 $1,976.52 $687.96

11/11/13 Monday $189.46 $0.76 $0.00 273 $51,722.58 $2,184.00 $207.48

11/12/13 Tuesday $189.55 $0.09 $0.00 273 $51,747.15 $2,208.57 $24.57

11/13/13 Wednesday $190.79 $1.24 $0.00 273 $52,085.67 $2,547.09 $338.52

11/14/13 Thursday $192.23 $1.44 $0.00 273 $52,478.79 $2,940.21 $393.12

11/15/13 Friday $193.34 $1.11 $0.00 273 $52,781.82 $3,243.24 $303.03

- 9. ($1,500.00)

($1,000.00)

($500.00)

$0.00

$500.00

$1,000.00

$1,500.00

$2,000.00

$2,500.00

$3,000.00

$3,500.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

Total

Difference

Total

Difference

- 10. Future: Stock Index SPZ13 Investment

S&P 500 Index (December Contract) $18,000.00

Date Close

Index Point

Change

$ Change Ending Balance

Total

Difference

9/23/13 Monday $1,692.70 0 $0.00 $18,000.00

9/24/13 Tuesday $1,692.50 -‐0.20 -‐$50.00 $17,950.00 ($50.00)

9/25/13 Wednesday $1,685.80 -‐6.70 -‐$1,675.00 $16,275.00 ($1,725.00)

9/26/13 Thursday $1,692.50 6.70 $1,675.00 $17,950.00 ($50.00)

9/27/13 Friday $1,686.40 -‐6.10 -‐$1,525.00 $16,425.00 ($1,575.00)

9/30/13 Monday $1,674.30 -‐12.1 -‐$3,025.00 $13,400.00 ($4,600.00)

10/1/13 Tuesday $1,689.40 $15.10 $3,775.00 $17,175.00 ($825.00)

10/2/13 Wednesday $1,683.10 -‐6.3 -‐$1,575.00 $15,600.00 ($2,400.00)

10/3/13 Thursday $1,669.70 -‐13.4 -‐$3,350.00 $12,250.00 ($5,750.00)

10/4/13 Friday $1,684.80 15.1 $3,775.00 $16,025.00 ($1,975.00)

10/7/13 Monday $1,667.70 -‐17.1 -‐$4,275.00 $11,750.00 ($6,250.00)

10/8/13 Tuesday $1,650.40 -‐17.3 -‐$4,325.00 $7,425.00 ($10,575.00)

10/9/13 Wednesday $1,648.80 -‐1.6 -‐$400.00 $7,025.00 ($10,975.00)

10/10/13 Thursday $1,685.00 36.2 $9,050.00 $16,075.00 ($1,925.00)

10/11/13 Friday $1,699.00 14 $3,500.00 $19,575.00 $1,575.00

10/14/13 Monday $1,704.30 5.3 $1,325.00 $20,900.00 $2,900.00

10/15/13 Tuesday $1,692.00 -‐12.3 -‐$3,075.00 $17,825.00 ($175.00)

10/16/13 Wednesday $1,713.20 21.2 $5,300.00 $23,125.00 $5,125.00

10/17/13 Thursday $1,727.80 14.6 $3,650.00 $26,775.00 $8,775.00

10/18/13 Friday $1,736.50 8.7 $2,175.00 $28,950.00 $10,950.00

10/21/13 Monday $1,738.20 1.7 $425.00 $29,375.00 $11,375.00

10/22/13 Tuesday $1,749.40 11.2 $2,800.00 $32,175.00 $14,175.00

10/23/13 Wednesday $1,741.80 -‐7.6 -‐$1,900.00 $30,275.00 $12,275.00

10/24/13 Thursday $1,748.50 6.7 $1,675.00 $31,950.00 $13,950.00

10/25/13 Friday $1,753.90 5.4 $1,350.00 $33,300.00 $15,300.00

10/28/13 Monday $1,758.90 5 $1,250.00 $34,550.00 $16,550.00

10/29/13 Tuesday $1,767.40 8.5 $2,125.00 $36,675.00 $18,675.00

- 11. ($15,000.00)

($10,000.00)

($5,000.00)

$0.00

$5,000.00

$10,000.00

$15,000.00

$20,000.00

$25,000.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

S&P500

Futures

Total

Difference

- 12. Future: Stock Index SPZ13 Investment

S&P 500 Index (December Contract) $18,000.00

Date Close

Index Point

Change

$ Change Ending Balance

Total

Difference

9/23/13 Monday $1,692.70 0 $0.00 $18,000.00

9/24/13 Tuesday $1,692.50 -‐0.20 -‐$50.00 $17,950.00 ($50.00)

9/25/13 Wednesday $1,685.80 -‐6.70 -‐$1,675.00 $16,275.00 ($1,725.00)

9/26/13 Thursday $1,692.50 6.70 $1,675.00 $17,950.00 ($50.00)

9/27/13 Friday $1,686.40 -‐6.10 -‐$1,525.00 $16,425.00 ($1,575.00)

9/30/13 Monday $1,674.30 -‐12.1 -‐$3,025.00 $13,400.00 ($4,600.00)

10/1/13 Tuesday $1,689.40 $15.10 $3,775.00 $17,175.00 ($825.00)

10/2/13 Wednesday $1,683.10 -‐6.3 -‐$1,575.00 $15,600.00 ($2,400.00)

10/3/13 Thursday $1,669.70 -‐13.4 -‐$3,350.00 $12,250.00 ($5,750.00)

10/4/13 Friday $1,684.80 15.1 $3,775.00 $16,025.00 ($1,975.00)

10/7/13 Monday $1,667.70 -‐17.1 -‐$4,275.00 $11,750.00 ($6,250.00)

10/8/13 Tuesday $1,650.40 -‐17.3 -‐$4,325.00 $7,425.00 ($10,575.00)

10/9/13 Wednesday $1,648.80 -‐1.6 -‐$400.00 $7,025.00 ($10,975.00)

10/10/13 Thursday $1,685.00 36.2 $9,050.00 $16,075.00 ($1,925.00)

10/11/13 Friday $1,699.00 14 $3,500.00 $19,575.00 $1,575.00

10/14/13 Monday $1,704.30 5.3 $1,325.00 $20,900.00 $2,900.00

10/15/13 Tuesday $1,692.00 -‐12.3 -‐$3,075.00 $17,825.00 ($175.00)

10/16/13 Wednesday $1,713.20 21.2 $5,300.00 $23,125.00 $5,125.00

10/17/13 Thursday $1,727.80 14.6 $3,650.00 $26,775.00 $8,775.00

10/18/13 Friday $1,736.50 8.7 $2,175.00 $28,950.00 $10,950.00

10/21/13 Monday $1,738.20 1.7 $425.00 $29,375.00 $11,375.00

10/22/13 Tuesday $1,749.40 11.2 $2,800.00 $32,175.00 $14,175.00

10/23/13 Wednesday $1,741.80 -‐7.6 -‐$1,900.00 $30,275.00 $12,275.00

10/24/13 Thursday $1,748.50 6.7 $1,675.00 $31,950.00 $13,950.00

10/25/13 Friday $1,753.90 5.4 $1,350.00 $33,300.00 $15,300.00

10/28/13 Monday $1,758.90 5 $1,250.00 $34,550.00 $16,550.00

10/29/13 Tuesday $1,767.40 8.5 $2,125.00 $36,675.00 $18,675.00

- 13. ($15,000.00)

($10,000.00)

($5,000.00)

$0.00

$5,000.00

$10,000.00

$15,000.00

$20,000.00

$25,000.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

S&P500

Futures

Total

Difference

- 14. S&P500

SPDR State Global Advisors

The investment seeks to provide investment results that, before expenses, generally correspond to the price and yield performance of the S&P 500 Index.

Category: Large Blend

Morningstar Style Box: Large Blend

Net Assets: 157.23$

Annual Report Expense Ratio (net): 0.09

Annual Holding Turnover: 3.80$

Date Price

Price

change

Dividend

Paid

Shares

Holding

Ending

Balance

Total

Difference

Daily

Difference

10/29/13 Tuesday $177.17 $0.00 207 $36,674.19

10/30/13 Wednesday $176.29 -‐$0.88 $0.00 207 $36,492.03 ($182.16) ($182.16)

10/31/13 Thursday $175.79 -‐$0.50 $0.00 207 $36,388.53 ($285.66) ($103.50)

11/1/13 Friday $176.21 $0.42 $0.00 207 $36,475.47 ($198.72) $86.94

11/4/13 Monday $176.83 $0.62 $0.00 207 $36,603.81 ($70.38) $128.34

11/5/13 Tuesday $176.27 -‐$0.56 $0.00 207 $36,487.89 ($186.30) ($115.92)

11/6/13 Wednesday $177.17 $0.90 $0.00 207 $36,674.19 $0.00 $186.30

11/7/13 Thursday $174.93 -‐$2.24 $0.00 207 $36,210.51 ($463.68) ($463.68)

11/8/13 Friday $177.29 $2.36 $0.00 207 $36,699.03 $24.84 $488.52

11/11/13 Monday $177.32 $0.03 207 $36,705.24 $31.05 $6.21

11/12/13 Tuesday $176.96 -‐$0.36 $0.00 207 $36,630.72 ($43.47) ($74.52)

11/13/13 Wednesday $178.38 $1.42 $0.00 207 $36,924.66 $250.47 $293.94

11/14/13 Thursday $179.27 $0.89 $0.00 207 $37,108.89 $434.70 $184.23

11/15/13 Friday $180.05 $0.78 $0.00 207 $37,270.35 $596.16 $161.46

- 16. DBJP

db X-trackers MSCI Japan Hedge Eq

The fund employs a sampling strategy in seeking to track the performance of a veriety of Japanese companies.

Category: Japan Stock

Morningstar Style Box: Large Stock

Net Assets: 149.50M

Annual Report Expense Ratio (net): 0.52%

Annual Holding Turnover: N/A

Date Price

Price

change

Dividend

Paid

Shares

Holding

Ending

Balance

Total

Difference

Daily

Difference

9/23/13 Monday $35.56 $0.00 $0.00 1,391 $49,463.96

9/24/13 Tuesday $35.60 $0.04 $0.00 1,391 $49,519.60 $55.64 $55.64

9/25/13 Wednesday $35.44 -‐$0.16 $0.00 1,391 $49,297.04 ($166.92) ($222.56)

9/26/13 Thursday $36.31 $0.87 $0.00 1,391 $50,507.21 $1,043.25 $1,210.17

9/27/13 Friday $35.69 -‐$0.62 $0.00 1,391 $49,644.79 $180.83 ($862.42)

9/30/13 Monday $35.42 -‐$0.27 $0.00 1,391 $49,269.22 ($194.74) ($375.57)

10/1/13 Tuesday $35.12 -‐$0.30 $0.00 1,391 $48,851.92 ($612.04) ($417.30)

10/2/13 Wednesday $34.84 -‐$0.28 $0.00 1,391 $48,462.44 ($1,001.52) ($389.48)

10/3/13 Thursday $34.46 -‐$0.38 $0.00 1,391 $47,933.86 ($1,530.10) ($528.58)

10/4/13 Friday $34.67 $0.21 $0.00 1,391 $48,225.97 ($1,237.99) $292.11

10/7/13 Monday $33.75 -‐$0.92 $0.00 1,391 $46,946.25 ($2,517.71) ($1,279.72)

10/8/13 Tuesday $33.59 -‐$0.16 $0.00 1,391 $46,723.69 ($2,740.27) ($222.56)

10/9/13 Wednesday $34.58 $0.99 $0.00 1,391 $48,100.78 ($1,363.18) $1,377.09

10/10/13 Thursday $35.46 $0.88 $0.00 1,391 $49,324.86 ($139.10) $1,224.08

10/11/13 Friday $35.58 $0.12 $0.00 1,391 $49,491.78 $27.82 $166.92

10/14/13 Monday $35.63 $0.05 $0.00 1,391 $49,561.33 $97.37 $69.55

10/15/13 Tuesday $35.29 -‐$0.34 $0.00 1,391 $49,088.39 ($375.57) ($472.94)

10/16/13 Wednesday $35.80 $0.51 $0.00 1,391 $49,797.80 $333.84 $709.41

10/17/13 Thursday $35.76 -‐$0.04 $0.00 1,391 $49,742.16 $278.20 ($55.64)

10/18/13 Friday $35.82 $0.06 $0.00 1,391 $49,825.62 $361.66 $83.46

10/21/13 Monday $35.77 -‐$0.05 $0.00 1,391 $49,756.07 $292.11 ($69.55)

10/22/13 Tuesday $36.05 $0.28 $0.00 1,391 $50,145.55 $681.59 $389.48

10/23/13 Wednesday $35.08 -‐$0.97 $0.00 1,391 $48,796.28 ($667.68) ($1,349.27)

10/24/13 Thursday $35.36 $0.28 $0.00 1,391 $49,185.76 ($278.20) $389.48

10/25/13 Friday $34.84 -‐$0.52 $0.00 1,391 $48,462.44 ($1,001.52) ($723.32)

10/28/13 Monday $35.07 $0.23 $0.00 1,391 $48,782.37 ($681.59) $319.93

10/29/13 Tuesday $35.59 $0.52 $0.00 1,391 $49,505.69 $41.73 $723.32

10/30/13 Wednesday $35.75 $0.16 $0.00 1,391 $49,728.25 $264.29 $222.56

10/31/13 Thursday $35.36 -‐$0.39 $0.00 1,391 $49,185.76 ($278.20) ($542.49)

11/1/13 Friday $35.25 -‐$0.11 $0.00 1,391 $49,032.75 ($431.21) ($153.01)

11/4/13 Monday $35.25 $0.00 $0.00 1,391 $49,032.75 ($431.21) $0.00

11/5/13 Tuesday $34.94 -‐$0.31 $0.00 1,391 $48,601.54 ($862.42) ($431.21)

11/6/13 Wednesday $35.39 $0.45 $0.00 1,391 $49,227.49 ($236.47) $625.95

11/7/13 Thursday $34.52 -‐$0.87 $0.00 1,391 $48,017.32 ($1,446.64) ($1,210.17)

11/8/13 Friday $35.19 $0.67 $0.00 1,391 $48,949.29 ($514.67) $931.97

11/11/13 Monday $35.09 -‐$0.10 $0.00 1,391 $48,810.19 ($653.77) ($139.10)

11/12/13 Tuesday $35.79 $0.70 $0.00 1,391 $49,783.89 $319.93 $973.70

11/13/13 Wednesday $35.94 $0.15 $0.00 1,391 $49,992.54 $528.58 $208.65

11/14/13 Thursday $36.44 $0.50 $0.00 1,391 $50,688.04 $1,224.08 $695.50

11/15/13 Friday $37.01 $0.57 $0.00 1,391 $51,480.91 $2,016.95 $792.87

- 17. ($3,000.00)

($2,000.00)

($1,000.00)

$0.00

$1,000.00

$2,000.00

$3,000.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

Total

Difference

Total

Difference

- 18. CHIX

Global X China Financials ETF (CHIX)

The fund employs a sampling strategy in seeking to track the performance of a veriety of the Solactive China Financials Index

Category: China Stock

Morningstar Style Box: Large Stock

Net Assets: 35.97M

Annual Report Expense Ratio (net): 0.01

Annual Holding Turnover: N/A

Date Price

Price

change

Dividend

Paid

Shares

Holding

Ending

Balance

Total

Difference

Daily

Difference

10/25/13 Friday $12.70 2451 $31,127.70

10/28/13 Monday $12.74 $0.04 $0.00 2451 $31,225.74 $98.04 $98.04

10/29/13 Tuesday $13.02 $0.28 $0.00 2451 $31,912.02 $784.32 $686.28

10/30/13 Wednesday $13.17 $0.15 $0.00 2451 $32,279.67 $1,151.97 $367.65

10/31/13 Thursday $13.23 $0.06 $0.00 2451 $32,426.73 $1,299.03 $147.06

11/1/13 Friday $13.39 $0.16 $0.00 2451 $32,818.89 $1,691.19 $392.16

11/4/13 Monday $13.40 $0.01 $0.00 2451 $32,843.40 $1,715.70 $24.51

11/5/13 Tuesday $13.17 -‐$0.23 $0.00 2451 $32,279.67 $1,151.97 $563.73

11/6/13 Wednesday $13.13 -‐$0.04 $0.00 2451 $32,181.63 $1,053.93 $98.04

11/7/13 Thursday $12.91 -‐$0.22 $0.00 2451 $31,642.41 $514.71 $539.22

11/8/13 Friday $12.97 $0.06 $0.00 2451 $31,789.47 $661.77 $147.06

11/11/13 Monday $13.07 $0.10 $0.00 2451 $32,034.57 $906.87 $245.10

11/12/13 Tuesday $12.96 -‐$0.11 $0.00 2451 $31,764.96 $637.26 $269.61

11/13/13 Wednesday $12.87 -‐$0.09 $0.00 2451 $31,544.37 $416.67 $220.59

11/14/13 Thursday $12.96 $0.09 $0.00 2451 $31,764.96 $637.26 $220.59

11/15/13 Friday $13.56 $0.60 $0.00 2452 $33,249.12 $2,121.42 $1,484.16

- 19. $0.00

$500.00

$1,000.00

$1,500.00

$2,000.00

$2,500.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Total

Difference

Total

Difference

- 20. CVX

Chevron Corporation (Oil, Gas & Consumable Fuel

Beta:

1.16 EPS:

12.34 P/E:

10.12 DIV

&

Yield:

4.00

(3.20%)

Market Cap 241.35B

Date Price Price change

Dividend

Paid

Shares

Holding

Ending

Balance

Total Balance Daily Balance

9/23/13 Monday $125.52 $0.00 $0.00 719 $90,248.88

9/24/13 Tuesday $124.49 -‐$1.03 $0.00 719 $89,508.31 ($740.57) ($740.57)

9/25/13 Wednesday $124.07 -‐$0.42 $0.00 719 $89,206.33 ($1,042.55) ($301.98)

9/26/13 Thursday $123.49 -‐$0.58 $0.00 719 $88,789.31 ($1,459.57) ($417.02)

9/27/13 Friday $122.64 -‐$0.85 $0.00 719 $88,178.16 ($2,070.72) ($611.15)

9/30/13 Monday $121.50 -‐$1.14 $0.00 719 $87,358.50 ($2,890.38) ($819.66)

10/1/13 Tuesday $121.32 -‐$0.18 $0.00 719 $87,229.08 ($3,019.80) ($129.42)

10/2/13 Wednesday $120.83 -‐$0.49 $0.00 719 $86,876.77 ($3,372.11) ($352.31)

10/3/13 Thursday $118.25 -‐$2.58 $0.00 719 $85,021.75 ($5,227.13) ($1,855.02)

10/4/13 Friday $118.13 -‐$0.12 $0.00 719 $84,935.47 ($5,313.41) ($86.28)

10/7/13 Monday $117.87 -‐$0.26 $0.00 719 $84,748.53 ($5,500.35) ($186.94)

10/8/13 Tuesday $116.73 -‐$1.14 $0.00 719 $83,928.87 ($6,320.01) ($819.66)

10/9/13 Wednesday $116.13 -‐$0.60 $0.00 719 $83,497.47 ($6,751.41) ($431.40)

10/10/13 Thursday $116.38 $0.25 $0.00 719 $83,677.22 ($6,571.66) $179.75

10/11/13 Friday $117.67 $1.29 $0.00 719 $84,604.73 ($5,644.15) $927.51

10/14/13 Monday $118.58 $0.91 $0.00 719 $85,259.02 ($4,989.86) $654.29

10/15/13 Tuesday $118.15 -‐$0.43 $0.00 719 $84,949.85 ($5,299.03) ($309.17)

10/16/13 Wednesday $119.16 $1.01 $0.00 719 $85,676.04 ($4,572.84) $726.19

10/17/13 Thursday $119.52 $0.36 $0.00 719 $85,934.88 ($4,314.00) $258.84

10/18/13 Friday $119.65 $0.13 $0.00 719 $86,028.35 ($4,220.53) $93.47

10/21/13 Monday $119.82 $0.17 $0.00 719 $86,150.58 ($4,098.30) $122.23

10/22/13 Tuesday $120.64 $0.82 $0.00 719 $86,740.16 ($3,508.72) $589.58

10/23/13 Wednesday $120.13 -‐$0.51 $0.00 719 $86,373.47 ($3,875.41) ($366.69)

10/24/13 Thursday $120.56 $0.43 $0.00 719 $86,682.64 ($3,566.24) $309.17

10/25/13 Friday $120.59 $0.03 719 $86,704.21 ($3,544.67) $21.57

- 22. CMG

Chipotle Mexican Grill

Beta:

0.55 EPS:

9.87 P/E:

18.99 DIV

&

Yield:

N/A

Market Cap 16.65B

Date Price

Price

change

Dividend

Paid

Shares

Holding

Ending

Balance

Total

Diference

10/25/13 Friday $527.50 $0.00 $0.00 213 $112,357.50

10/28/13 Monday $527.85 $0.35 $0.00 213 $112,432.05 $74.55

10/29/13 Tuesday $527.93 $0.08 $0.00 213 $112,449.09 $91.59

10/30/13 Wednesday $524.35 -‐$3.58 $0.00 213 $111,686.55 ($670.95)

10/31/13 Thursday $526.97 $2.62 $0.00 213 $112,244.61 ($112.89)

11/1/13 Friday $527.60 $0.63 $0.00 213 $112,378.80 $21.30

11/4/13 Monday $535.18 $7.58 $0.00 213 $113,993.34 $1,635.84

11/5/13 Tuesday $543.05 $7.87 $0.00 213 $115,669.65 $3,312.15

11/6/13 Wednesday $539.63 -‐$3.42 $0.00 213 $114,941.19 $2,583.69

11/7/13 Thursday $525.02 -‐$14.61 $0.00 213 $111,829.26 ($528.24)

11/8/13 Friday $535.20 $10.18 $0.00 213 $113,997.60 $1,640.10

11/11/13 Monday $536.44 $1.24 $0.00 213 $114,261.72 $1,904.22

11/12/13 Tuesday $535.42 -‐$1.02 $0.00 213 $114,044.46 $1,686.96

11/13/13 Wednesday $537.58 $2.16 $0.00 213 $114,504.54 $2,147.04

11/14/13 Thursday $543.92 $6.34 $0.00 213 $115,854.96 $3,497.46

11/15/13 Friday $546.97 $3.05 $0.00 213 $116,504.61 $4,147.11

- 23. ($1,000.00)

$0.00

$1,000.00

$2,000.00

$3,000.00

$4,000.00

$5,000.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Chipotle

Mexican

Grill

Total

Diference

- 24. CA

CA Technologies (System Software)

Beta:

1.47 EPS:

2.29 P/E:

13.42 DIV

&

Yield:

1.00

(3.30%)

Market Cap 14.00B

Date Price Price change

Dividend

Paid

Shares

Holding

Ending

Balance

Total

Difference

Daily

Difference

9/23/13 Monday $30.48 $0.00 $0.00 1000.00 $30,480.00

9/24/13 Tuesday $30.26 -‐$0.22 $0.00 1000.00 $30,260.00 ($220.00) ($220.00)

9/25/13 Wednesday $30.33 $0.07 $0.00 1000.00 $30,330.00 ($150.00) $70.00

9/26/13 Thursday $30.25 -‐$0.08 $0.00 1000.00 $30,250.00 ($230.00) ($80.00)

9/27/13 Friday $30.06 -‐$0.19 $0.00 1000.00 $30,060.00 ($420.00) ($190.00)

9/30/13 Monday $29.67 -‐$0.39 $0.00 1000.00 $29,670.00 ($810.00) ($390.00)

10/1/13 Tuesday $29.93 $0.26 $0.00 1000.00 $29,930.00 ($550.00) $260.00

10/2/13 Wednesday $29.75 -‐$0.18 $0.00 1000.00 $29,750.00 ($730.00) ($180.00)

10/3/13 Thursday $29.23 -‐$0.52 $0.00 1000.00 $29,230.00 ($1,250.00) ($520.00)

10/4/13 Friday $29.57 $0.34 $0.00 1000.00 $29,570.00 ($910.00) $340.00

10/7/13 Monday $29.27 -‐$0.30 $0.00 1000.00 $29,270.00 ($1,210.00) ($300.00)

10/8/13 Tuesday $28.82 -‐$0.45 $0.00 1000.00 $28,820.00 ($1,660.00) ($450.00)

10/9/13 Wednesday $28.70 -‐$0.12 $0.00 1000.00 $28,700.00 ($1,780.00) ($120.00)

10/10/13 Thursday $29.25 $0.55 $0.00 1000.00 $29,250.00 ($1,230.00) $550.00

10/11/13 Friday $29.52 $0.27 $0.00 1000.00 $29,520.00 ($960.00) $270.00

10/14/13 Monday $29.77 $0.25 $0.00 1000.00 $29,770.00 ($710.00) $250.00

10/15/13 Tuesday $29.49 -‐$0.28 $0.00 1000.00 $29,490.00 ($990.00) ($280.00)

10/16/13 Wednesday $29.75 $0.26 $0.00 1000.00 $29,750.00 ($730.00) $260.00

10/17/13 Thursday $30.02 $0.27 $0.00 1000.00 $30,020.00 ($460.00) $270.00

10/18/13 Friday $30.10 $0.08 $0.00 1000.00 $30,100.00 ($380.00) $140.72

10/21/13 Monday $30.16 $0.06 $0.00 1000.00 $30,160.00 ($320.00) $60.00

10/22/13 Tuesday $30.36 $0.20 $0.00 1000.00 $30,360.00 ($120.00) $200.00

10/23/13 Wednesday $30.29 -‐$0.07 $0.00 1000.00 $30,290.00 ($190.00) ($70.00)

10/24/13 Thursday $30.39 $0.10 $0.00 1000.00 $30,390.00 ($90.00) $100.00

10/25/13 Friday $31.40 $1.01 $0.00 1000.00 $31,400.00 $920.00 $1,010.00

10/28/13 Monday $31.45 $0.05 $0.00 1000.00 $31,450.00 $970.00 $50.00

10/29/13 Tuesday $31.76 $0.31 $0.00 1000.00 $31,760.00 $1,280.00 $310.00

10/30/13 Wednesday $31.79 $0.03 $0.00 1000.00 $31,790.00 $1,310.00 $30.00

10/31/13 Thursday $31.76 -‐$0.03 $0.00 1000.00 $31,760.00 $1,280.00 ($30.00)

11/1/13 Friday $31.73 -‐$0.03 $0.00 1000.00 $31,730.00 $1,250.00 ($30.00)

11/4/13 Monday $31.86 $0.13 $0.00 1000.00 $31,860.00 $1,380.00 $130.00

11/5/13 Tuesday $31.65 -‐$0.21 $0.00 1000.00 $31,650.00 $1,170.00 ($210.00)

11/6/13 Wednesday $31.99 $0.34 $0.00 1000.00 $31,990.00 $1,510.00 $340.00

11/7/13 Thursday $31.66 -‐$0.33 $0.00 1000.00 $31,660.00 $1,180.00 ($330.00)

11/8/13 Friday $31.93 $0.27 $0.00 1000.00 $31,930.00 $1,450.00 $270.00

11/11/13 Monday $32.09 $0.16 $0.00 1000.00 $32,090.00 $1,610.00 $160.00

11/12/13 Tuesday $32.13 $0.04 $0.00 1000.00 $32,130.00 $1,650.00 $40.00

11/13/13 Wednesday $32.83 $0.70 $0.00 1000.00 $32,830.00 $2,350.00 $700.00

11/14/13 Thursday $32.68 -‐$0.15 $0.00 1000.00 $32,680.00 $2,200.00 ($150.00)

11/15/13 Friday $32.85 $0.17 $0.00 1000.00 $32,850.00 $2,370.00 $170.00

- 25. ($2,000.00)

($1,500.00)

($1,000.00)

($500.00)

$0.00

$500.00

$1,000.00

$1,500.00

$2,000.00

$2,500.00

$3,000.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

CA

Technologies

Total

Difference

- 26. BRK-B

Berkshire Hathaway Inc. (Insurance)

Beta:

0.29 EPS:

10868.19 P/E:

0.01 DIV

&

Yield:

N/A

(N/A)

Market Cap 194.18M

Date Price Price change

Dividend

Paid

Shares

Holding

Ending

Balance

Total Difference

Daily

Difference

9/23/13 Monday $115.64 $0.00 $0.00 735 $84,995.40

9/24/13 Tuesday $115.05 -‐$0.59 $0.00 735 $84,561.75 ($433.65) ($433.65)

9/25/13 Wednesday $115.51 $0.46 $0.00 735 $84,899.85 ($95.55) $338.10

9/26/13 Thursday $115.79 $0.28 $0.00 735 $85,105.65 $110.25 $205.80

9/27/13 Friday $114.85 -‐$0.94 $0.00 735 $84,414.75 ($580.65) ($690.90)

9/30/13 Monday $113.51 -‐$1.34 $0.00 735 $83,429.85 ($1,565.55) ($984.90)

10/1/13 Tuesday $114.14 $0.63 $0.00 735 $83,892.90 ($1,102.50) $463.05

10/2/13 Wednesday $114.41 $0.27 $0.00 735 $84,091.35 ($904.05) $198.45

10/3/13 Thursday $113.34 -‐$1.07 $0.00 735 $83,304.90 ($1,690.50) ($786.45)

10/4/13 Friday $113.75 $0.41 $0.00 735 $83,606.25 ($1,389.15) $301.35

10/7/13 Monday $112.86 -‐$0.89 $0.00 735 $82,952.10 ($2,043.30) ($654.15)

10/8/13 Tuesday $111.37 -‐$1.49 $0.00 735 $81,856.95 ($3,138.45) ($1,095.15)

10/9/13 Wednesday $111.77 $0.40 $0.00 735 $82,150.95 ($2,844.45) $294.00

10/10/13 Thursday $114.84 $3.07 $0.00 735 $84,407.40 ($588.00) $2,256.45

10/11/13 Friday $115.81 $0.97 $0.00 735 $85,120.35 $124.95 $712.95

10/14/13 Monday $116.00 $0.19 $0.00 735 $85,260.00 $264.60 $139.65

10/15/13 Tuesday $114.63 -‐$1.37 $0.00 735 $84,253.05 ($742.35) ($1,006.95)

10/16/13 Wednesday $116.69 $2.06 $0.00 735 $85,767.15 $771.75 $1,514.10

10/17/13 Thursday $116.92 $0.23 $0.00 735 $85,936.20 $940.80 $169.05

10/18/13 Friday $116.97 $0.05 $0.00 735 $85,972.95 $977.55 $36.75

10/21/13 Monday $116.89 -‐$0.08 $0.00 735 $85,914.15 $918.75 ($58.80)

10/22/13 Tuesday $117.49 $0.60 $0.00 735 $86,355.15 $1,359.75 $441.00

10/23/13 Wednesday $116.41 -‐$1.08 $0.00 735 $85,561.35 $565.95 ($793.80)

10/24/13 Thursday $116.84 $0.43 $0.00 735 $85,877.40 $882.00 $316.05

10/25/13 Friday $117.03 $0.19 $0.00 735 $86,017.05 $1,021.65 $139.65

10/28/13 Monday $116.94 -‐$0.09 $0.00 735 $85,950.90 $955.50 ($66.15)

10/29/13 Tuesday $117.41 $0.47 $0.00 735 $86,296.35 $1,300.95 $345.45

10/30/13 Wednesday $116.34 -‐$1.07 $0.00 735 $85,509.90 $514.50 ($786.45)

10/31/13 Thursday $115.09 -‐$1.25 $0.00 735 $84,591.15 ($404.25) ($918.75)

11/1/13 Friday $115.27 $0.18 $0.00 735 $84,723.45 ($271.95) $132.30

11/4/13 Monday $114.87 -‐$0.40 $0.00 735 $84,429.45 ($565.95) ($294.00)

11/5/13 Tuesday $114.36 -‐$0.51 $0.00 735 $84,054.60 ($940.80) ($374.85)

11/6/13 Wednesday $114.90 $0.54 $0.00 735 $84,451.50 ($543.90) $396.90

11/7/13 Thursday $113.83 -‐$1.07 $0.00 735 $83,665.05 ($1,330.35) ($786.45)

11/8/13 Friday $115.88 $2.05 $0.00 735 $85,171.80 $176.40 $1,506.75

11/11/13 Monday $115.65 -‐$0.23 $0.00 735 $85,002.75 $7.35 ($169.05)

11/12/13 Tuesday $114.21 -‐$1.44 $0.00 735 $83,944.35 ($1,051.05) ($1,058.40)

11/13/13 Wednesday $114.81 $0.60 $0.00 735 $84,385.35 ($610.05) $441.00

11/14/13 Thursday $115.69 $0.88 $0.00 735 $85,032.15 $36.75 $646.80

11/15/13 Friday $116.30 $0.61 $0.00 735 $85,480.50 $485.10 $448.35

- 27. ($3,500.00)

($3,000.00)

($2,500.00)

($2,000.00)

($1,500.00)

($1,000.00)

($500.00)

$0.00

$500.00

$1,000.00

$1,500.00

$2,000.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

Berk

Shire

Hathatway

Inc.

Total

Difference