Outlook for Week of February 9, 2015

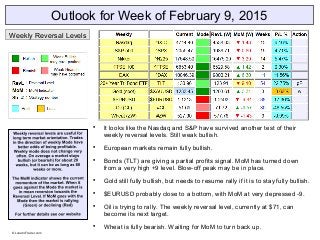

- 1. Outlook for Week of February 9, 2015 It looks like the Nasdaq and S&P have survived another test of their weekly reversal levels. Still weak bullish. European markets remain fully bullish. Bonds (TLT) are giving a partial profits signal. MoM has turned down from a very high +9 level. Blow-off peak may be in place. Gold still fully bullish, but needs to resume rally if it is to stay fully bullish. $EURUSD probably close to a bottom, with MoM at very depressed -9. Oil is trying to rally. The weekly reversal level, currently at $71, can become its next target. Wheat is fully bearish. Waiting for MoM to turn back up. Weekly Reversal Levels © LunaticTrader.com

- 2. US markets are bouncing back strongly. Probably headed for their Top targets next (see page 5). Japanese and EU markets are digesting their recent rallies. Bonds (TLT) are giving a sell signal. With weekly MoM also down I wouldn't negate this signal. Gold is giving a sell signal as well. Waiting for MoM to turn back up. EURUSD is stabilizing. Will rally further if it can close above its daily reversal level, currently at 1.1664 Oil gave a buy signal early in the week, but dropped back quickly. MoM has continued to point upwards. Another buy signal this week would probably give us a more sustained rally to $60+. Watch oil. Wheat is pushing towards its daily reversal level. Needs a close above 546 to turn bullish. Daily Reversal Levels © LunaticTrader.com

- 3. Buy signal for Canada and MSCI World Index. Sell signal for Turkey. Weak buy signal for Dow Industrials. Can take partial profits in Dow Utilities. Comment: Not a bad week and we see some further greening up in our table. Most buy signals we got in recent weeks are doing well. Australia is up 7% in a few weeks. France, Italy, South Africa and Hong Kong are all climbing nicely as well. It is important to see follow through after fresh weekly buy signals. The new buy signal in the MSCI World Index is also boding well. Weekly Reversal Levels for World markets © LunaticTrader.com

- 4. Buy signals for T and VZ Speculative buy signal for CVX 16 stocks bullish, up from 14 last week. Back above 15 = hesitating market looking for direction. See article: Keeping an eye on the Dow stocks Comment: Last week we had a serious warning when the number of bullish stocks dropped below 15. This week we have two buyers, putting the total back above 15. We need to see 20 bullish stocks to give an “all clear” message. So, this is a market that remains on the edge. Weekly Reversal Levels for 30 Dow stocks © LunaticTrader.com Note: the weekly reversal levels for over 1000 stocks and ETF can be picked up for free on my blog every weekend The daily reversal levels for over 1000 stocks and ETF are available for a few $ on Scutify every day: click here

- 5. No new targets this week. The Top1 targets are in play for stock indexes. For most markets it is the second or third attempt at these levels, so we may get breakouts to the upside. Gold has reversed at its Top1 target Euro is hanging on to its Bottom targets at 1.14 and 1.11 If these levels hold a nice rally is rally setting up in EURUSD . Target zones Legend * = new or updated target (W) = major weekly target Note: we use a +/-1% zone around these targets. The target zones are a by-product of the reversal level calculations. When a target is reached the market will typically react and turn back from it. On the second or third attempt the target finally gets broken and then the next target comes into play. So these target zones can be used as price objectives for taking profits or for entering the market after a significant sell-off. They can be seen as a kind of pivot points. When MoM indicator reverses right near a target zone it is very likely that the market has reached a temporary peak (or bottom). For more details about the target zones, see: http://lunatictrader.wordpress.com/2013/08/20/key-target-levels/ © LunaticTrader.com

- 6. More details about the reversal levels and how to use them in your trading can be found here: http://lunatictrader.wordpress.com/key-reversal-levels/ Blog: http://LunaticTrader.Wordpress.com On Twitter: http://twitter.com/lunatictrader1 On Scutify: http://www.scutify.com/profiles/scutifier.aspx?q=LunaticTrader On Stocktwits: http://stocktwits.com/LunaticTrader For daily reversal levels, regular market commentary or questions you are welcome to follow or contact us here: © LunaticTrader.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. LunaticTrader cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility. Note: the weekly reversal levels for over 1000 stocks and ETF can be picked up for free on my blog every weekend The daily reversal levels for over 1000 stocks and ETF are available for a few $ on Scutify every day: click here

- 7. More details about the reversal levels and how to use them in your trading can be found here: http://lunatictrader.wordpress.com/key-reversal-levels/ Blog: http://LunaticTrader.Wordpress.com On Twitter: http://twitter.com/lunatictrader1 On Scutify: http://www.scutify.com/profiles/scutifier.aspx?q=LunaticTrader On Stocktwits: http://stocktwits.com/LunaticTrader For daily reversal levels, regular market commentary or questions you are welcome to follow or contact us here: © LunaticTrader.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. LunaticTrader cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility. Note: the weekly reversal levels for over 1000 stocks and ETF can be picked up for free on my blog every weekend The daily reversal levels for over 1000 stocks and ETF are available for a few $ on Scutify every day: click here