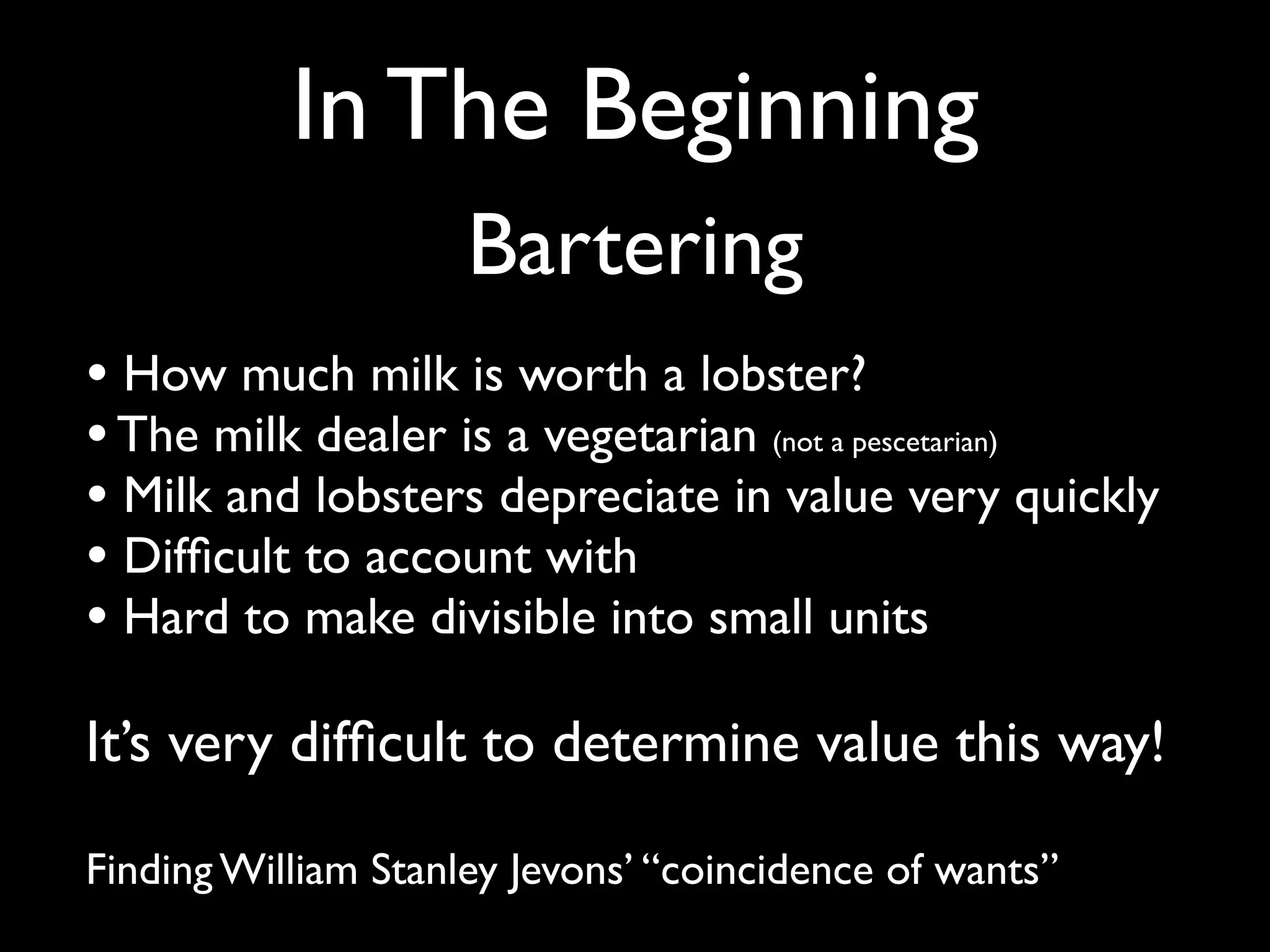

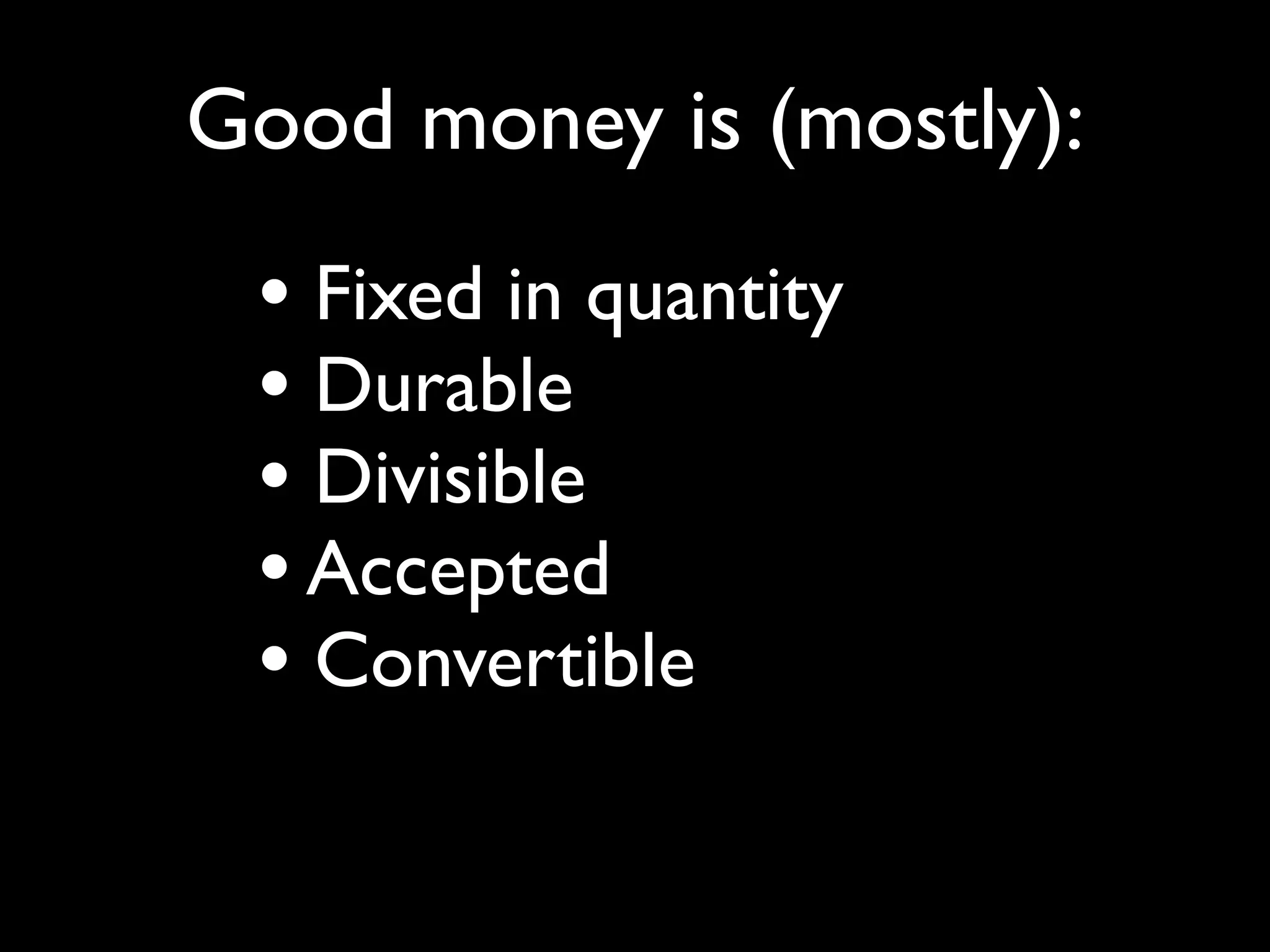

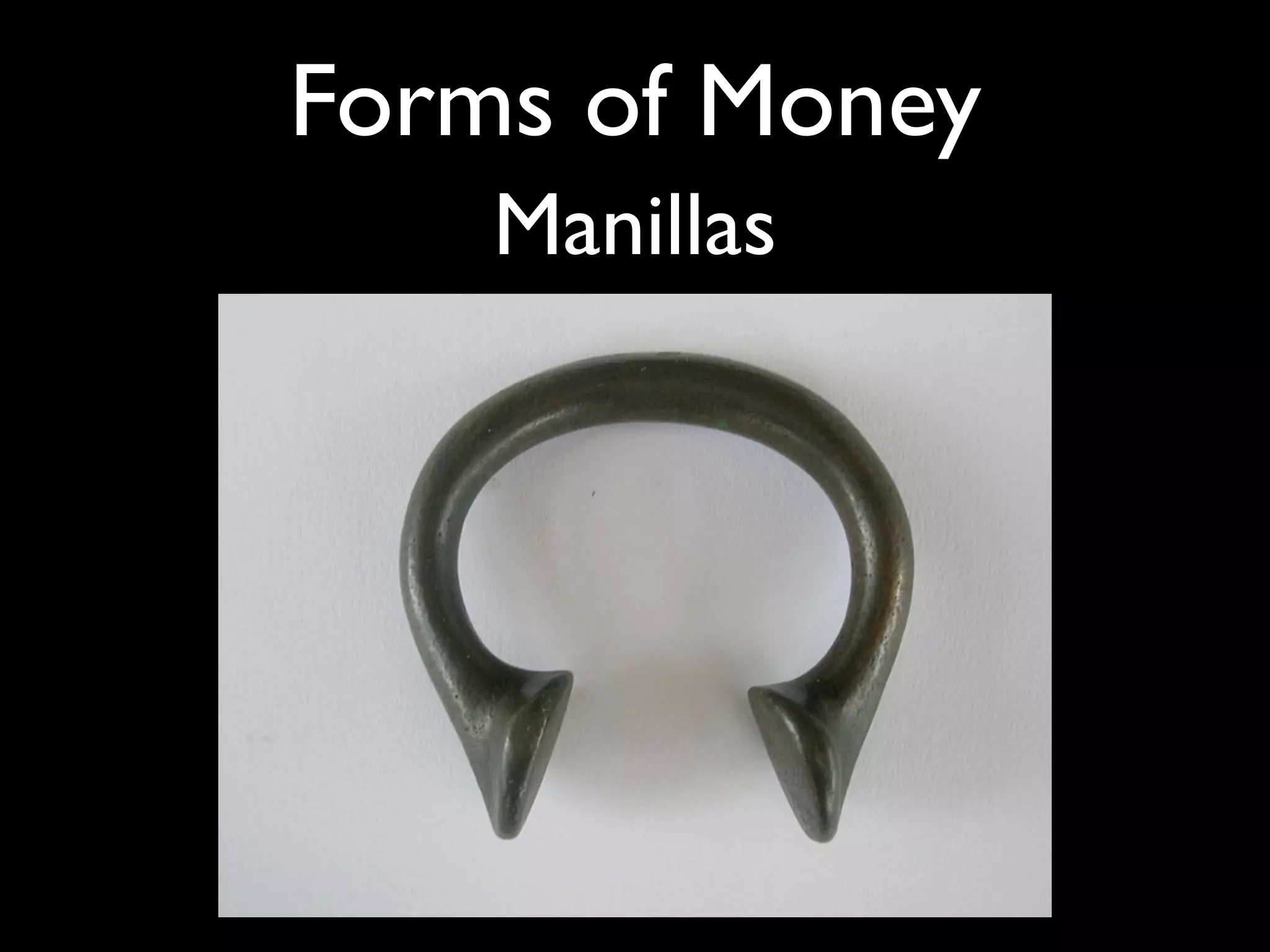

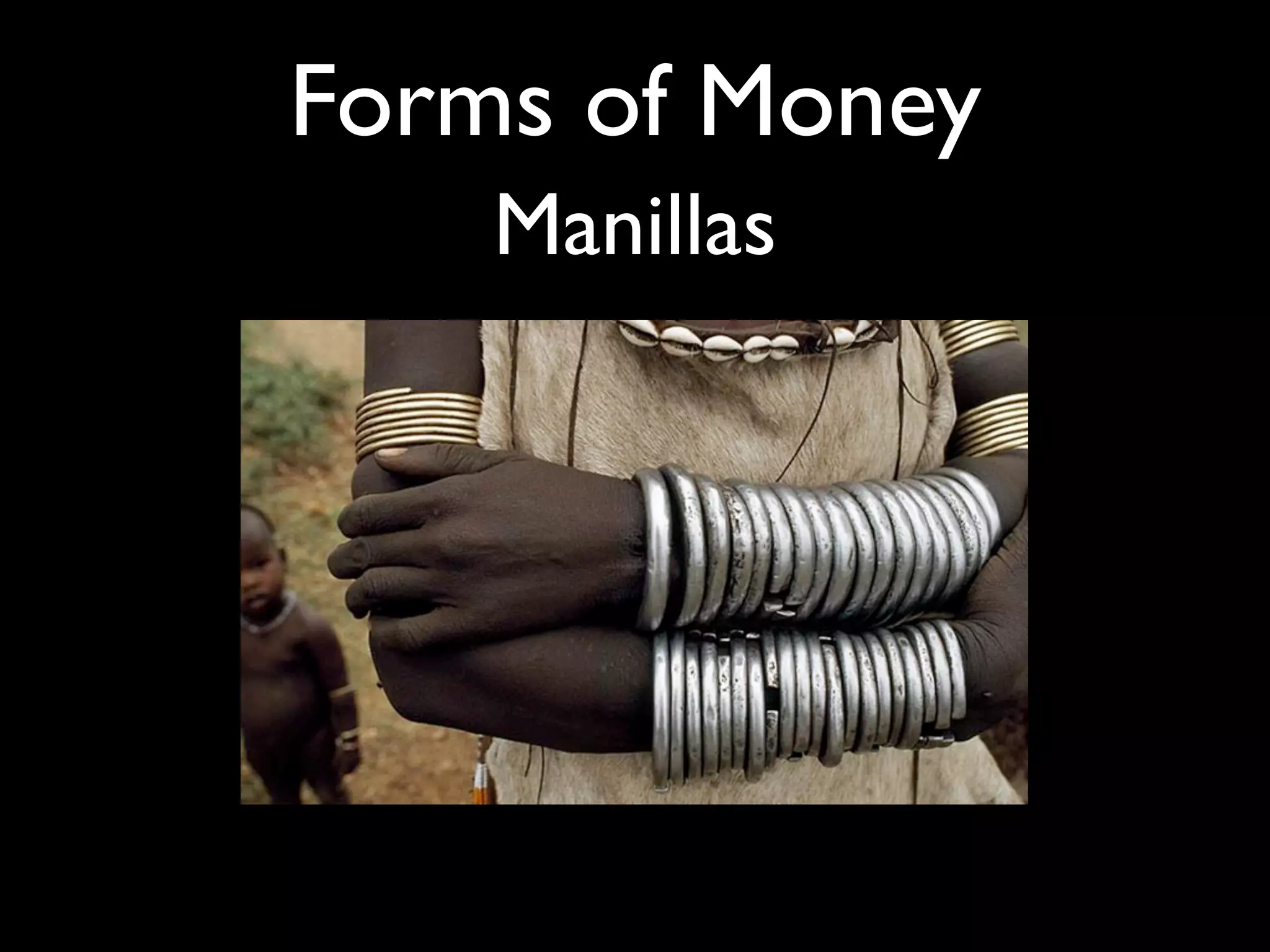

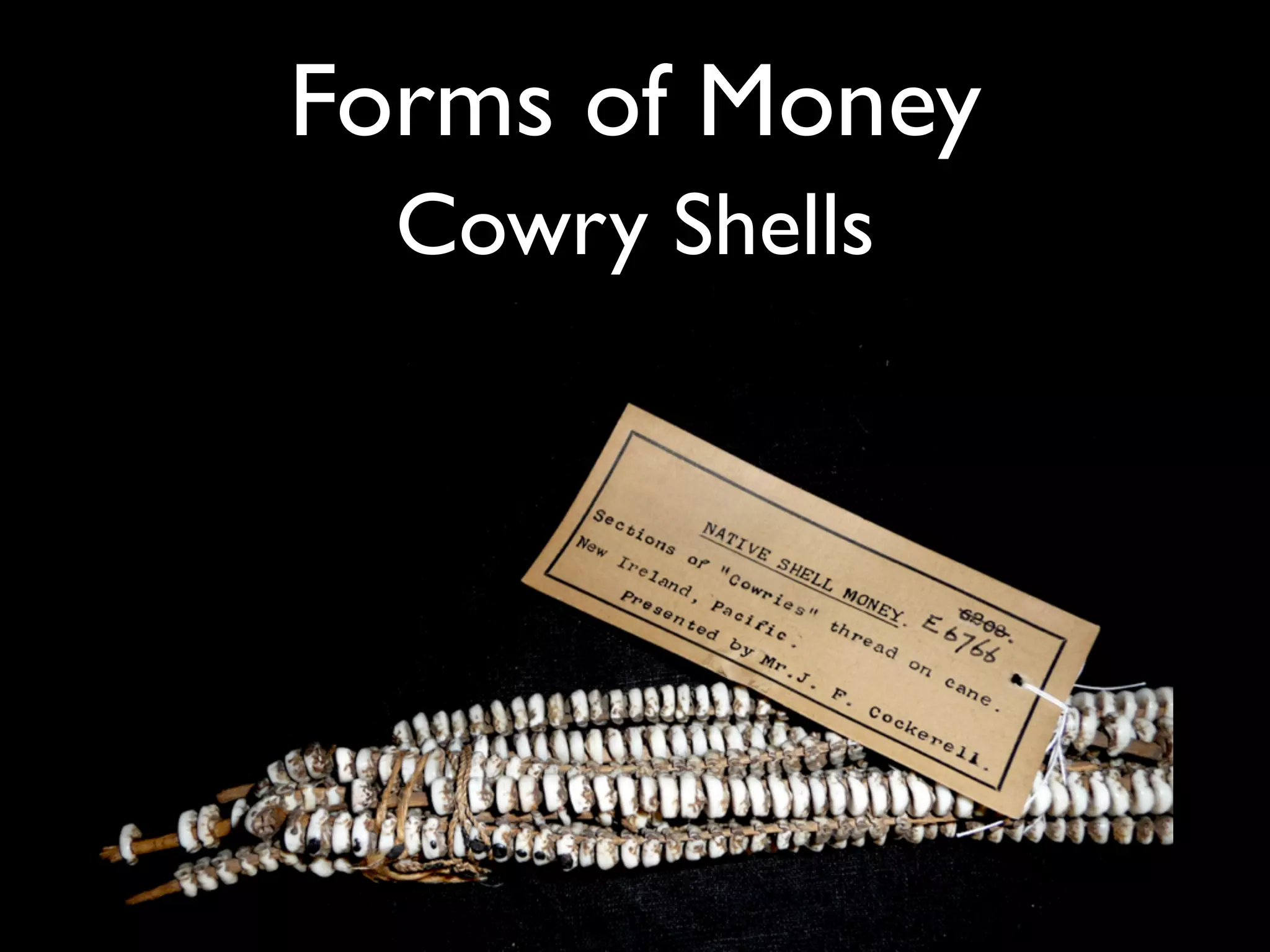

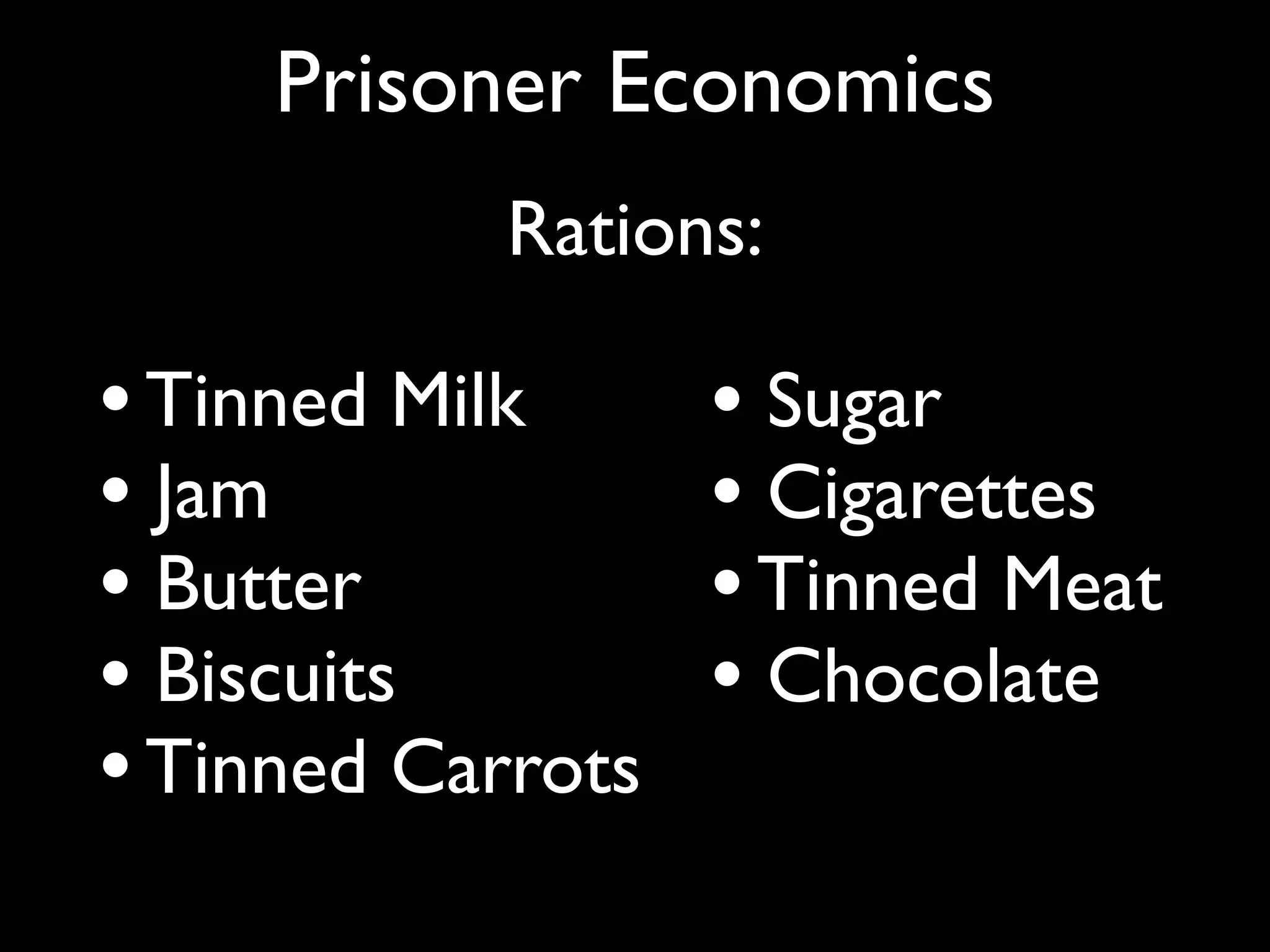

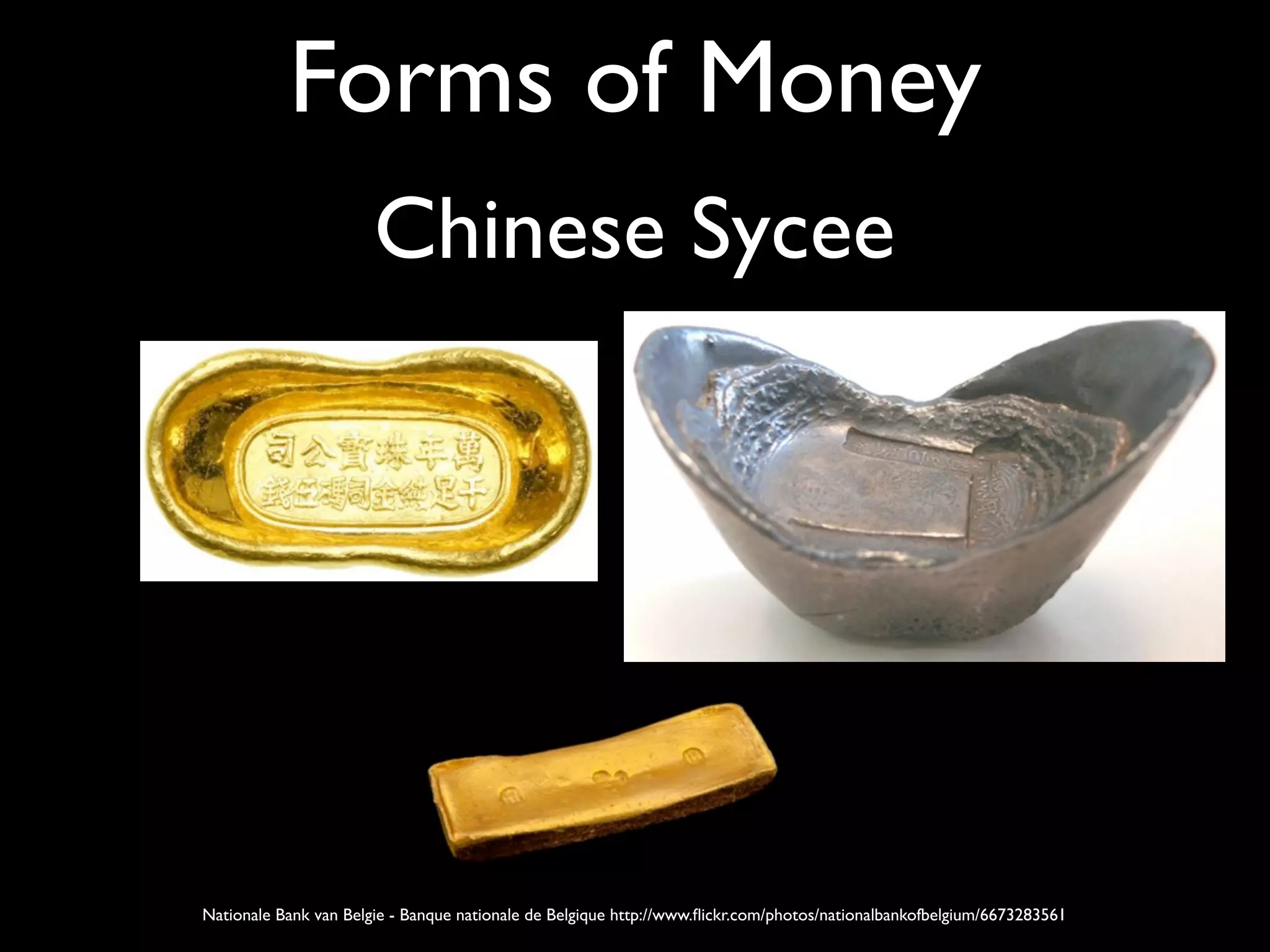

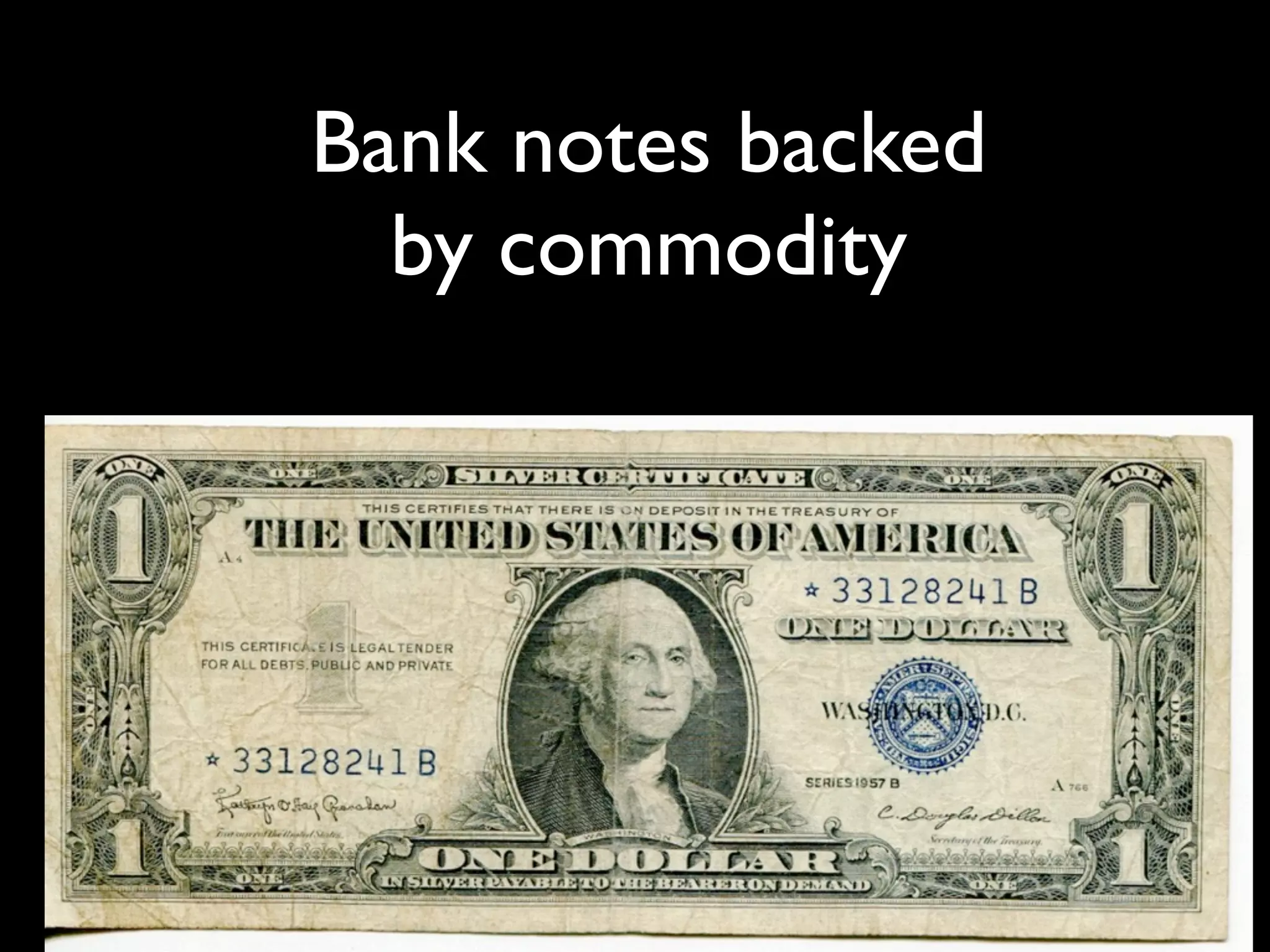

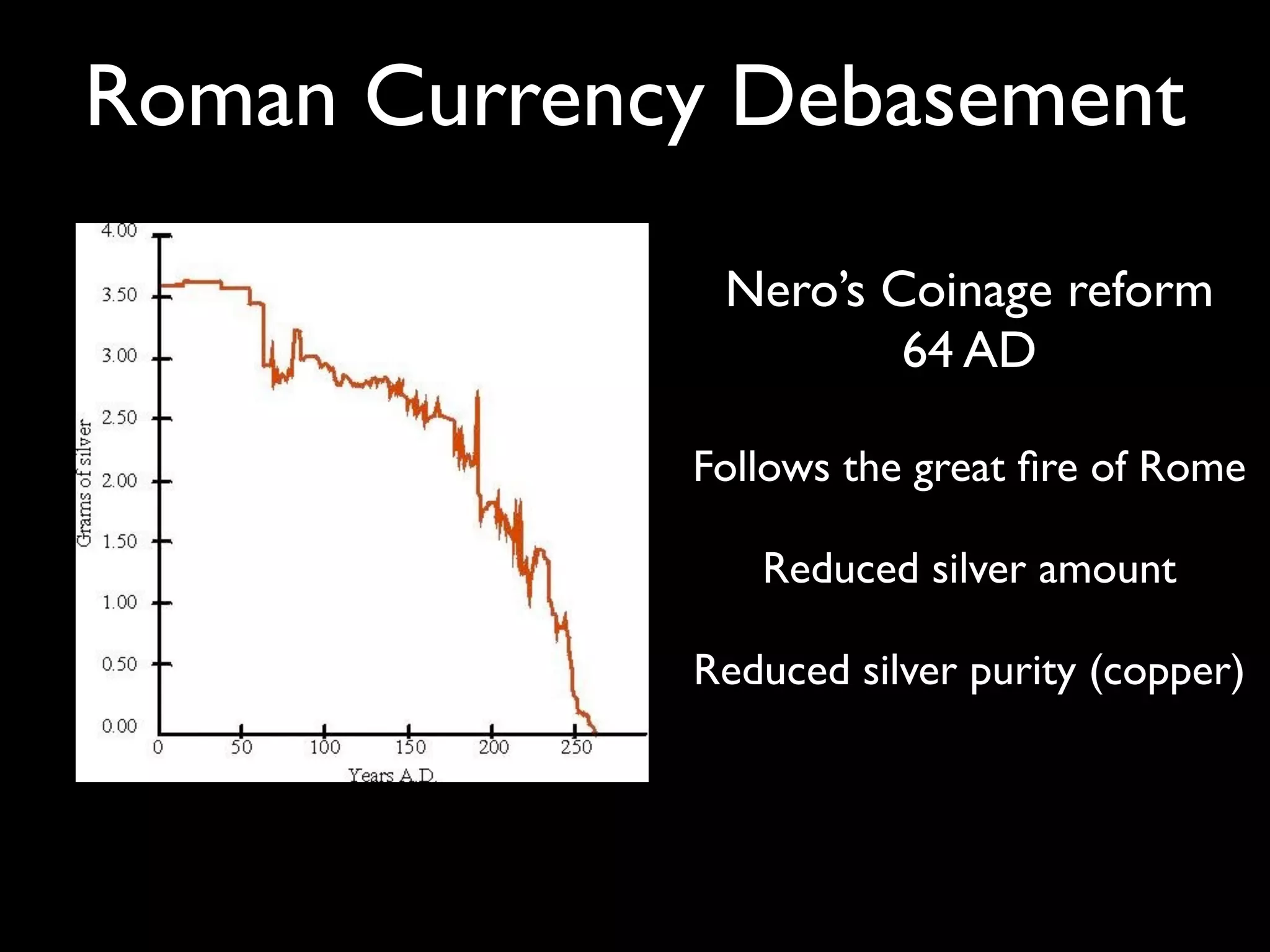

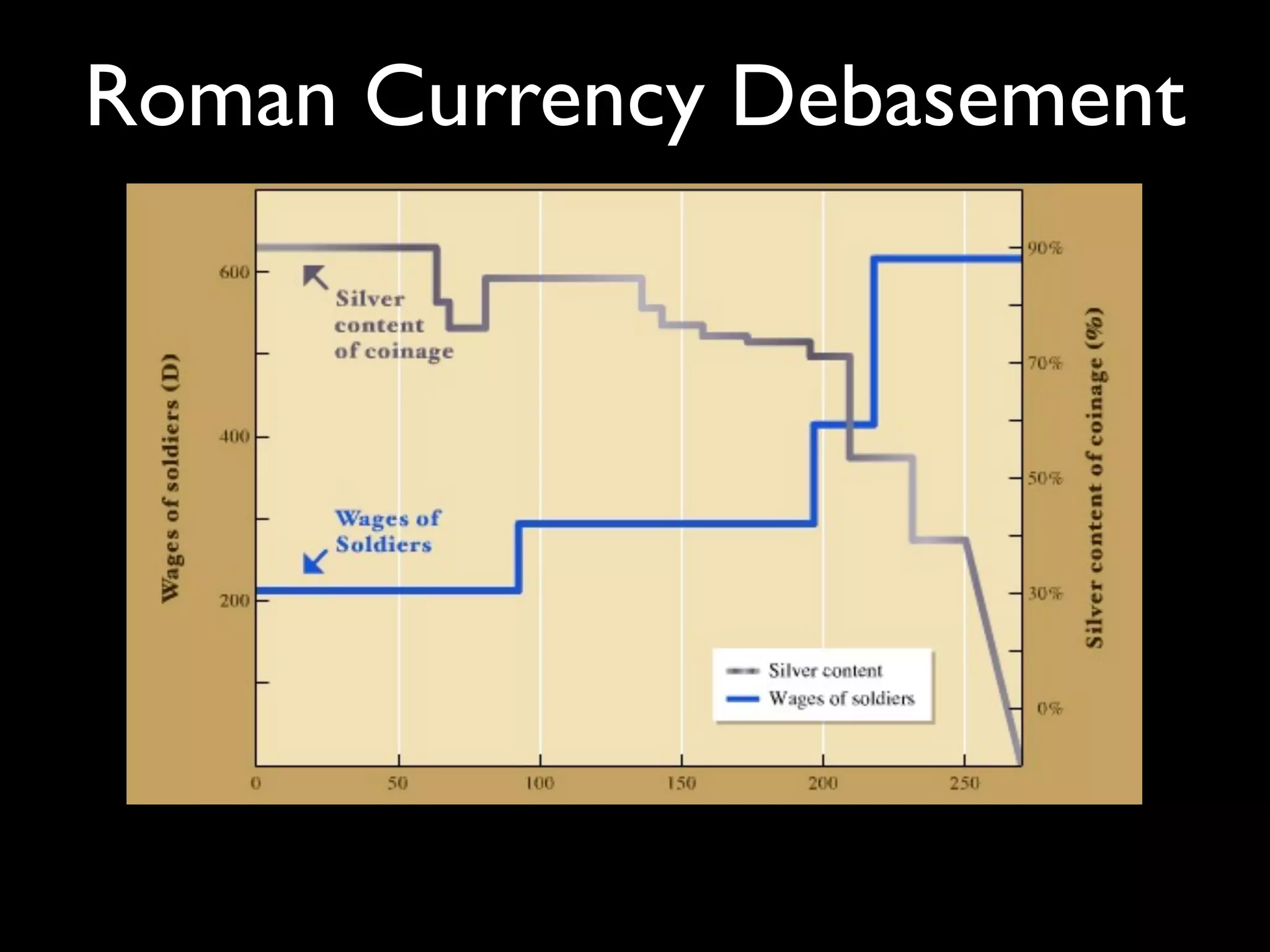

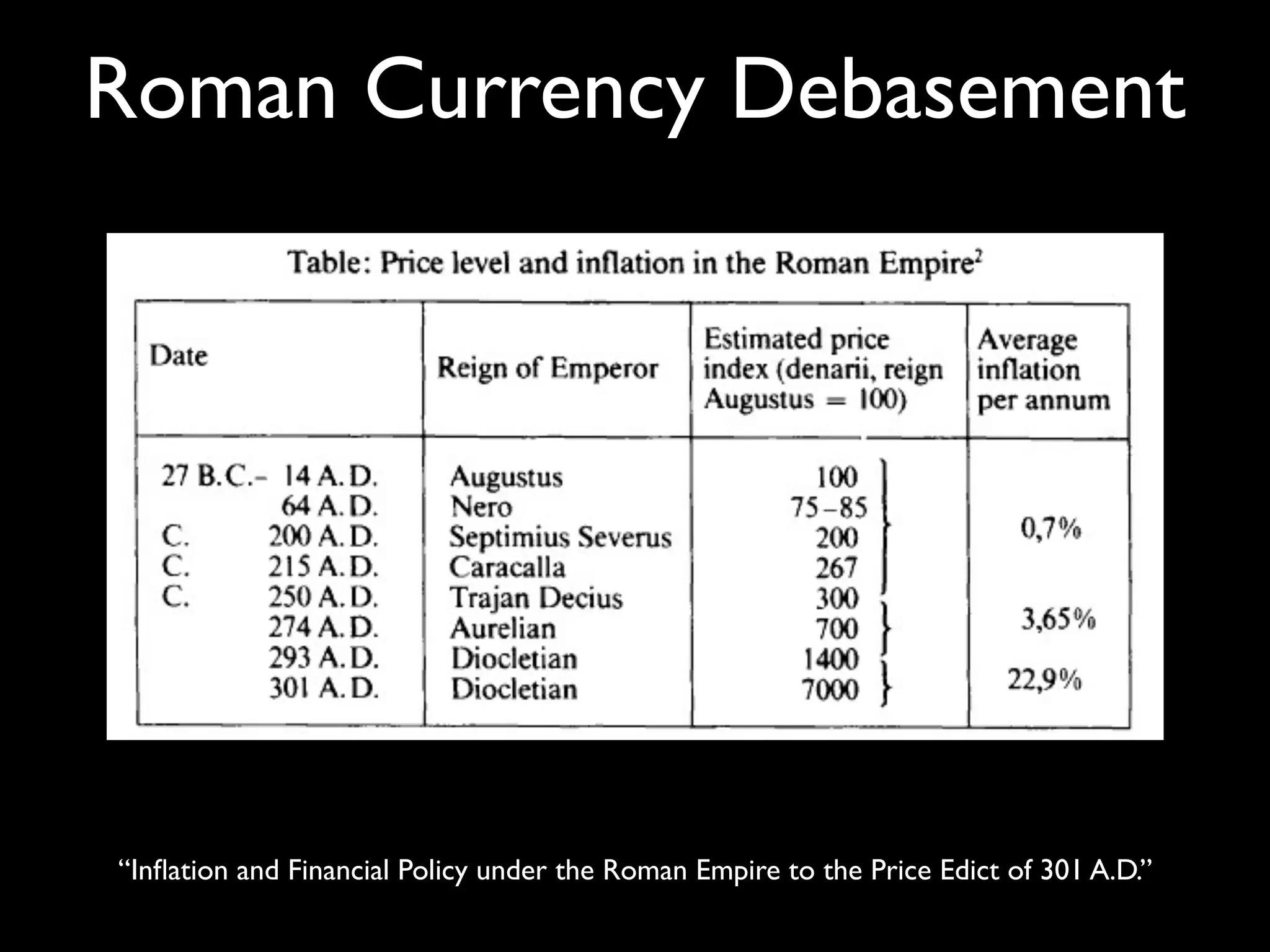

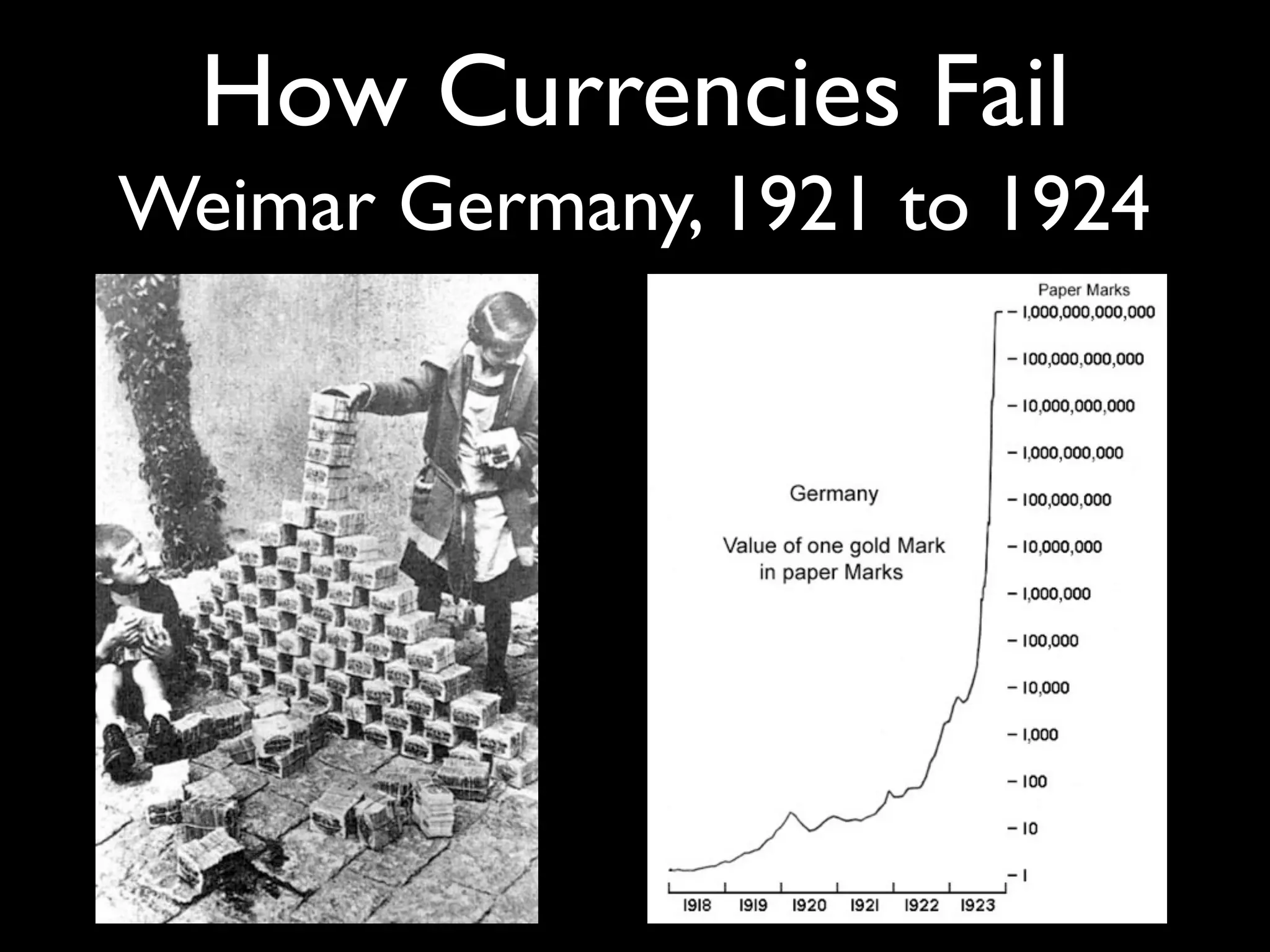

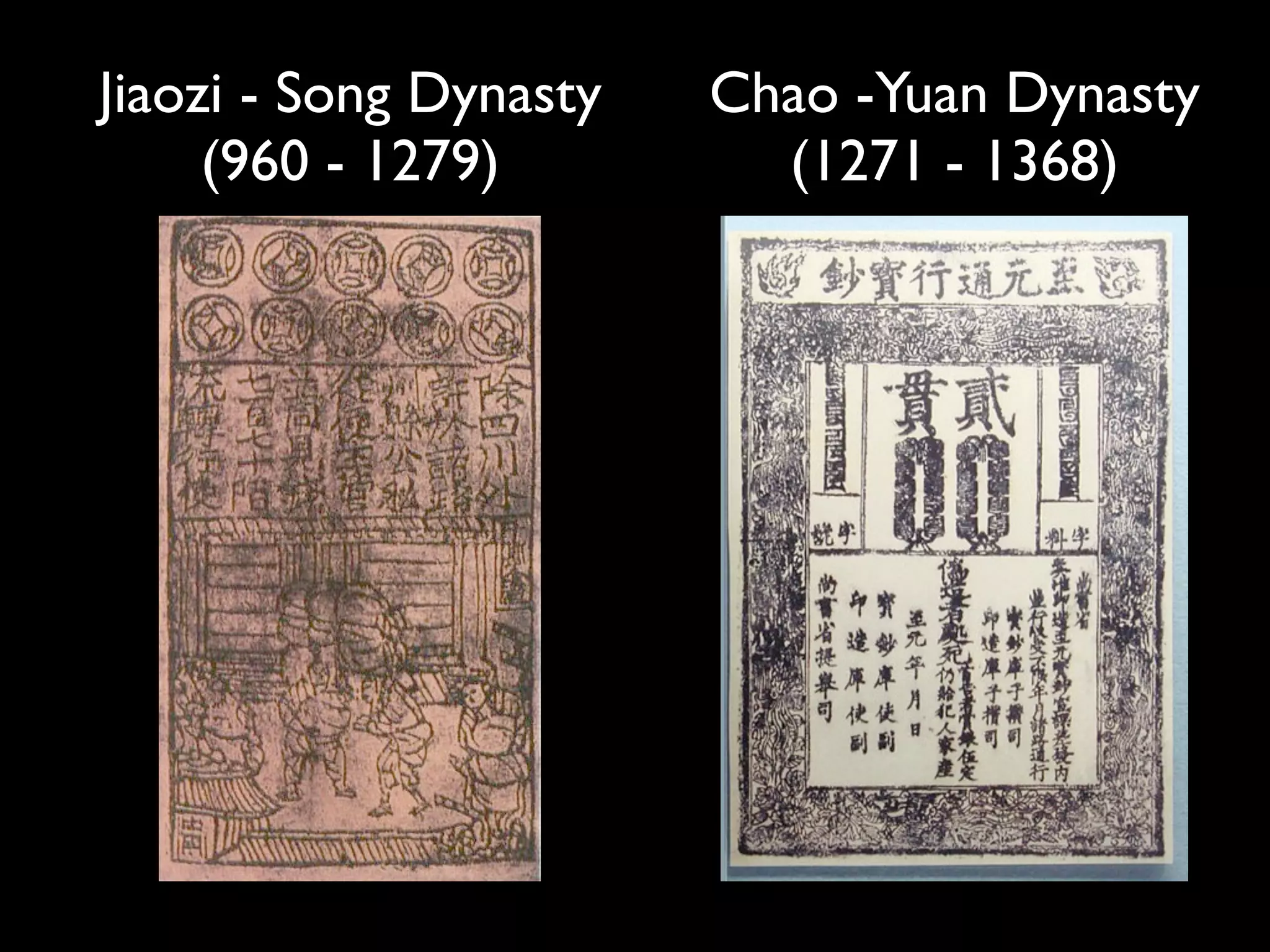

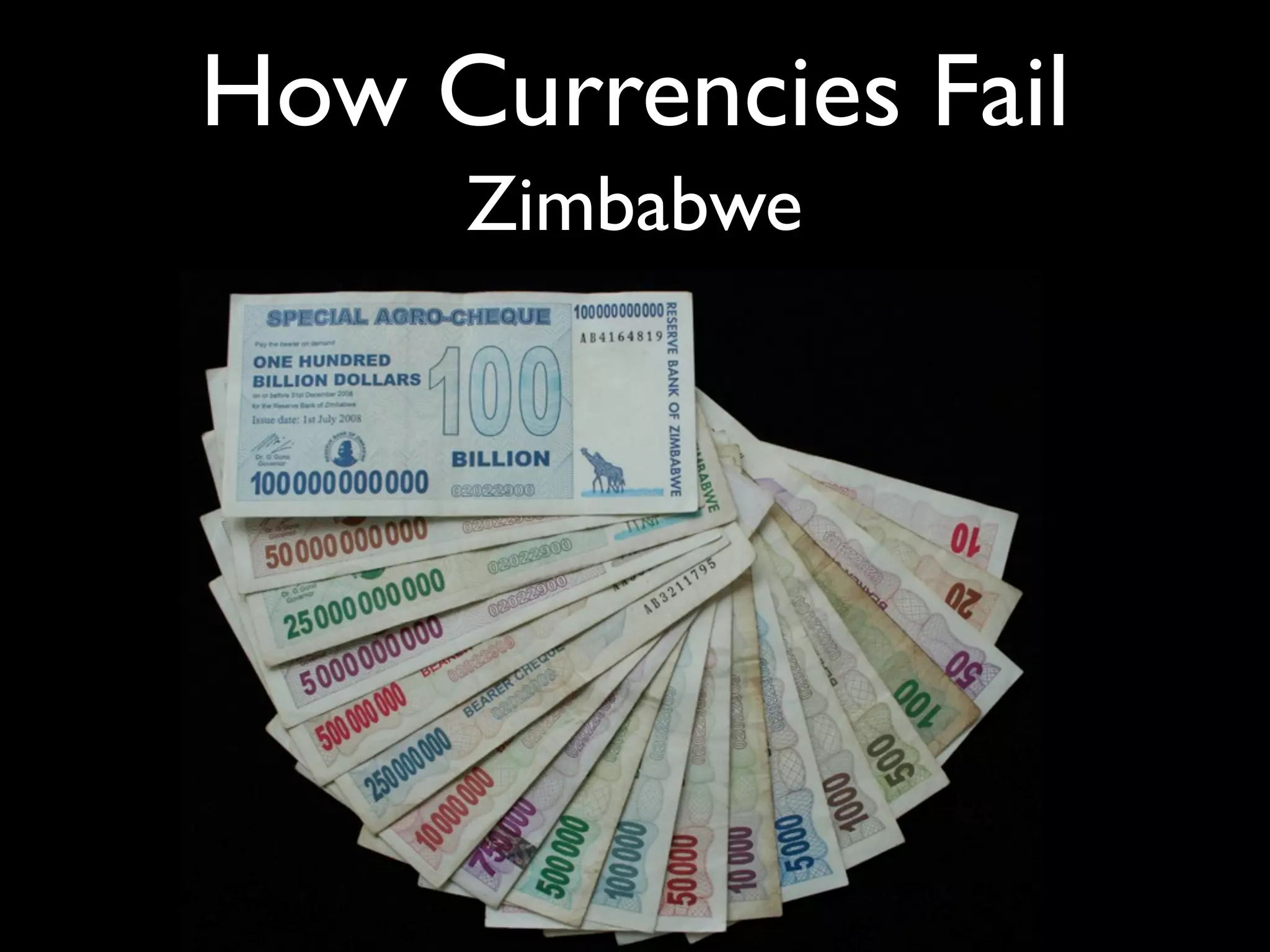

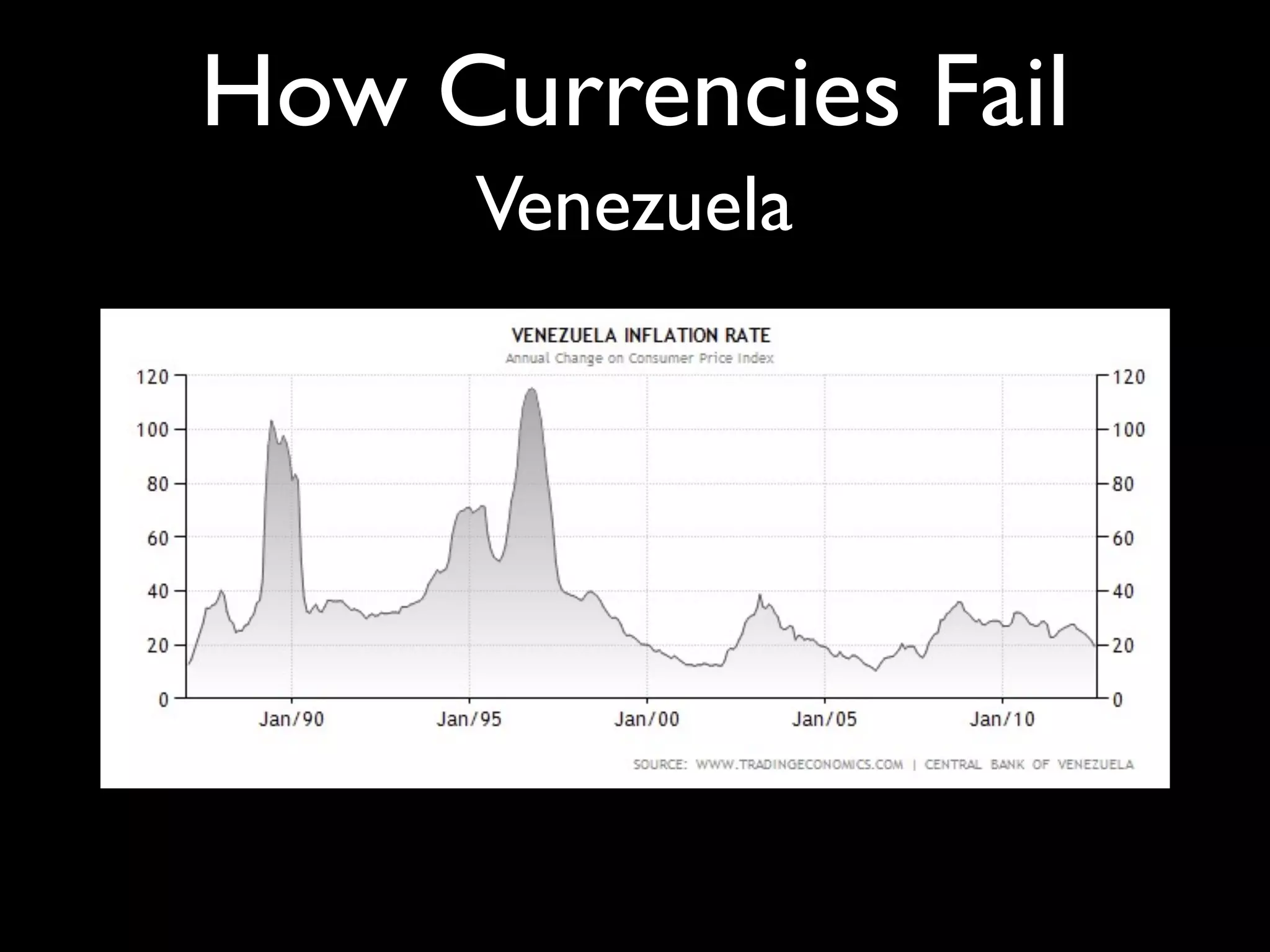

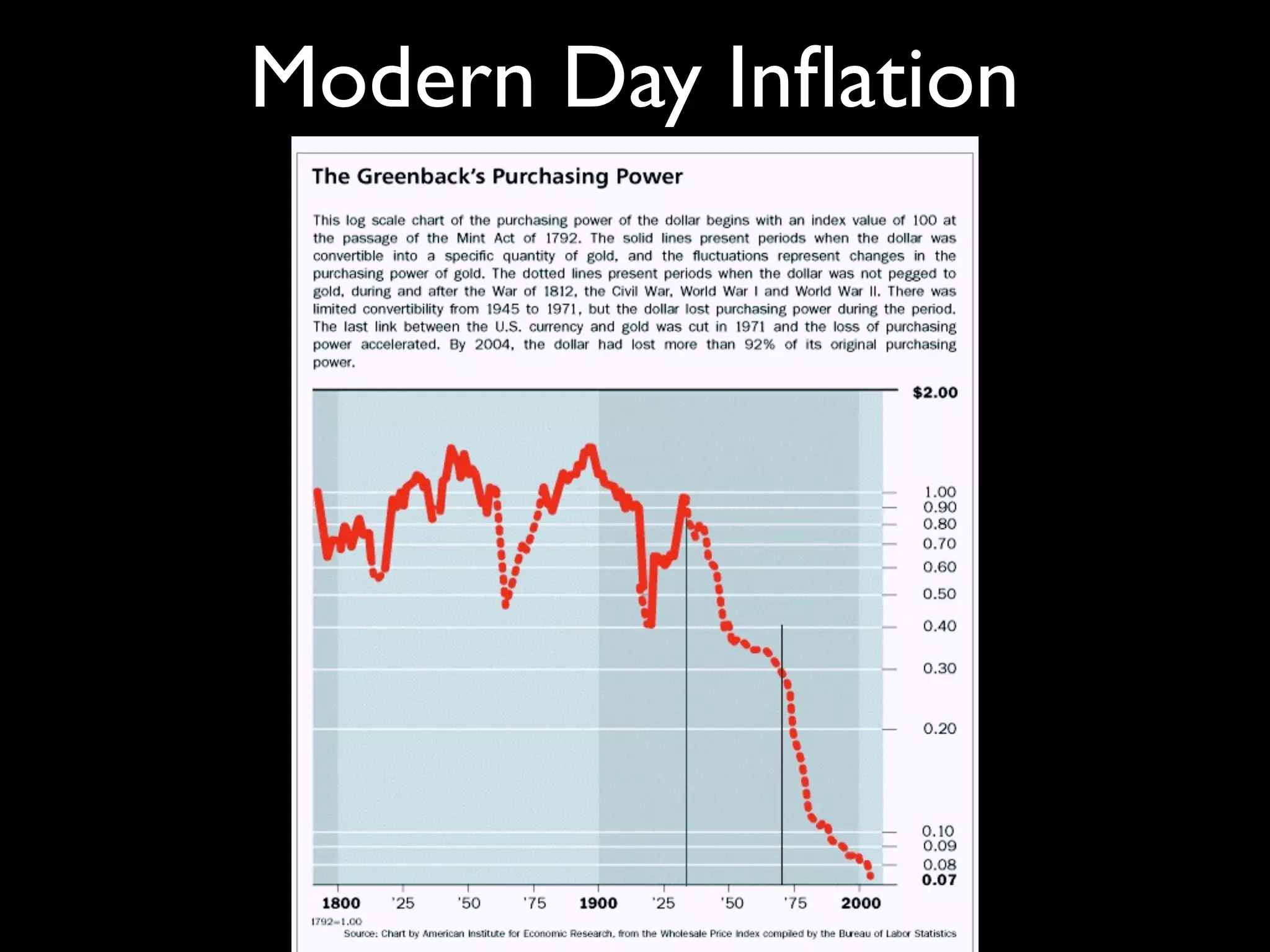

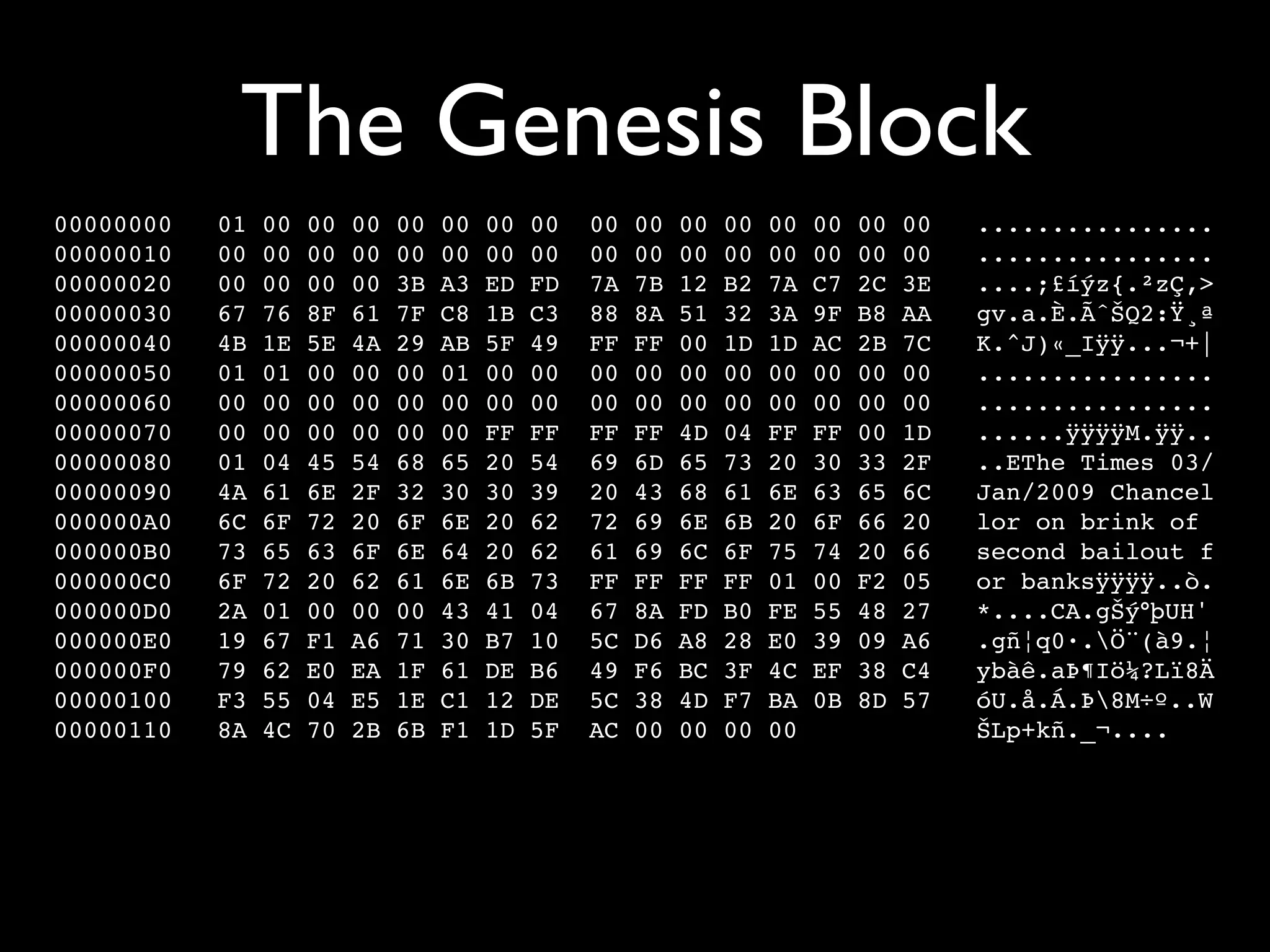

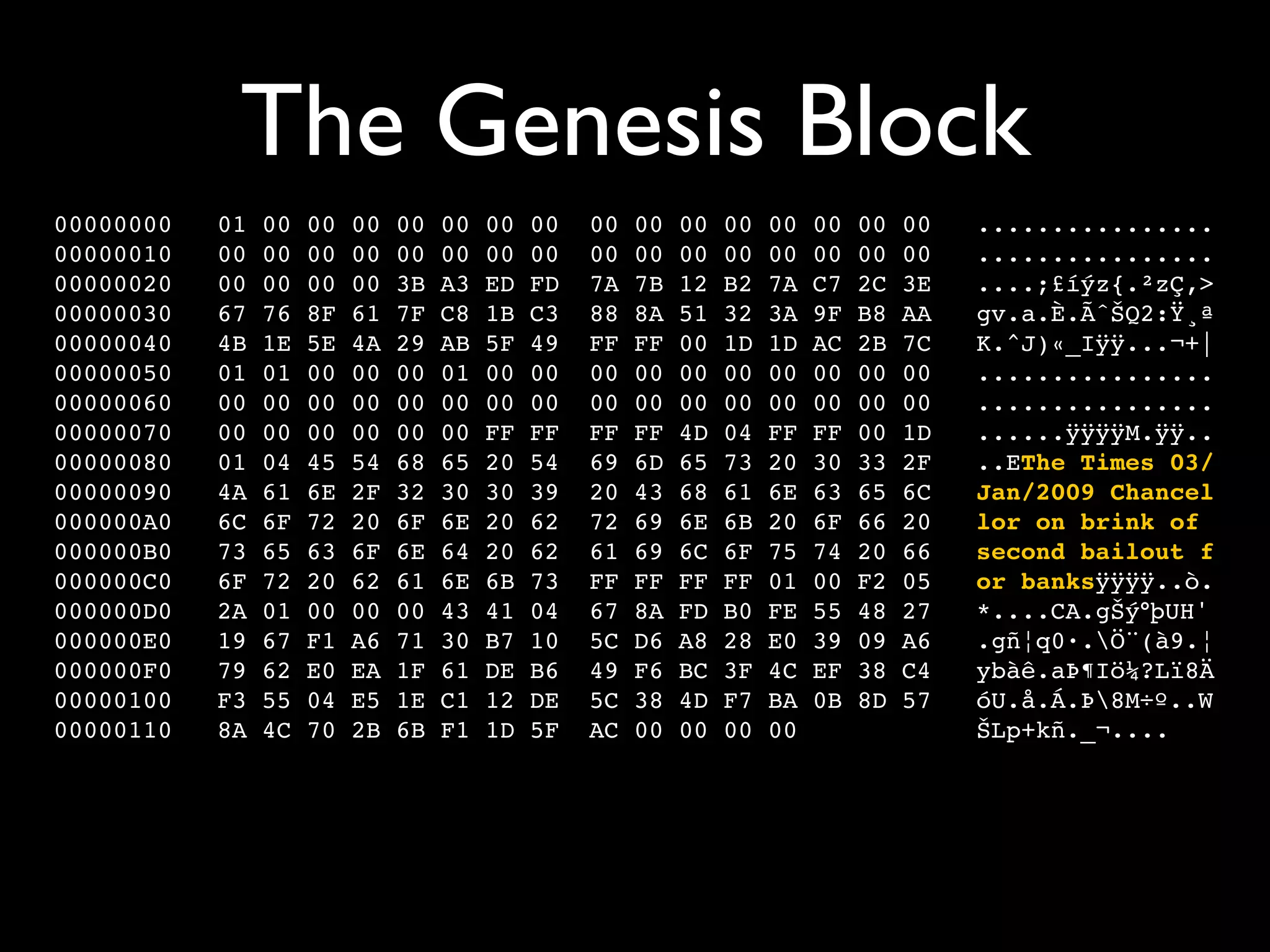

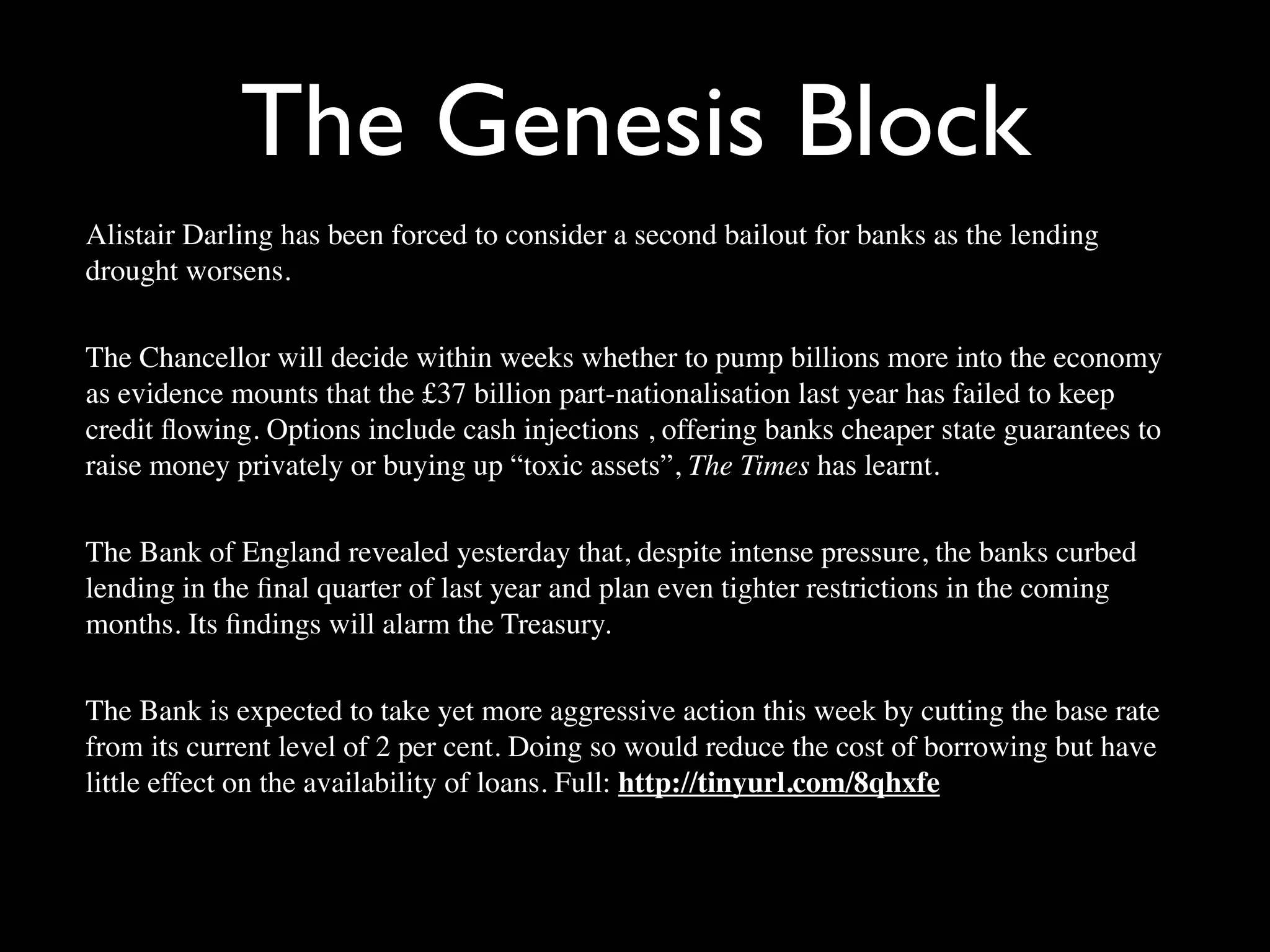

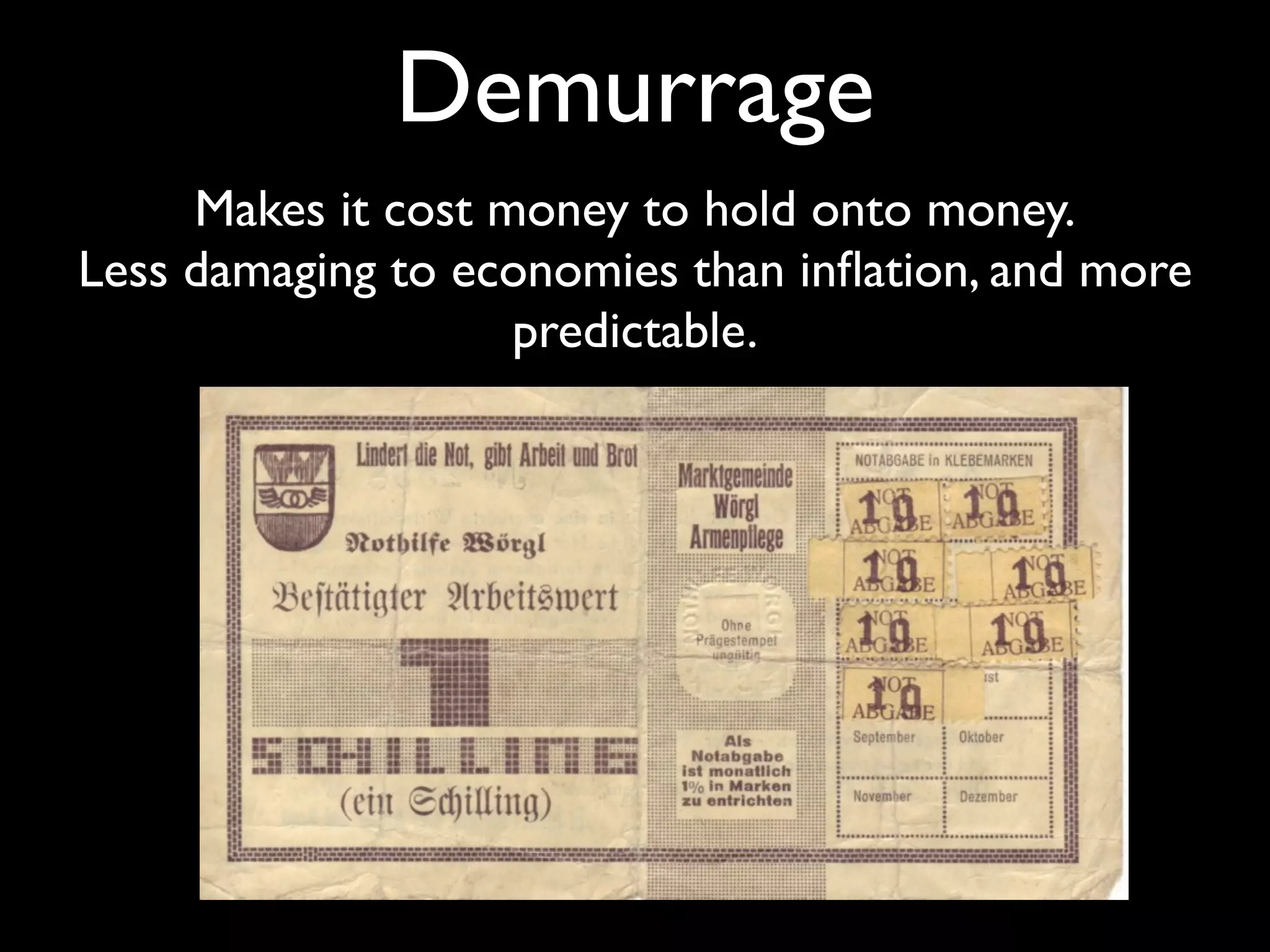

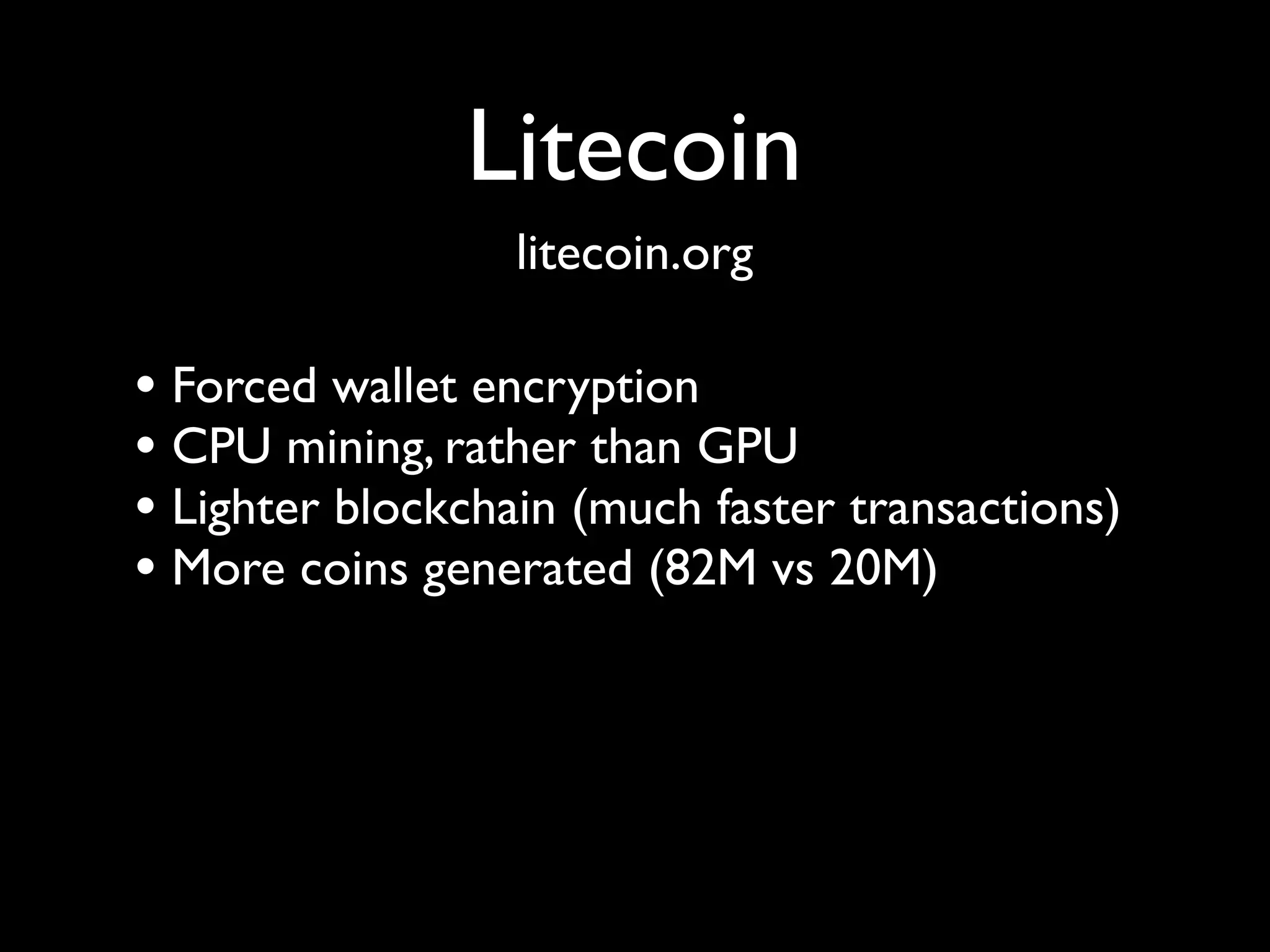

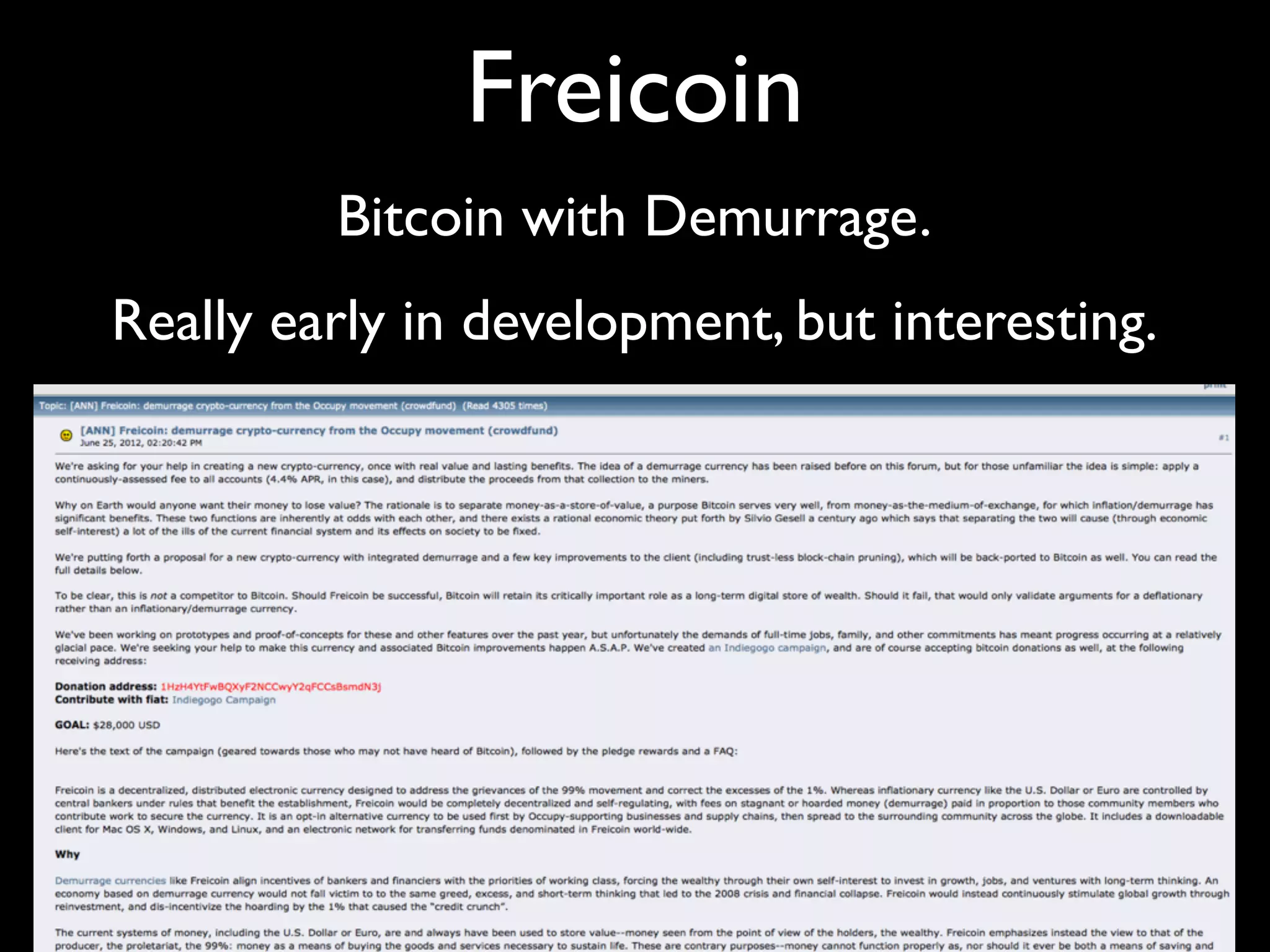

The document discusses the evolution of money, examining its role as a medium of exchange, unit of account, and store of value. It outlines the historical use of various forms of money, including barter systems, commodities like gold and silver, and paper currency, along with the pitfalls of currency debasement and inflation. Finally, it introduces Bitcoin as a decentralized digital currency designed to control inflation and proposes alternatives and improvements, showcasing the potential for cryptocurrencies to enhance economic stability.