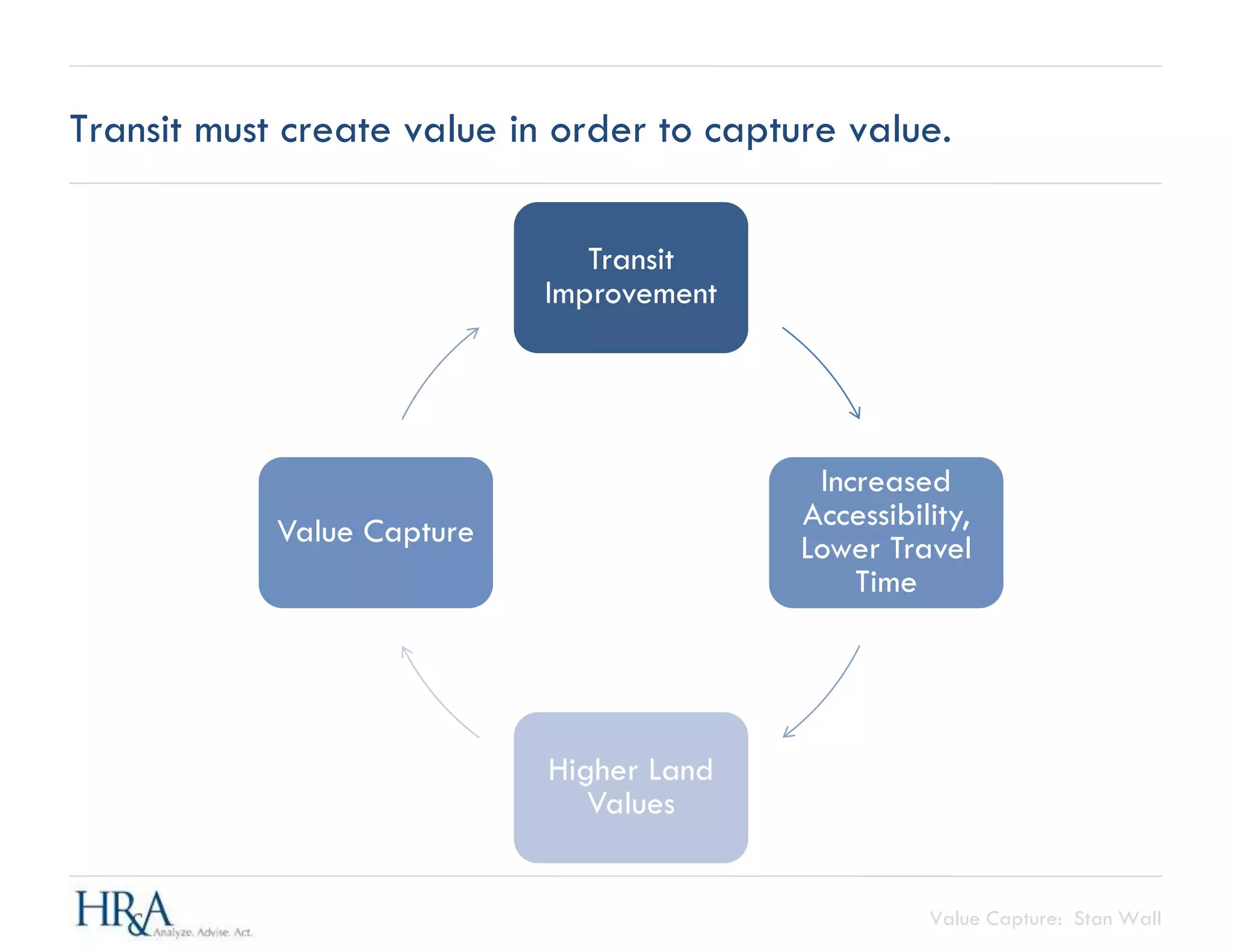

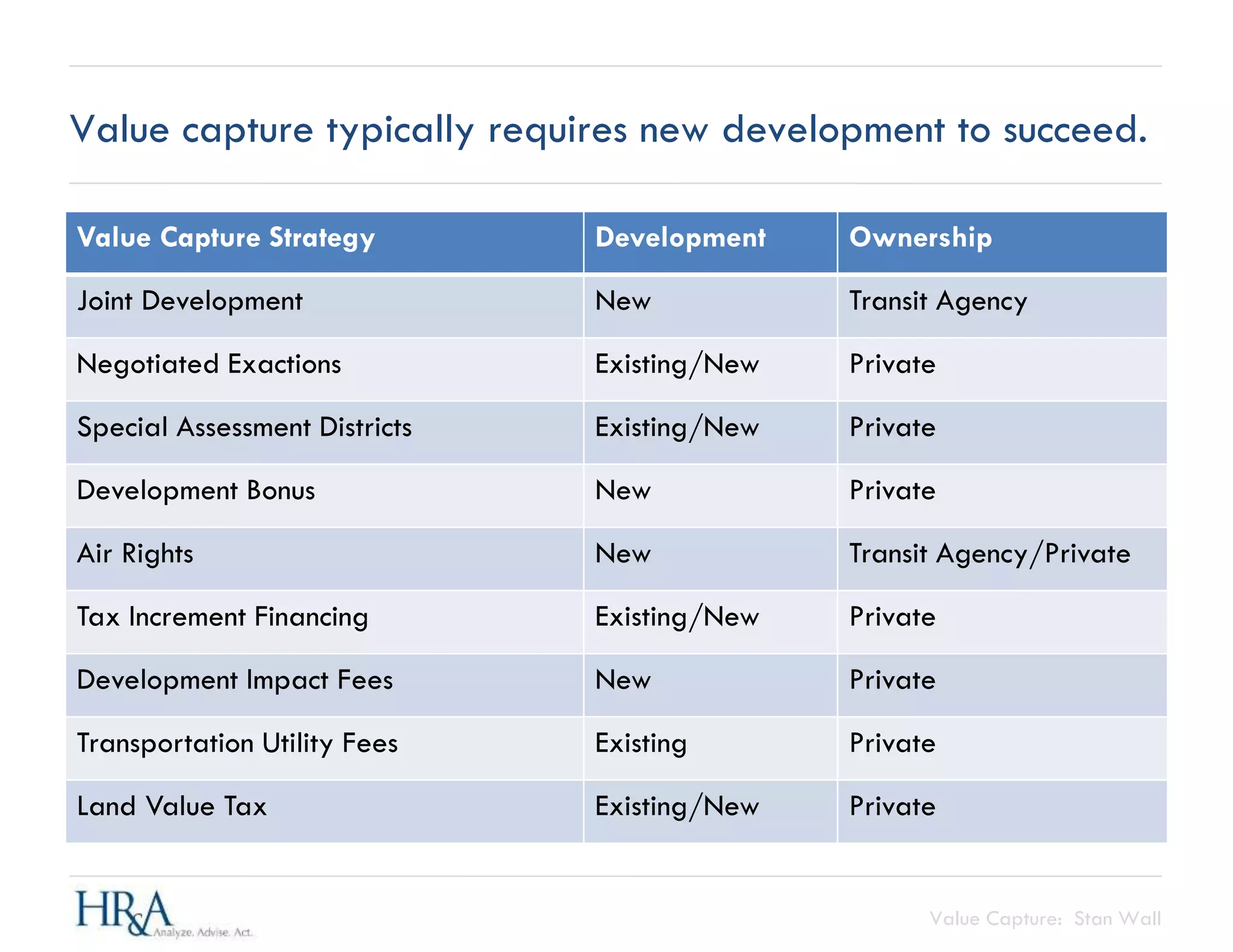

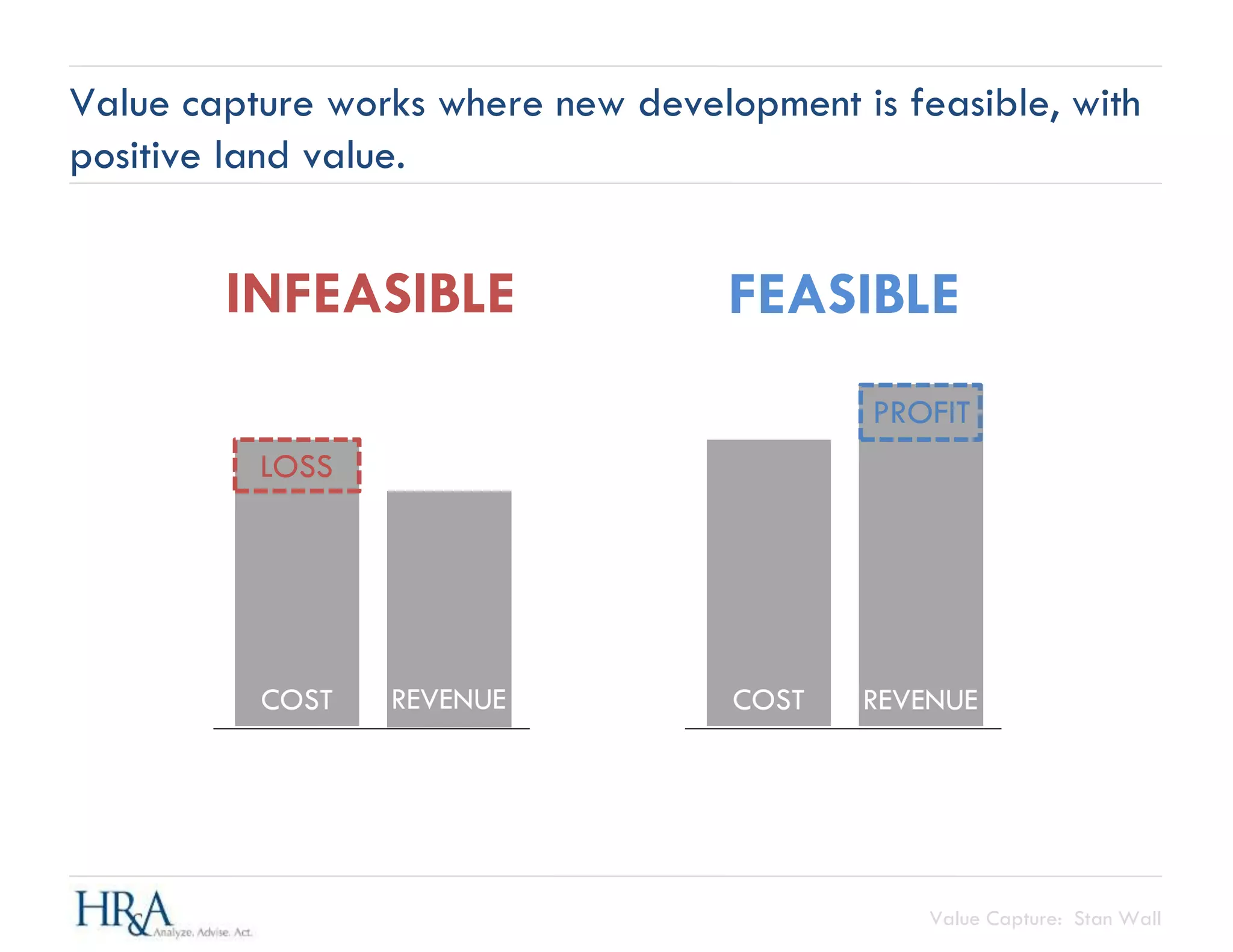

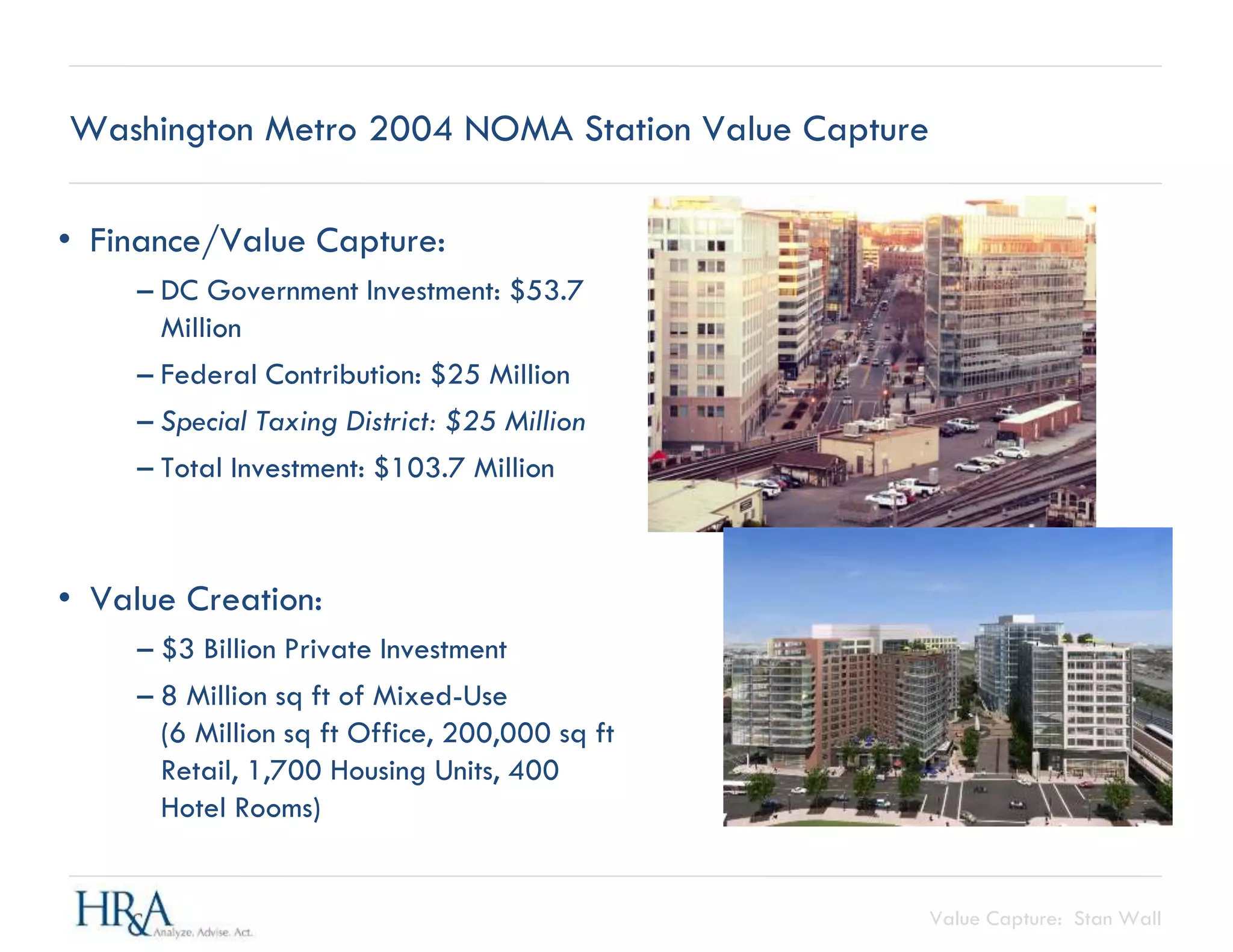

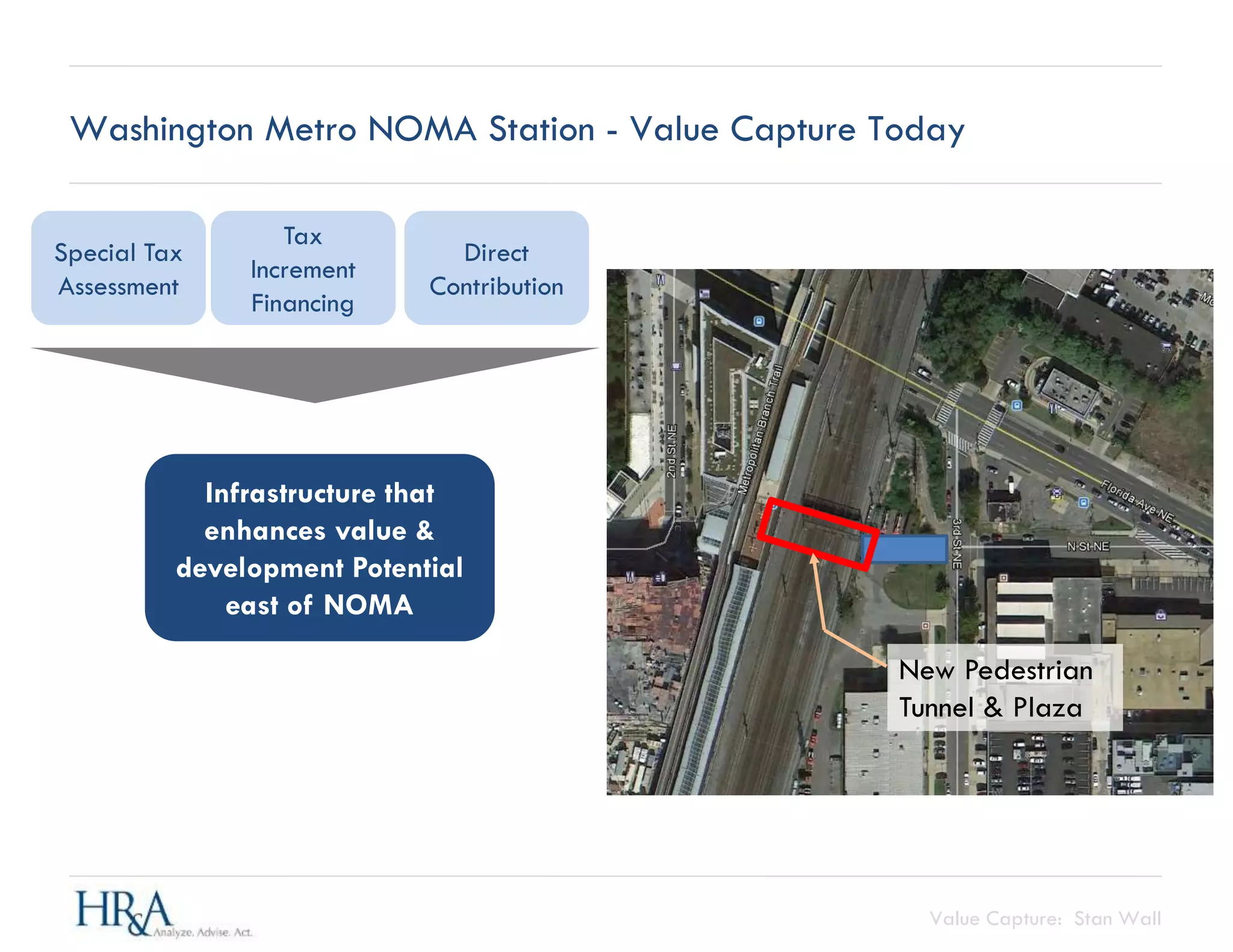

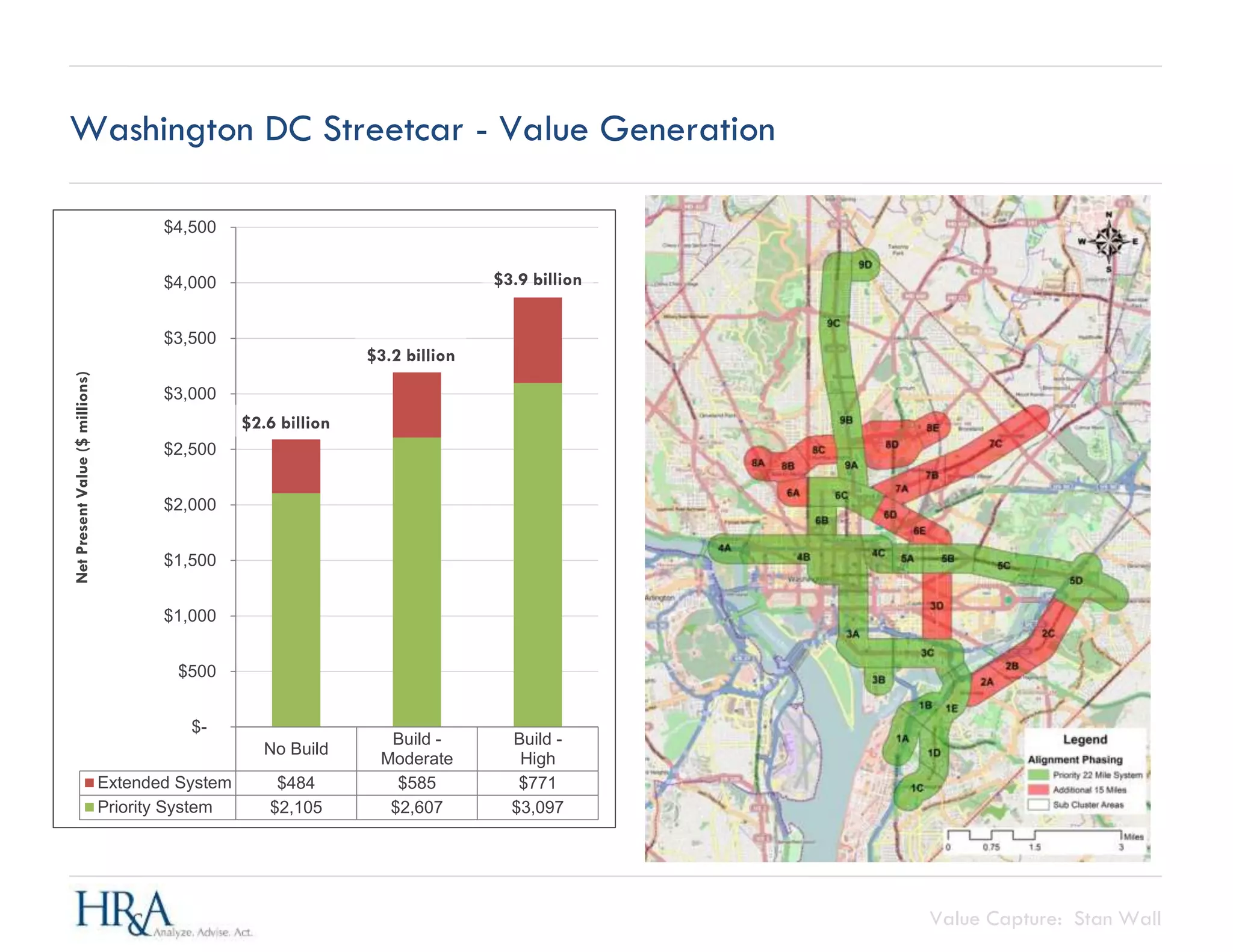

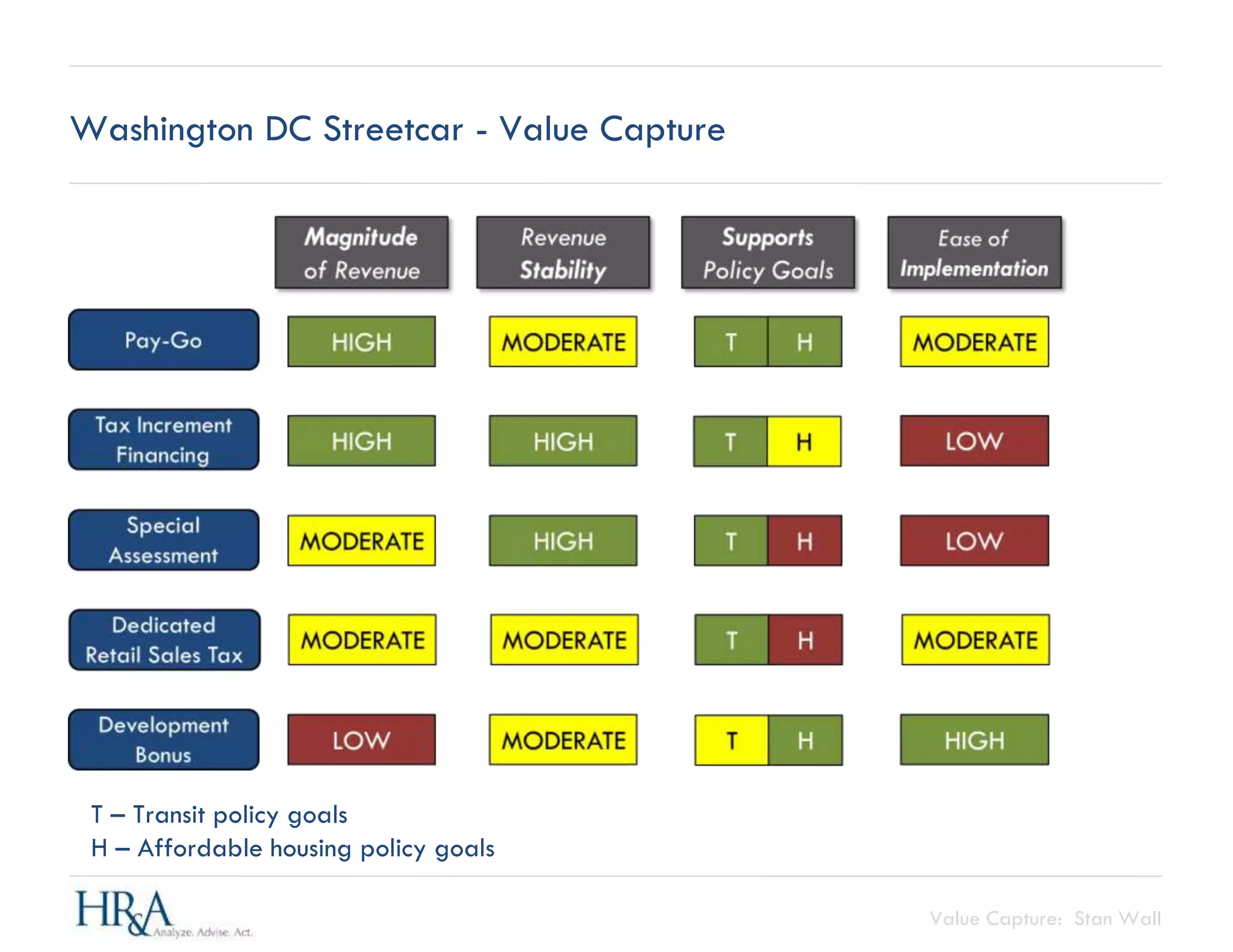

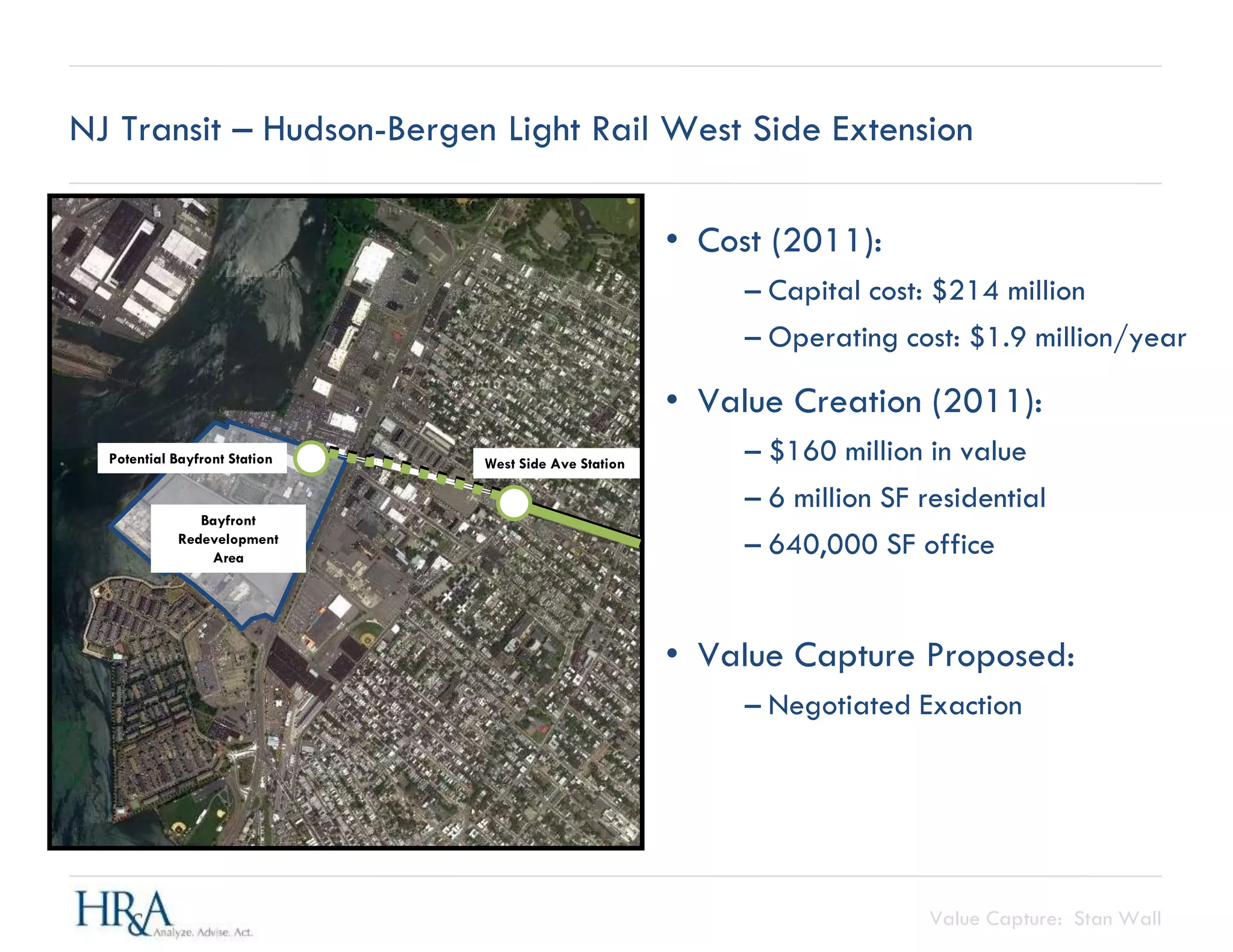

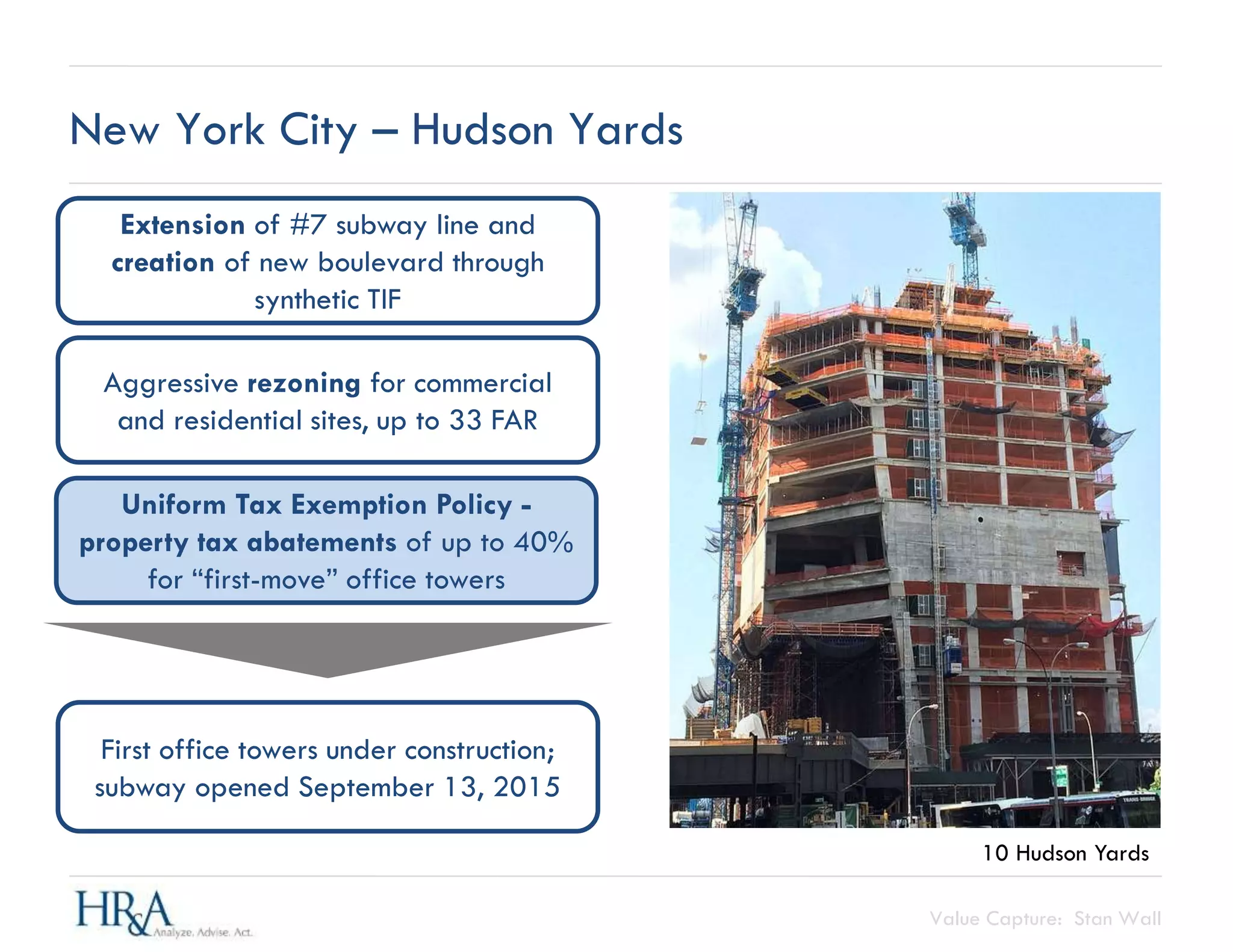

The document outlines strategies for value capture in transit improvements, highlighting the necessity of creating value to capture it effectively. It discusses various mechanisms such as negotiated exactions, tax increment financing, and public-private partnerships, using examples like Washington Metro's NOMA station and New Jersey's Hudson-Bergen Light Rail. Successful value capture relies on the feasibility of new developments and strong real estate and capital markets.