What happens to my mortgage loan when it is sold to another lender?

•

0 likes•231 views

What happens to my mortgage loan when it is sold to another lender?

Report

Share

Report

Share

Download to read offline

Recommended

How is Debt Treated if Someone Dies During Ongoing Bankruptcy Case?

How is Debt Treated if Someone Dies During Ongoing Bankruptcy Case?Nader & Berneman, Attorneys at Law

Recommended

How is Debt Treated if Someone Dies During Ongoing Bankruptcy Case?

How is Debt Treated if Someone Dies During Ongoing Bankruptcy Case?Nader & Berneman, Attorneys at Law

More Related Content

Viewers also liked

Viewers also liked (9)

Similar to What happens to my mortgage loan when it is sold to another lender?

Similar to What happens to my mortgage loan when it is sold to another lender? (20)

How Come You Pay Those Excessive Rates Of Interest For Bad Credit Home Loans?

How Come You Pay Those Excessive Rates Of Interest For Bad Credit Home Loans?

Credit Scores – How Much do They Matter with a Mortgage?

Credit Scores – How Much do They Matter with a Mortgage?

Credit Scores - How Much Do They Matter with A Mortgage

Credit Scores - How Much Do They Matter with A Mortgage

More from Socially Savvy

More from Socially Savvy (20)

The Power Of Social Media: Leveraging Brand Image to Drive Business Growth

The Power Of Social Media: Leveraging Brand Image to Drive Business Growth

The Ultimate Guide To The Best Digital Marketing Tools in 2023

The Ultimate Guide To The Best Digital Marketing Tools in 2023

Optimizing Social Media Marketing Strategies For Search Engines

Optimizing Social Media Marketing Strategies For Search Engines

Enhancing Video Content: Leveraging Polls, Quizzes, and CTAs

Enhancing Video Content: Leveraging Polls, Quizzes, and CTAs

Demographic Profiling Your Audience's Vital Statistics

Demographic Profiling Your Audience's Vital Statistics

The Ultimate Guide to Social Media Advertising Platforms.pdf

The Ultimate Guide to Social Media Advertising Platforms.pdf

How to Utilize TikTok Analytics to Refine Your Content Strategy.pdf

How to Utilize TikTok Analytics to Refine Your Content Strategy.pdf

Crafting an Instagram Content Calendar for Consistency.pdf

Crafting an Instagram Content Calendar for Consistency.pdf

How to Grow Your Twitter Following Organically with Valuable Content.pdf

How to Grow Your Twitter Following Organically with Valuable Content.pdf

Tips for Collaborating with Other Brands or Creators on Social Media Videos.pdf

Tips for Collaborating with Other Brands or Creators on Social Media Videos.pdf

How to Use Twitter Analytics to Improve Your Social Media Strategy.pdf

How to Use Twitter Analytics to Improve Your Social Media Strategy.pdf

Recently uploaded

Recently uploaded (20)

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

Call Girls in Maurice Nagar (Delhi) ꧁8447779280꧂ Female Escorts Service in De...

Call Girls in Maurice Nagar (Delhi) ꧁8447779280꧂ Female Escorts Service in De...

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

Kohinoor Courtyard One Wakad Pune | Elegant Living Spaces

Kohinoor Courtyard One Wakad Pune | Elegant Living Spaces

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

Low rate ↬Call girls in Sabzi Mandi Delhi | 8447779280}Escort Service In All ...

Low rate ↬Call girls in Sabzi Mandi Delhi | 8447779280}Escort Service In All ...

Low Density Living New Project in BPTP THE AMAARIO Sector 37D Gurgaon Haryana...

Low Density Living New Project in BPTP THE AMAARIO Sector 37D Gurgaon Haryana...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

What happens to my mortgage loan when it is sold to another lender?

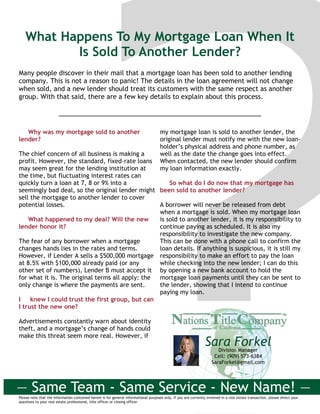

- 1. What Happens To My Mortgage Loan When It Is Sold To Another Lender? Many people discover in their mail that a mortgage loan has been sold to another lending company. This is not a reason to panic! The details in the loan agreement will not change when sold, and a new lender should treat its customers with the same respect as another group. With that said, there are a few key details to explain about this process. Please note that the information contained herein is for general informational purposes only. If you are currently involved in a real estate transaction, please direct your questions to your real estate professional, title officer or closing officer Why was my mortgage sold to another lender? The chief concern of all business is making a profit. However, the standard, fixed-rate loans may seem great for the lending institution at the time, but fluctuating interest rates can quickly turn a loan at 7, 8 or 9% into a seemingly bad deal, so the original lender might sell the mortgage to another lender to cover potential losses. What happened to my deal? Will the new lender honor it? The fear of any borrower when a mortgage changes hands lies in the rates and terms. However, if Lender A sells a $500,000 mortgage at 8.5% with $100,000 already paid (or any other set of numbers), Lender B must accept it for what it is. The original terms all apply: the only change is where the payments are sent. I knew I could trust the first group, but can I trust the new one? Advertisements constantly warn about identity theft, and a mortgage’s change of hands could make this threat seem more real. However, if my mortgage loan is sold to another lender, the original lender must notify me with the new loan- holder’s physical address and phone number, as well as the date the change goes into effect. When contacted, the new lender should confirm my loan information exactly. So what do I do now that my mortgage has been sold to another lender? A borrower will never be released from debt when a mortgage is sold. When my mortgage loan is sold to another lender, it is my responsibility to continue paying as scheduled. It is also my responsibility to investigate the new company. This can be done with a phone call to confirm the loan details. If anything is suspicious, it is still my responsibility to make an effort to pay the loan while checking into the new lender; I can do this by opening a new bank account to hold the mortgage loan payments until they can be sent to the lender, showing that I intend to continue paying my loan. Sara ForkelDivision Manager Cell: (909) 573-6384 SaraForkel@gmail.com — Same Team - Same Service - New Name! —