The Impact of Health Care Reform on Compensation

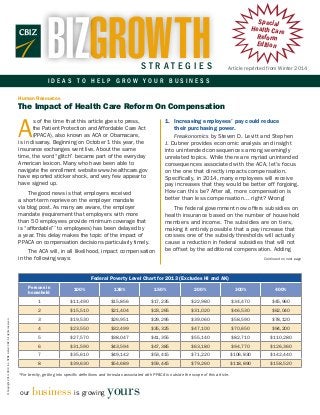

- 1. BIZGROWTH STRATEGIES Special Health Care Reform Edition Article reprinted from Winter 2014 IDEAS TO HELP GROW YOUR BUSINESS Human Resources The Impact of Health Care Reform On Compensation A 1. Increasing employees’ pay could reduce their purchasing power. Freakonomics by Steven D. Levitt and Stephen J. Dubner provides economic analysis and insight into unintended consequences among seemingly unrelated topics. While there are myriad unintended consequences associated with the ACA, let’s focus on the one that directly impacts compensation. Specifically, in 2014, many employees will receive pay increases that they would be better off forgoing. How can this be? After all, more compensation is better than less compensation… right? Wrong! s of the time that this article goes to press, the Patient Protection and Affordable Care Act (PPACA), also known as ACA or Obamacare, is in disarray. Beginning on October 1 this year, the insurance exchanges went live. About the same time, the word “glitch” became part of the everyday American lexicon. Many who have been able to navigate the enrollment website www.healthcare.gov have reported sticker shock, and very few appear to have signed up. The good news is that employers received a short-term reprieve on the employer mandate via blog post. As many are aware, the employer mandate (requirement that employers with more than 50 employees provide minimum coverage that is “affordable”* to employees) has been delayed by a year. This delay makes the topic of the impact of PPACA on compensation decisions particularly timely. The ACA will, in all likelihood, impact compensation in the following ways: The federal government now offers subsidies on health insurance based on the number of household members and income. The subsidies are on tiers, making it entirely possible that a pay increase that crosses one of the subsidy thresholds will actually cause a reduction in federal subsidies that will not be offset by the additional compensation. Adding Continued on next page Federal Poverty Level Chart for 2013 (Excludes HI and AK) 100% 138% 150% 200% 300% 400% 1 $11,490 $15,856 $17,235 $22,980 $34,470 $45,960 2 © Copyright 2014. CBIZ, Inc. NYSE Listed: CBZ. All rights reserved. Persons in household $15,510 $21,404 $23,265 $31,020 $46,530 $62,040 3 $19,530 $26,951 $29,295 $39,060 $58,590 $78,120 4 $23,550 $32,499 $35,325 $47,100 $70,650 $94,200 5 $27,570 $38,047 $41,355 $55,140 $82,710 $110,280 6 $31,590 $43,594 $47,385 $63,180 $94,770 $126,360 7 $35,610 $49,142 $53,415 $71,220 $106,830 $142,440 8 $39,630 $54,689 $59,445 $79,260 $118,890 $158,520 * or brevity, getting into specific definitions and formulas associated with PPACA is outside the scope of this article. F our business is growing yours

- 2. BIZGROWTH ST R ATEG IES Human Resources (Continued) complication to this issue is the fact that the subsidies are based on household income, so if one of your employees has a spouse who works, you may not have all of the information necessary to evaluate their subsidy level. The chart on page 1 lists the threshold amounts that may create this issue. 2. The employer mandate may impact the mix of total rewards at an organization. The ACA mandates coverage or penalties for lowpaid employees, many of whom were not previously covered by health insurance. Economics 101 illustrates how increases to the minimum wage result in companies seeking creative alternatives to more labor and thus higher unemployment. While the ACA does not directly increase the federal minimum wage, it does directly increase the cost of labor, which has the same impact. 3. The individual mandate increases cost of living – particularly for lower paid employees. As indicated above, the delayed employer mandate is effectively an increase in the minimum wage. However, the individual mandate (which has not been delayed) increases the cost of living. When individuals are forced to buy health insurance (whether they want to or not), they have less income available for the necessities of life. Many are predicting that industries with a large number of low-wage workers will move many of their employees to the state exchanges for health insurance. As they shift the cost of insurance to employees, they may find that they need to increase base pay in order to be market competitive. It is hard to predict the ultimate direction of the ACA, but in the short term it is reasonable to expect that employers who offer health coverage to their employees will be able to pay less in compensation than those who don’t. Be sure to reach out to an experienced compensation professional in order to keep up with trends and best practices as organizations experiment with different mixes of pay considerations. EDWARD R. RATAJ CBIZ Human Capital Services • St. Louis, MO 314.692.5884 • erataj@cbiz.com