Eco 305 week 10 quiz – strayer

- 1. ECO 305 Week 10 Quiz – Strayer Click on the Link Below to Purchase A+ Graded Course Material http://budapp.net/ECO-305-Week-10-Quiz-Strayer-367.htm Quiz 9 Chapter 14 and 15 EXCHANGE-RATE ADJUSTMENTS AND THE BALANCE OF PAYMENTS MULTIPLE CHOICE 1. According to the absorption approach, the economic circumstances that best warrant a currency devaluation is where the domestic economy faces: a. Unemployment coupled with a payments deficit b. Unemployment coupled with a payments surplus c. Full employment coupled with a payments deficit d. Full employment coupled with a payments surplus 2. According to the J-curve effect, when the exchange value of a country's currency appreciates, the country's trade balance: a. First moves toward deficit, then later toward surplus b. First moves toward surplus, then later toward deficit c. Moves into deficit and stays there d. Moves into surplus and stays there 3. Assume that Brazil has a constant money supply and that it devalues its currency. The monetary approach to devaluation reasons that one of the following tends to occur for Brazil: a. Domestic prices rise--purchasing power of money falls--consumption falls b. Domestic prices rise--purchasing power of money rises--consumption rises c. Domestic prices fall--purchasing power of money rises--consumption falls d. Domestic prices fall--purchasing power of money rises--consumption rises 4. According to the Marshall-Lerner approach, a currency depreciation will best lead to an improvement on the home country's trade balance when the: a. Home demand for imports is inelastic--foreign export demand is inelastic b. Home demand for imports is inelastic--foreign export demand is elastic c. Home demand for imports is elastic--foreign export demand is inelastic d. Home demand for imports is elastic--foreign export demand is elastic

- 2. 5. Assume an economy operates at full employment and faces a trade deficit. According to the absorption approach, currency devaluation will improve the trade balance if domestic: a. Interest rates rise, thus encouraging investment spending b. Income rises, thus stimulating consumption c. Output falls to a lower level d. Spending is cut, thus freeing resources to produce exports 6. An appreciation of the U.S. dollar tends to: a. Discourage foreigners from making investments in the United States b. Discourage Americans from purchasing foreign goods and services c. Increase the number of dollars that could be bought with foreign currencies d. Discourage Americans from traveling overseas 7. The Marshall-Lerner condition deals with the impact of currency depreciation on: a. Domestic income b. Domestic absorption c. Purchasing power of money balances d. Relative prices 8. According to the J-curve concept, which of the following is false--that the effects of a currency depreciation on the balance of payments are: a. Transmitted primarily via the income adjusted mechanism b. Likely to be adverse or negative in the short run c. In the long run positive, given favorable elasticity conditions d. Influenced by offsetting devaluations made by other countries 9. Which of the following is true for the J-curve effect? It: a. Applies to the interest rate effects of currency depreciation b. Applies to the income effects of currency depreciation c. Suggests that demand tends to be most elastic over the long run d. Suggests that demand tends to be least elastic over the long run

- 3. 10. American citizens planning a vacation abroad would welcome: a. Appreciation of the dollar b. Depreciation of the dollar c. Higher wages extended to foreign workers d. Lower wages extended to foreign workers 11. Assume the Canadian demand elasticity for imports equals 0.2, while the foreign demand elasticity for Canadian exports equals 0.3. Responding to a trade deficit, suppose the Canadian dollar depreciates by 20 percent. For Canada, the depreciation would lead to a: a. Worsening trade balance--a larger deficit b. Improving trade balance--a smaller deficit c. Unchanged trade balance d. None of the above 12. Assume the Canadian demand elasticity for imports equals 1.2, while the foreign demand elasticity for Canadian exports equals 1.8. Responding to a trade deficit, suppose the Canadian dollar depreciates by 10 percent. For Canada, the depreciation would lead to a(n): a. Worsening trade balance--a larger deficit b. Improving trade balance--a smaller deficit c. Unchanged trade balance d. None of the above 13. From 1985 to 1988 the U.S. dollar depreciated over 50 percent against the yen, yet Japanese export prices to Americans did not come down the full extent of the dollar depreciation. This is best explained by: a. Partial currency pass-through b. Complete currency pass-through c. Partial J-curve effect d. Complete J-curve effect 14. Because of the J-curve effect and partial currency pass-through, a depreciation of the domestic currency tends to increase the size of a: a. Trade surplus in the short run b. Trade surplus in the long run

- 4. c. Trade deficit in the short run d. Trade deficit in the long run 15. According to the Marshall-Lerner condition, a currency depreciation is least likely to lead to an improvement in the home country's trade balance when: a. Home demand for imports is inelastic and foreign export demand is inelastic b. Home demand for imports is elastic and foreign export demand is inelastic c. Home demand for imports is inelastic and foreign export demand is elastic d. Home demand for imports is elastic and foreign export demand is elastic 16. If foreign manufacturers cut manufacturing costs and profit margins in response to a depreciation in the U.S. dollar, the effect of these actions is to: a. Shorten the amount of time in which the depreciation leads to a smaller trade deficit b. Shorten the amount of time in which the depreciation leads to a smaller trade surplus c. Lengthen the amount of time in which the depreciation leads to a smaller trade deficit d. Lengthen the amount of time in which the depreciation leads to a smaller trade surplus 17. The shift in focus toward imperfectly competitive markets in domestic and international trade questions the concept of: a. Official exchange rates b. Complete currency pass-through c. Exchange arbitrage d. Trade-adjustment assistance 18. The extent to which a change in the exchange rate leads to changes in import and export prices is known as: a. The J-curve effect b. The Marshall-Lerner effect c. The absorption effect d. Pass-through effect

- 5. 19. Complete currency pass-through arises when a 10 percent depreciation in the value of the dollar causes U.S.: a. Import prices to fall by 10 percent b. Import prices to rise by 10 percent c. Export prices to rise by 10 percent d. Export prices to rise by 20 percent 20. Which approach predicts that if an economy operates at full employment and faces a trade deficit, currency devaluation (depreciation) will improve the trade balance only if domestic spending is cut, thus freeing resources to produce exports? a. The absorption approach b. The Marshall-Lerner approach c. The monetary approach d. The elasticities approach 21. Which approach analyzes a nation's balance of payments in terms of money demand and money supply? a. Expenditures approach b. Absorption approach c. Elasticities approach d. Monetary approach 22. The ____ effect suggests that following a currency depreciation a country's trade balance worsens for a period before it improves. a. Marshall-Lerner b. J-curve c. Absorption d. Pass-through 23. The J-curve effect implies that following a currency appreciation, a country's trade balance: a. Worsens before it improves b. Continually worsens c. Improves before it worsens d. Continually improves

- 6. 24. Which analysis considers the extent by which foreign and domestic prices adjust to a change in the exchange rate in the short run: a. Monetary analysis b. Absorption analysis c. Expenditures analysis d. Pass-through analysis 25. The longer the currency pass-through period, the ____ required for currency depreciation to have the intended effect on the trade balance. a. Shorter the time period b. Longer the time period c. Larger the spending cut d. Smaller the spending cut 26. The shorter the currency pass-through period, the ____ required for currency depreciation to have the intended effect on the trade balance. a. Shorter the time period b. Longer the time period c. Larger the spending cut d. Smaller the spending cut 27. Assume that Ford Motor Company obtains all of its inputs in the United States and all of its costs are denominated in dollars. A depreciation of the dollar's exchange value: a. Enhances its international competitiveness b. Worsens its international competitiveness c. Does not affect its international competitiveness d. None of the above 28. Assume that Ford Motor Company obtains all of its inputs in the United States and all of its costs are denominated in dollars. An appreciation of the dollar's exchange value: a. Enhances its international competitiveness b. Worsens its international competitiveness c. Does not affect its international competitiveness d. None of the above

- 7. 29. Assume that Ford Motor Company obtains some of its inputs in Mexico (foreign sourcing). As the peso becomes a larger portion of Ford's total costs, a dollar appreciation leads to a ____ in the peso cost of a Ford vehicle and a ____ in the dollar cost of a Ford compared to the cost changes that occur when all input costs are dollar denominated. a. Smaller increase, larger decrease b. Smaller increase, smaller decrease c. Larger increase, smaller decrease d. Larger increase, larger decrease 30. Assume that Ford Motor Company obtains some of its inputs in Mexico (foreign sourcing). As the peso becomes a larger portion of Ford's total costs, a dollar depreciation leads to a (an) ____ in the peso cost of a Ford vehicle and a (an) ____ in the dollar cost of a Ford compared to the cost changes that occur when all input costs are dollar denominated. a. Decrease, increase b. Increase, decrease c. Decrease, decrease d. Increase, increase 31. Given favorable elasticity conditions, an appreciation of the yen results in a. A smaller Japanese trade deficit b. A larger Japanese trade surplus c. Decreased prices for imported products for Japan d. Increased prices for imported products for Japan 32. Given favorable elasticity conditions, a depreciation of the lira tends to result in: a. Lower prices of imported products for Italy b. Higher prices of imported products for Italy c. A larger trade deficit for Italy d. A smaller trade surplus for Italy

- 8. 33. According to the J-curve effect, a depreciation of the pound's exchange value has: a. No impact on a U.K. balance-of-trade deficit in the short run b. No impact on a U.K. balance-of-trade deficit in the long run c. An immediate negative effect on the U.K. balance of trade d. An immediate positive effect on the U.K. balance of trade 34. According to the J-curve effect, an appreciation of the yens exchange value has: a. No impact on the Japanese trade balance in the short run b. No impact on the Japanese trade balance in the long run c. An immediate negative effect on the Japanese trade balance d. An immediate positive effect on the Japanese trade balance 35. According to the Marshall-Lerner condition, currency depreciation has no effect on a country's trade balance if the elasticity of demand for its exports plus the elasticity of demand for its imports equals: a. 0.1 b. 0.5 c. 1.0 d. 2.0 36. According to the Marshall-Lerner condition, currency depreciation would have a positive effect on a country's trade balance if the elasticity of demand for its exports plus the elasticity of demand for its imports equals: a. 0.2 b. 0.5 c. 1.0 d. 2.0 37. According to the Marshall-Lerner condition, currency depreciation would have a negative effect on a country's trade balance if the elasticity of demand for its exports plus the elasticity of demand for its imports equals: a. 0.5 b. 1.0 c. 1.5 d. 2.0

- 9. 38. The absorption approach suggests that one of the following causes a trade deficit to decrease following currency depreciation: a. A decline in domestic interest rates b. A rise in domestic imports c. A rise in government spending d. A decline in domestic absorption 39. The absorption approach to currency depreciation is represented by one of the following equations: a. B = Y - A b. Y = C + I + G + (X-M) c. I + X = S + M d. S - I = X - M 40. The time period that it takes for companies to form new business connections and place new orders in response to currency depreciation is known as the: a. Recognition lag b. Replacement lag c. Decision lag d. Production lag 41. The time period that it takes for companies to increase output of commodities for which demand has increased due to currency depreciation is known as the: a. Recognition lag b. Decision lag c. Replacement lag d. Production lag 42. According to the J-curve effect, currency appreciation: a. Decreases a trade surplus b. Increases a trade surplus c. Decreases a trade surplus before increasing a trade surplus d. Increases a trade surplus before decreasing a trade surplus

- 10. 43. According to the J-curve effect, currency depreciation: a. Decreases a trade deficit b. Increases a trade deficit c. Decreases a trade deficit before increasing a trade deficit d. Increases a trade deficit before decreasing a trade deficit 44. The analysis of the effects of currency depreciation include all of the following except the: a. Absorption approach b. Elasticity approach c. Fiscal approach d. Monetary approach 45. According to the absorption approach (B = Y - A), currency devaluation improves a nation's trade balance if: a. Y increases and A increases b. Y decreases and A decreases c. Y increases and/or A decreases d. Y decreases and/or A increases 46. The effect of currency depreciation on the purchasing power of money balances and the resulting impact on domestic expenditures is emphasized by the: a. Absorption approach b. Monetary approach c. Fiscal approach d. Elasticity approach 47. The Marshall-Lerner condition suggests that depreciation of the franc leads to a worsening of France's trade account if the: a. Elasticity of demand for French exports is 0.4 while the French elasticity of demand for imports is 0.2 b. Elasticity of demand for French exports is 0.6 while the French elasticity of demand for imports is 0.4

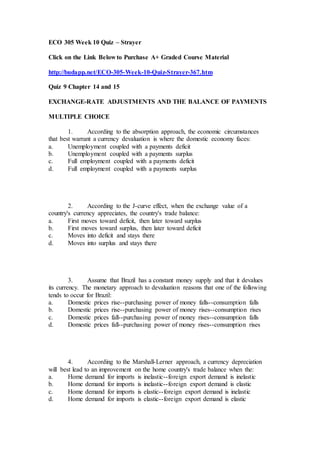

- 11. c. Elasticity of demand for French exports is 0.5 while the French elasticity of demand for imports is 0.7 d. Elasticity of demand for French exports is 0.6 while the French elasticity of demand for imports is 0.7 Table 14.1. Hypothetical Costs of Producing an Automobile for Toyota Inc. of Japan Cost Component Yen Cost Dollar-Equivalent Cost Labor 1,200,000 Materials Steel 800,000 Other materials 1,600,000 Total material costs 2,400,000 Other costs 400,000 Total costs 4,000,000 48. Refer to Table 14.1. Assuming that Toyota obtains all inputs from Japanese suppliers and that the yen/dollar exchange rate is 200 yen per dollar. The dollar-equivalent cost of a Toyota automobile equals: a. $5000 b. $10,000 c. $15,000 d. $20,000 49. Refer to Table 14.1. Assume that Toyota Inc. obtains all of its automobile inputs from Japanese suppliers. If the yen's exchange value appreciates from 200 yen = $1 to 100 yen = $1, the yen cost of a Toyota automobile equals: a. 4,000,000 yen b. 6,000,000 yen c. 8,000,000 yen d. 10,000,000 yen 50. Refer to Table 14.1. Assume that Toyota Inc. obtains all of its automobile inputs from Japanese suppliers. If the yen's exchange value appreciates from 200 yen = $1 to 100 yen = $1, the dollar-equivalent cost of a Toyota automobile equals: a. $10,000 b. $20,000 c. $30,000

- 12. d. $40,000 51. Refer to Table 14.1. Assume that Toyota Inc. imports steel from U.S. suppliers, whose costs are denominated in dollars, while all other inputs are obtained from Japanese suppliers whose costs are denominated in yen. If the yen's exchange value appreciates from 200 yen = $1 to 100 yen = $1, the yen cost of a Toyota automobile equals: a. 2,400,000 yen b. 3,000,000 yen c. 3,600,000 yen d. 4,200,000 yen 52. Refer to Table 14.1. Assume that Toyota Inc. imports steel from U.S. suppliers, whose costs are denominated in dollars, while all other inputs are obtained from Japanese suppliers whose costs are denominated in yen. If the yen's exchange value appreciates from 200 yen = $1 to 100 yen = $1, the dollar-equivalent cost of a Toyota automobile equals: a. $24,000 b. $30,000 c. $36,000 d. $42,000 53. The lag that occurs between changes in relative prices and the quantities of goods traded is the a. Recognition lag b. Recovery lag c. Implementation lag d. Legislative lag 54. The Marshall-Lerner condition illustrates a. The price effects of a nation's currency depreciation on its trade deficit b. The price effects of a nation's currency appreciation on its trade deficit c. The effect of fixed exchange rate systems on the trade balance d. None of the above

- 13. 55. The absorption approach to currency depreciation focuses on the a. Purchasing power of money b. Relative price effects c. Income effects d. Price elasticity of demand 56. Reversing balance of payments disequilibria may came at the expense of a. Economic relations with our trading partners b. Domestic recession c. Price inflation d. All of the above TRUE/FALSE 1. Currency devaluation is initiated by governmental policy rather than the free-market forces of supply and demand. 2. If a currency's exchange rate is overvalued, a government would likely initiate actions to revalue the currency. 3. If a currency's exchange rate is undervalued, a government would likely initiate actions to devalue the currency. 4. The purpose of currency devaluation is to cause a depreciation in a currency's exchange value. 5. The purpose of currency revaluation is to cause an appreciation in a currency's exchange value. 6. Assume that General Motors employs labor and materials, whose costs are denominated in dollars, in the production of automobiles. If the dollar's exchange value depreciates by 10 percent against the yen, the yen-denominated cost of a GM vehicle rises by 10 percent.

- 14. 7. Assume that General Motors employs labor and materials, whose costs are denominated in dollars, in the production of automobiles. If the dollar's exchange value appreciates by 10 percent against the yen, the yen-denominated cost of a GM vehicle falls by 10 percent. 8. Appreciation of the dollar's exchange value worsens the international competitiveness of Boeing Inc., whereas a dollar depreciation improves its international competitiveness. 9. When manufacturing automobiles, suppose that General Motors uses labor and materials whose costs are denominated in dollars and pounds respectively. If the dollar's exchange value appreciates by 15 percent against the pound, the pound- denominated cost of a GM vehicle rises by 15 percent. 10. According to the absorption approach, currency devaluation best improves a country's trade balance when its economy is at maximum capacity. 11. When manufacturing computer software, suppose that Microsoft Inc. uses labor and materials whose costs are denominated in dollars and francs respectively. If the dollar's exchange value depreciates 10 percent against the franc, the franc-denominated cost of the firm's software falls by 10 percent. 12. When producing jetliners, suppose that Boeing employs labor and materials whose costs are denominated in dollars and marks respectively. If the dollar's exchange value depreciates 20 percent against the mark, the mark- denominated cost of a Boeing jetliner falls by an amount less than 20 percent. 13. As yen-denominated costs become a larger portion of Ford's total costs, a dollar appreciation results in a smaller increase in the yen-denominated cost of a Ford auto than occurs when all input costs are dollar denominated. 14. A depreciation of the dollar results in Whirlpool dishwashers becoming less competitive in Europe.

- 15. 15. By decreasing the relative production costs of U.S. companies, a dollar appreciation tends to lower U.S. export prices in foreign-currency terms, which induces an increase in the amount of U.S. goods exported abroad. 16. By increasing relative U.S. production costs, a dollar depreciation tends to increase U.S. export prices in foreign-currency terms, which results in an increase in the quantity of U.S. goods exported abroad. 17. Suppose the exchange value of the franc rises against the currencies of Switzerland's major trading partners. To protect themselves from decreases in foreign sales caused by the mark's appreciation, Swiss companies could shift production to countries whose currencies had depreciated against the mark. 18. In the early 1990s, the yen sharply appreciated against the dollar. To protect themselves from export reductions caused by the yen's appreciation, Japanese auto companies transferred increasing amounts of auto production from the United States to Japan. 19. The elasticity approach to currency depreciation emphasizes the income effects of depreciation. 20. The elasticity approach to currency depreciation emphasizes the relative price effects of depreciation and suggests that depreciation best improves a country's trade balance when the elasticities of demand for the country's imports and exports are high. 21. The absorption approach to currency devaluation deals with the income effects of devaluation while the elasticity approach to devaluation deals with the price effects of devaluation. 22. According to the absorption approach, an increase in domestic expenditures must occur for currency devaluation to promote balance of trade equilibrium.

- 16. 23. The monetary approach emphasizes the effects of currency depreciation on the purchasing power of money, and the resulting impact on domestic expenditure levels. 24. According to the Marshall-Lerner condition, currency depreciation will worsen a country's balance of trade if the country's elasticity of demand for imports plus the foreign demand elasticity for the country's exports exceeds 1.0. 25. The Marshall-Lerner condition asserts that if the sum of a country's elasticity of demand for imports and the foreign elasticity of demand for the country's exports equals 1.0, a depreciation of the country's currency will not affect its balance of trade. 26. Suppose the U.S. price elasticity of demand for imports equals 0.4 and the foreign demand elasticity for the U.S. exports equals 0.2. According to the Marshall-Lerner condition, a depreciation of the dollar's exchange value will improve the U.S. balance of trade. 27. The Marshall-Lerner condition suggests that if the sum of a country's elasticity of demand for imports and the foreign elasticity of demand for the country's exports exceeds 1.0, an appreciation of the country's exchange rate will worsen its balance of trade. 28. Suppose the U.S. price elasticity of demand for imports equals 1.2 and the foreign elasticity of demand for U.S. exports equals 1.5. According to the Marshall-Lerner condition, an appreciation of the dollar's exchange value would worsen the U.S. balance of trade. 29. Empirical research suggests that most countries' price elasticities of demand for imports and exports are very inelastic, suggesting that currency depreciation would result in a worsening of a country's balance of trade.

- 17. 30. The J-curve effect implies that in the short run a currency depreciation will result in a balance of trade surplus for the home country. As time passes, however, the home country's balance of trade will move toward deficit. 31. Suppose the dollar appreciates 10 percent against the Swiss franc. According to the J-curve effect, the U.S. balance of trade will initially worsen, but then improve as time passes. 32. The J-curve effect implies that the price elasticity of demand for imports and exports is more elastic in the short run than in the long run. 33. The extent to which changing currency values result in changing prices of imports and exports is known as the J-curve effect. 34. Complete currency pass through suggests that if the dollar's exchange value depreciates by 10 percent, imports will become 10 percent more expensive to Americans while U.S. exports will become 10 percent cheaper to foreigners. 35. Partial currency pass-through implies that if the dollar's exchange value appreciates by 10 percent, imports would become, say, 6 percent more expensive to Americans while U.S. exports would become, say, 8 percent cheaper to foreigners. 36. Suppose the U.S. economy is operating at full capacity and the dollar's exchange value depreciates. According to the absorption approach, the United States would have to accept reductions in domestic spending if the U.S. trade balance is to improve as a result of the depreciation. SHORT ANSWER 1. How do demand elasticities influence a country's trade position when exchange rates change?

- 18. 2. How is the absorption approach used for analyzing the effects of currency devaluation? ESSAY 1. What is a pass-through relationship? 2. How do movements in exchange rates affect domestic costs, in the presence of foreign sourcing? CHAPTER 15—EXCHANGE-RATE SYSTEMS AND CURRENCY CRISES MULTIPLE CHOICE 1. The exchange-rate system that best characterizes the present international monetary arrangement used by industrialized countries is: a. Freely fluctuating exchange rates b. Adjustable pegged exchange rates c. Managed floating exchange rates d. Pegged or fixed exchange rates 2. Which exchange-rate mechanism is intended to insulate the balance of payments from short-term capital movements while providing exchange rate stability for commercial transactions? a. Dual exchange rates b. Managed floating exchange rates c. Adjustable pegged exchange rates d. Crawling pegged exchange rates 3. Which exchange-rate mechanism calls for frequent redefining of the par value by small amounts to remove a payments disequilibrium? a. Dual exchange rates b. Adjustable pegged exchange rates c. Managed floating exchange rates d. Crawling pegged exchange rates

- 19. 4. Under managed floating exchange rates, if the rate of inflation in the United States is less than the rate of inflation of its trading partners, the dollar will likely: a. Appreciate against foreign currencies b. Depreciate against foreign currencies c. Be officially revalued by the government d. Be officially devalued by the government 5. Under adjustable pegged exchange rates, if the rate of inflation in the United States exceeds the rate of inflation of its trading partners: a. U.S. exports tend to rise and imports tend to fall b. U.S. imports tend to rise and exports tend to fall c. U.S. foreign exchange reserves tend to rise d. U.S. foreign exchange reserves remain constant 6. Under a pegged exchange-rate system, which does not explain why a country would have a balance-of-payments deficit? a. Very high rates of inflation occur domestically b. Foreigners discriminate against domestic products c. Technological advance is superior abroad d. The domestic currency is undervalued relative to other currencies 7. Which exchange-rate system does not require monetary reserves for official exchange-rate intervention? a. Floating exchange rates b. Pegged exchange rates c. Managed floating exchange rates d. Dual exchange rates 8. A primary objective of dual exchange rates is to allow a country the ability to insulate its balance of payments from net: a. Current account transactions b. Unilateral transfers c. Merchandise trade transactions d. Capital account transactions

- 20. 9. During the 1970s, the European Union, in its quest for monetary union, adopted what came to be referred to as the "Community Snake." This device was a: a. Adjustable pegged exchange rate system b. Dual exchange rate system c. Jointly floating exchange rate system d. Freely floating exchange rate system 10. Under the historic adjustable pegged exchange-rate system, member countries were permitted to correct persistent and sizable payment deficits (i.e., fundamental disequilibrium) by: a. Officially revaluing their currencies b. Officially devaluing their currencies c. Allowing their currencies to depreciate in the free market d. Allowing their currencies to appreciate in the free market 11. Which exchange-rate system involves a "leaning against the wind" strategy in which short-term fluctuations in exchange rates are reduced without adhering to any particular exchange rate over the long run? a. Pegged or fixed exchange rates b. Adjustable pegged exchange rates c. Managed floating exchange rates d. Freely floating exchange rates 12. In 1973, the reform of the international monetary system resulted in the change from: a. Adjustable pegged rates to managed floating rates b. Managed floating rates to adjustable pegged rates c. Crawling pegged rates to freely floating rates d. Freely floating rates to crawling pegged rates 13. The Bretton Woods Agreement of 1944 established a monetary system based on: a. Gold and managed floating exchange rates b. Gold and adjustable pegged exchange rates c. Special Drawing Rights and managed floating exchange rates

- 21. d. Special Drawing Rights and adjustable pegged exchange rates 14. Rather than constructing their own currency baskets, many nations peg the value of their currencies to a currency basket defined by the International Monetary Fund. Which of the following illustrates this basket? a. IMF tranche b. Special Drawing Rights c. Primary reserve asset d. Swap facility 15. Small nations (e.g., the Ivory Coast) whose trade and financial relationships are mainly with a single partner tend to utilize: a. Pegged exchange rates b. Freely floating exchange rates c. Managed floating exchange rates d. Crawling pegged exchange rates 16. Small nations (e.g., Tanzania) with more than one major trading partner tend to peg the value of their currencies to: a. Gold b. Silver c. A single currency d. A basket of currencies 17. Under a floating exchange-rate system, if American exports increase and American imports fall, the value of the dollar will: a. Appreciate b. Depreciate c. Be officially revalued d. Be officially devalued 18. Under a floating exchange-rate system, if American exports decrease and American imports rise, the value of the dollar will: a. Appreciate b. Depreciate

- 22. c. Be officially revalued d. Be officially devalued 19. Under a floating exchange rate system, an increase in U.S. imports of Japanese goods will cause the demand schedule for Japanese yen to: a. Increase, inducing a depreciation in the yen b. Decrease, inducing a depreciation in the yen c. Increase, inducing an appreciation in the yen d. Decrease, inducing an appreciation in the yen 20. Given an initial equilibrium in the money market and foreign exchange market, suppose the Federal Reserve increases the money supply of the United States. Under a floating exchange-rate system, the dollar would: a. Appreciate in value relative to other currencies b. Depreciate in value relative to other currencies c. Be officially devalued by the government d. Be officially revalued by the government 21. Given an initial equilibrium in the money market and foreign exchange market, suppose the Federal Reserve decreases the money supply of the United States. Under a floating exchange rate system, the dollar would: a. Appreciate in value relative to other currencies b. Depreciate in value relative to other currencies c. Be officially devalued by the government d. Be officially revalued by the government 22. Under a floating exchange-rate system, if the U.S. dollar depreciates against the Swiss franc: a. American exports to Switzerland will be cheaper in francs b. American exports to Switzerland will be more expensive in francs c. American imports from Switzerland will be cheaper in dollars d. None of the above 23. If the Japanese yen depreciates against other currencies in the exchange markets, this will:

- 23. a. Have no effect on the Japanese balance of trade b. Tend to worsen the Japanese balance of trade c. Tend to improve the Japanese balance of trade d. None of the above 24. If the Japanese yen appreciates against other currencies in the exchange markets, this will: a. Have no effect on the Japanese balance of trade b. Tend to improve the Japanese balance of trade c. Tend to worsen the Japanese balance of trade d. None of the above 25. Suppose Sweden's inflation rate is less than that of its trading partner. Under a floating exchange rate system, Sweden would experience a: a. Appreciation in its currency b. Depreciation in its currency c. Fall in the level of its exports d. Rise in the level of its imports 26. Assume that interest rates in London rise relative to those in Switzerland. Under a floating exchange-rate system, one would expect the pound (relative to the franc) to: a. Depreciate due to the increased demand for pounds b. Depreciate due to the increased demand for francs c. Appreciate due to the increased demand for francs d. Appreciate due to the increased demand for pounds 27. Under a floating exchange-rate system, which of the following best leads to a depreciation in the value of the Canadian dollar? a. A decrease in the Canadian money supply b. A fall in the Canadian interest rate c. An increase in national income overseas d. Rising inflation overseas

- 24. 28. A market-determined increase in the dollar price of the pound is associated with: a. Revaluation of the dollar b. Devaluation of the dollar c. Appreciation of the dollar d. Depreciation of the dollar 29. A market-determined decrease in the dollar price of the pound is associated with: a. Revaluation of the dollar b. Devaluation of the dollar c. Appreciation of the dollar d. Depreciation of the dollar 30. Which of the following is not a potential disadvantage of freely floating exchange rates? a. They require larger amounts of international reserves than other exchange systems b. Demand schedules for imports and exports may be price speculation c. There may occur large amounts of destabilizing speculation d. Capital movements among nations may be hindered via exchange rate fluctuations 31. Proponents of freely floating exchange rates maintain that: a. Central banks can easily modify fluctuations in exchange rates b. The system allows policy makers freedom in pursuing domestic economic goals c. Inelastic demand schedules prevent large fluctuations in exchange rates d. Inelastic supply schedules prevent large fluctuations in exchange rates 32. A potential disadvantage of freely floating exchange rates is that there would: a. Exist excessive amounts of hedging in the foreign exchange markets b. Be a lack of incentive to initiate exchange arbitrage c. Be excessive amounts of destabilizing speculation d. Exist a devaluation bias in the exchange markets

- 25. 33. Under a floating exchange rate system, if there occurs a fall in the dollar price of the franc: a. American exports to France will be cheaper in francs b. American exports to France will be more expensive in francs c. American imports from France will be more expensive in dollars d. None of the above 34. Under a system of floating exchange rates, a U.S. trade deficit with Japan will cause: a. A flow of gold from the United States to Japan b. The U.S. government to ration yen to U.S. importers c. An increase in the dollar price of yen d. A decrease in the dollar price of yen 35. A potential limitation of freely floating exchange rates is that: a. Countries require a larger amount of international reserves than otherwise b. Countries are unable to initiate economic policies to combat unemployment c. Exchange rates may experience wide and frequent fluctuations d. Demand tends to be highly sensitive to price movements 36. To temporarily offset an appreciation in the dollar's exchange value, the Federal Reserve could ____ the U.S. money supply which would promote a (an) ____ in U.S. interest rates and a ____ in investment flows to the United States. a. Increase, decrease, decrease b. Increase, increase, decrease c. Decrease, decrease, decrease d. Decrease, increase, decrease 37. To temporarily offset a depreciation in the dollar's exchange value, the Federal Reserve could ____ the U.S. money supply which would promote a (an) ____ in U.S. interest rates and a (an) ____ in investment flows to the United States. a. Increase, decrease, decrease b. Increase, increase, increase c. Decrease, decrease, increase d. Decrease, increase, increase

- 26. 38. In a managed floating exchange-rate system, temporary stabilization of the dollar's exchange value requires the Federal Reserve to adopt a (an) ____ monetary policy when the dollar is appreciating and a (an) ____ policy when the dollar is depreciating. a. Expansionary, expansionary b. Expansionary, contractionary c. Contractionary, expansionary d. Contractionary, contractionary 39. The central bank of the United Kingdom could prevent the pound from appreciating by: a. Selling pounds on the foreign exchange market b. Buying pounds on the foreign exchange market c. Reducing its inflation rate relative to its trading partners d. Promoting domestic investment and technological development 40. A surplus nation can reduce its payments imbalance by: a. Applying tariffs and trade restrictions on imports b. Revaluing its national currency c. Increasing its labor productivity d. Setting higher interest rates than its trading partners 41. A main purpose of exchange stabilization funds is to: a. Permit a country to overvalue its currency in the exchange markets b. Permit a country to undervalue its currency in the exchange markets c. Increase the supply of foreign currency when imports exceed exports d. Decrease the supply of foreign currency when imports exceed exports 42. As a policy instrument, currency devaluation may be controversial since it: a. Imposes hardships on the exporters of foreign countries b. Imposes hardships on exporters of the devaluing country c. Is generally followed by unemployment in the devaluing country d. Is generally followed by price deflation in the devaluing country

- 27. 43. Given a two-country world, assume Canada and Sweden devalue their currencies by 20 percent. This would result in: a. An appreciation in the Canadian currency b. An appreciation in the Swedish currency c. An appreciation in both currencies d. An appreciation in neither currency 44. Suppose that Japan maintains a pegged exchange rate that overvalues the yen. This would likely result in: a. Japanese exports becoming cheaper in world markets b. Imports becoming expensive in the Japanese market c. Unemployment for Japanese workers d. Full employment for Japanese workers 45. To defend a pegged exchange rate that overvalues its currency, a country could: a. Discourage commodity exports b. Encourage commodity imports c. Purchase its own currency in international markets d. Sell its own currency in international markets 46. Given a two-country world, suppose Japan devalues the yen by 20 percent and South Korea devalues the won by 15 percent. This results in: a. An appreciation in the value of both currencies b. A depreciation in the value of both currencies c. An appreciation in the value of the yen against the won d. A depreciation in the value of the yen against the won 47. Given a two-country world, suppose Japan revalues the yen by 15 percent and South Korea revalues the won by 12 percent. This results in: a. An appreciation in the value of both currencies b. A depreciation in the value of both currencies c. An appreciation in the value of the yen against the won d. A depreciation in the value of the yen against the won

- 28. Figure 15.1 shows the market for the Swiss franc. In the figure, the initial demand for marks and supply of marks are depicted by D0 and S0 respectively. Figure 15.1. The Market for the Swiss Franc 48. Refer to Figure 15.1. With a system of floating exchange rates, the equilibrium exchange rate is: a. $0.40 per franc b. $0.50 per franc c. $0.60 per franc d. $0.70 per franc 49. Refer to Figure 15.1. Suppose that the United States increases its imports from Switzerland, resulting in a rise in the demand for francs from D0 to D1. Under a floating exchange rate system, the new equilibrium exchange rate would be: a. $0.40 per franc b. $0.50 per franc c. $0.60 per franc d. $0.70 per franc 50. Refer to Figure 15.1. Suppose the United States decreases investment spending in Switzerland, thus reducing the demand for francs from D0 to D2. Under a floating exchange rate system, the new equilibrium exchange rate would be: a. $0.40 per franc b. $0.50 per franc c. $0.60 per franc d. $0.70 per franc 51. Refer to Figure 15.1. Suppose the demand for francs increases from D0 to D1. Under a fixed exchange rate system, the U.S. exchange stabilization fund could maintain a fixed exchange rate of $0.50 per franc by: a. Selling francs for dollars on the foreign exchange market b. Selling dollars for francs on the foreign exchange market c. Decreasing U.S. exports, thus decreasing the supply of francs d. Stimulating U.S. imports, thus increasing the demand for francs

- 29. Table 15.1. The Market for Francs Quantity of Dollar price Quantity of francs demanded of francs francs supplied 600 $0.05 0 500 0.10 100 400 0.15 200 300 0.20 300 200 0.25 400 100 0.30 500 0 0.35 600 52. Refer to Table 15.1. Under a system of floating exchange rates, the equilibrium exchange rate equals: a. $0.15 per franc b. $0.20 per franc c. $0.25 per franc d. $0.30 per franc 53. Refer to Table 15.1. If monetary authorities fix the exchange rate at $0.10 per franc, there would be a: a. Shortage of 200 francs b. Shortage of 400 francs c. Surplus of 200 francs d. Surplus of 400 francs 54. Refer to Table 15.1. If monetary authorities fix the exchange rate at $0.30 per franc, there will be a: a. Shortage of 200 francs b. Shortage of 400 francs c. Surplus of 200 francs d. Surplus of 400 francs 55. Under managed floating exchange rates, the Federal Reserve could offset an appreciation of the dollar against the yen by:

- 30. a. Increasing the money supply which promotes falling interest rates and net investment outflows b. Increasing the money supply which promotes rising interest rates and net investment inflows c. Decreasing the money supply which promotes falling interest rates and net investment outflows d. Decreasing the money supply which promotes rising interest rates and net investment inflows 56. Under managed floating exchange rates, a central bank would initiate: a. Contractionary monetary policy to offset a depreciation of its currency b. Contractionary monetary policy to offset an appreciation of its currency c. Expansionary monetary policy to offset a depreciation of its currency d. None of the above 57. To offset an appreciation of the dollar against the yen, the Federal Reserve would: a. Sell dollars on the foreign exchange market and lower domestic interest rates b. Sell dollars on the foreign exchange market and raise domestic interest rates c. Buy dollars on the foreign exchange market and lower domestic interest rates d. Buy dollars on the foreign exchange market and raise domestic interest rates 58. To help insulate their economies from inflation, currency depreciation, and capital flight, developing countries have implemented: a. Regional trading blocs b. Currency boards c. Central banks d. Regional fiscal policies 59. If Mexico dollarizes its economy, it essentially a. Allows the Federal Reserve to be its lender of last resort b. Accepts the monetary policy of the Federal Reserve c. Ensures that its business cycle was identical to that of the U.S. d. Abandons its ability to run governmental balanced budgets

- 31. 60. If Mexico fully dollarizes its economy, it agrees to a. Print pesos only to finance deficits of its national government b. Use the U.S. dollar alongside its peso to finance transactions c. Have the U.S. Treasury be in charge of its tax collections d. Replace pesos with U.S. dollars in its economy 61. An objective of the dollarization of the Mexican economy would be to: a. Shield its economy from hyperinflation, currency depreciation, and capital flight b. Allow the Federal Reserve to be its lender of last resort c. Ensure that its monetary policy is independent of the Federal Reserve d. Permit it to benefit from tariffs and subsidies imposed by the U.S. government 62. In order to stabilize a currency, the central bank will need to adopt a. An expansionary monetary policy to offset currency depreciation b. An expansionary monetary policy to offset currency appreciation c. A contractionary policy to offset currency appreciation d. Both b and c 63. The crawling peg is a a. Fixed exchange rate system b. Floating exchange rate system c. Compromise between fixed and floating exchange rates d. Exchange rate system used by nations experiencing no inflation 64. Exchange rate controls a. Achieved prominence during the economic crises of the late 1930's b. Were popular immediately after World War II c. Are widely used by the developing nations d. All of the above 65. The flexibility of floating rates may generate the problem of a. Inflationary bias b. Deflationary bias c. Continuous depreciation

- 32. d. Both a and c TRUE/FALSE 1. By the early 1970s, gold had been phased out of the international monetary system. 2. Since 1974, the major industrial countries have operated under a system of fixed exchange rates based on the gold standard. 3. Today, fixed exchange rates are used primarily by small, developing countries that tie their currencies to a key currency such as the U.S. dollar. 4. Smaller nations with relatively undiversified economies and large trade sectors tend to peg their currencies to one of the world's key currencies. 5. Large industrial nations with diversified economies and small trade sectors have generally pegged their currencies to one of the world's key currencies. 6. Small nations, such as Angola and Barbados, peg their currencies to the U.S. dollar since the prices of many of their traded goods are determined in markets in which the dollar is the key currency. 7. Many developing nations with low inflation rates have pegged their currencies to the U.S. dollar as a way of allowing modest increases in domestic inflation rates. 8. Pegging to a single currency is generally done by developing nations whose trade and financial relationships are mainly with a single industrial-country partner.

- 33. 9. Developing countries with more than one major trading partner often peg their currencies to a group or basket of those trading partner currencies. 10. Most developing countries have chosen to allow their currencies to float independently in the foreign exchange market. 11. Today, special drawing rights (SDRs) represent the most important currency basket against which developing countries maintain pegged exchange rates. 12. The special drawing right is a currency basket of five major industrial country currencies. 13. The Australian dollar is currently regarded is the key currency of the international monetary system. 14. A "key currency" is one that is widely traded on world money markets, has demonstrated relative stable values over time, and has widely been accepted as a means of international settlement. 15. The U.S. dollar is generally regarded as the major "key currency" of the international monetary system. 16. Most nations currently allow their currencies' exchange values to be determined solely by the forces of supply and demand in a free market. 17. Under the gold standard, the official exchange rate would be $2.80 per pound as long as the United States bought and sold gold at a fixed price of $35 per ounce and Britain bought and sold gold at 12.5 pounds per ounce. 18. The par values of most developing-country currencies are currently defined in terms of gold.

- 34. 19. The purpose of an exchange stabilization fund is to ensure that the market exchange rate does not deviate beyond unacceptable levels from the official exchange rate. 20. To keep the pound's exchange value from depreciating against the franc, the British exchange stabilization fund would sell pounds for francs on the foreign exchange market. 21. To keep the yen's exchange value from appreciating against the dollar, Japan's exchange stabilization fund would buy yen for dollars on the foreign exchange market. 22. The purpose of currency devaluation is to cause the home country's exchange value to appreciate, thus reducing a balance of trade surplus. 23. If Uganda devalues its shilling by 10 percent and Burundi devalues its franc by 5 percent, the shilling's exchange value appreciates 10 percent against the franc. 24. If Uganda sets its par value at 400 shillings per SDR and Burundi sets its par value at 200 francs per SDR, the official exchange rate is 1 franc = o.5 shillings. 25. If Uganda revalues its shilling by 20 percent and Burundi devalues its franc by 5 percent, the shillings exchange value will appreciate by 25 percent against the franc. 26. Unlike floating exchange rates, fixed exchange rates are not characterized by par values and central bank intervention in the foreign exchange market.

- 35. 27. Because there is no exchange stabilization fund under floating exchange rates, any holdings of international reserves serve as working balances rather than to maintain a given exchange rate for any currency. 28. Under an adjustable-pegged system, market exchange rates are intended to be maintained within a narrow band around a currency's official exchange rate. In the case of fundamental disequilibrium, the currency can be devalued or revalued to promote current-account equilibrium. 29. In 1973 the major industrial countries terminated managed-floating exchange rates and adopted an adjustable-pegged exchange rates. 30. A "dirty float" occurs when a nation used central bank intervention in the foreign exchange market to promote a depreciation of its currency's exchange value, thus gaining a competitive advantage compared to its trading partners. 31. Under managed-floating exchange rates, market forces are allowed to determine exchange rates in the short run while central bank intervention is used to stabilize exchange rates in the long run. 32. Under managed floating exchange rates, central bank intervention is used to offset temporary fluctuations in exchange rates that contribute to uncertainty in carrying out transactions in international trade and finance. 33. To offset an appreciation in the dollar's exchange value, the Federal Reserve can nudge interest rates down in the United States which results in net investment outflows. 34. When pursued over the long run, a policy of increasing the domestic money supply to offset an appreciation of the home country's currency results in inflation and a decrease in home-country competitiveness in key industries.

- 36. 35. At the Maastricht Treaty of 1991, members of the European Community established a blueprint for an Economic and Monetary Union with a single currency and a European central bank overseeing a single monetary policy. 36. It is universally recognized that Europe fulfills the conditions of an optimum currency area. SHORT ANSWER 1. Which nations use multiple exchange rates the most and why? 2. What is an SDR? ESSAY 1. What is the difference between the crawling peg and adjustable pegged exchange rates? 2. How can currency boards and dollarization prevent currency crises?