This whitepaper provides an insight into the e-Commerce market and its performance in China and the US and also includes a comparison of Amazon and Alibaba.

Key Takeaways:

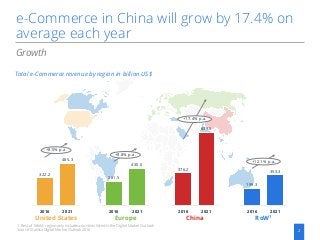

• e-Commerce in China will grow by 17.4% on average each year; growth in the US will be significantly smaller

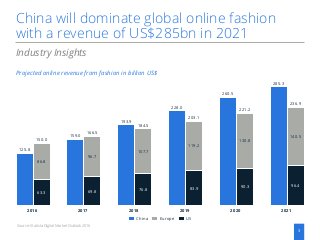

• China will dominate the global online fashion market with a revenue of more than US$285bn in 2021

• Amazon is#1 in Europe and in the US with a revenue ofUS$136 billion in 2016

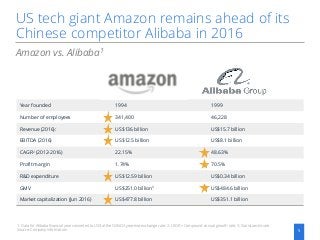

• US tech giant Amazon remains ahead of its Chinese competitor Alibaba in 2016

• Despite being #1 in the US & Europe, Amazon has not yet cracked the Chinese market

![Amazon is #1 in Europe and in the US with a

revenue of US$136 billion in 2016

4

Industry Insights

Amazon revenue development from foundation to 2016 in million US$

Source: Company information

1 61014816

2016

135,987

2015

107,006

2014

88,988

2013

74,452

2012

61,093

2011

48,077

2010

34,204

2009

24,509

2008

19,166

2007

14,835

2006

10,711

2005

8,490

2004

6,921

2003

5,264

2002

3,933

2001

3,122

2000

2,762

1999

1,640

1998199719961995

Mission statement:

‘Earth’s biggest book store’

Vision statement:

‘Our vision is to be earth's most

customer centric company […]’](https://image.slidesharecdn.com/e-commercechinavsuswhitepaper2017-180207112419/85/e-Commerce-China-vs-the-US-4-320.jpg?cb=1518002828)