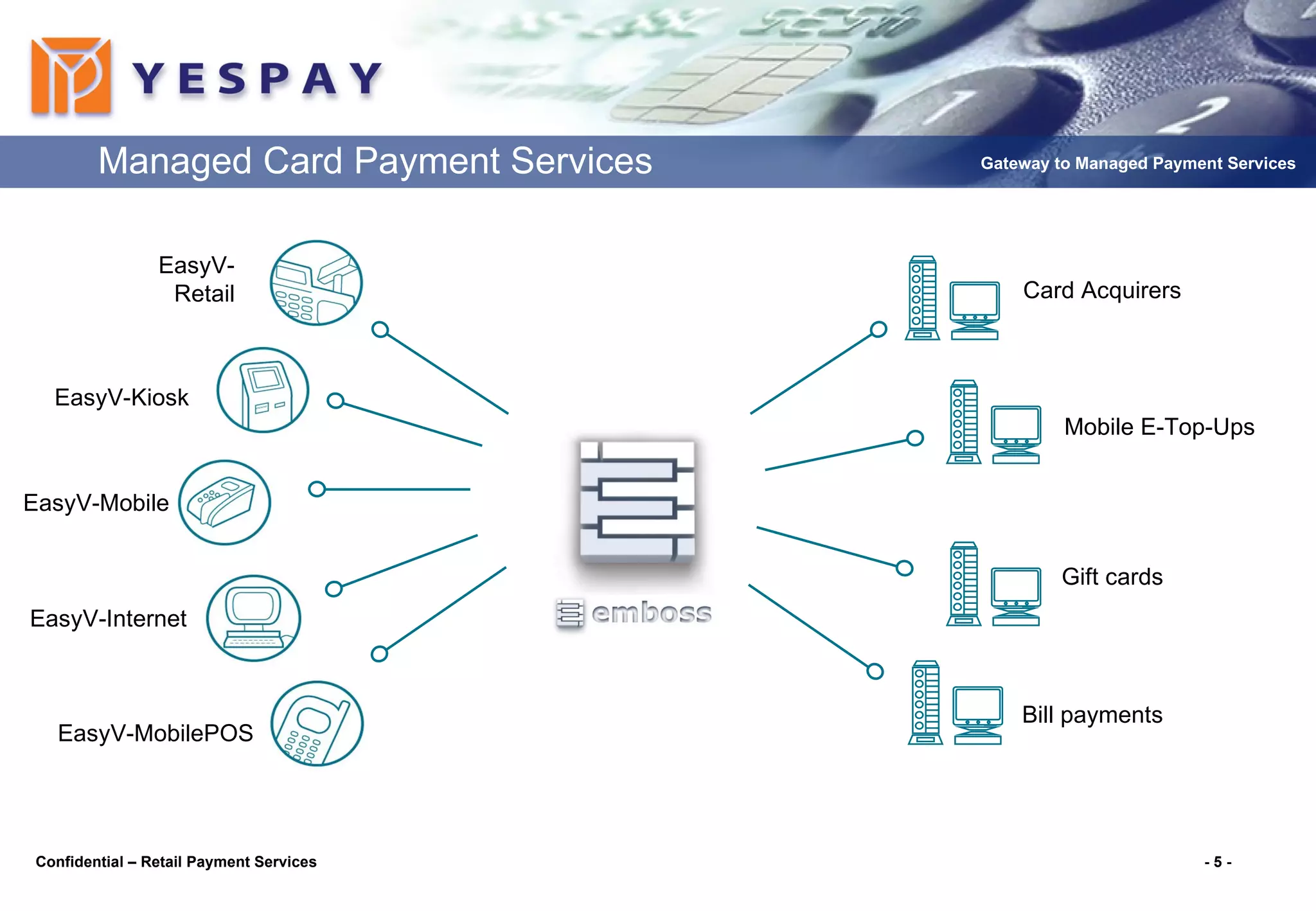

Yespay International Limited is a global provider of chip & pin and e-commerce card payment services, focusing on managed payment solutions for various sectors. The company, founded in 2002 and headquartered in London, offers a PCI DSS accredited service with a recurring revenue model, enabling retailers to reduce compliance costs significantly. Yespay partners with numerous banks and solutions companies to deliver high-speed, secure processing services, allowing merchants to enhance productivity and streamline operations.