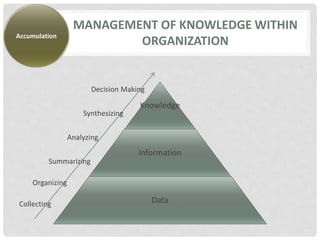

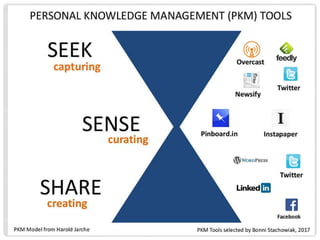

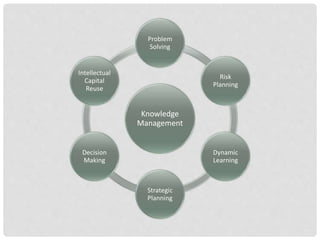

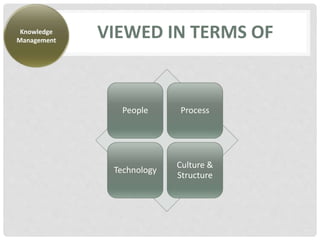

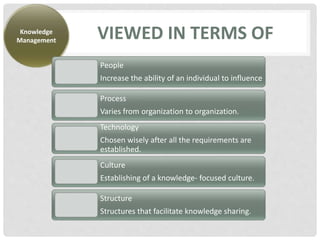

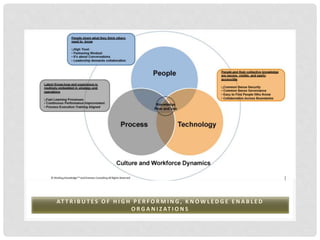

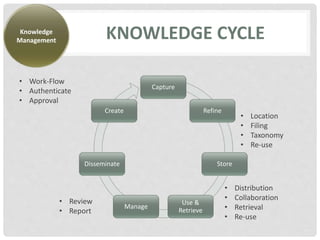

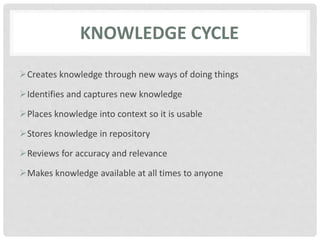

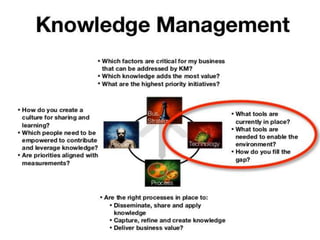

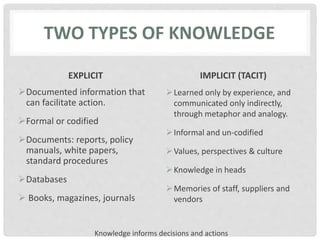

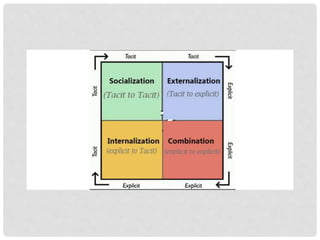

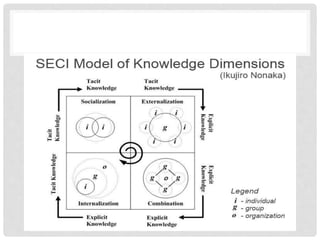

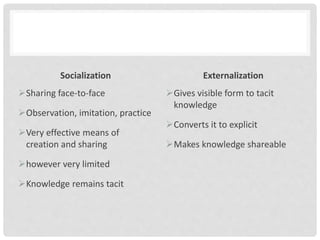

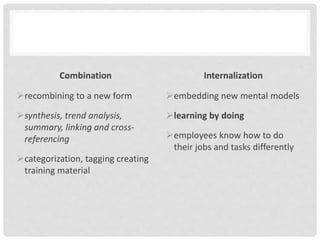

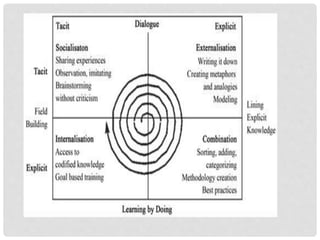

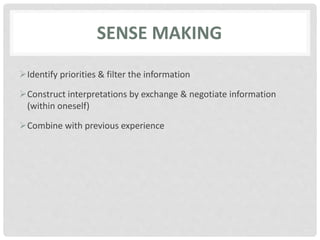

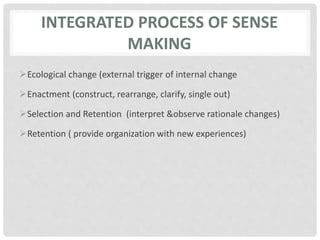

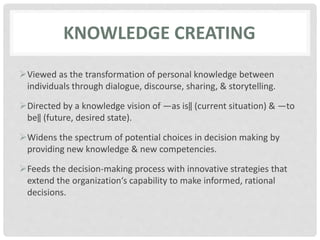

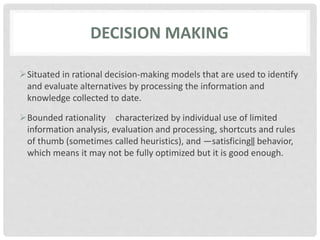

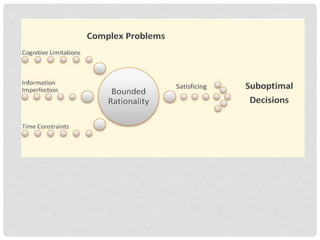

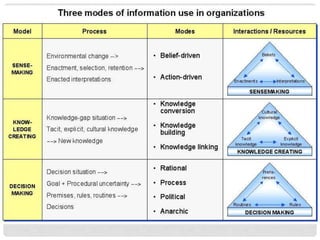

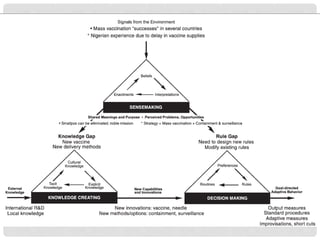

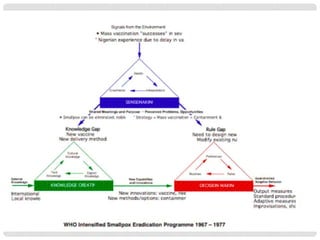

The document discusses knowledge management, highlighting its importance for organizational objectives and decision-making through the effective sharing and utilization of knowledge. It outlines the processes involved in knowledge management, the benefits it provides, and various types of knowledge, emphasizing the need for a culture that fosters knowledge sharing. The text also introduces models for knowledge conversion and decision-making strategies to enhance organizational capability and response to changing demands.