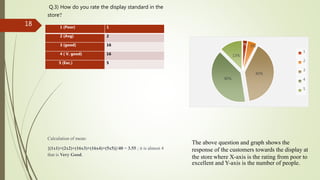

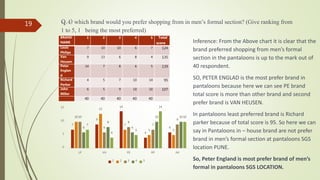

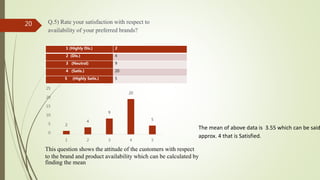

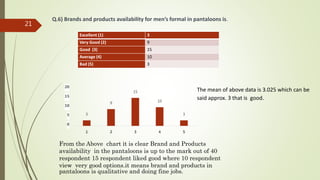

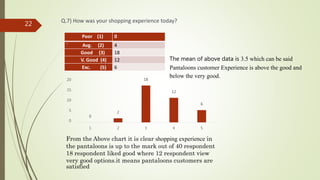

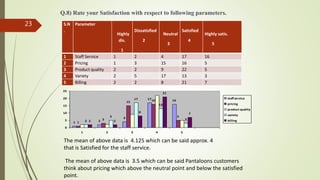

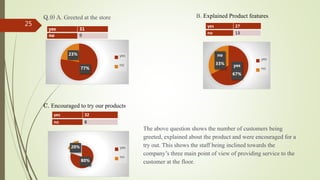

Pantaloons is a leading Indian retail chain that was analyzed to understand consumer buying behavior for men's formal attire. A survey of 40 customers found that most visitors were younger adults who shopped at Pantaloons monthly. Customers rated displays and availability of preferred brands like Peter England and Van Heusen positively, though some wanted more variety. Staff services received high satisfaction ratings. The analysis concluded Pantaloons is a top store choice in Pune, but could improve variety, services for high-income groups, and address occasional long billing lines.