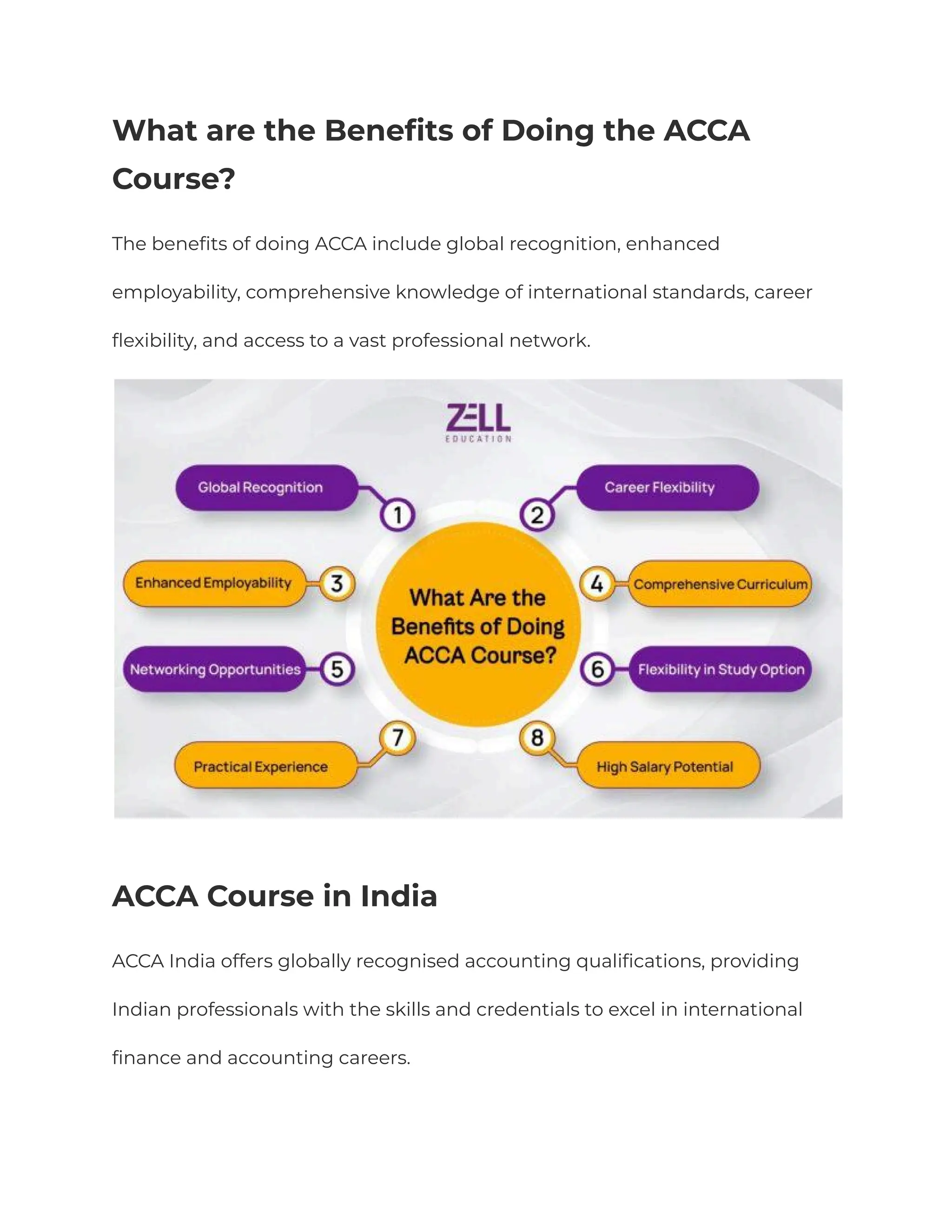

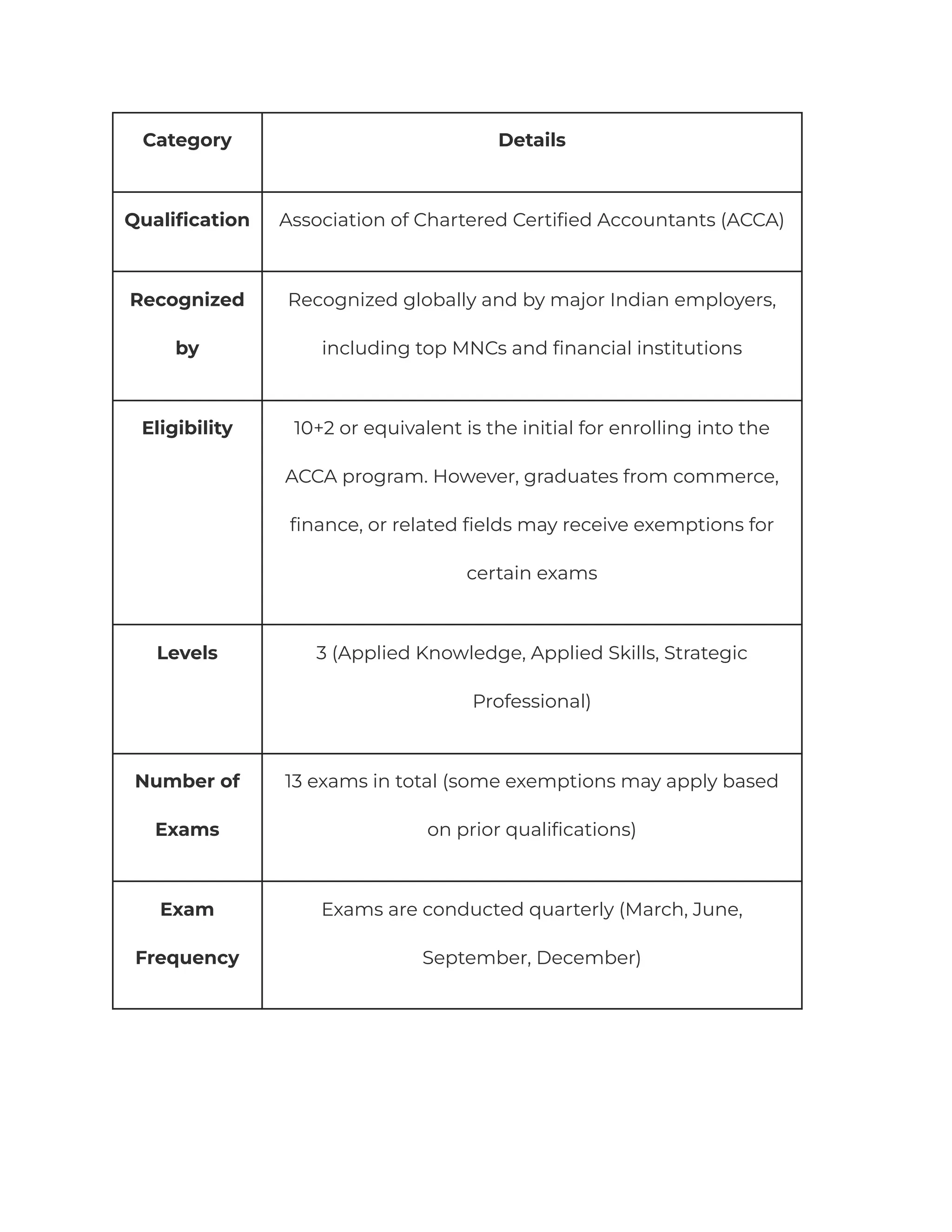

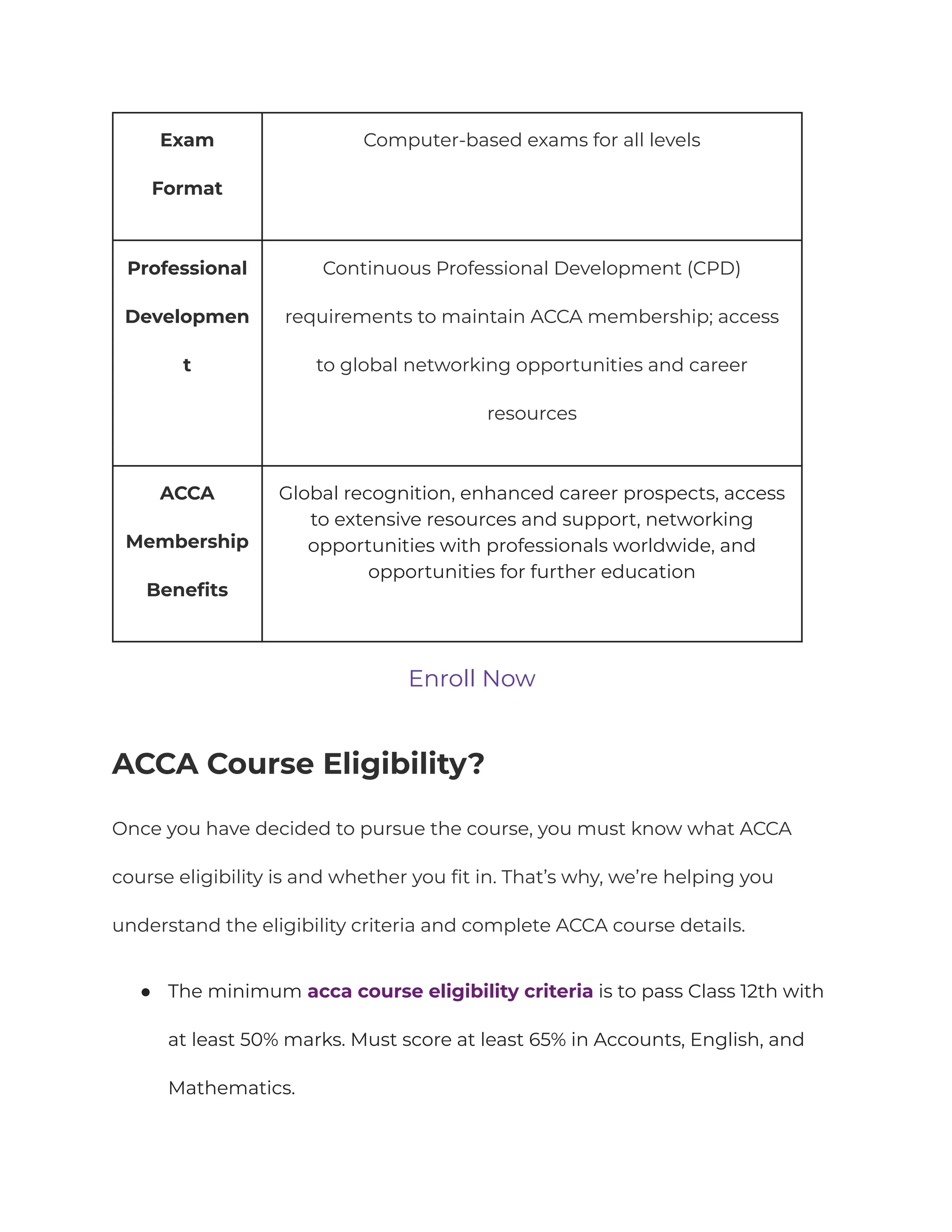

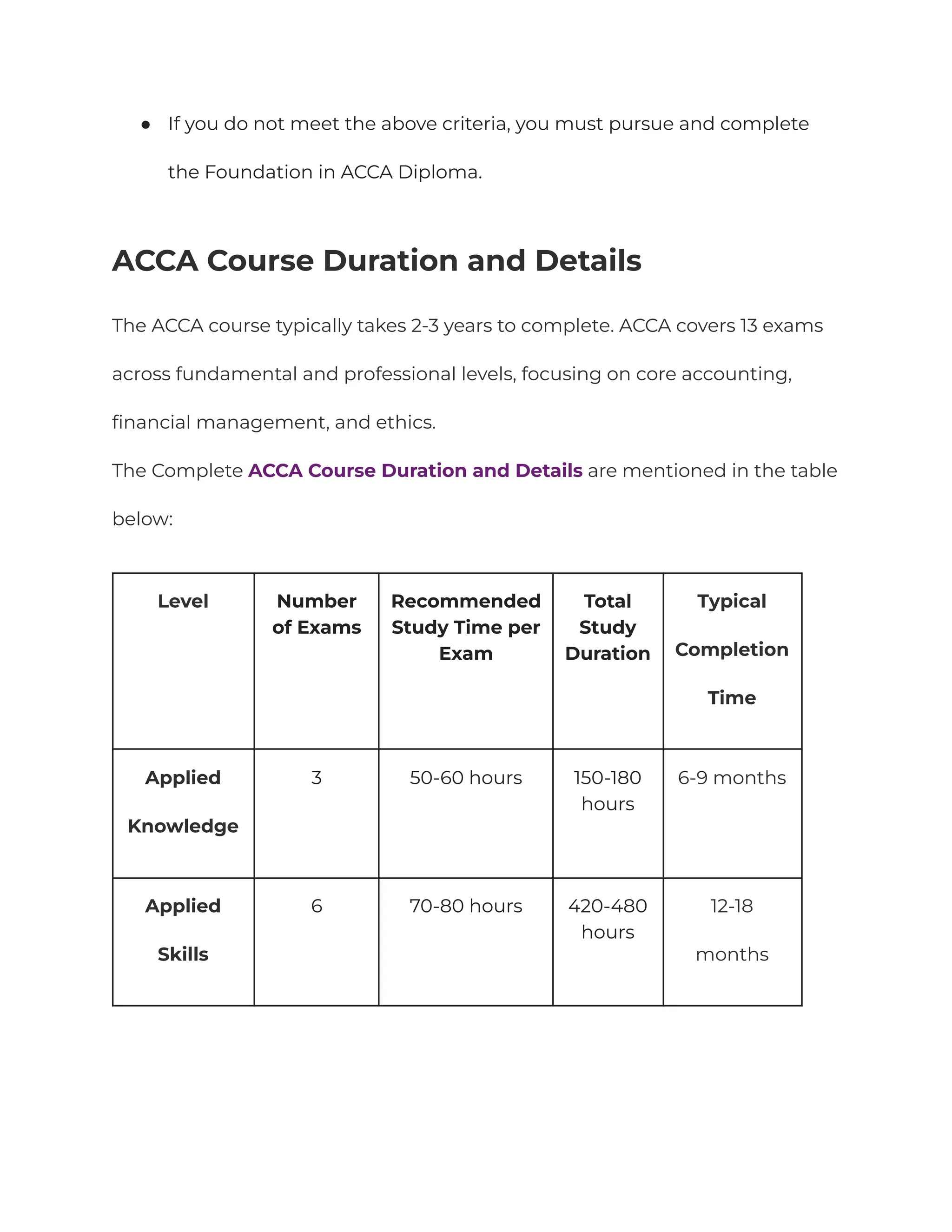

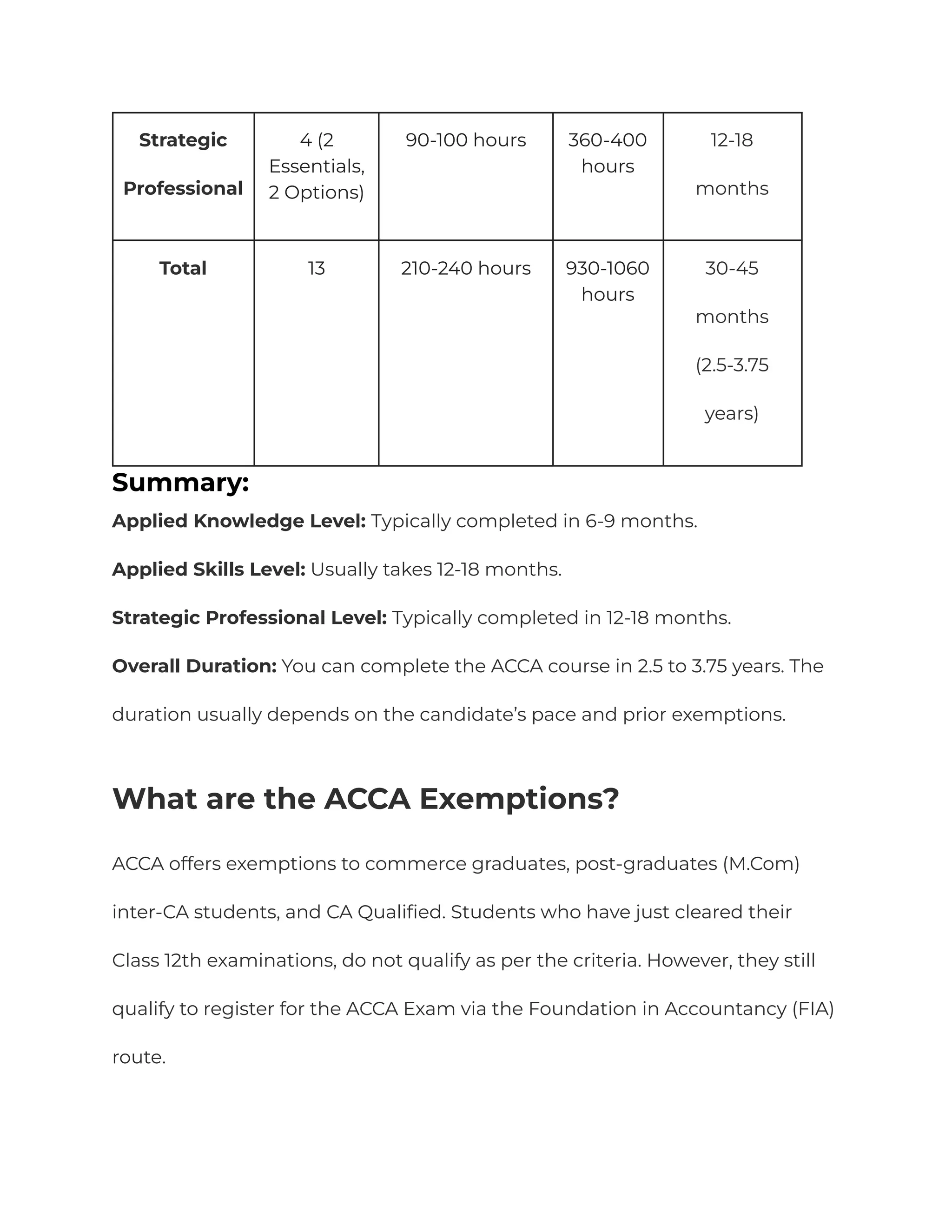

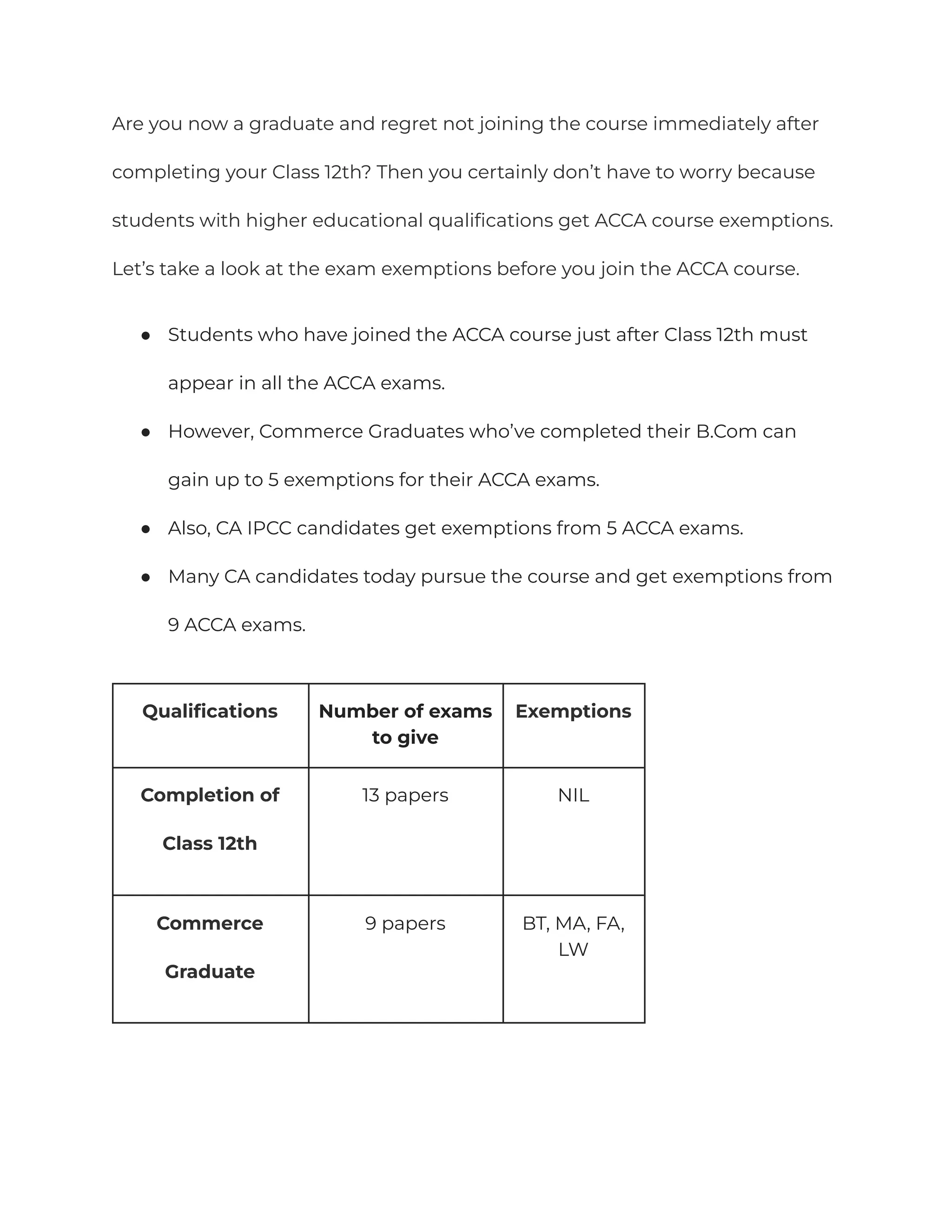

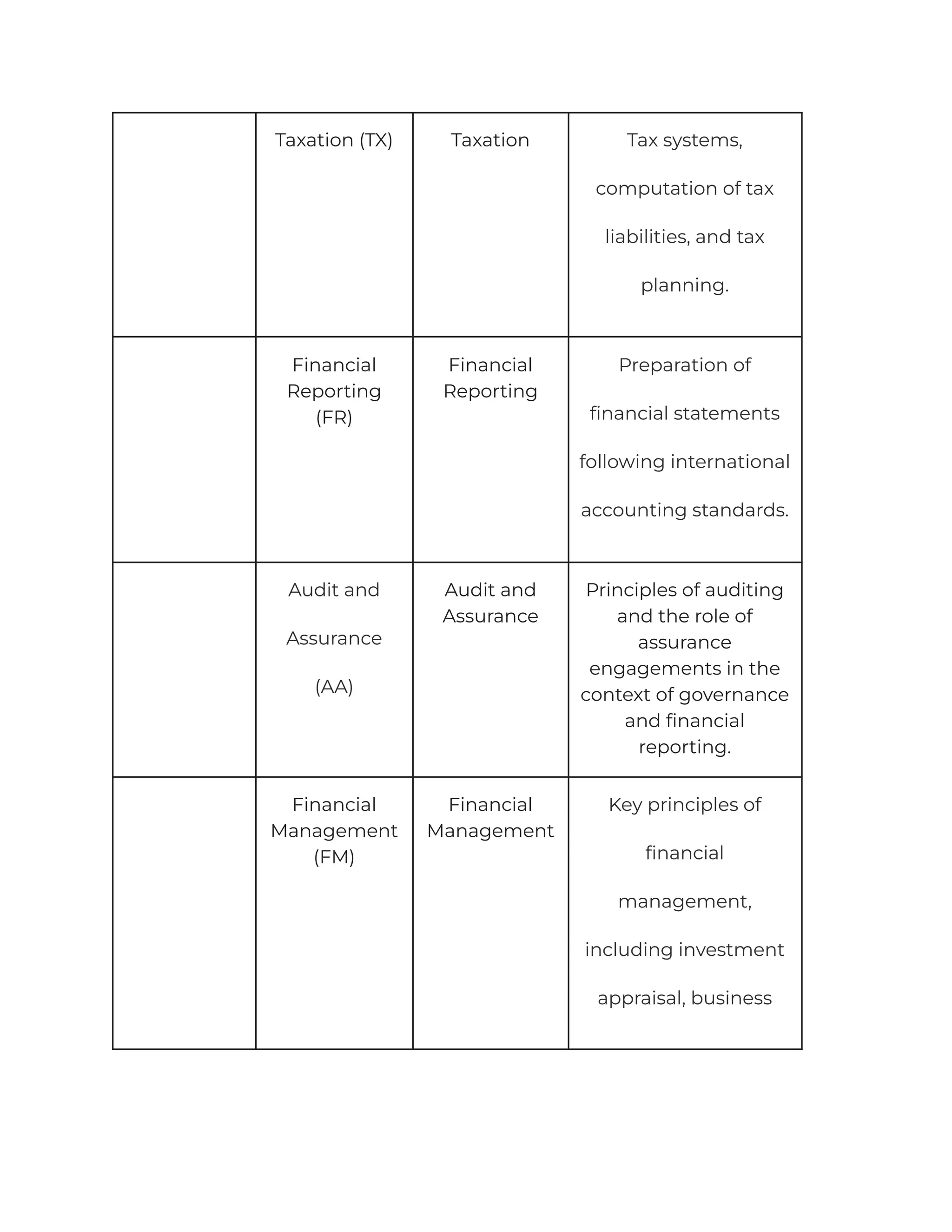

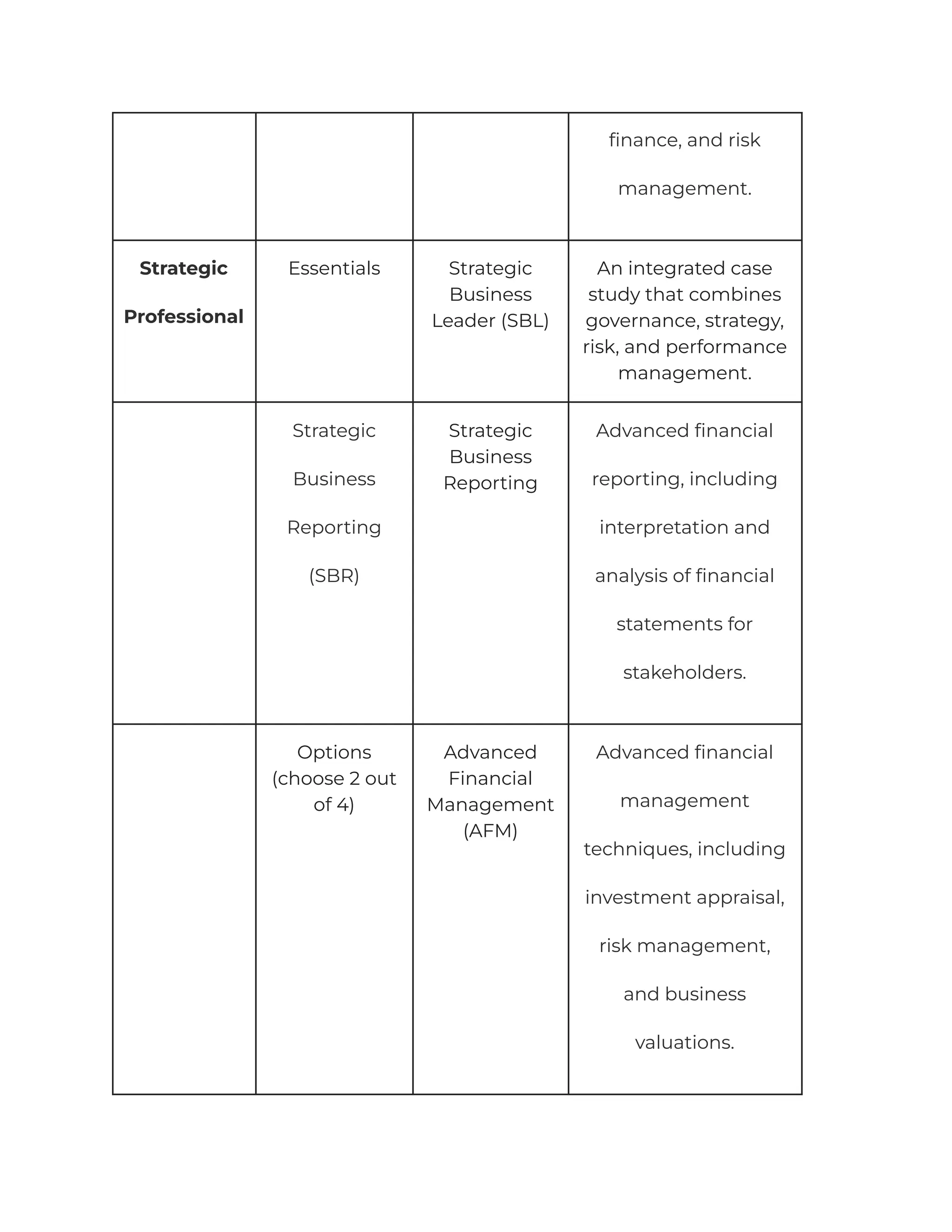

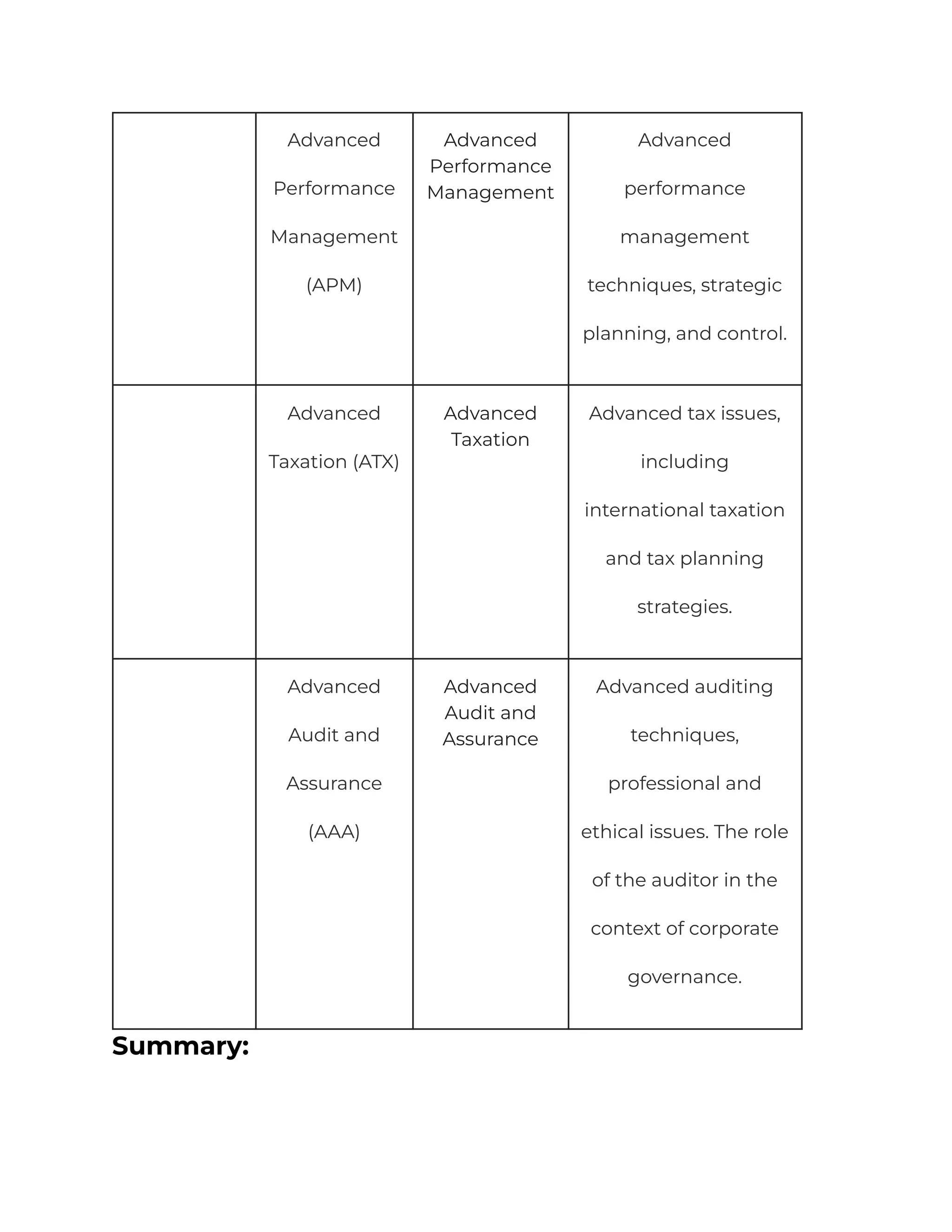

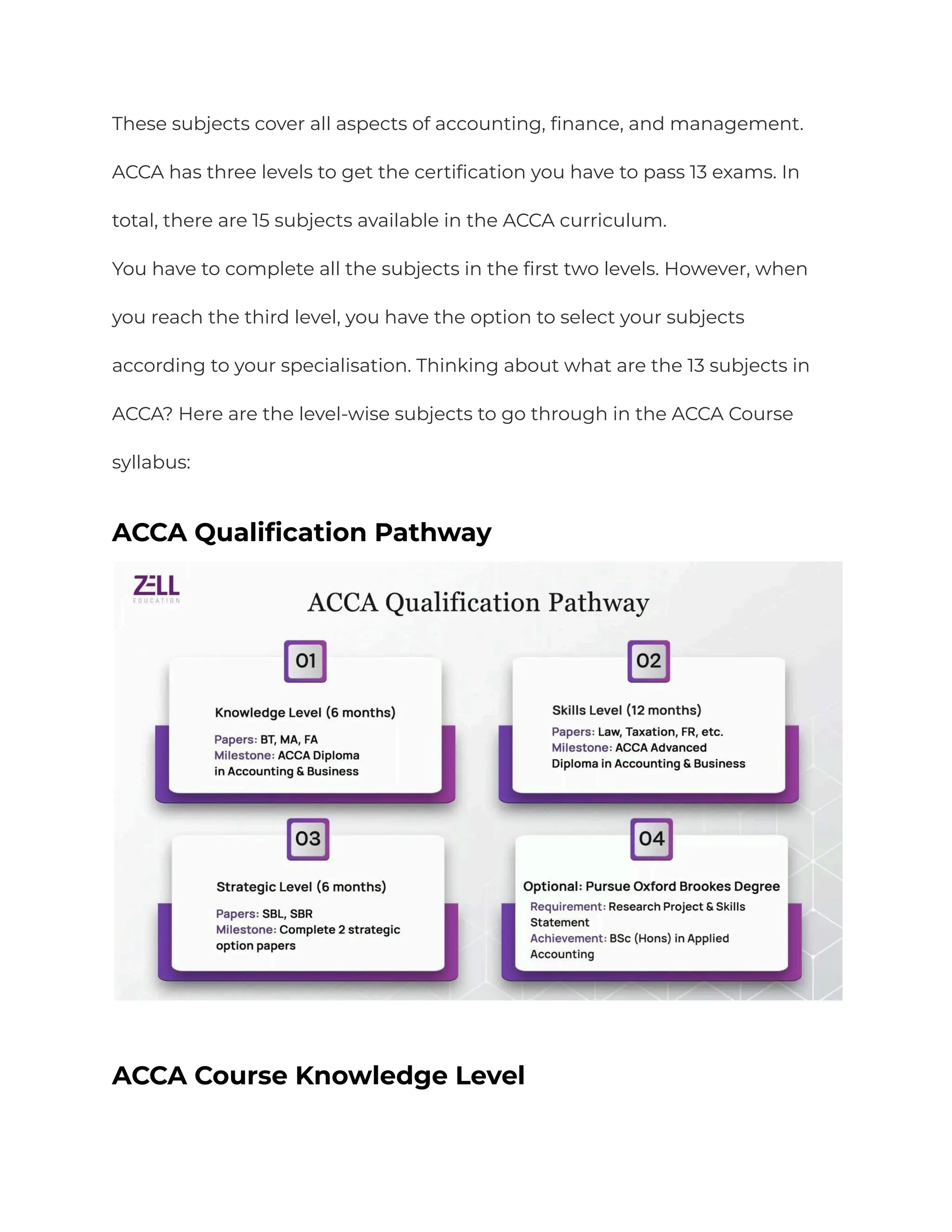

The ACCA (Association of Chartered Certified Accountants) is a globally recognized accounting qualification with a membership of over 200,000 and 600,000 students in 180+ countries. It offers a dynamic curriculum that includes foundational, applied skills, and strategic professional levels, requiring candidates to pass 13 exams typically completed in 2.5 to 3.75 years. The course provides numerous benefits, including global recognition, enhanced career opportunities, a robust professional network, and access to resources to support ongoing professional development.