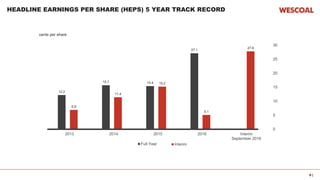

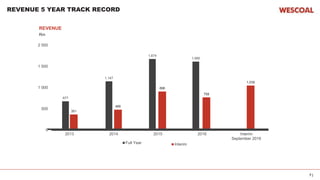

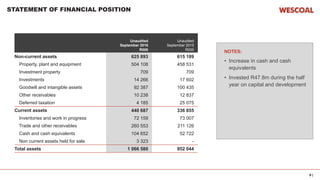

Wescoal Holdings Limited presented interim financial results for the six months ended 30 September 2016. Key highlights included a 37.1% increase in revenue to R1.039 billion and a 254% increase in EBITDA to R139.3 million. Headline earnings per share increased 445% to 27.8 cents. Wescoal delivered a solid performance due to strong sales and operational efficiencies from its flagship Elandspruit colliery. Management discussed strategic priorities such as completing a BEE transaction, diversifying revenue streams, and growing Wescoal's resource base.

![20 |

RISKS AND MITIGATIONS

Risk Response Update

1 HDSA ownership

of Wescoal

• BEE transaction to achieve HSDA control by

December 2016 advanced

• HDSA ownership currently over 40%

2 Wescoal funding • BEE transaction will inject R178m equity into the

Group

• Elandspruit operationalised

• Cost savings initiatives rolled out across the Group

• Gearing reduced to 0.26 [2015: 0.48]

• Cash flow position continues to strengthen

• Group debt funding capacity increased significantly due

to conclusion of long term Eskom and export contracts

3 Narrow revenue

base

• Secure long term Eskom coal supply contracts

• Broaden customer base and revenue generation

activities

• Long term coal supply contract signed with Eskom

• Significant progress in reaching target of 1Mtpa exports

in medium term

• Progress in developing initiatives to grow revenues

linked to non-Eskom domestic coal customers, coal

distribution networks, treatment of coal discard material

4 Declining

resource

• Grow the Wescoal resource base beyond the current

~15 year horizon

• Potential resources targets have been identified and

work has commenced on securing prioritised targets](https://image.slidesharecdn.com/wslinterimpressep16v5-161101102015/85/WESCOAL-INTERIM-RESULTS-PRESENTATION-20-320.jpg)