Weekly Technical Report :11 February 2019

•

0 likes•21 views

Axis Direct presents daily derivatives report presenting recommendations based on technical analysis. For trading in derivatives visit https://simplehai.axisdirect.in/offerings/products/derivatives

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Similar to Weekly Technical Report :11 February 2019

Similar to Weekly Technical Report :11 February 2019 (16)

More from Axis Direct

More from Axis Direct (20)

Recently uploaded

BHUBANESHWAR ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HAND CASH PAYMENT BHUBANESWAR CALL GIRL IN SEIRVEC ODIA ❣️72051SIYA37929❣️ CASH PAYMENT ONLY CA...

BHUBANESWAR CALL GIRL IN SEIRVEC ODIA ❣️72051SIYA37929❣️ CASH PAYMENT ONLY CA...ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HAND CASH PAYMENT

9565589233 Whatsapp Free Nude Video Call Service Porn Girls Porn Videos9565589233 Whatsapp Free Nude Video Call Service Porn Girls Porn Videos

9565589233 Whatsapp Free Nude Video Call Service Porn Girls Porn VideosWhatsapp Free Nude Video Call Service Porn Girls

PEMESANAN OBAT ASLI :: 087,776,558,899

Cara Menggugurkan Kandungan usia 1 , 2 , 3 , 4 , 5 , 6 , 7 , 8 bulan Jambi || obat penggugur kandungan Jambi || cara aborsi kandungan Jambi || obat penggugur kandungan 1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 bulan Jambi || bagaimana cara menggugurkan kandungan Jambi || tips Cara aborsi kandungan Jambi || trik Cara menggugurkan janin Jambi || Cara aman bagi ibu menyusui menggugurkan kandungan Jambi || klinik apotek jual obat penggugur kandungan Jambi || jamu PENGGUGUR KANDUNGAN Jambi || WAJIB TAU CARA ABORSI JANIN Jambi || GUGURKAN KANDUNGAN AMAN TANPA KURET Jambi || CARA Menggugurkan Kandungan tanpa efek samping Jambi || rekomendasi dokter obat herbal penggugur kandungan Jambi || ABORSI janin Jambi || aborsi kandungan Jambi || jamu herbal Penggugur kandungan Jambi || cara Menggugurkan Kandungan yang cacat Jambi || tata cara Menggugurkan Kandungan Jambi || obat penggugur kandungan di apotik kimia Farma Jambi || obat telat datang bulan Jambi || obat penggugur kandungan tuntas Jambi || obat penggugur kandungan alami Jambi || klinik aborsi janin gugurkan kandungan Jambi || Cytotec misoprostol BPOM Jambi || OBAT PENGGUGUR KANDUNGAN CYTOTEC Jambi || aborsi janin dengan pil Cytotec Jambi || Cytotec misoprostol BPOM 100% Jambi || penjual obat penggugur kandungan asli Jambi || klinik jual obat aborsi janin Jambi || obat penggugur kandungan di klinik k-24 Jambi || obat penggugur Cytotec di apotek umum Jambi || CYTOTEC ASLI Jambi || obat Cytotec yang asli 200mcg Jambi || obat penggugur ASLI Jambi || pil Cytotec© tablet Jambi || cara gugurin kandungan Jambi || jual Cytotec 200mg Jambi || dokter gugurkan kandungan Jambi || cara menggugurkan kandungan dengan cepat selesai dalam 24 jam secara alami buah buahan Jambi || usia kandungan 1 2 3 4 5 6 7 8 bulan masih bisa di gugurkan Jambi || obat penggugur kandungan cytotec dan gastrul Jambi || cara gugurkan pembuahan janin secara alami dan cepat Jambi || gugurkan kandungan Jambi || gugurin janin Jambi || cara Menggugurkan janin di luar nikah Jambi || contoh aborsi janin yang benar Jambi || contoh obat penggugur kandungan asli Jambi || contoh cara Menggugurkan Kandungan yang benar Jambi || telat haid Jambi || obat telat haid Jambi || Cara Alami gugurkan kehamilan Jambi || obat telat menstruasi Jambi || cara Menggugurkan janin anak haram Jambi || cara aborsi menggugurkan janin yang tidak berkembang Jambi || gugurkan kandungan dengan obat Cytotec Jambi || obat penggugur kandungan Cytotec 100% original Jambi || HARGA obat penggugur kandungan Jambi || obat telat haid 1 2 3 4 5 6 7 bulan Jambi || obat telat menstruasi 1 2 3 4 5 6 7 8 BULAN Jambi || obat telat datang bulan Jambi

©©©©©©©©©©©©©©©©©©©©©©©©©

Cara Menggugurkan Kandungan Usia Janin 1 | 7 | 8 Bulan Dengan Cepat Dalam Hitungan Jam Secara Alami, Kami Siap Meneriman Pesanan Ke Seluruh Indonesia, Melputi: Ambon, Banda Aceh, Bandung, Banjarbaru, Batam, Bau-Bau, Bengkulu, Binjai, Blitar, Bontang, Cilegon, Cirebon, Depok💊💊 OBAT PENGGUGUR KANDUNGAN JAMBI 08776558899 ATAU CARA GUGURKAN JANIN KLINIK...

💊💊 OBAT PENGGUGUR KANDUNGAN JAMBI 08776558899 ATAU CARA GUGURKAN JANIN KLINIK...Cara Menggugurkan Kandungan 087776558899

BERHAMPUR CALL GIRL IN SEIRVEC ODIA ❣️72051SIYA37929❣️ CASH PAYMENT ONLY CALL GIRL IN ESCORT SEIRVECE BERHAMPUR ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO ...

BERHAMPUR ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO ...ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HAND CASH PAYMENT

KHORDHA ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HAND CASH PAYMENT KHORDHA ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HA...

KHORDHA ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HA...ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HAND CASH PAYMENT

Recently uploaded (8)

BHUBANESWAR CALL GIRL IN SEIRVEC ODIA ❣️72051SIYA37929❣️ CASH PAYMENT ONLY CA...

BHUBANESWAR CALL GIRL IN SEIRVEC ODIA ❣️72051SIYA37929❣️ CASH PAYMENT ONLY CA...

Namakkal ❤CALL GIRL 84099*07087 ❤CALL GIRLS IN Namakkal ESCORT SERVICE❤CALL GIRL

Namakkal ❤CALL GIRL 84099*07087 ❤CALL GIRLS IN Namakkal ESCORT SERVICE❤CALL GIRL

9565589233 Whatsapp Free Nude Video Call Service Porn Girls Porn Videos

9565589233 Whatsapp Free Nude Video Call Service Porn Girls Porn Videos

💊💊 OBAT PENGGUGUR KANDUNGAN JAMBI 08776558899 ATAU CARA GUGURKAN JANIN KLINIK...

💊💊 OBAT PENGGUGUR KANDUNGAN JAMBI 08776558899 ATAU CARA GUGURKAN JANIN KLINIK...

BERHAMPUR ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO ...

BERHAMPUR ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO ...

KHORDHA ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HA...

KHORDHA ODIA CALL GIRL SEIRVEC ❣️ 72051//37929❣️ CALL GIRL IN ODIA HAND TO HA...

Prince Armahs(Tinky) Brochure, for Funeral service

Prince Armahs(Tinky) Brochure, for Funeral service

Hosur ❤CALL GIRL 84099*07087 ❤CALL GIRLS IN Hosur ESCORT SERVICE❤CALL GIRL

Hosur ❤CALL GIRL 84099*07087 ❤CALL GIRLS IN Hosur ESCORT SERVICE❤CALL GIRL

Weekly Technical Report :11 February 2019

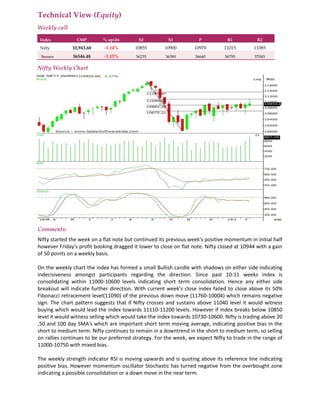

- 1. Technical View (Equity) Weekly call Index CMP % up/dn S2 S1 P R1 R2 Nifty 10,943.60 -1.14% 10855 10900 10970 11015 11085 Sensex 36546.48 -1.15% 36235 36390 36640 36795 37045 Nifty Weekly Chart Comments: Nifty started the week on a flat note but continued its previous week's positive momentum in initial half however Friday's profit booking dragged it lower to close on flat note. Nifty closed at 10944 with a gain of 50 points on a weekly basis. On the weekly chart the index has formed a small Bullish candle with shadows on either side indicating indecisiveness amongst participants regarding the direction. Since past 10-11 weeks index is consolidating within 11000-10600 levels indicating short term consolidation. Hence any either side breakout will indicate further direction. With current week’s close index failed to close above its 50% Fibonacci retracement level(11090) of the previous down move (11760-10004) which remains negative sign. The chart pattern suggests that if Nifty crosses and sustains above 11040 level it would witness buying which would lead the index towards 11110-11200 levels. However if index breaks below 10850 level it would witness selling which would take the index towards 10730-10600. Nifty is trading above 20 ,50 and 100 day SMA's which are important short term moving average, indicating positive bias in the short to medium term. Nifty continues to remain in a downtrend in the short to medium term, so selling on rallies continues to be our preferred strategy. For the week, we expect Nifty to trade in the range of 11000-10750 with mixed bias. The weekly strength indicator RSI is moving upwards and is quoting above its reference line indicating positive bias. However momentum oscillator Stochastic has turned negative from the overbought zone indicating a possible consolidation or a down move in the near term.

- 2. The trend deciding level for the day is 10970. If NIFTY trades above this level then we may witness a further rally up to 11015-11085-11130 levels. However, if NIFTY trades below 10970 levels then we may see some profit booking initiating in the market, which may correct up to 10900-10855-10785 levels Stocks to focus for intraday Long Dlf,Jubliant, Syngen, Kotak Bank Stocks to focus for intraday Short Ujjivan, OrientBank, IbulHsgfin, Pnb, Equitas, M&Mfin, Glenmark