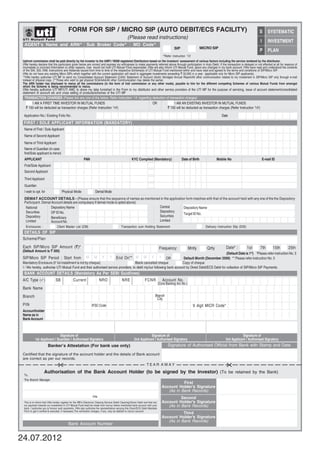

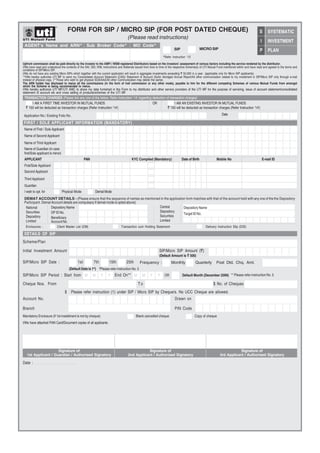

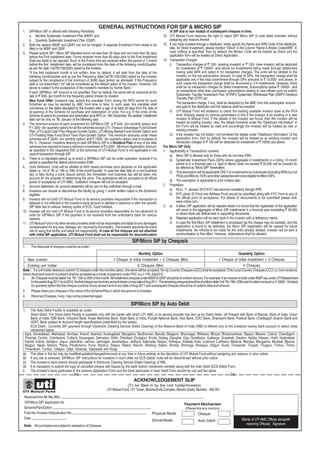

The document outlines the application process for systematic investment plans (SIPs) and micro SIPs through UTI Mutual Fund, including details on eligibility, transaction charges, and the required documentation for registration. It emphasizes that investors must adhere to certain limits on aggregate investments and provides specific instructions for submitting applications. The document also includes policies on communication preferences and the liabilities of UTI Mutual Fund regarding transaction issues.