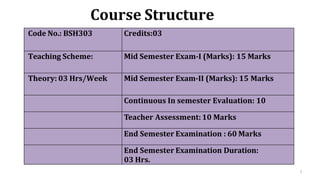

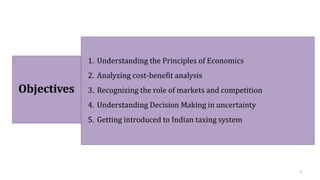

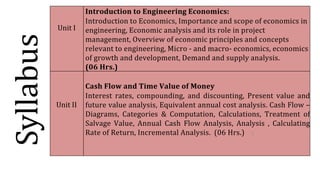

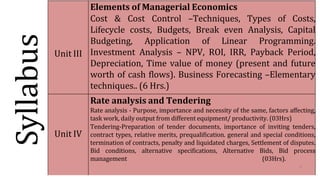

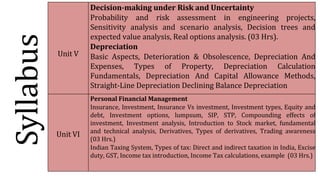

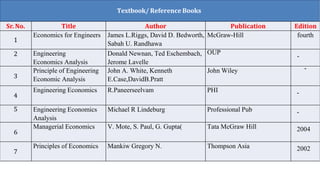

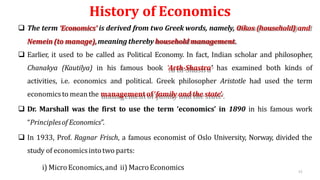

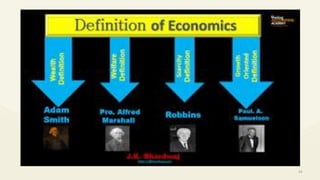

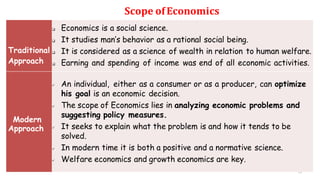

This document provides information about an engineering economics course, including its structure, objectives, syllabus, and textbook references. The course aims to introduce students to key economic principles and concepts relevant to engineering. It will cover topics such as cash flow analysis, cost control techniques, investment analysis, decision-making under risk and uncertainty, and personal financial management. The course is worth 3 credits and includes a midterm exam, in-semester evaluation, teacher assessment, and end-semester examination.