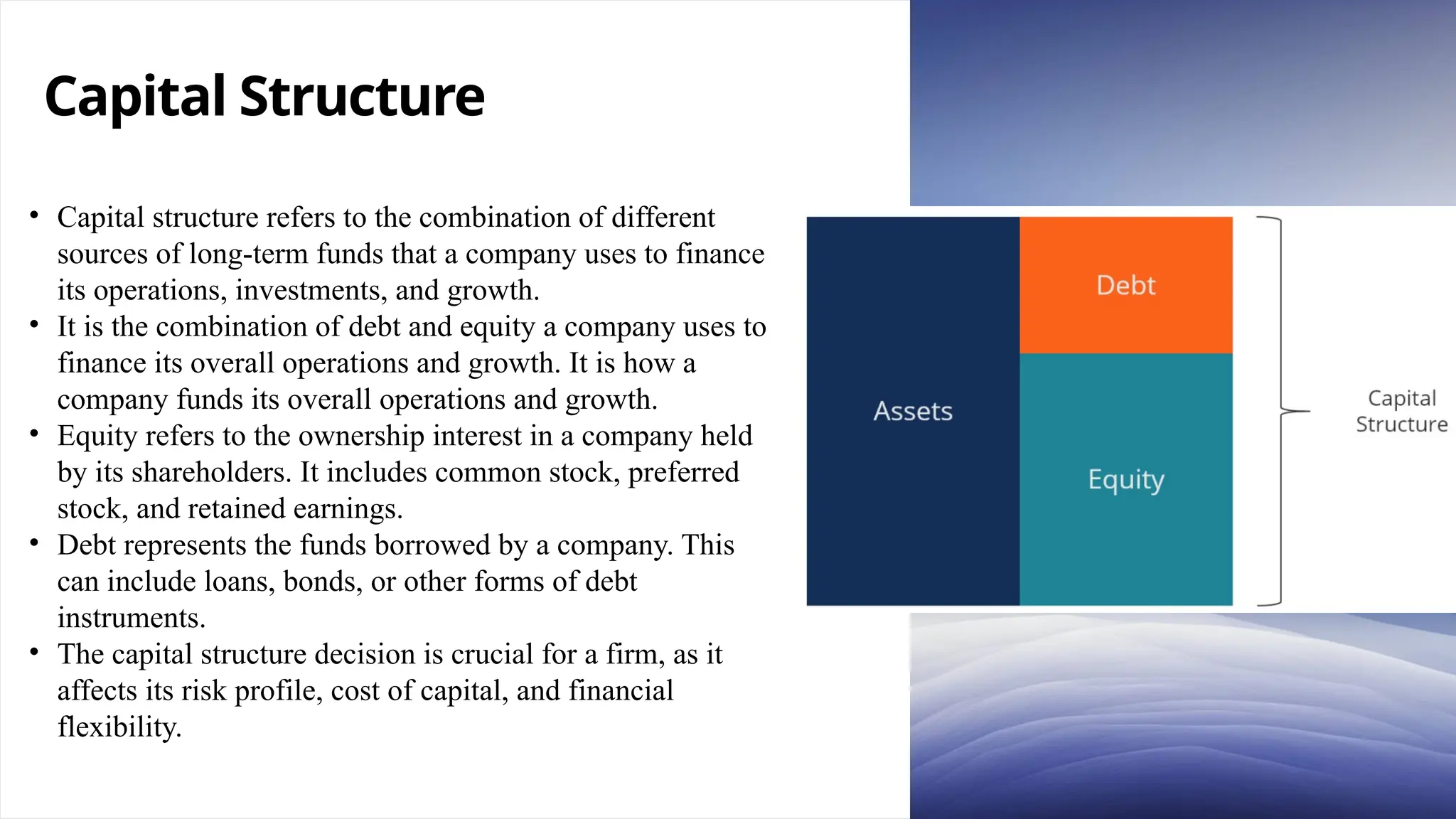

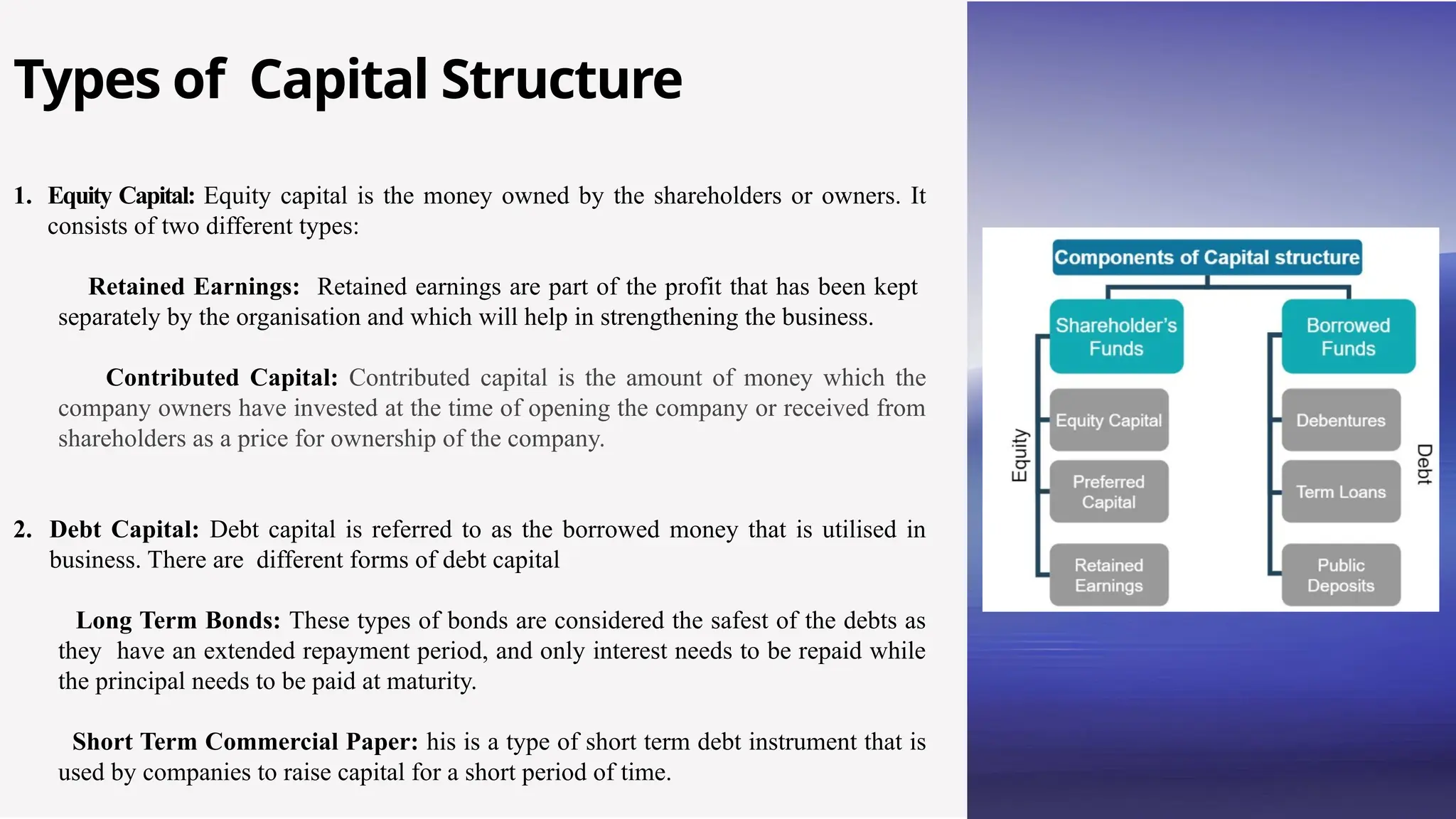

The document discusses capital structure, which is the mix of debt and equity a company uses to finance its operations and growth. It outlines factors that influence financing decisions including business risk, financial risk tolerance, market conditions, and management philosophy. Additionally, it emphasizes the significance of capital structure decisions in managing financial risk, maximizing shareholder value, and providing stability and flexibility for strategic growth.