The document summarizes the findings of CompTIA's 2013 study on enterprise mobility trends. Some key findings include:

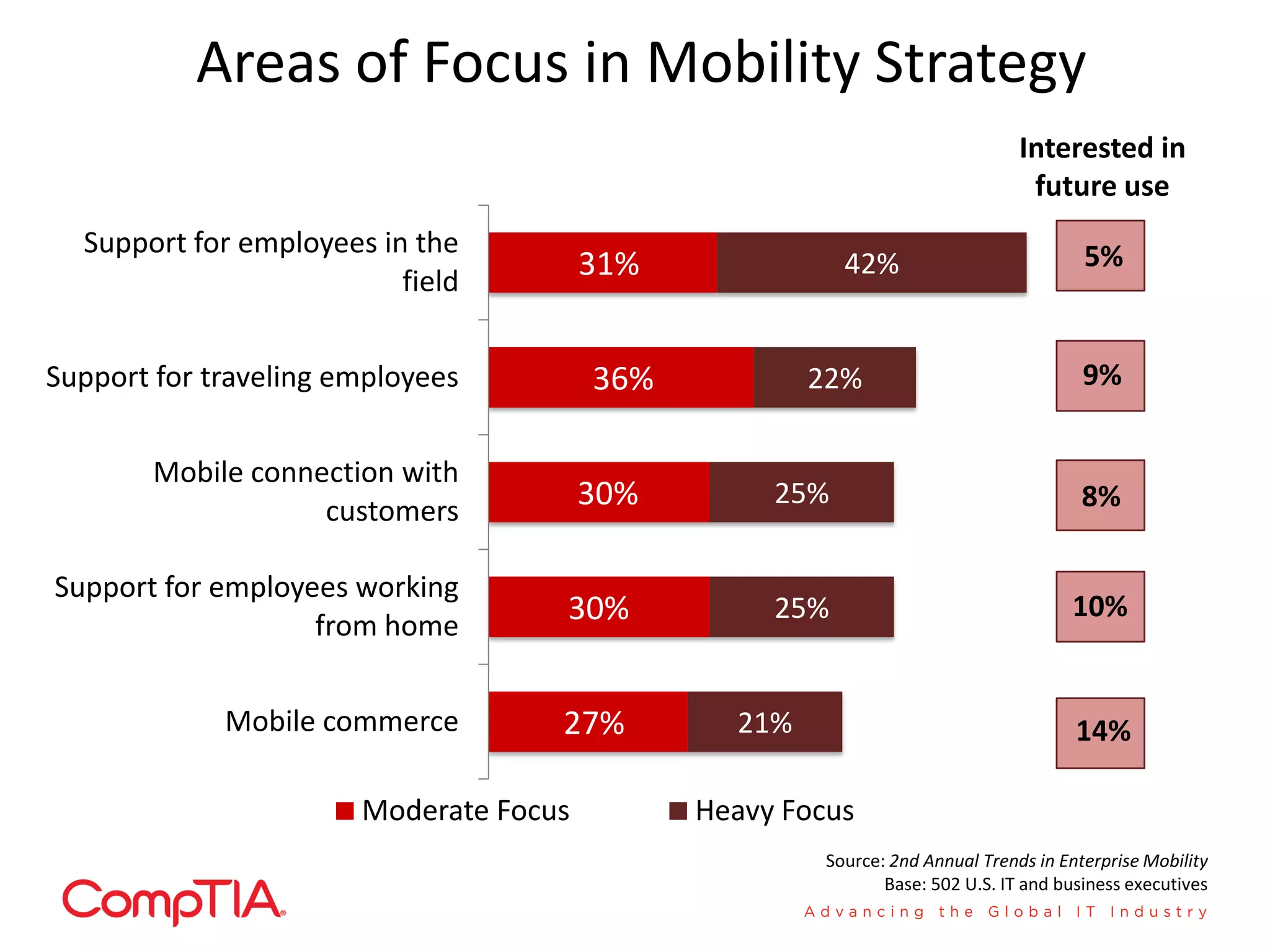

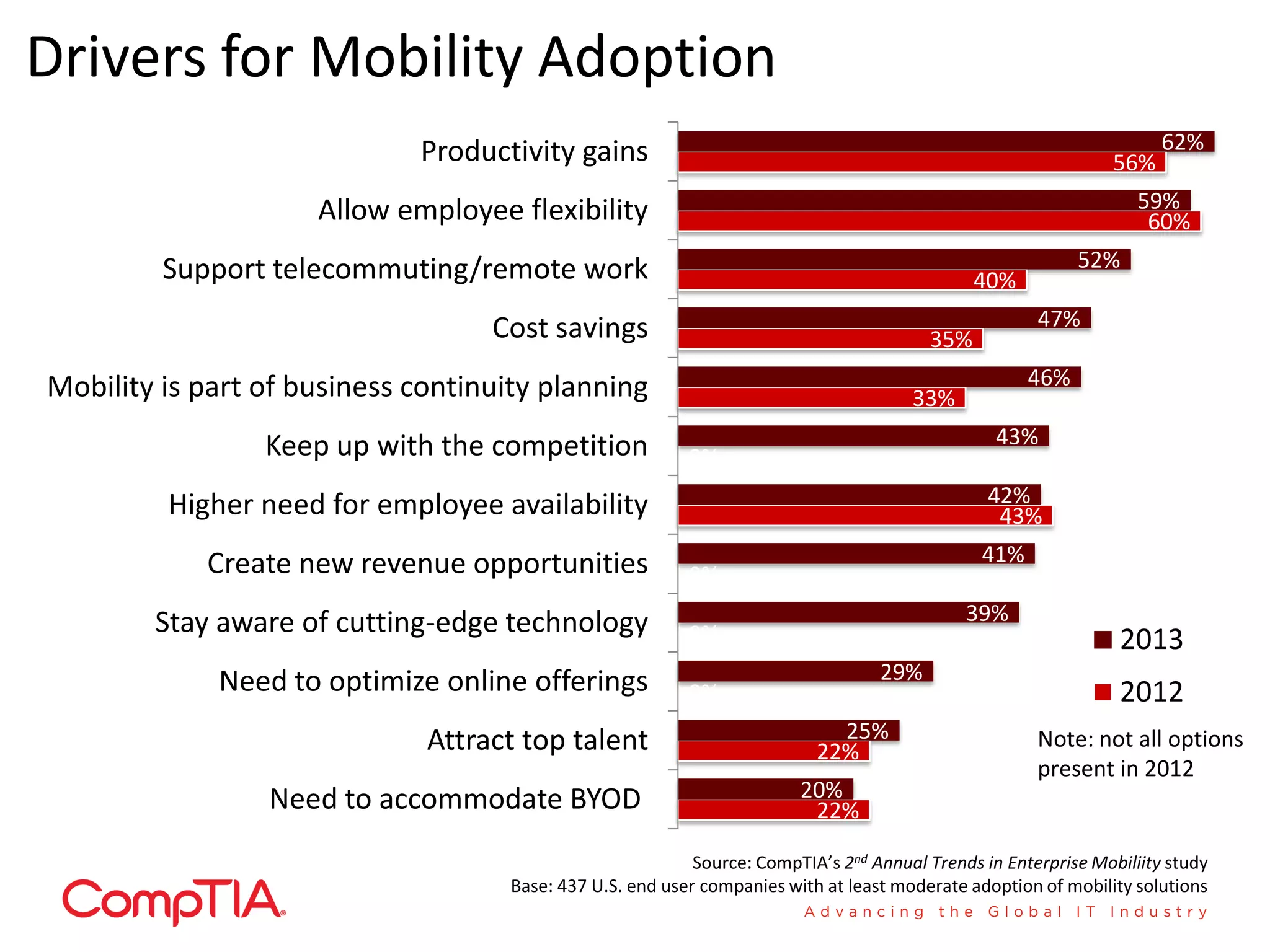

- Productivity gains and allowing employee flexibility were the top drivers for companies adopting mobility solutions.

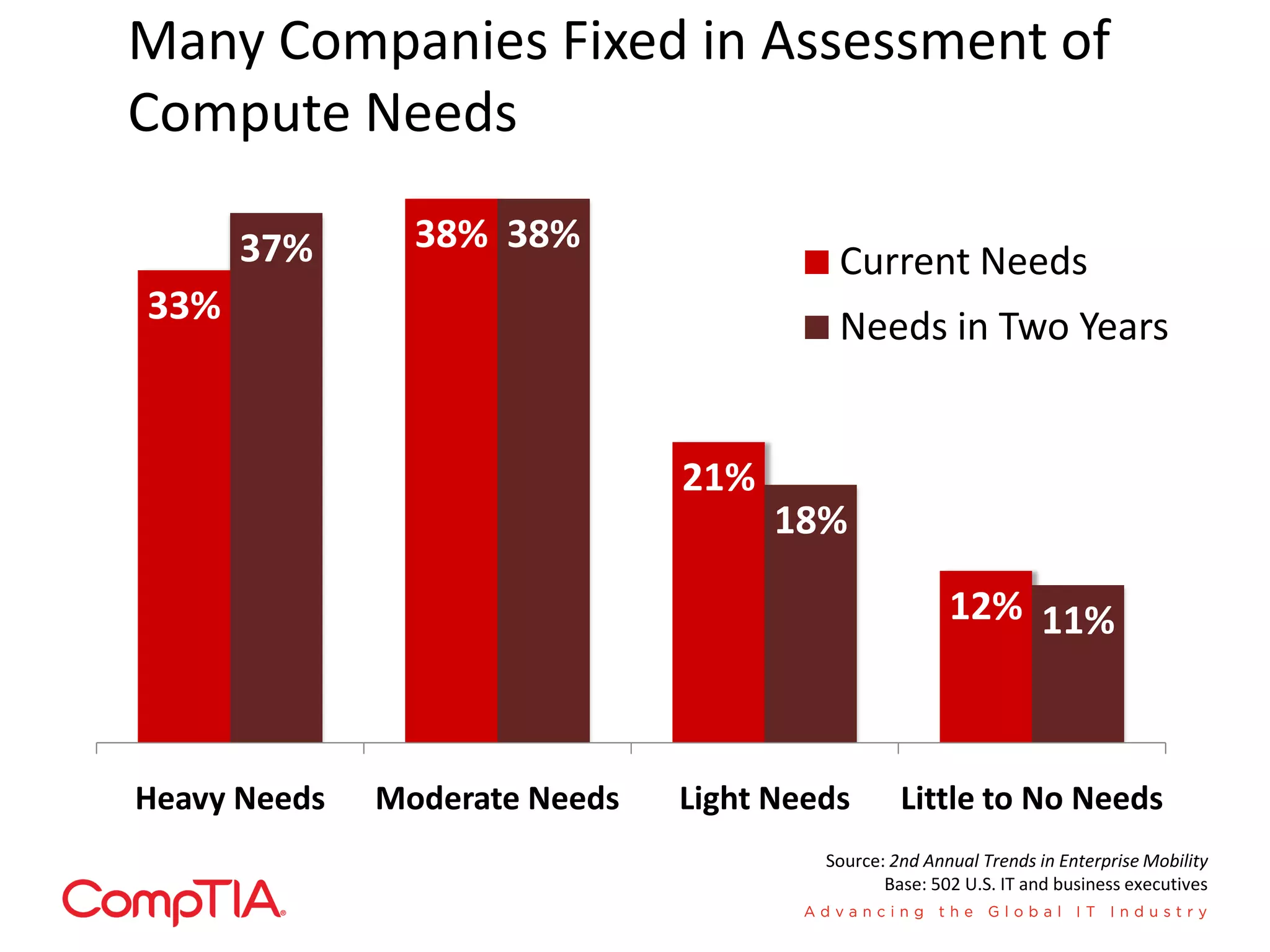

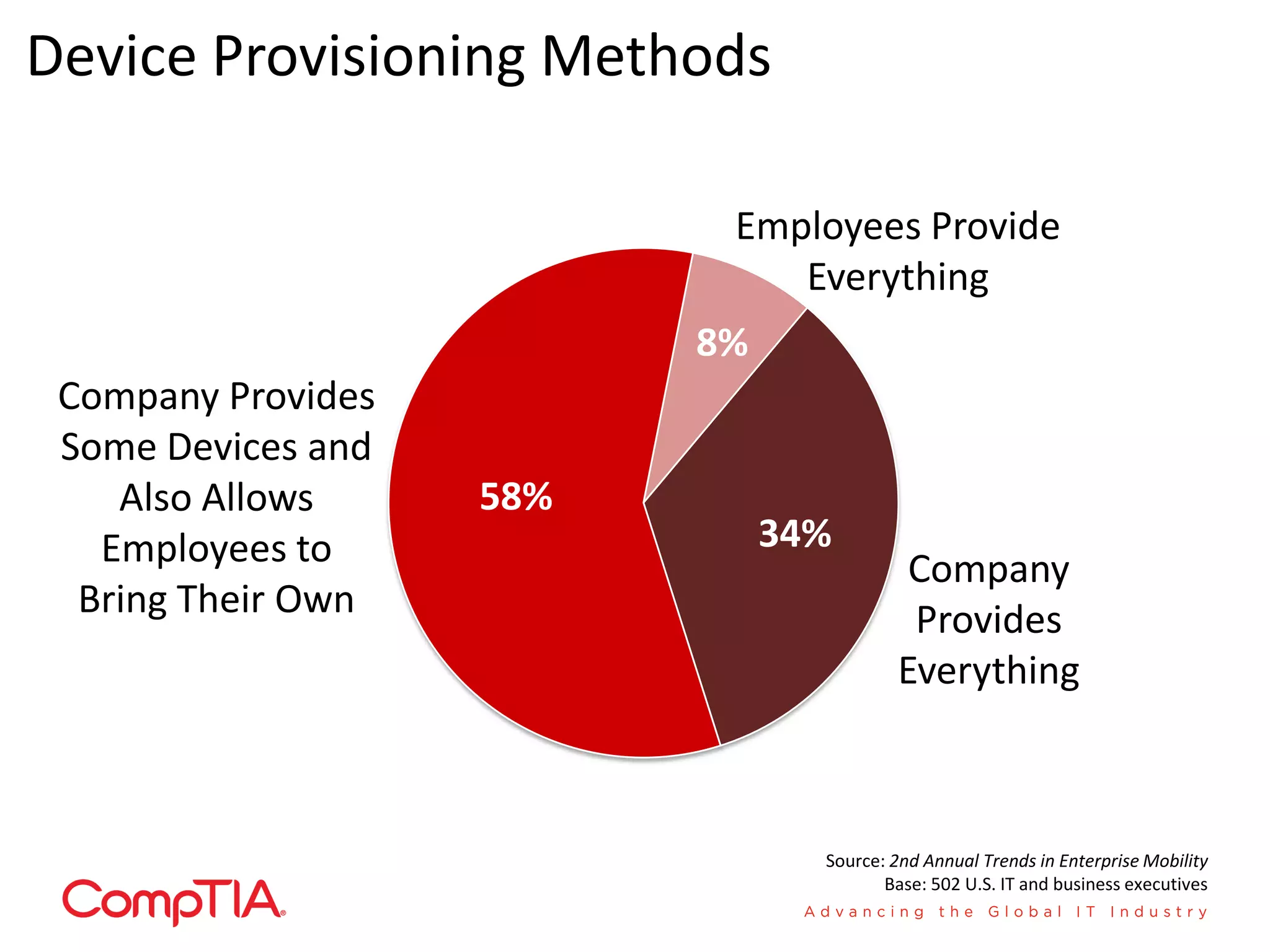

- Many companies take a mixed approach to device provisioning, providing some devices while also allowing BYOD.

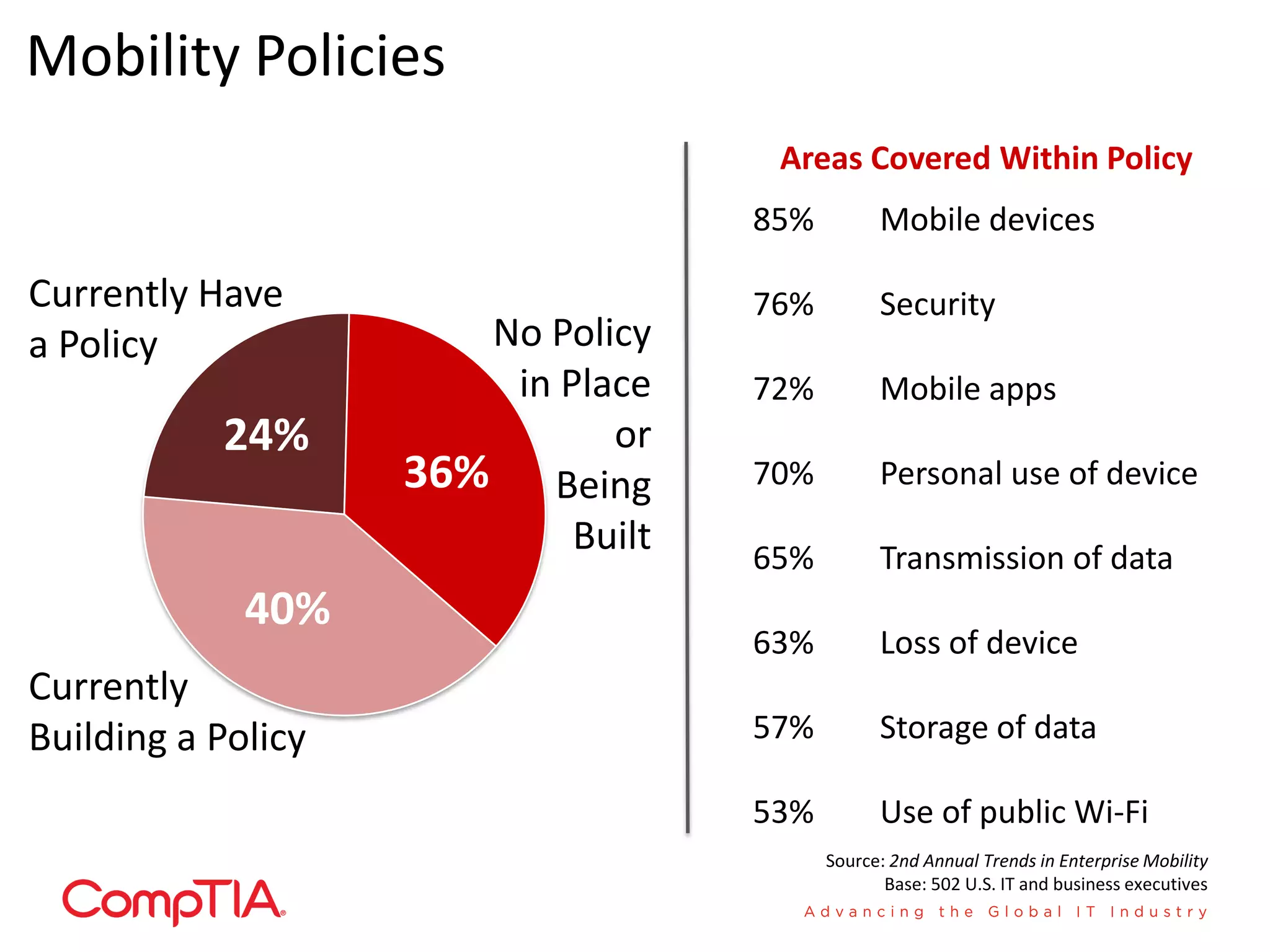

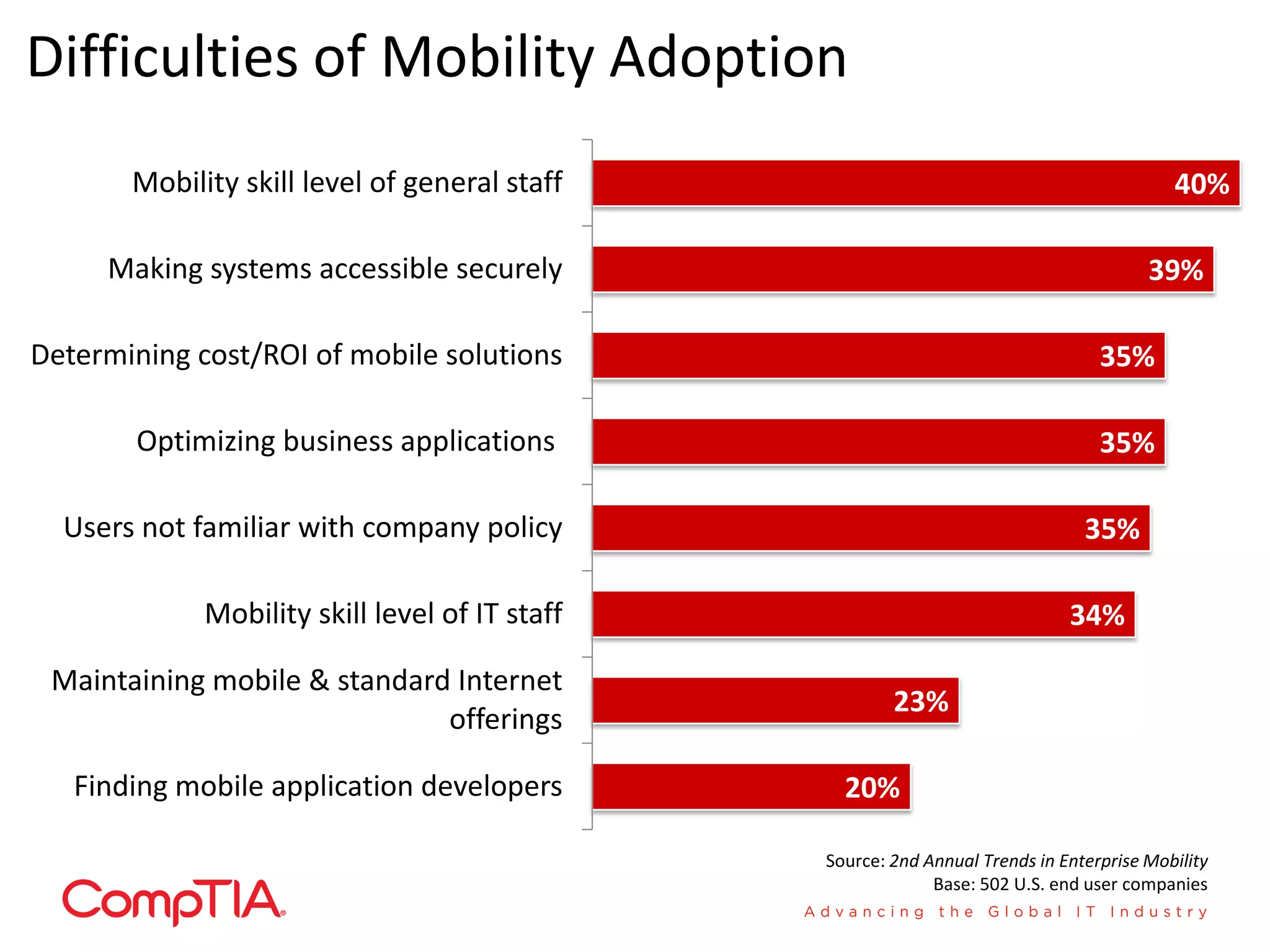

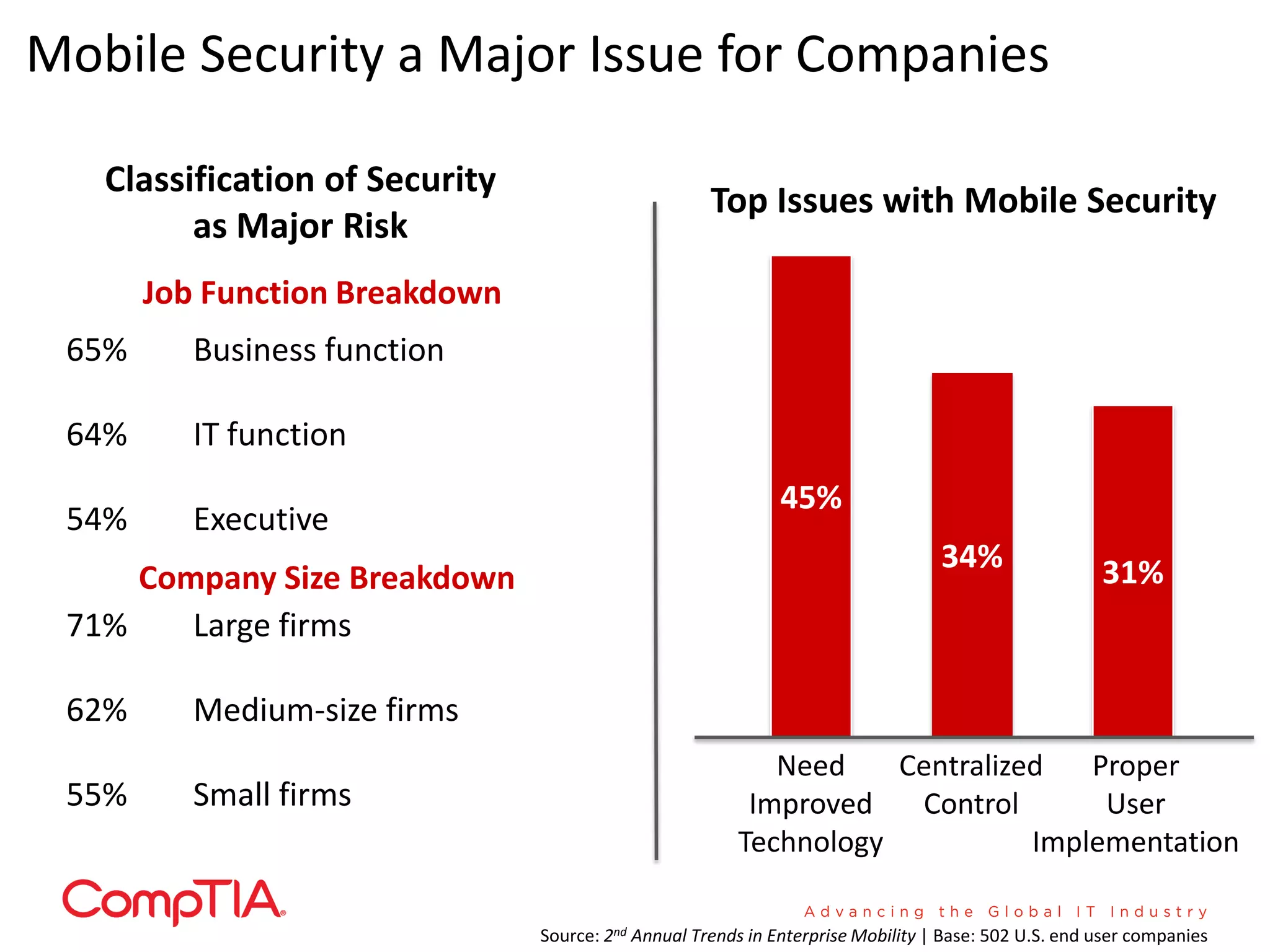

- Security was identified as a major risk and top concern for mobile solutions. A lack of mobility skills among IT staff was also a challenge.

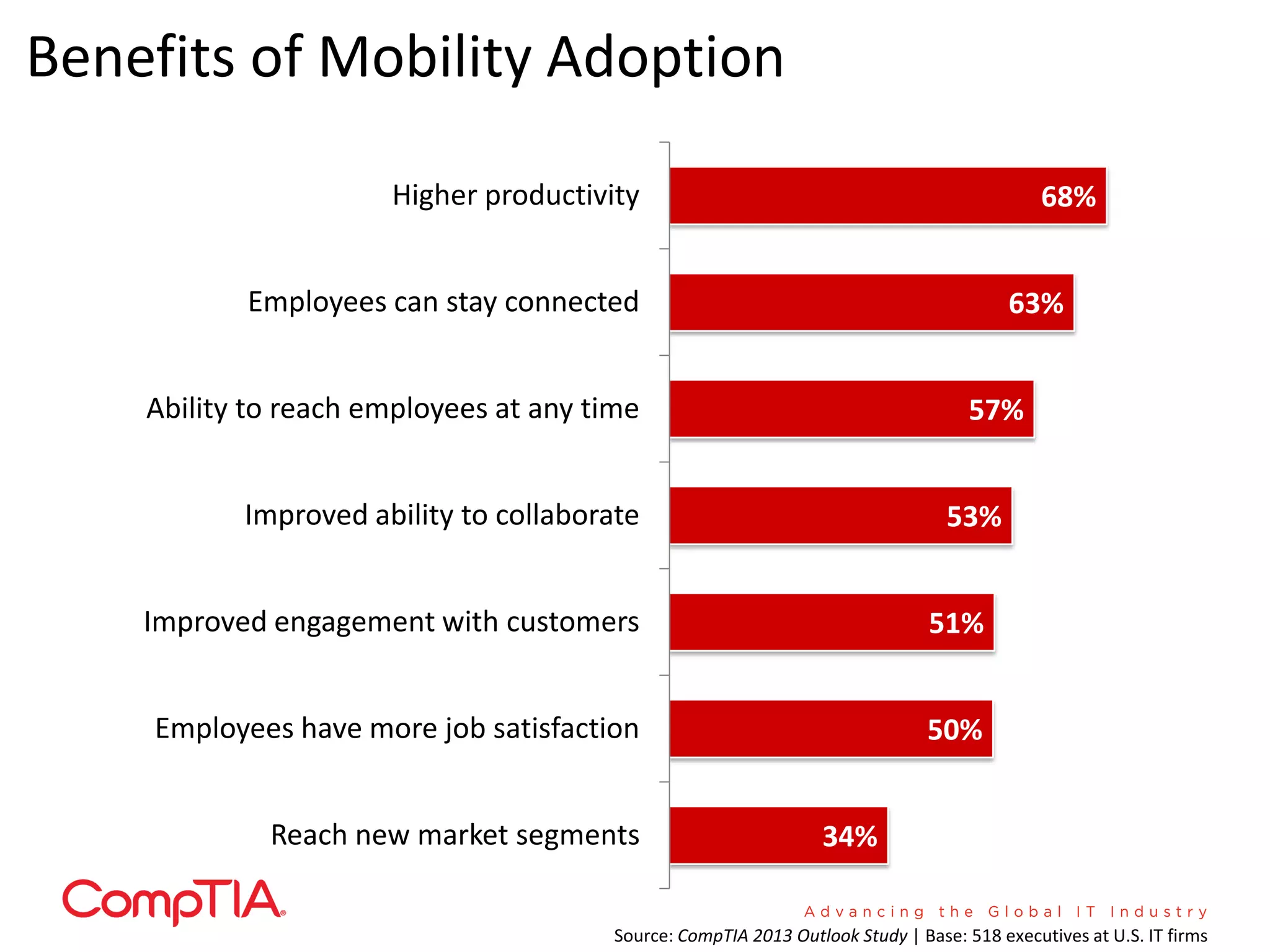

- Benefits of mobility included improved productivity, collaboration and ability to engage customers across locations.