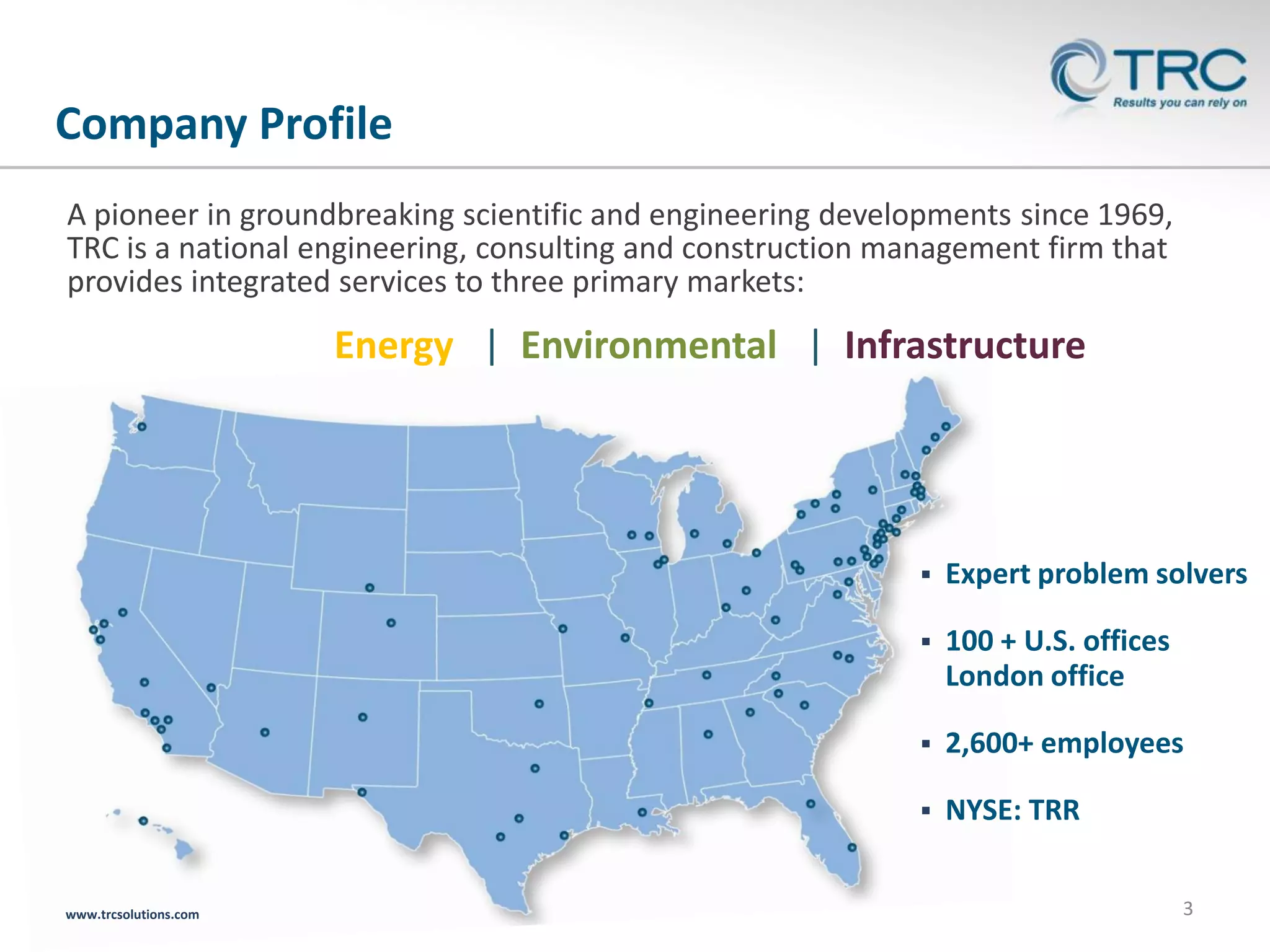

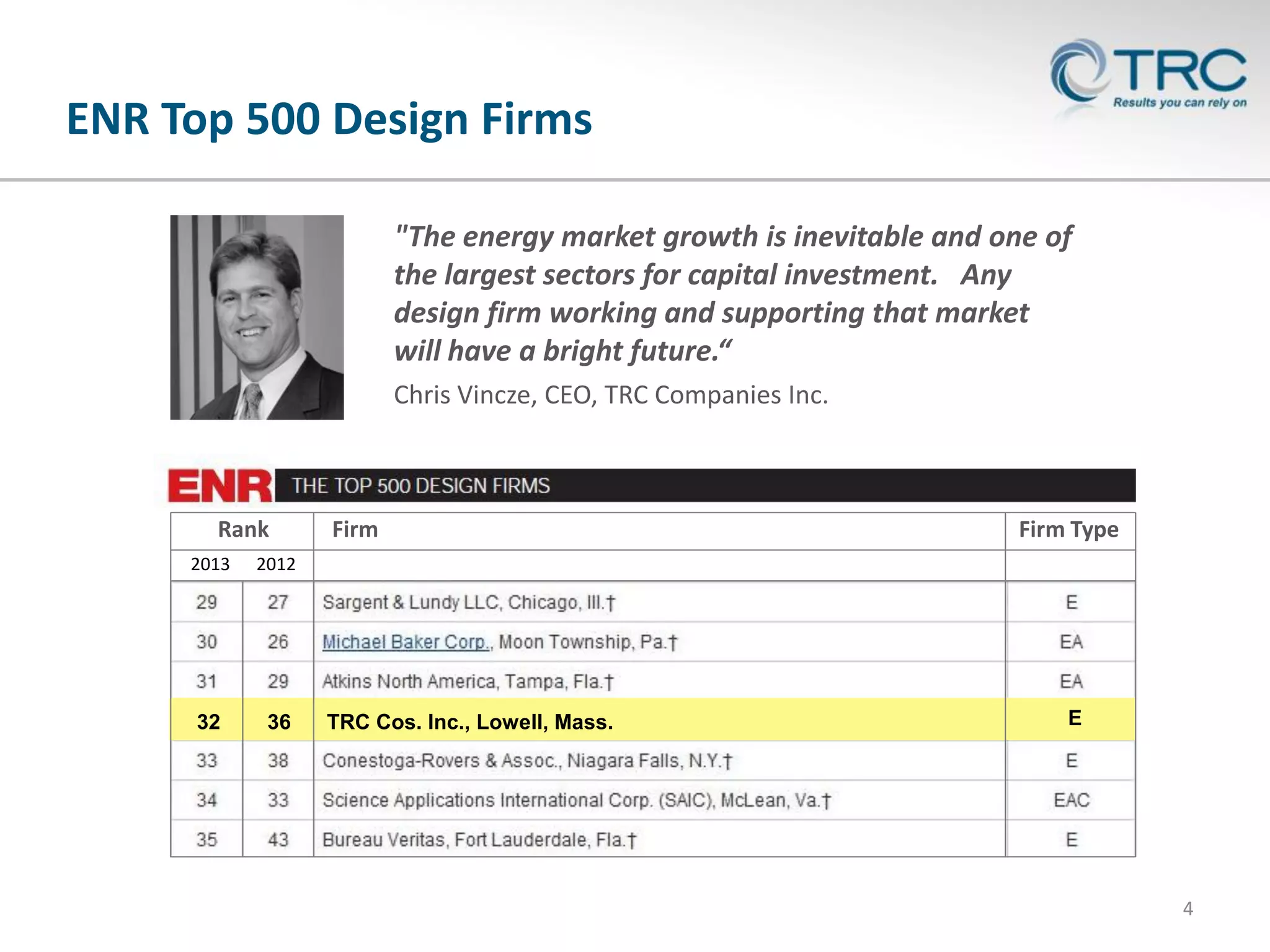

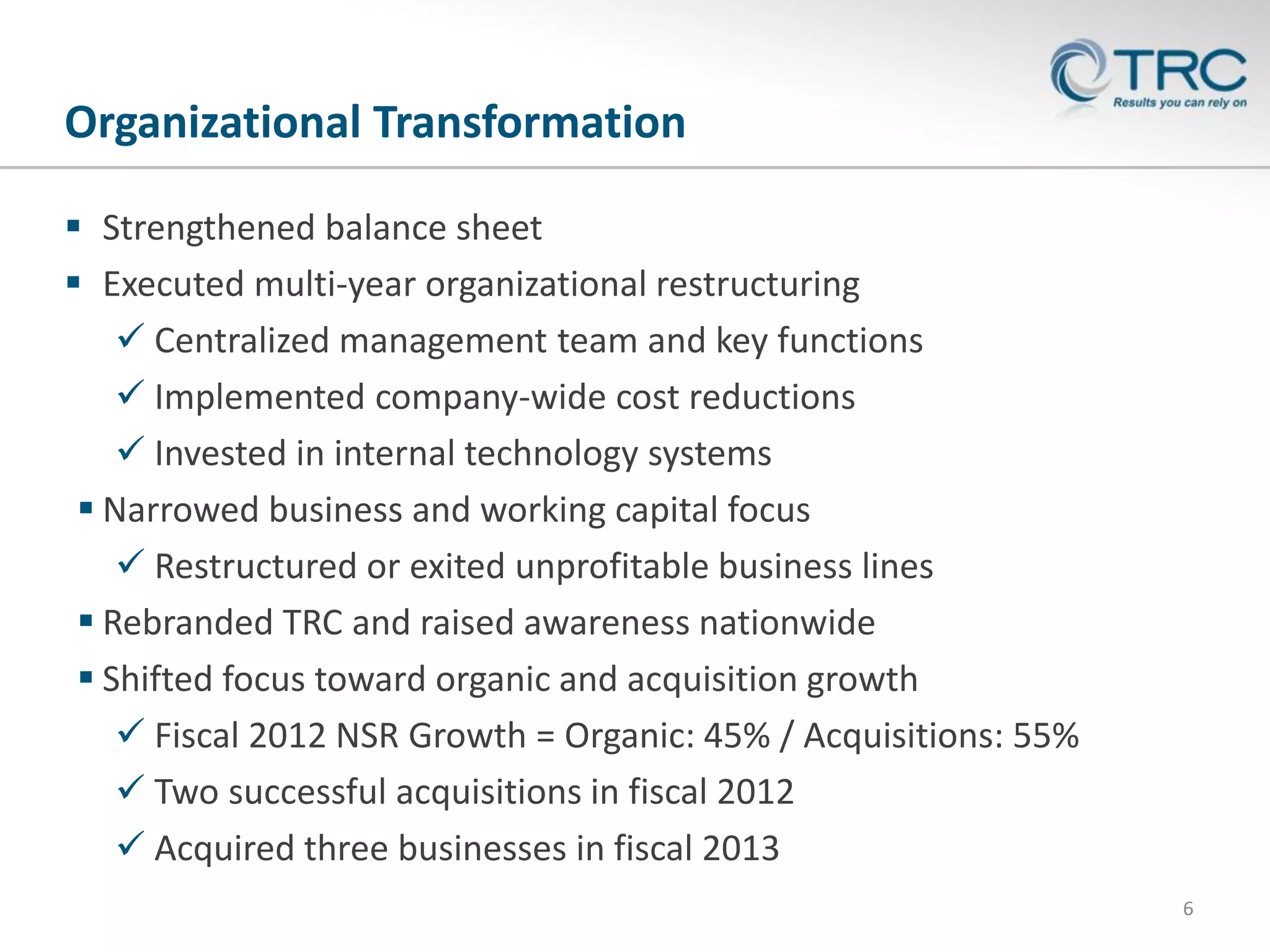

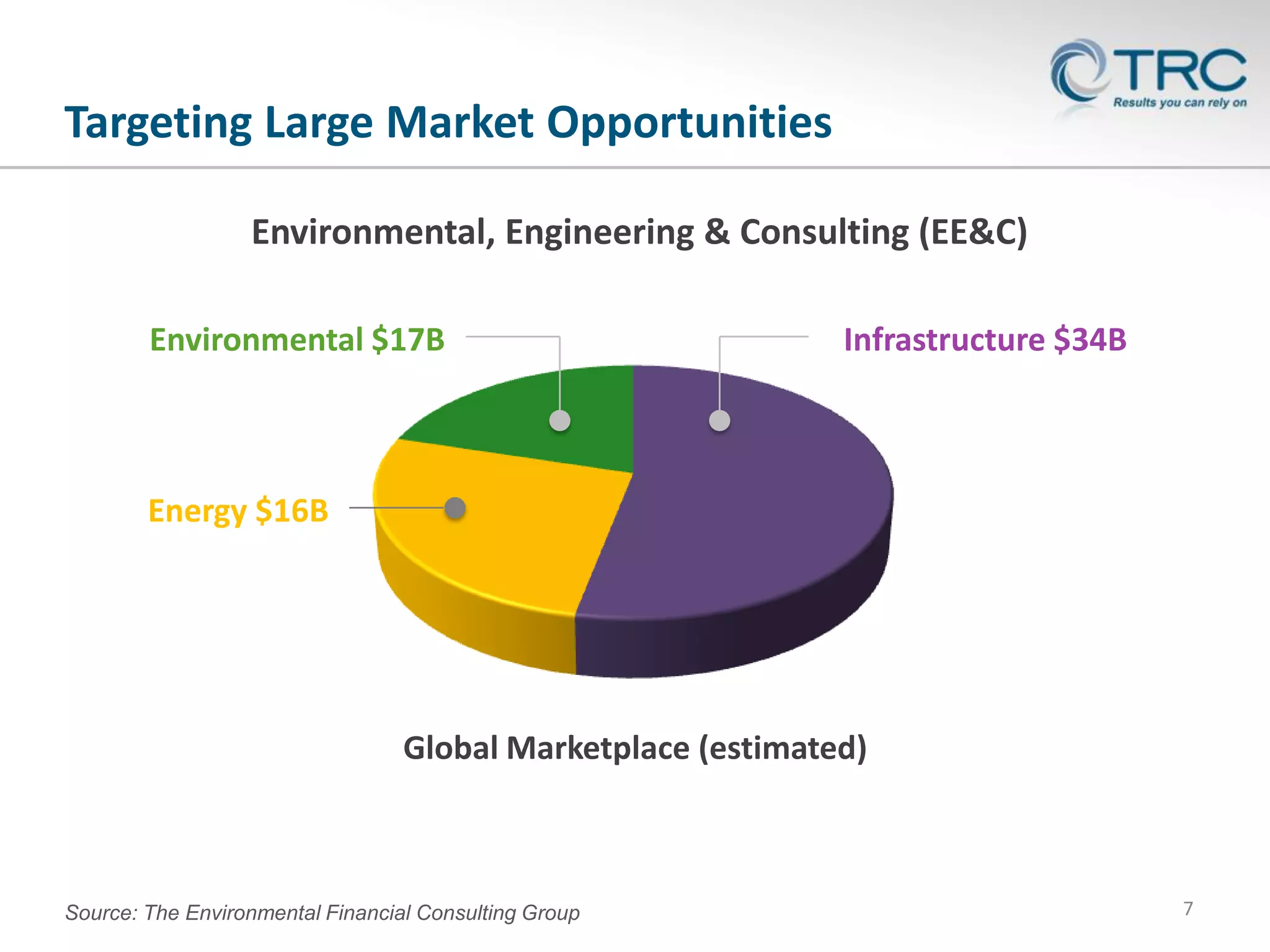

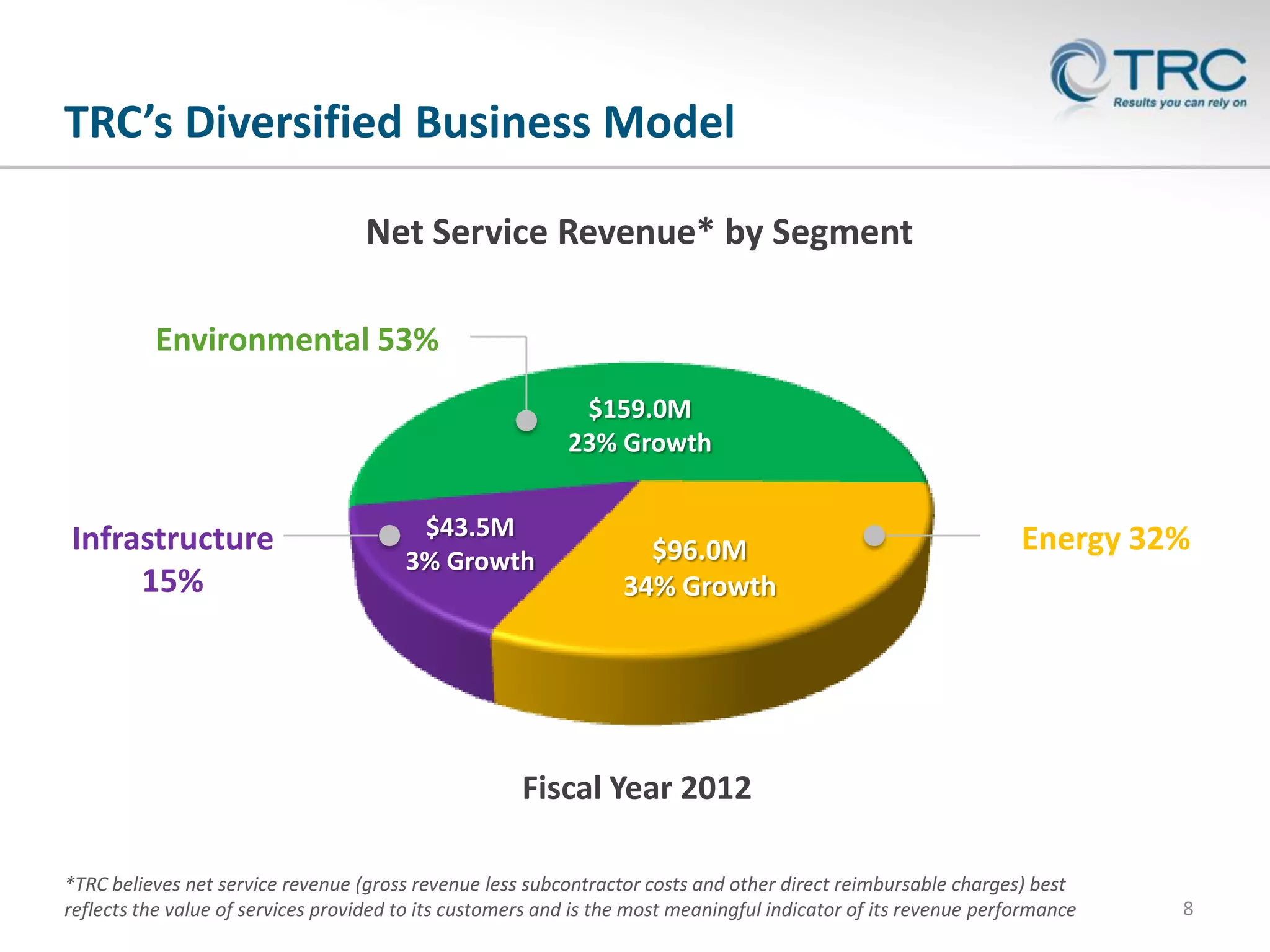

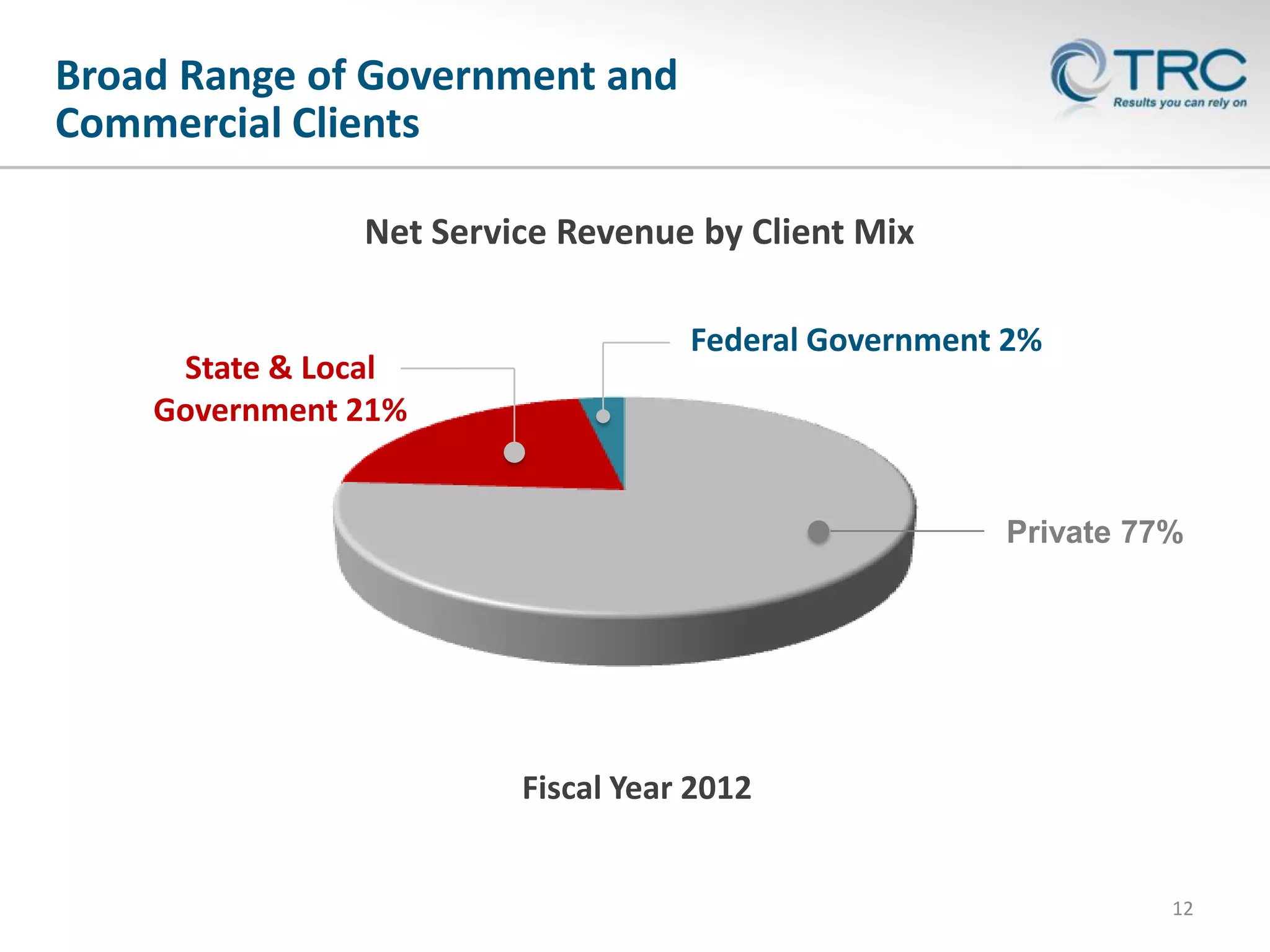

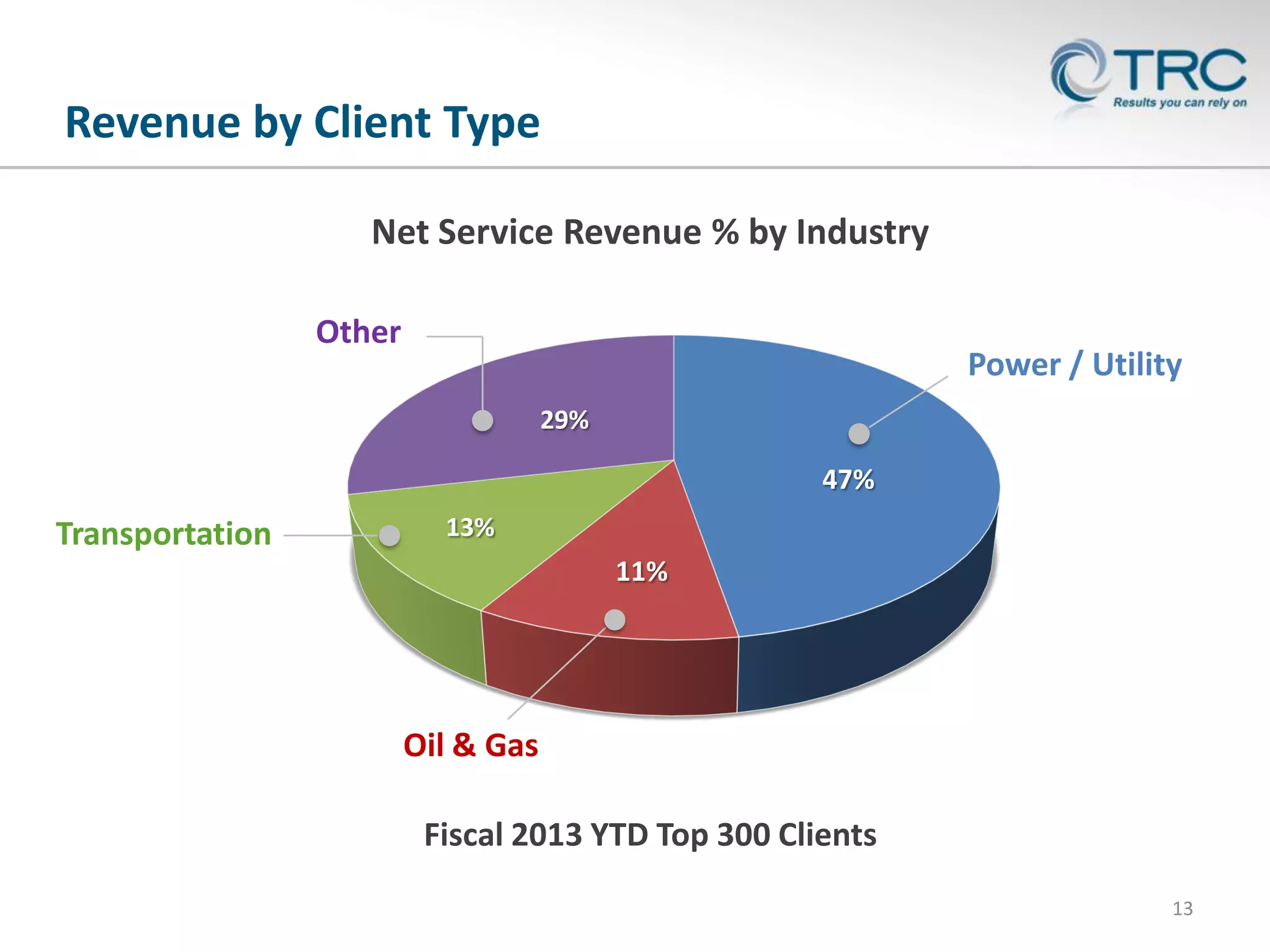

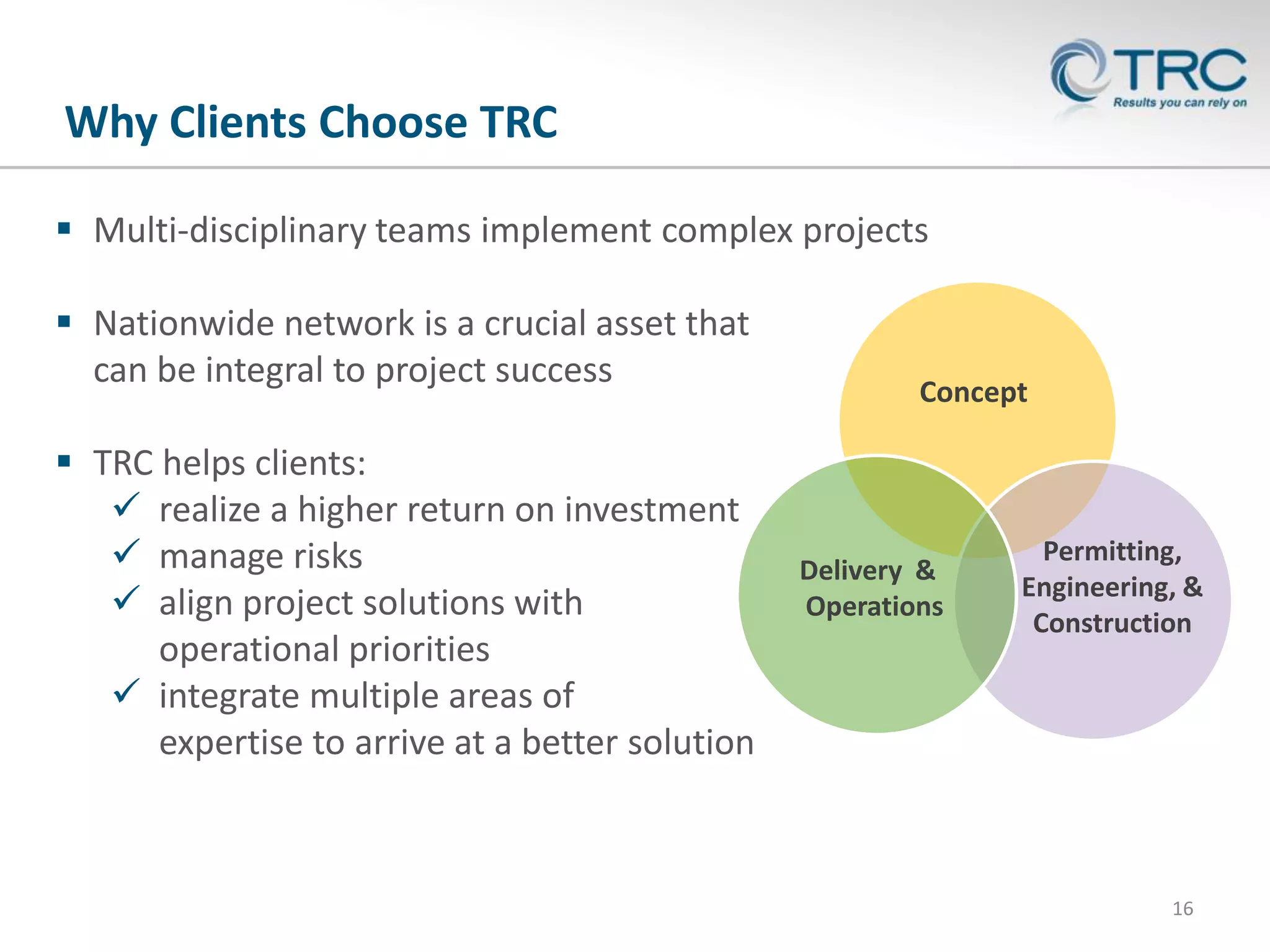

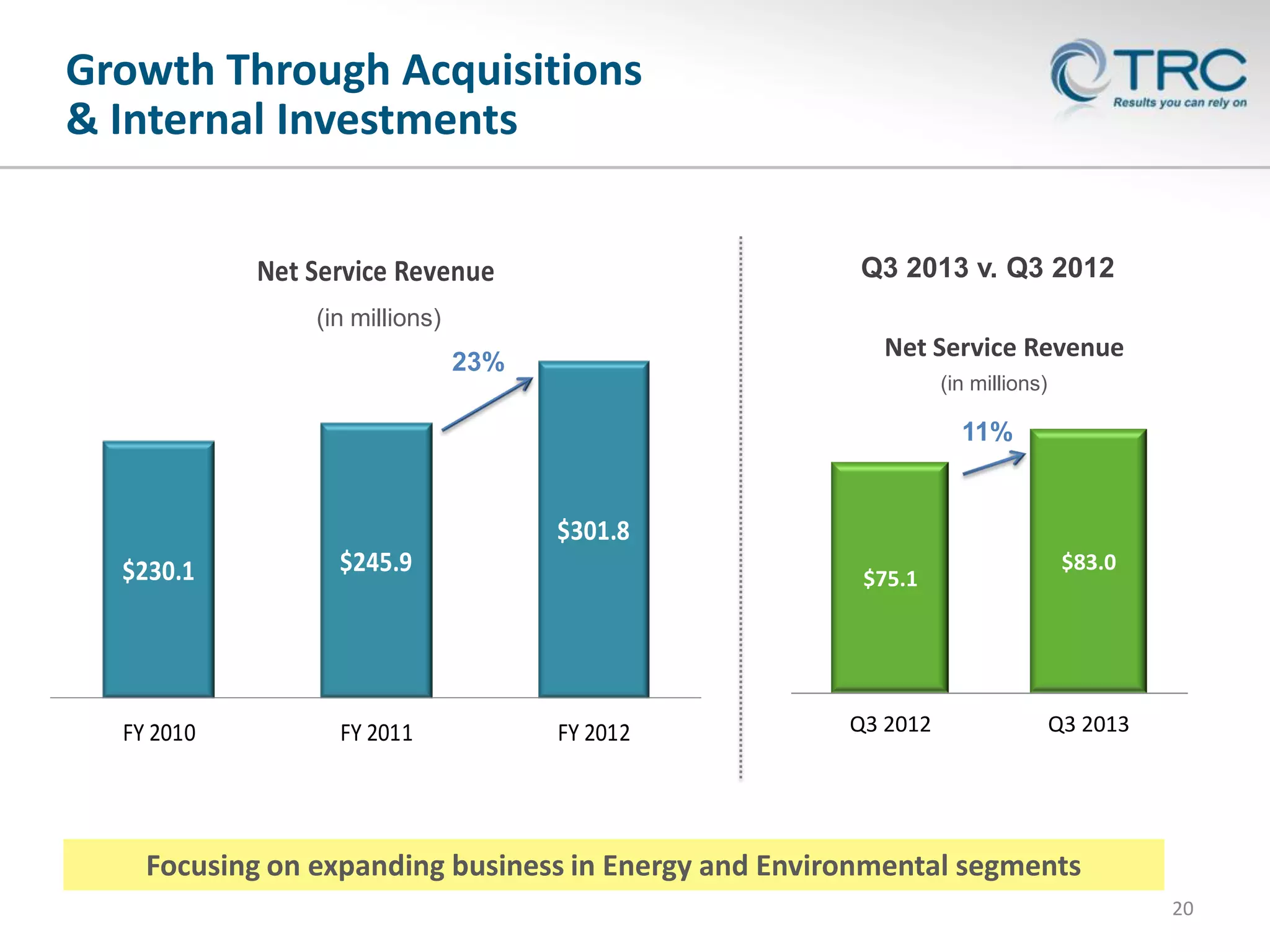

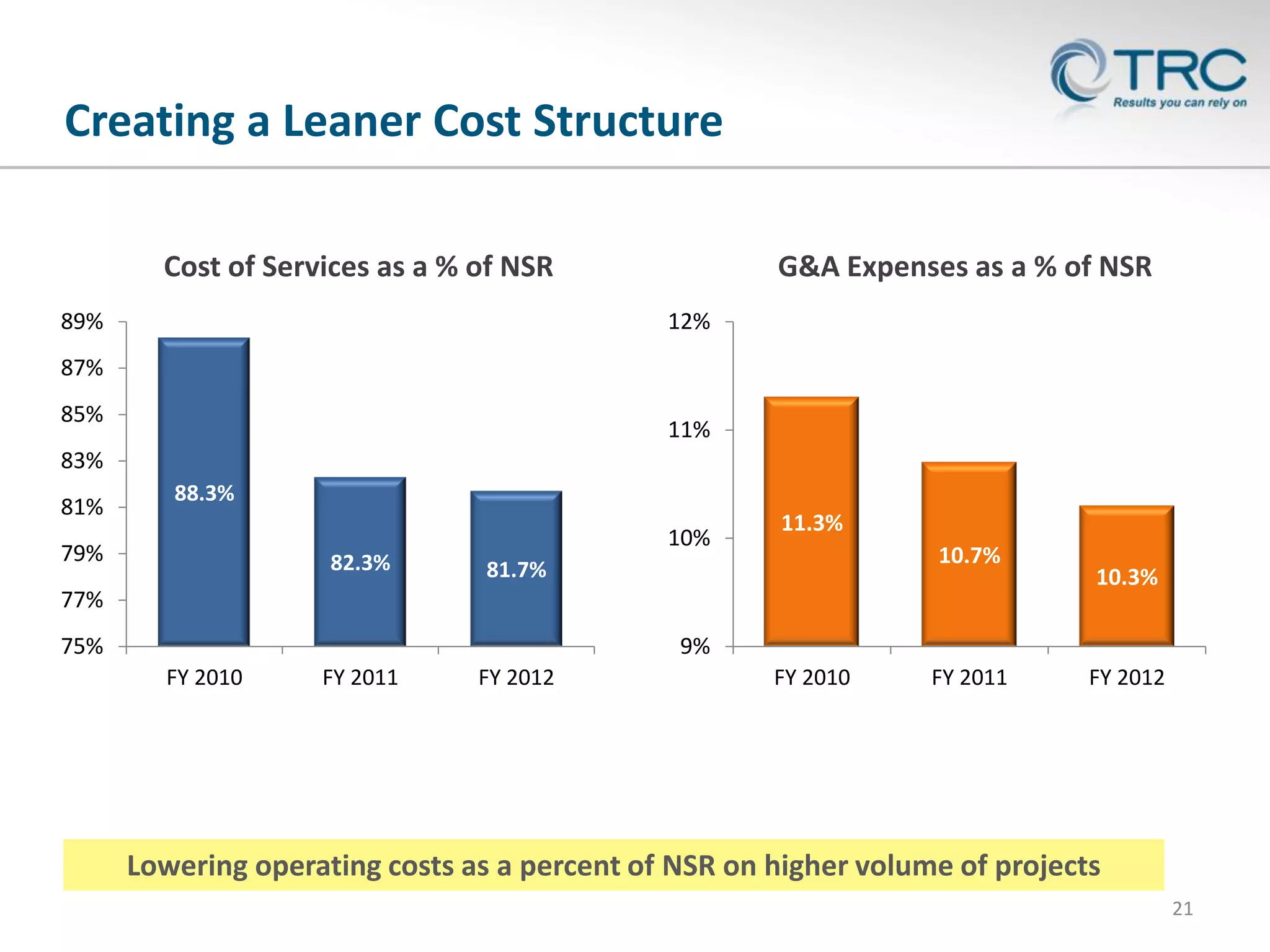

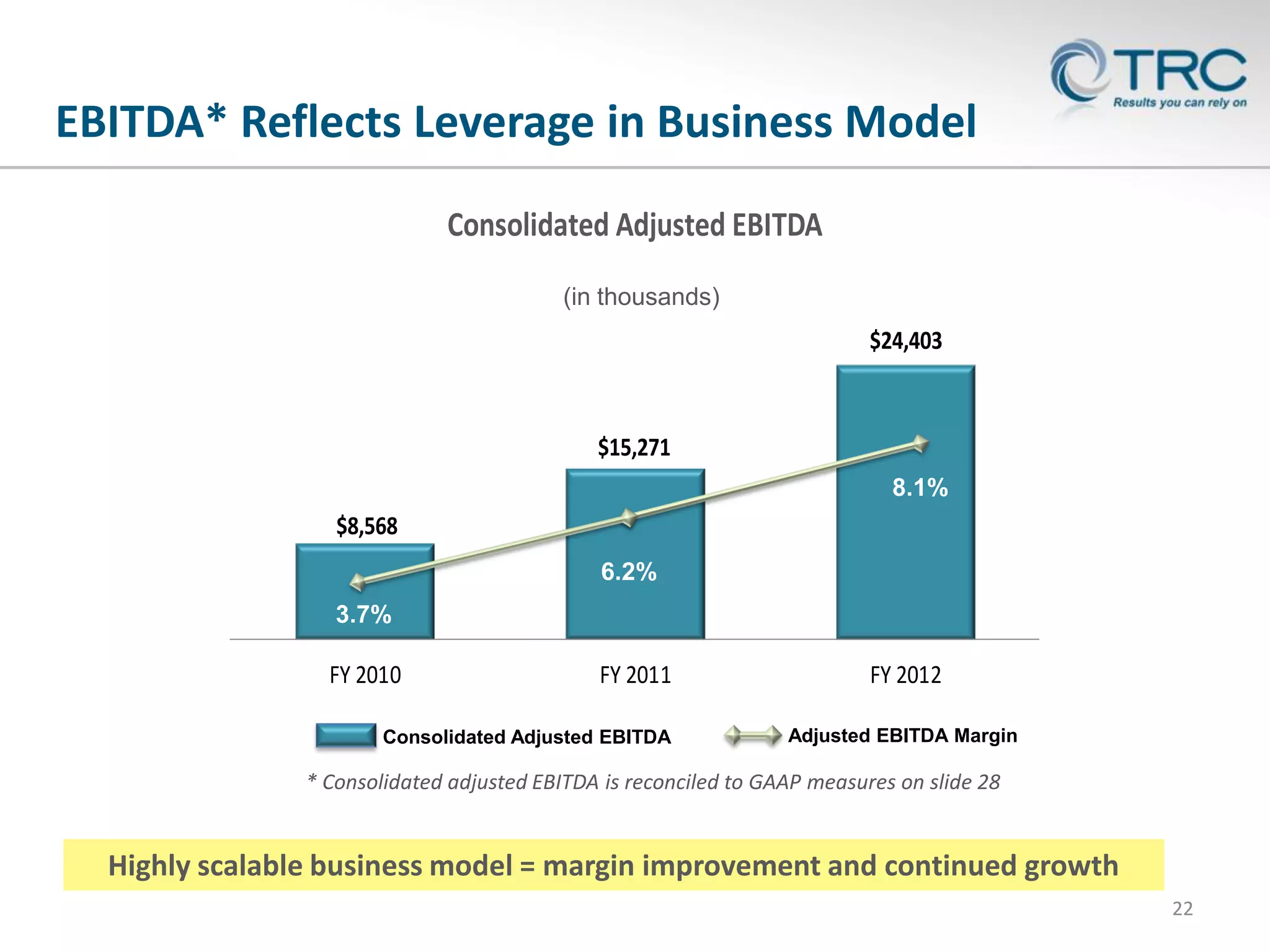

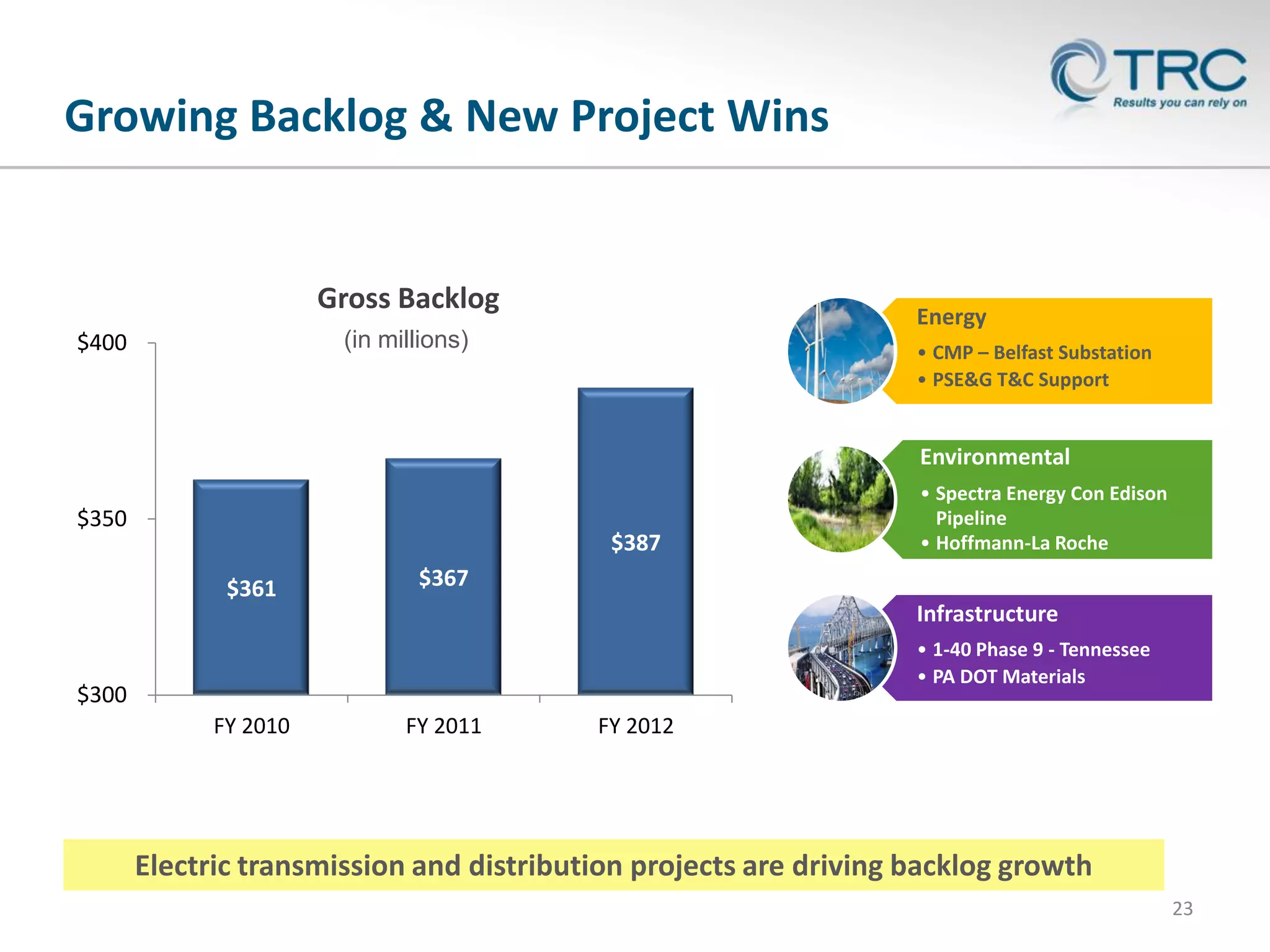

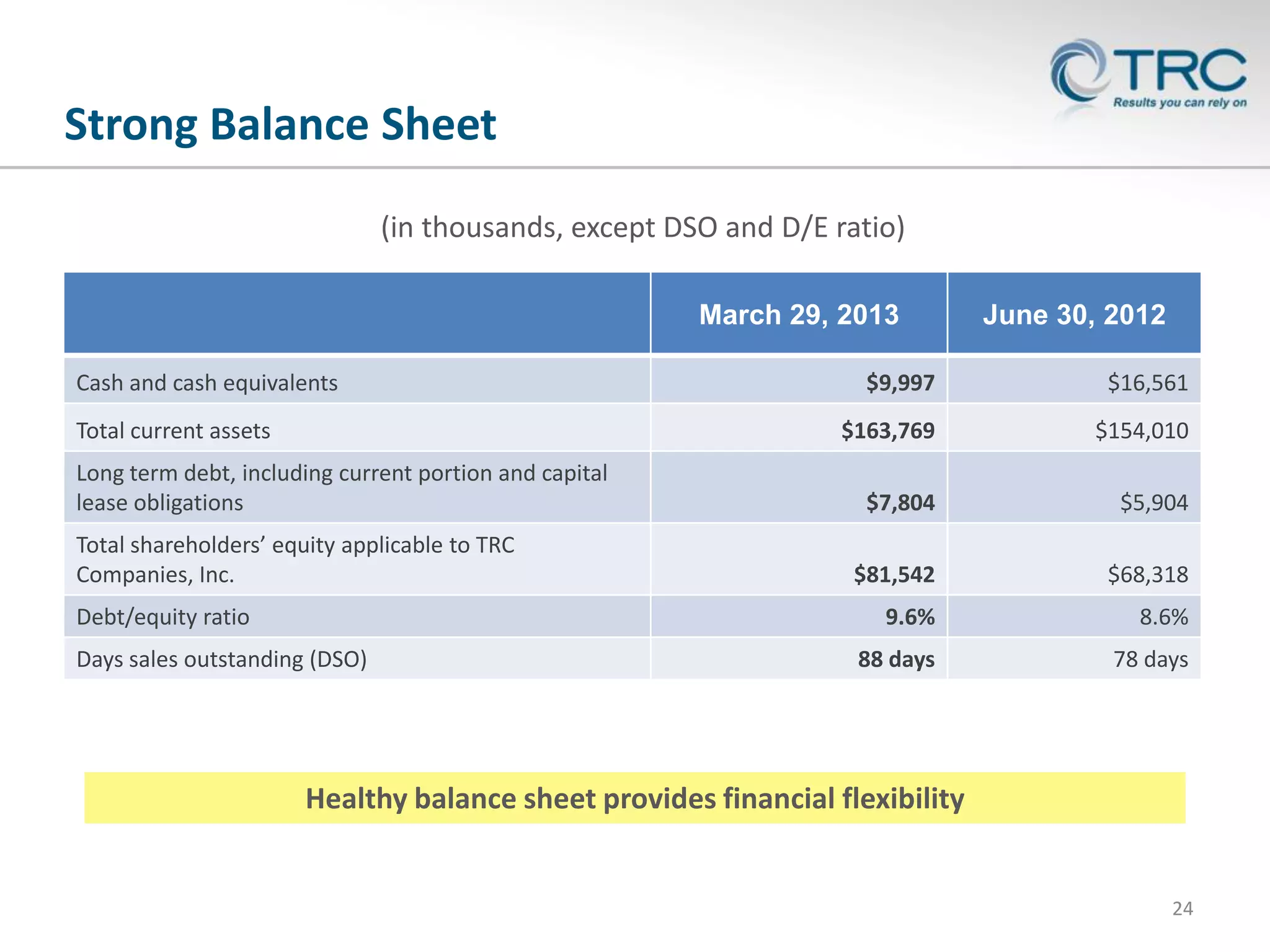

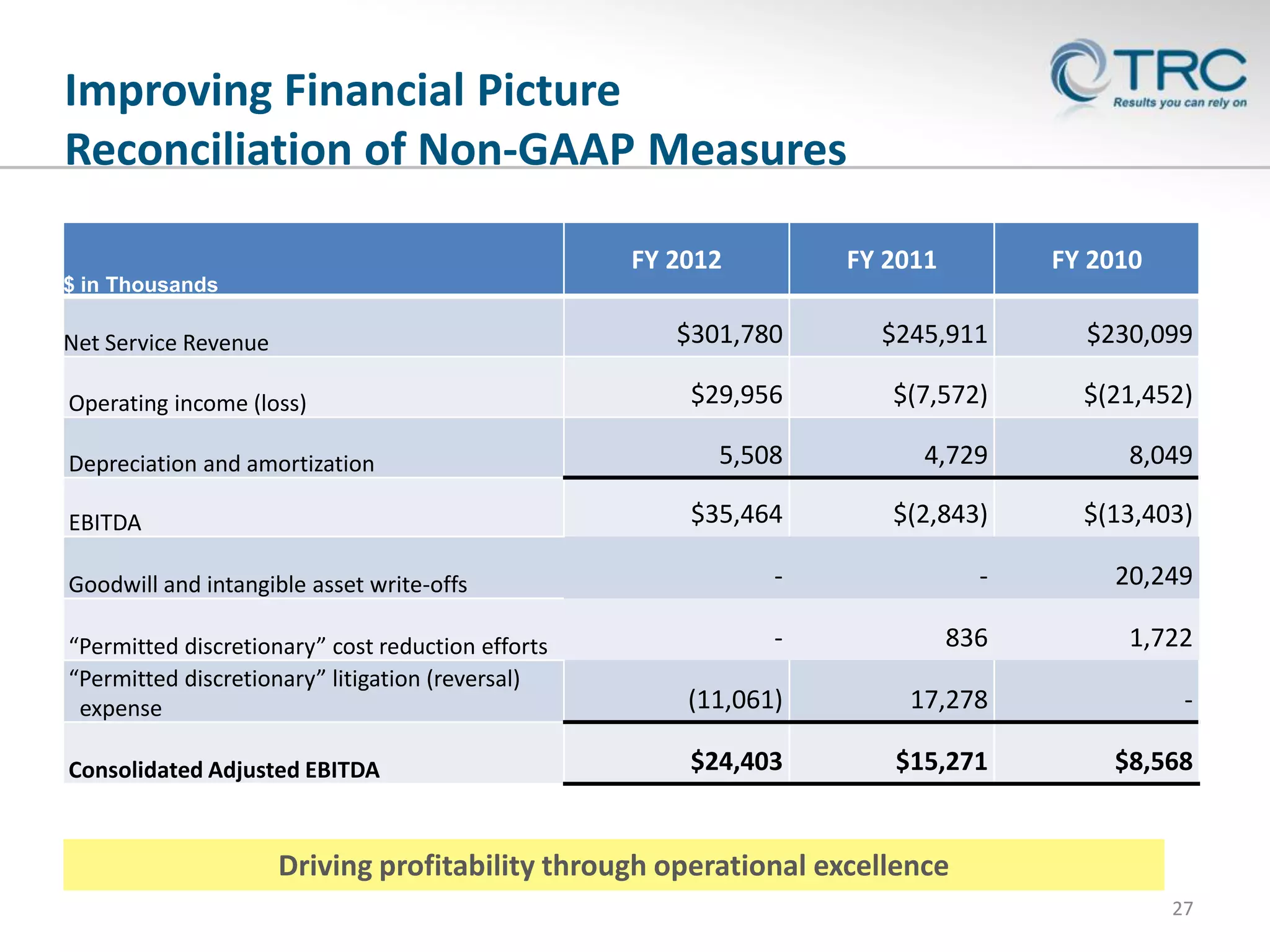

The presentation summarizes TRC's business and financial performance. TRC provides engineering, consulting and construction management services to the energy, environmental and infrastructure industries. It has transformed its business through acquisitions, cost reductions and a focus on higher-growth markets. TRC has a diversified revenue base across business segments and clients. It is pursuing organic growth and acquisitions in the utility/power and oil & gas industries. TRC has strengthened its balance sheet and is demonstrating improved financial metrics as it leverages its business model.