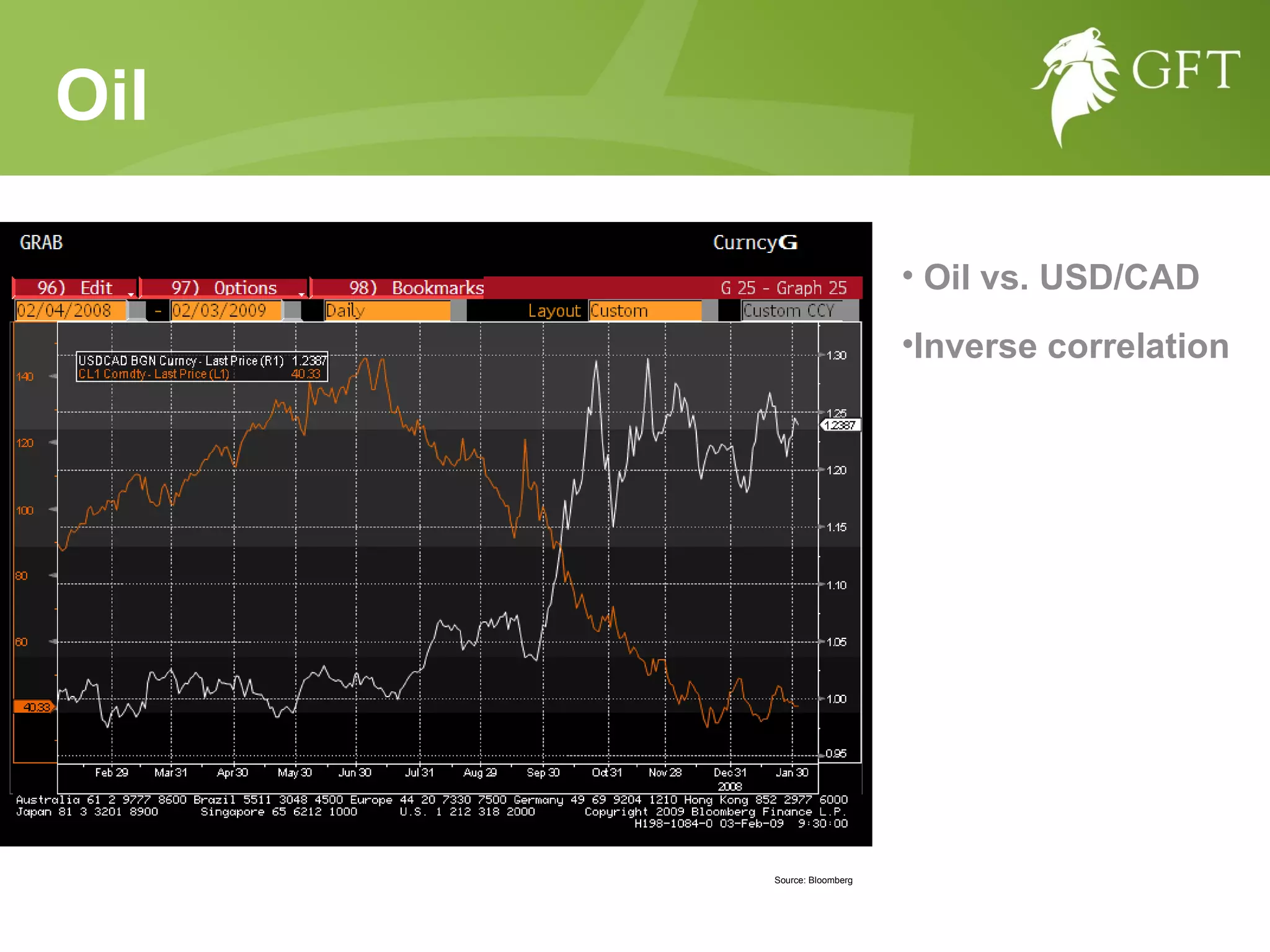

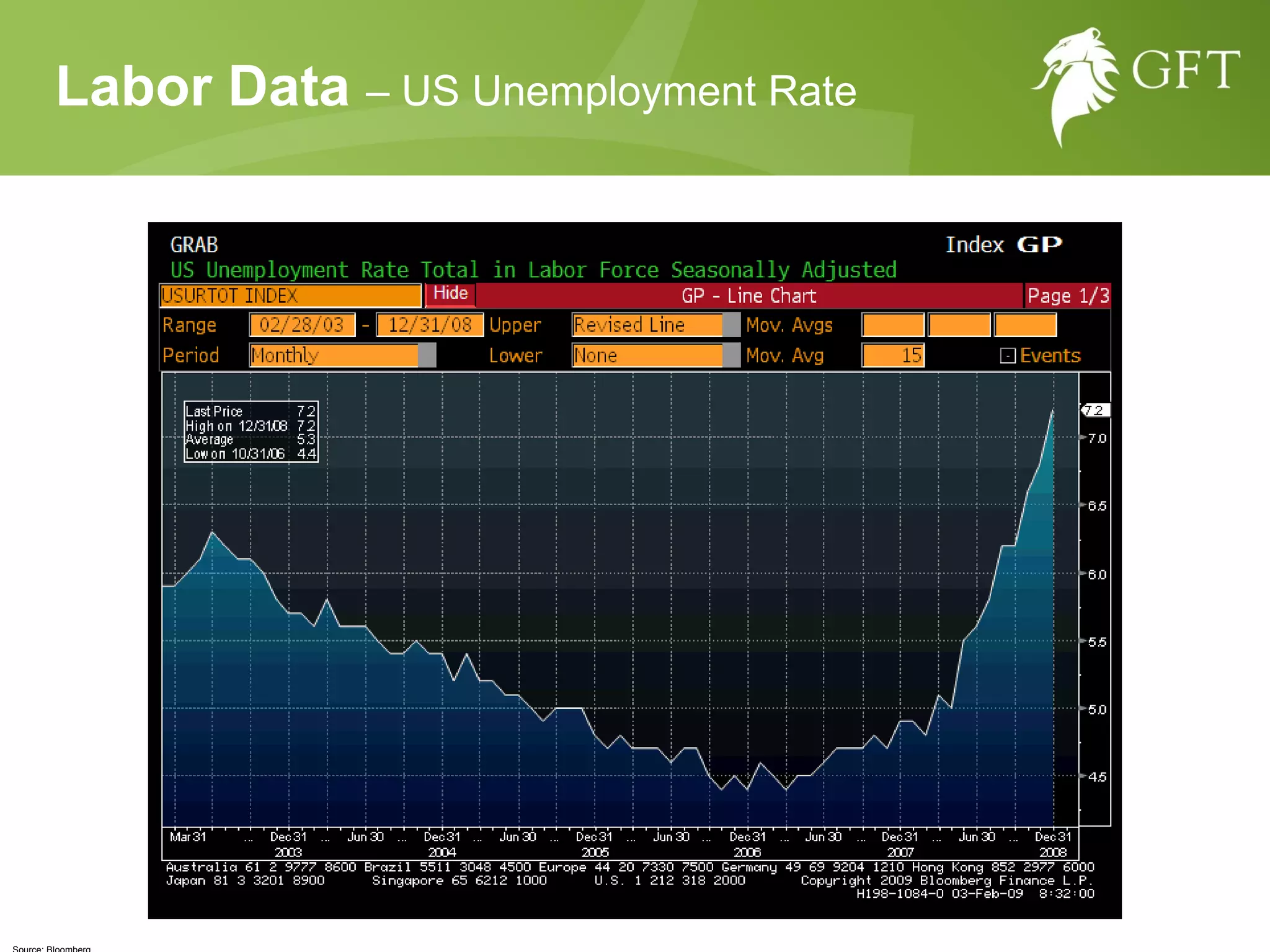

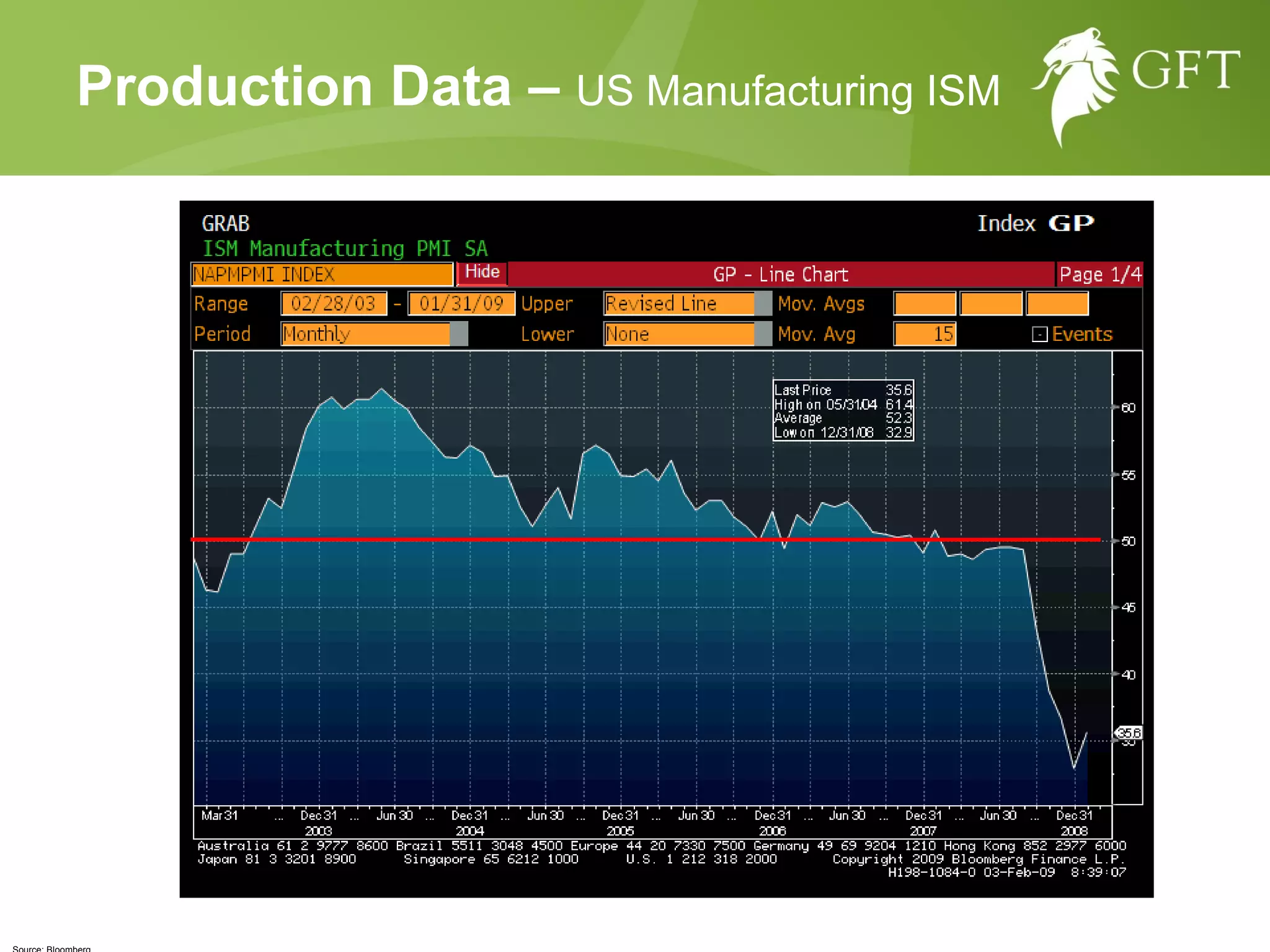

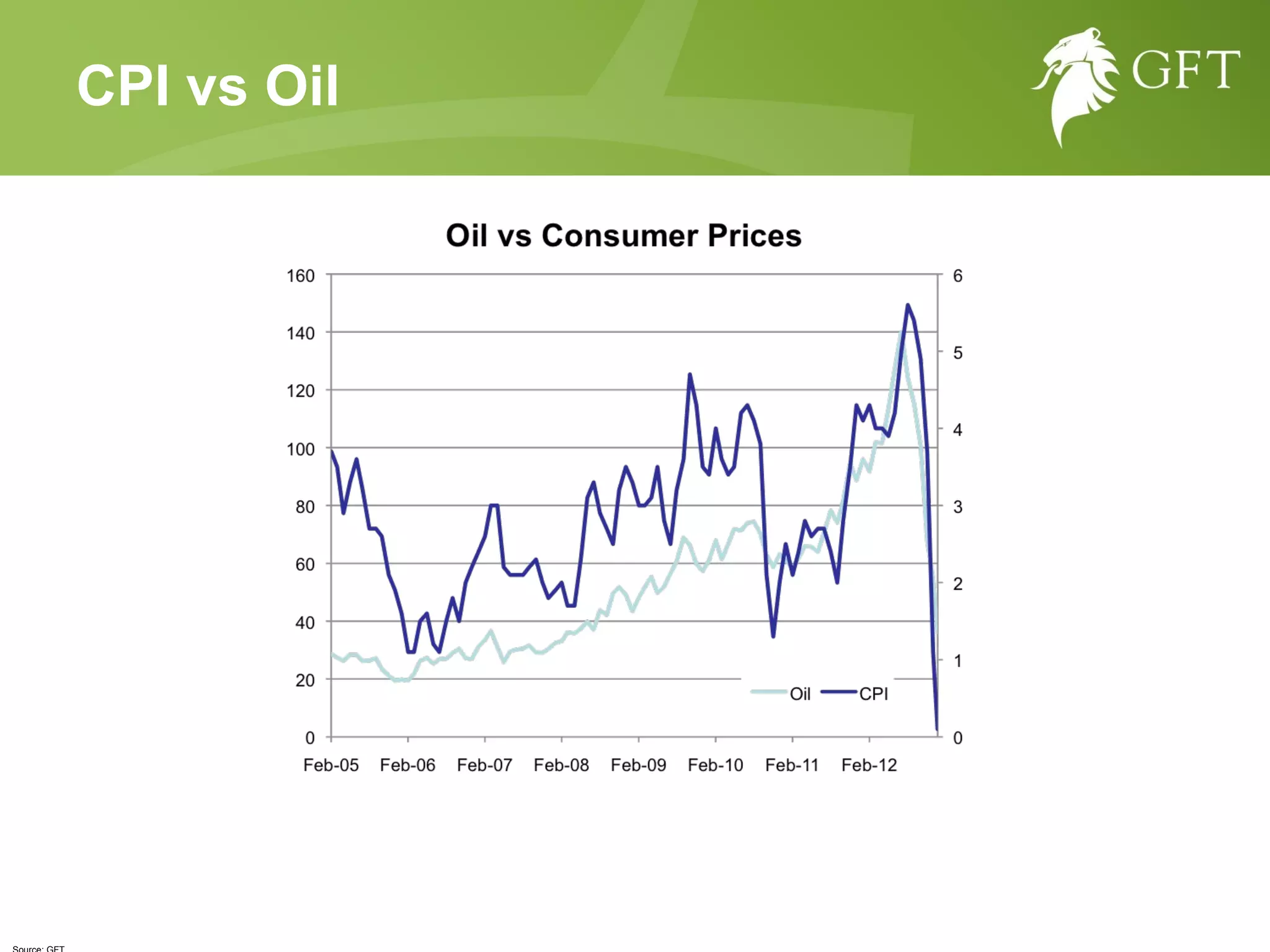

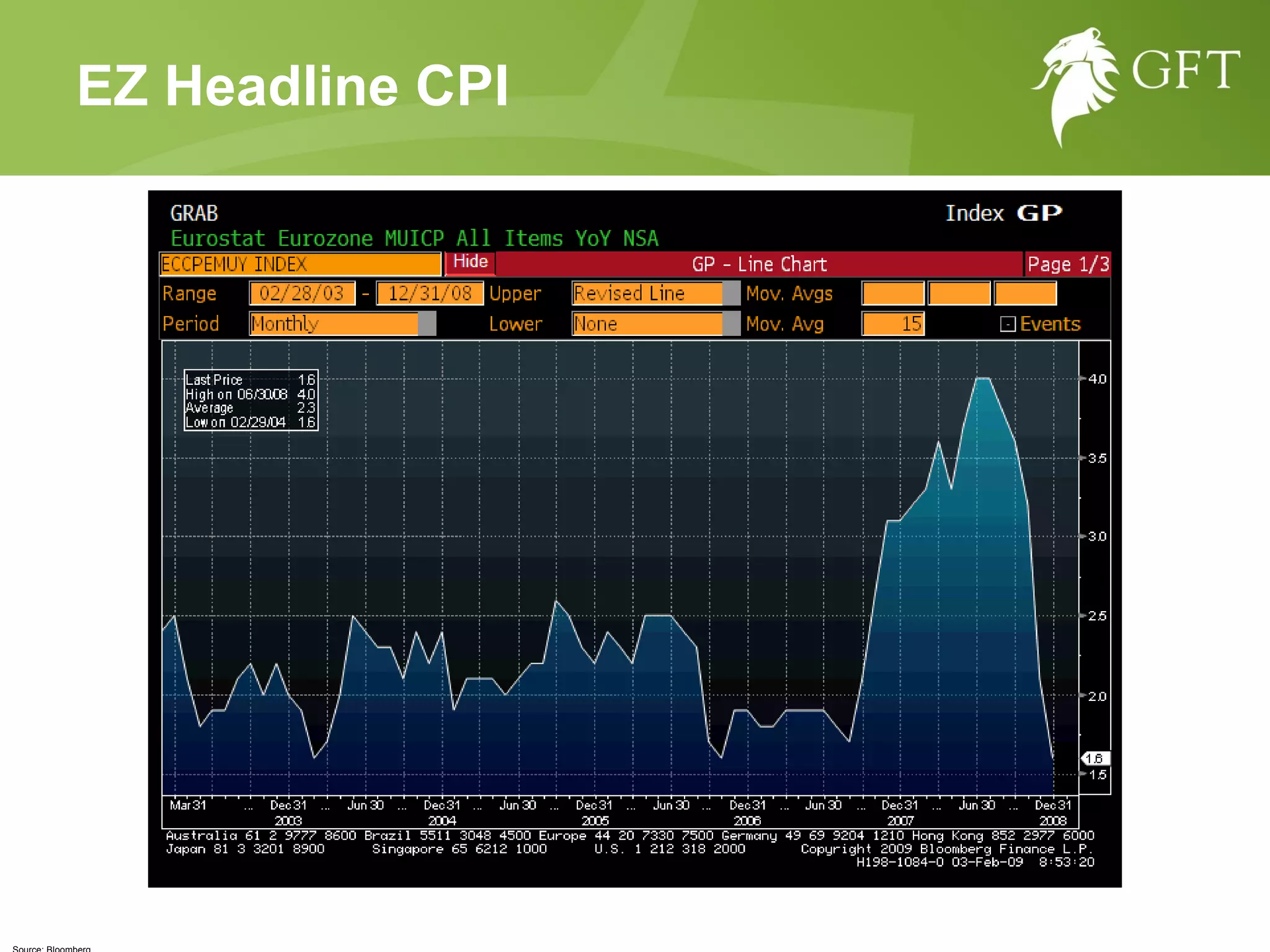

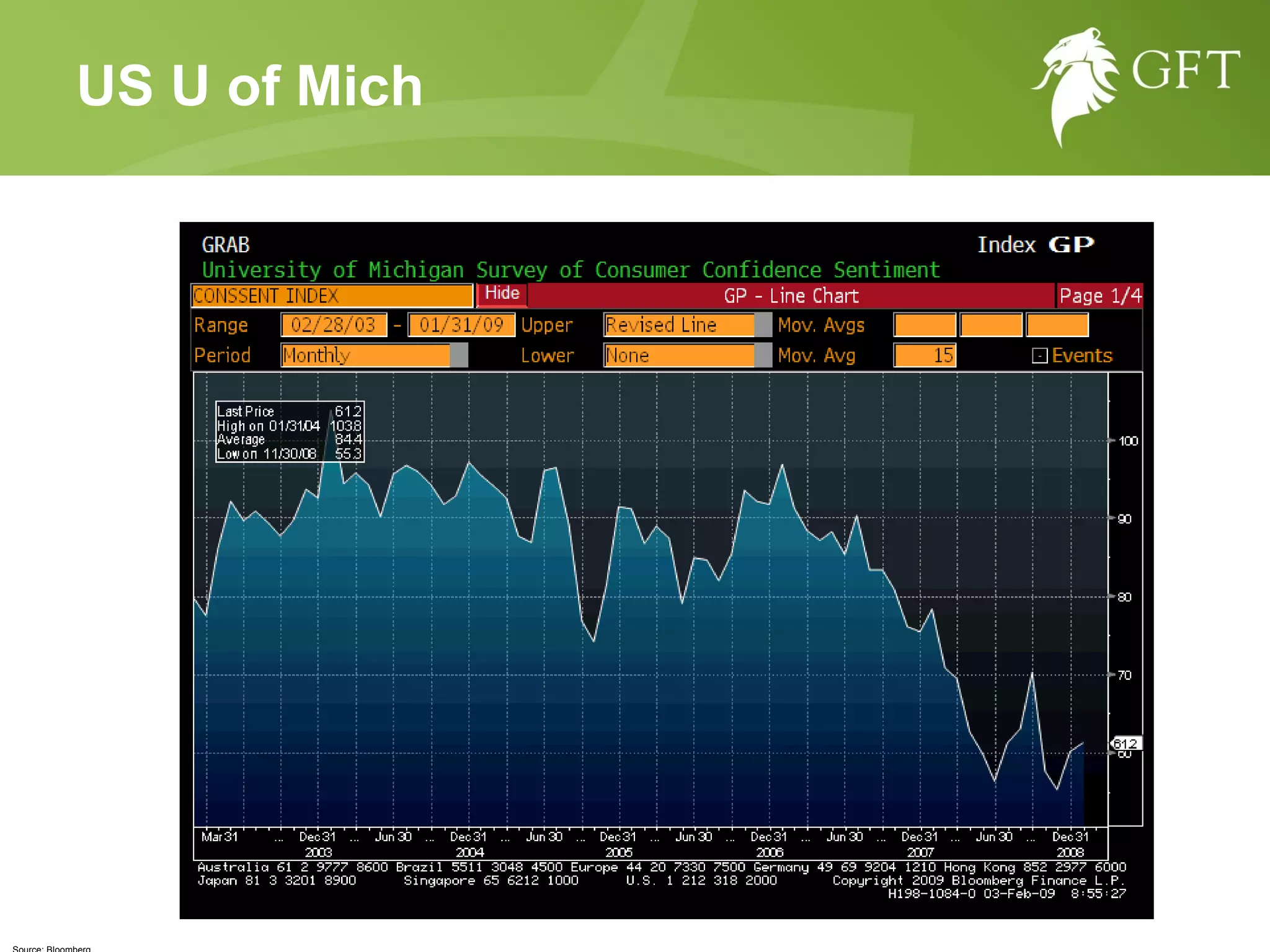

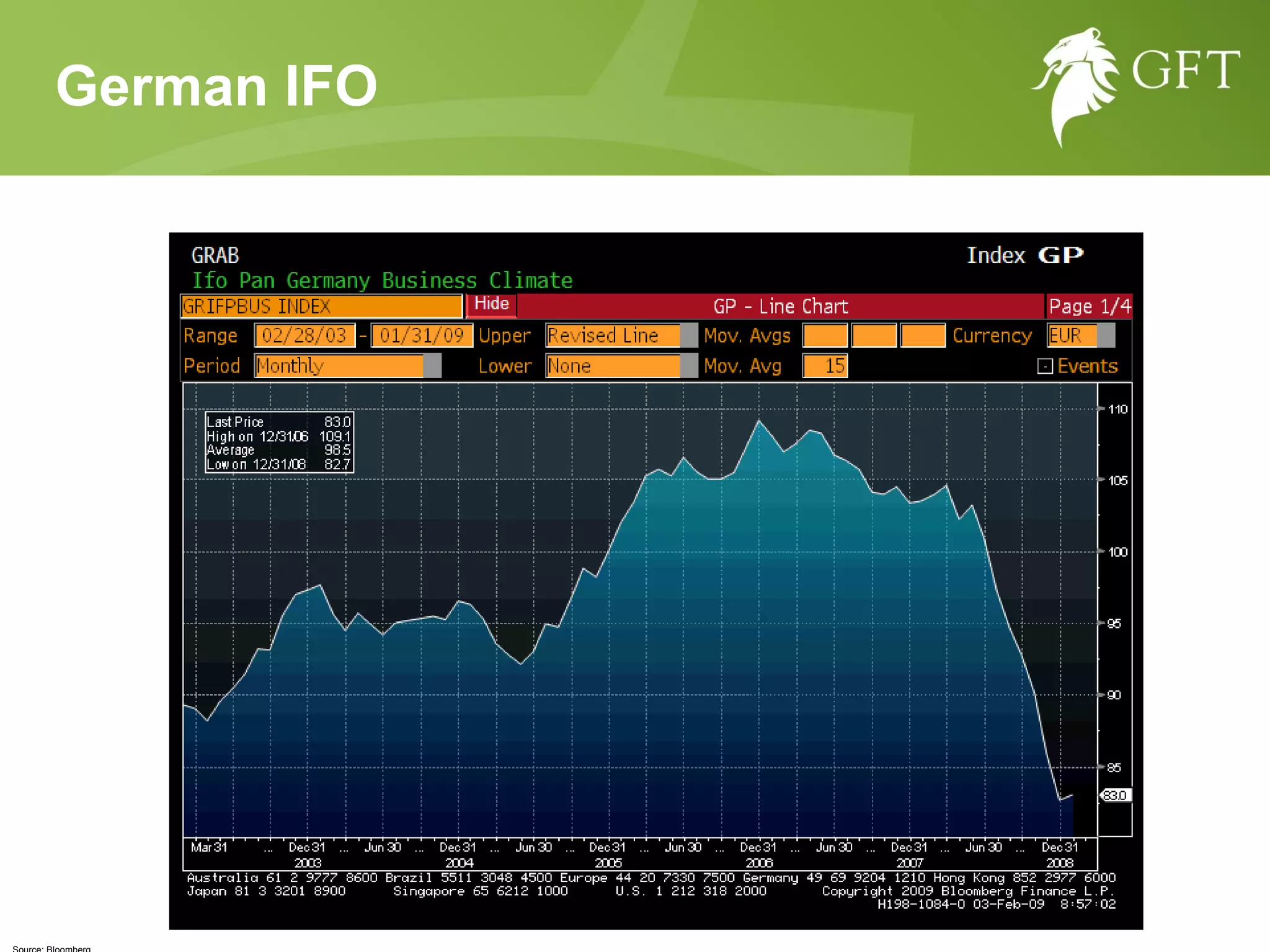

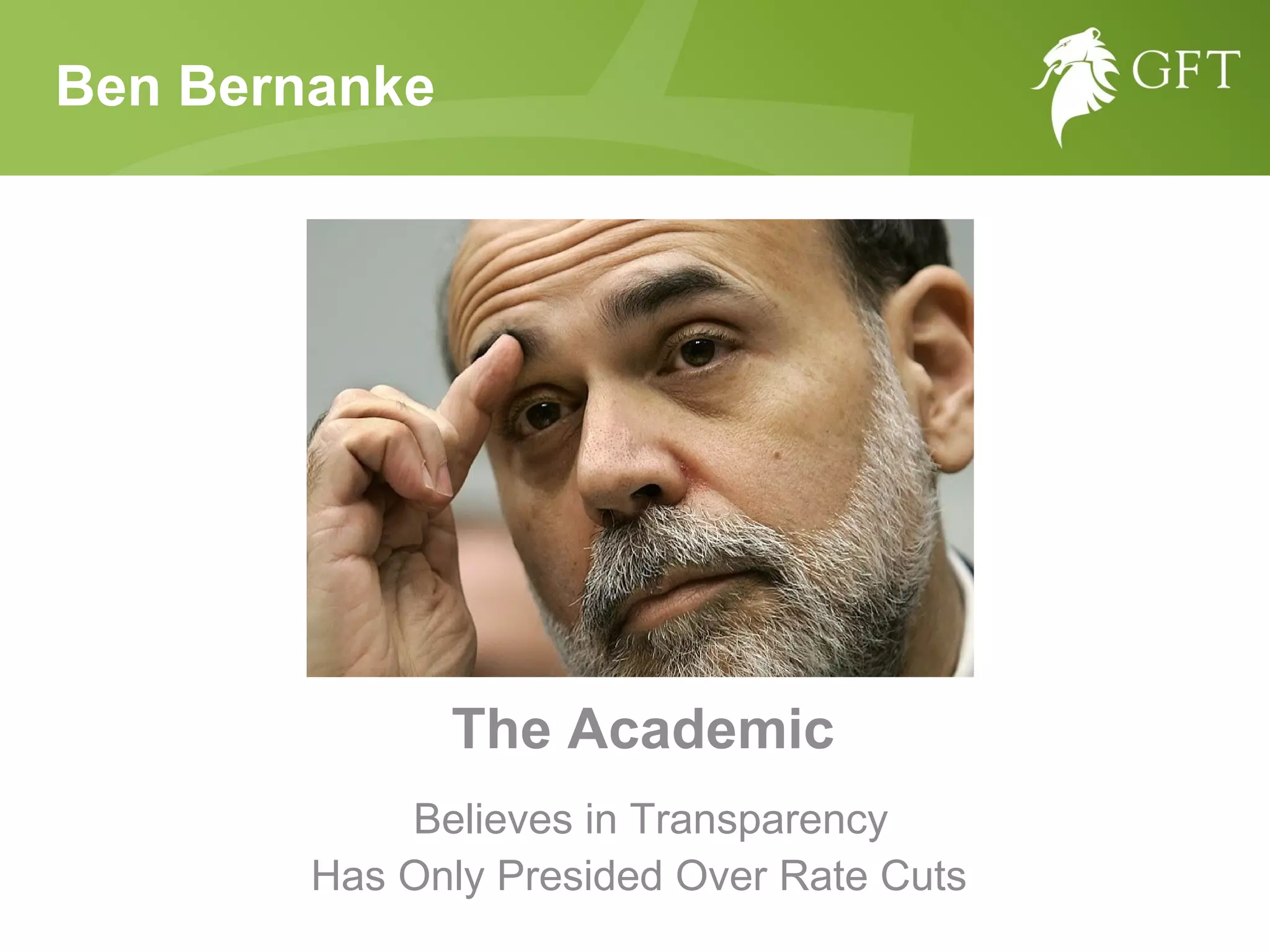

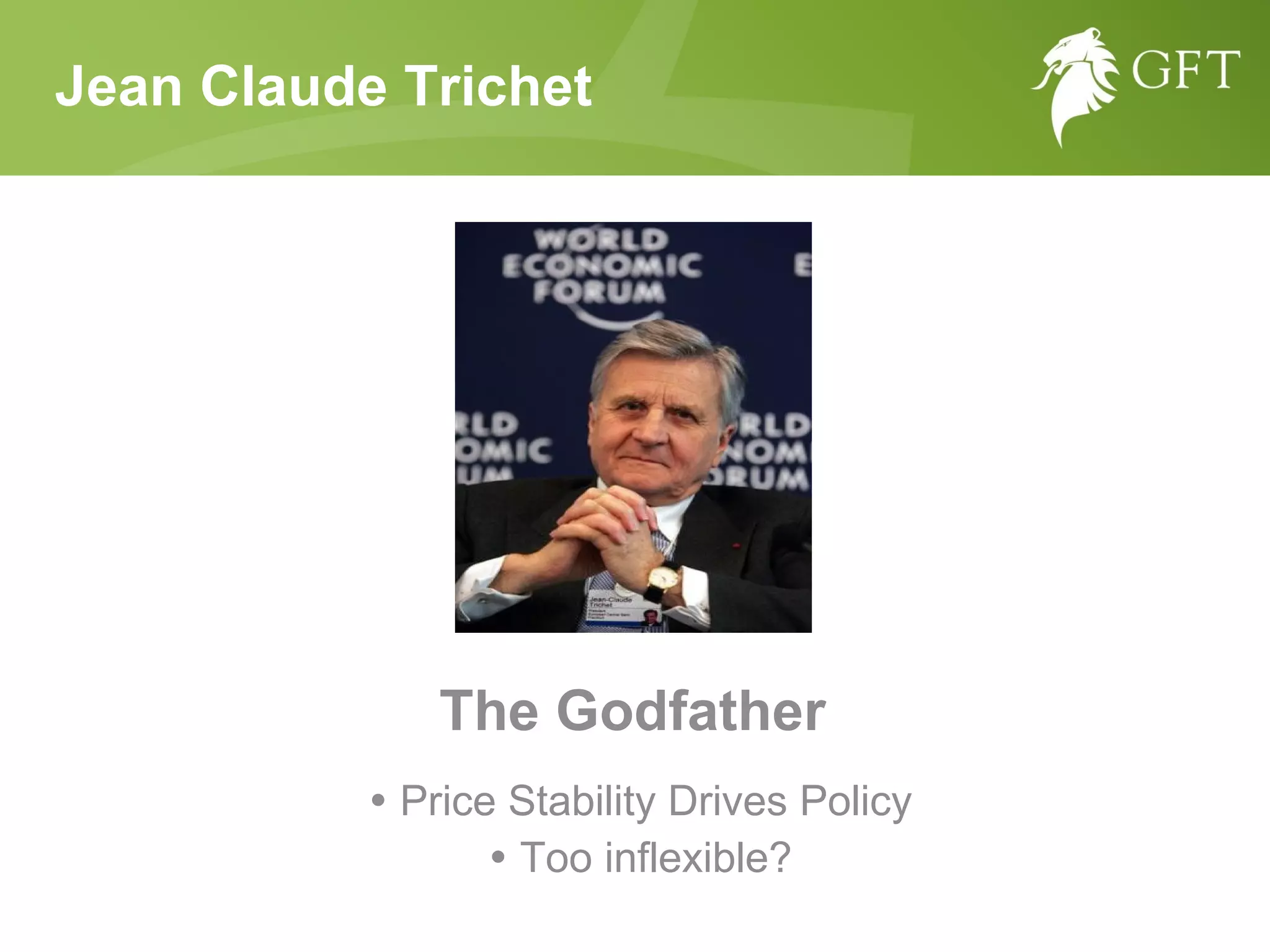

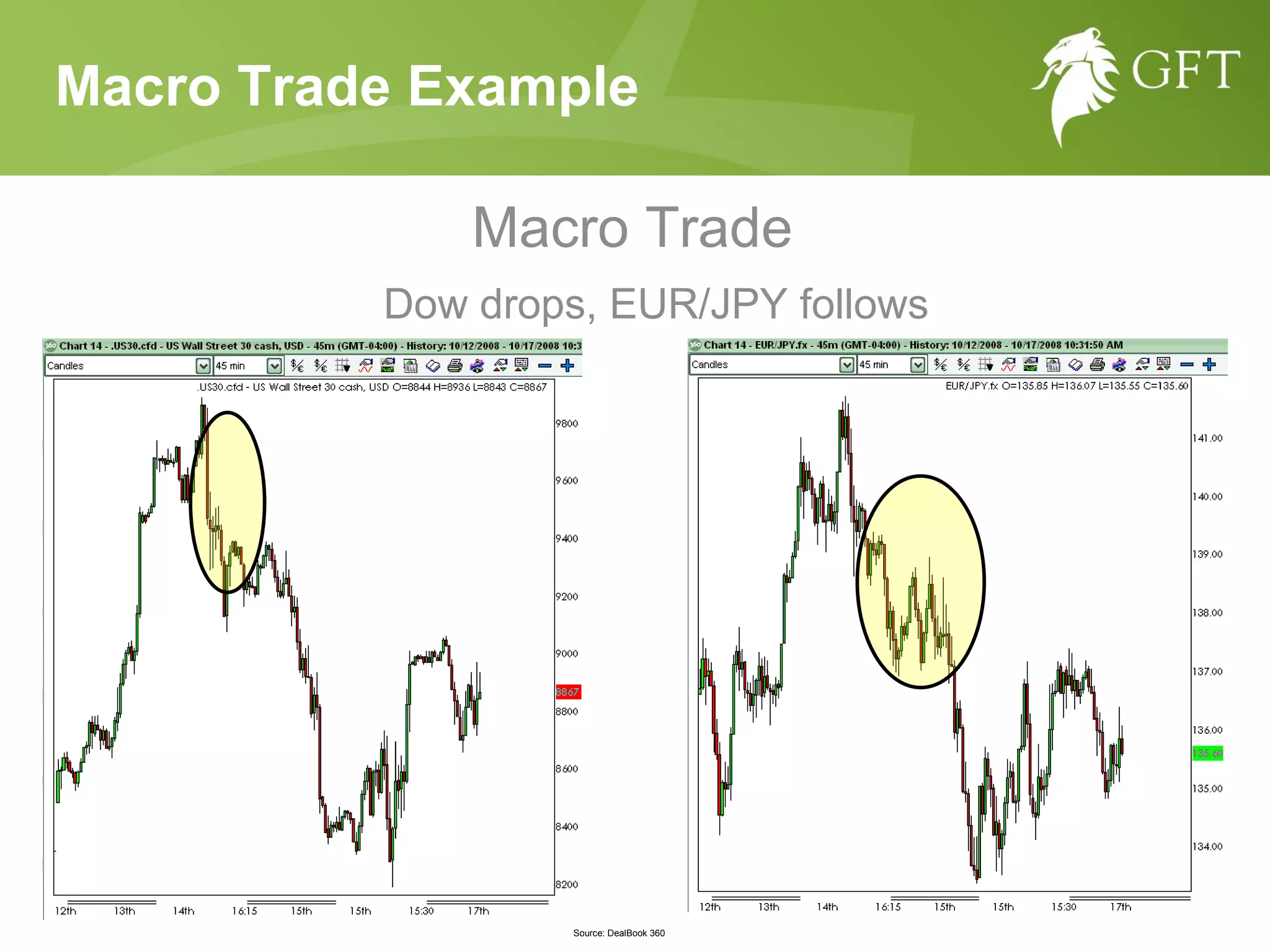

The 3 main factors that influence currency movements are macro factors, micro factors, and monetary policy. Macro factors include political conflicts, equity markets, oil prices, gold prices, and economic sentiment indicators. Micro factors include key economic data releases like employment reports, manufacturing surveys, inflation figures, and consumer sentiment indexes. Monetary policy refers to the interest rate decisions and actions of central banks which can significantly impact currency values.

![GFT refers to Global Futures & Forex, Ltd. and all of its divisions, branches and subsidiaries, including Global Forex Trading, GFT Global Markets Asia Pte. Ltd. and GFT Global Markets UK Limited. In the United Kingdom, GFT Global Markets UK Limited is authorized and regulated by the United Kingdom Financial Services Authority. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful. Trading of foreign exchange contracts, contracts for differences, derivatives and other investment products which are leveraged, can carry a high level of risk, and may not be suitable for all investors. It is possible to lose more than the initial investment. In Australia, GFT means Global Futures & Forex, Ltd. ARBN 103 508 461, AFS License 226625. A Product Disclosure Statement (PDS) is available at www.gft.com.au. You should read and consider the PDS before making any decision to deal in GFT products. This [advertisement] is published by GFT Global Markets Asia Pte. Ltd. (Company Registration Number 200717665N) in Singapore for informational purposes only and is not an offer or a solicitation to deal in any investment product or to enter into any legal relations, nor an advice or a recommendation with respect to such investment product. © 2009 Global Futures & Forex, Ltd. All rights reserved. CD08BKU.003.021809 DISCLAIMER: This presentation and the information provided here should not be relied upon as a substitute for extensive independent research before making your investment decisions. Global Forex Trading is merely providing this presentation for your general information. This presentation and its information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision based upon this presentation or any information contained within. In addition, any projections or views of the market provided by the author may not prove to be accurate. Global Forex Trading, Boris Schlossberg, and Kathy Lien will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained in this presentation. Global Forex Trading, Boris Schlossberg, and Kathy Lien do not render investment, legal, accounting, tax or other professional advice. If such advice is sought, or other expert assistance is required, the services of a competent professional should be sought Disclaimer](https://image.slidesharecdn.com/three-ms-currency-market-090303191350-phpapp01/75/Three-Ms-Currency-Market-2-2048.jpg)

![GFT refers to Global Futures & Forex, Ltd. and all of its divisions, branches and subsidiaries, including Global Forex Trading, GFT Global Markets Asia Pte. Ltd. and GFT Global Markets UK Limited. In the United Kingdom, GFT Global Markets UK Limited is authorized and regulated by the United Kingdom Financial Services Authority. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful. Trading of foreign exchange contracts, contracts for differences, derivatives and other investment products which are leveraged, can carry a high level of risk, and may not be suitable for all investors. It is possible to lose more than the initial investment. In Australia, GFT means Global Futures & Forex, Ltd. ARBN 103 508 461, AFS License 226625. A Product Disclosure Statement (PDS) is available at www.gft.com.au. You should read and consider the PDS before making any decision to deal in GFT products. This [advertisement] is published by GFT Global Markets Asia Pte. Ltd. (Company Registration Number 200717665N) in Singapore for informational purposes only and is not an offer or a solicitation to deal in any investment product or to enter into any legal relations, nor an advice or a recommendation with respect to such investment product. © 2009 Global Futures & Forex, Ltd. All rights reserved. DISCLAIMER: This presentation and the information provided here should not be relied upon as a substitute for extensive independent research before making your investment decisions. Global Forex Trading is merely providing this presentation for your general information. This presentation and its information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision based upon this presentation or any information contained within. In addition, any projections or views of the market provided by the author may not prove to be accurate. Global Forex Trading, Boris Schlossberg, and Kathy Lien will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained in this presentation. Global Forex Trading, Boris Schlossberg, and Kathy Lien do not render investment, legal, accounting, tax or other professional advice. If such advice is sought, or other expert assistance is required, the services of a competent professional should be sought. CD08BKU.003.021809 Disclaimer](https://image.slidesharecdn.com/three-ms-currency-market-090303191350-phpapp01/75/Three-Ms-Currency-Market-39-2048.jpg)