Teaching from Experience

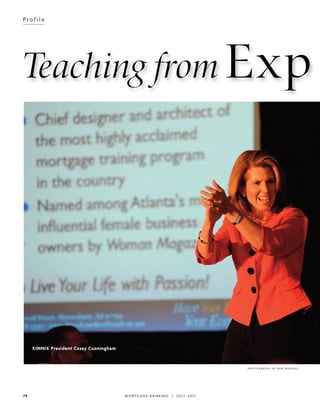

- 1. 78 MORTGAGE BANKING | JULY 201 1 Profile PHOTOGRAPHY BY ROB WHELESS Teaching from Exp XINNIX President Casey Cunningham

- 2. H BY FRANK REDDY 79MORTGAGE BANKING | JULY 201 1 eat from the tarmac seeps through the soles of the young man’s boots. I The 22-year-old walks with a confident gait, his gaze steady and focused as he approaches the sleek, silver war machine. I Stepping onto the aircraft, he pauses. The moment feels surreal. The palms of his hands sweat, but his body moves with precision as he eases into the seat and seals the cockpit. I He looks up. The soft blue is scored by the white streaks of high-flying aircraft making their mark, like signatures in the sky. I The fighter jet’s twin engines erupt with fire. I It’s been a long time, yet even today—some 27 years later—Rob Cunning- ham says he’ll never forget what got him into the pilot’s seat of such a masterful machine. Underneath it all was the training. I Cunning- ham’s wife, Casey, still smiles when she hears her husband recall his days as a military aviator. The tales come with ease, the stories filled with insight into the kind of rigorous training required of a disciplined aviator. I His training to become a jet pilot taught him many lessons. I Some of those lessons he and Casey have used to underscore a business plan that relies on a foundation of knowledge—the type of knowledge that aims for high-performance and success in the mortgage industry. I “In aviation, you can’t have a Cessna 150 pilot trying to train F-15 pilots,” says Rob Cunningham, who is executive vice president and co-founder of XINNIX, The Mortgage Academy of Excellence, Alpharetta, Georgia. erience A husband-and-wife team took an idea about building a training company and built a business whose annual revenues more than tripled from 2009 to 2011.

- 3. “They’re never going to listen to a word you have to say. You need those with experience to teach—those who have proven they know how to operate at the edge, the ones who have pushed the envelope.” With Casey Cunningham at the helm of XINNIX, the national business aims to give mortgage loan officers and sales managers the tools its founders have garnered through two lifetimes of sepa- rate but surprisingly similar experience. Casey’s career alone spans nearly three decades. The mort- gage industry, however, was not her first choice. Starting out “I wanted to teach from the time I was a little girl,” says Casey, XINNIX’s president and co- founder. “My mother was a school teacher. You know how you want to follow in your mom or dad’s footsteps?” An energetic and charismatic woman, Casey found she could capture and hold the attention of a large group in most any situation—a trait that would stick. “I was really good in front of an audience and had no stage fright whatsoever, and I really wanted to teach and help people learn,” she says. Casey’s mother told her that teaching might limit her, and she should consider testing other waters. For the time being, she heeded her mother’s advice. In 1984, Casey landed her first job with Atlanta-based Decatur Federal Savings and Loan. Initially hired as a junior administrator, the job descrip- tion of a loan officer enticed her. “At the time, somebody told me that [loan officers] helped people buy a home or finance it, and I said, ‘That’s what I want to do,’” she says. “Even though I wasn’t teach- ing, I wanted to do something that was impacting people’s lives and making a difference,” she says. “Around the time I stumbled into the mortgage area, I found that peo- ple have three things they want in their lifetime in gen- eral: They want to buy a home, get married and have children. 80 MORTGAGE BANKING | JULY 201 1 XINNIX aims to give mortgage loan officers and sales managers the tools its founders have garnered through two lifetimes of separate but surprisingly similar experience. Rob and Casey Cunningham founded XINNIX in 2002

- 4. 81MORTGAGE BANKING | JULY 201 1 “I said to myself, being in this field will allow me to impact them in one of the most significant areas of life—helping them to buy a home.” She continued her career in the industry, taking a position with HomeBanc, then working her way up to executive vice president of the $4 billion super-regional mortgage company, where she earned recognition as one of the top-producing loan officers in the nation. As a loan officer from day one, she began chronicling the ideas and tools she—and others—could use to succeed in the fast-paced, rapidly evolving mortgage industry. Adaptation Since its founding in 2002, XINNIX began offering train- ing classes exclusively in the traditional, face-to-face class- room setting. In 2008, however, the Cun- ninghams decided to make some changes out of a growing need to respond to the industry, which at the time was undergo- ing an epic downturn. The costs associated with travel—including hotel rooms, booking flights and rental cars—were increasingly hard to justify for course participants as the mortgage market entered a tailspin. “Really, 2008 was a difficult year,” Casey says. “In October of 2008, when the crickets were chirping in the industry and everybody was in dire straits, we came together as a team and decided to go online. It was a radically different model.” It turned out to be a successful model that has grown. The company also offers one-on-one training and coach- ing, but online classes currently account for 90 percent of XINNIX course material. “We put [online courses] through a rigorous testing program, with resounding success. Today, what you see with our online courses comes from years of practicing and getting better and refining . . . that includes the way the materials flow and what goes on the screen,” Casey says. XINNIX’s online courses currently include sales man- agement training, advanced loan officer training and wholesale account executive workshops. When working with XINNIX, Sandy, Utah–based Academy Mortgage Corporation chose an interactive, integrated suite of training programs and services. Throughout the eight-week courses, Senior Vice Presi- dent Bill Bent says the value becomes apparent. “We didn’t even consider other training programs,” says Bent, who has been a XINNIX customer for more than eight years. “My belief and faith in the program was strong enough to recommend it to Academy Mortgage.” Bent is also a member of XINNIX’s nine-person advi- sory board, a forum for established industry experts to address and respond to sales and leadership challenges specific to the financial industry. “We were eager to join [the advisory board] and be as instrumental in their growth as they have been in ours,” Bent says. Financial growth The privately held business has done well, with annual revenues from 2009 through 2011 more than tripling. XINNIX—which owns all of the company—has aver- aged 68 percent year-over-year growth during the past 24 months. According to Casey, it’s a financial trend that she sees continuing into the future. “We anticipate our best year to be 2011 in terms of demand we are seeing for XINNIX services,” she says. The services XINNIX offers, she adds, are the reason for continued success. It wouldn’t be possible, she adds, without a regimen that chal- lenges its participants in ways others programs don’t. Terry Mott, vice president of production at Murray, Utah–based Republic Mort- gage Home Loans, says that over the past seven years, XIN- NIX has challenged his com- pany’s employees in training that is “second to none in the industry.” He adds, “Casey and her staff share an enthusiasm, commit- ment and personal integrity that set them apart from their peers.” Mott says he has an “appreciation for XINNIX and the impact [its] training has had on our organization.” Keeping trainees on their toes There are certain aspects that give XINNIX its uniqueness, says Casey Cunningham. Most notably, XINNIX strives to keep the classroom setting one of “pure learning.” She adds, “In most training online, you can see the other attendees’ names. You can be recruited . . . starting a dialog with another attendee. . . . From what I’ve seen in the mortgage world, that kind of online setup quickly becomes a recruiting channel. “It is possible to still create the dialog and the sharing of information without disclosing everyone’s names,” she says. During online classes, Casey and other XINNIX train- ers use tools like voting polls and drawing boards. Stu- dents can also chat directly with the instructor at any time. Creating an environment of pure learning also means keeping trainees on their toes. The software XINNIX uses for its online classrooms allows the instructor to see if participants minimize their Internet browser window. It’s the virtual equivalent of falling asleep in class, Casey says, and she’ll be the first to call participants out when they’re not keeping up with the program. “If you’re in a class and you’re not paying attention, how much do you think you are going to learn? I want you to look at me when we’re talking. It’s the same XINNIX—which owns all of the company— has averaged 68 percent year-over-year growth during the past 24 months.

- 5. online as it is in person,” she says. “I’ve never had students complain: ‘Gosh, they’re call- ing me out.’ I hope it tells them we care,” she says. Greg Clements, branch manager in Atlanta for Des Moines, Iowa–based Wells Fargo Home Mortgage, says that in general XINNIX’s online training approach goes above and beyond the industry norm. “With today’s technology, it is cheaper and easier to train from a central location via online computer and telephone than to have people travel,” Clements says. As it continues to pursue the online route, XINNIX also is taking on social media. An upcoming course entitled “LinkedIn for Loan Officers” helps participants maximize social media channels using the online networking site. Going online was one of the company’s major adapta- tions in the midst of a changing industry. Another big innova- tion was the decision to allow lenders to buy corporate part- nerships with XINNIX. Corporate partnerships “That was a radical change for us,” Casey says. “Prior to that, a company would buy 10 seats in our courses . . . now, [we ask] ‘How big is your company, how many people do you have and here’s the price to have access to everything we offer for a year.’” Academy Mortgage pur- chased a corporate partnership from XINNIX in 2010, enabling the company to extend access to its 75 branches nationwide and hundreds of satellite offices. “We had utilized XINNIX training programs previ- ously on an a la carte basis,” Bent says. “However, with their online training, we were able to more broadly invest in XINNIX’s corporate partnership, providing our entire workforce access to all the training programs available.” Prior to the corporate partnership option, lenders were buying course slots for “a select group of loan offi- cers instead of offering it for the whole company,” says Casey. “We felt like we couldn’t change a culture, we couldn’t get the unified sales culture, we couldn’t get the accountability and the leaders if we didn’t have every single person involved . . . from the top down.” The advantages to that, Rob Cunningham adds, are immeasurable. “It becomes a prioritization issue as opposed to a cost- rationalization issue,” he says. “We can deliver a full year’s worth of training enterprisewide for what is well less than the revenue that could be generated by one additional closed loan per year, per person. “We’ve completely collapsed any competitive advan- tage that the biggest banks might have as far as training and development is concerned. It’s hard to match what we’re offering,” he says. XINNIX has sold 15 enterprisewide annual corporate partnerships to date, according to the company. The next era of loan officers The company opened in 2002 “with one product,” Casey says. “It was about creating the next era of loan officers by training them the right way on the front end . . . finding sales professionals, financial planners, CPAs [certified pub- lic accountants], stockbrokers and insurance agents, and teaching them the mortgage industry.” To address the needs of today’s mortgage loan offi- cers, new-career seekers and sales management teams, XINNIX aimed to inject knowledge, skills, discipline and ethics “into the very DNA” of the corporate sales struc- ture, Casey says. “We tend to help corporations,” Casey says. “We’re not going after individual loan officers, [although] we have individual loan officers come to us on a regular basis.” The business offers cus- tomized solutions for lenders all around the nation, whether it’s a small shop of three loan officers or a giant company with 5,000 employees. “It’s talking them through their vision—where they’re headed, what their current sta- tus is, what their needs are and what their budget is,” says Casey. The first series of courses that XINNIX ever offered was its sales and leadership pro- gram, which it still offers. The course assists sales manage- ment in strategic business planning, recruiting and retention of loan officers. It also offers coaching skills and sales-force management tactics. “We launched our sales and leadership program to make sure that any salesperson, whether new in the industry or already in the industry, would have a way to accelerate their production and their success,” says Casey. “I’ve always believed, and still do, that leadership in an organization will set the culture and determine the direction and help in reinforcing the company’s mes- sage,” she says. When XINNIX was first founded, its owners hoped to draw its customers from the small to medium-sized busi- nesses, “because they usually didn’t have a training department,” Casey says. Instead, the business was surprised to be “consumed on the front end by the giants that already had training departments, but their training departments didn’t have [courses for] ‘How do you create a business plan? How do you self-source business? How do you sell? And what are the core sales skills necessary to be successful?’ They lacked in those areas,” Casey says. What many in the industry also lack, Rob says, is an “entrepreneur’s mindset. “It’s the idea that every employee, every CEO [chief executive officer], every loan officer should feel responsi- ble for their business and for their own destiny,” he says. And that is a “universal language” that transcends all 82 MORTGAGE BANKING | JULY 201 1 As it continues to pursue the online route, XINNIX also is taking on social media.

- 6. business titles, he adds. “Whether you’re a manager going through the leader- ship class and looking at business planning tools . . . or if you’re an experienced loan officer that’s a veteran . . . all the business management tools and all the terminology are exactly the same,” he says. In order to put trainees into the correct mindset, Rob adds, the trainers must first have “street credibility.” The staff of instructors at XINNIX has grown over the years, now teaching hundreds of courses per year. Of the more than 10,000 mortgage loan officers trained to date, the business has assisted with training and placement of more than 1,000 new loan officers throughout the United States, with more than 200 lenders and brokerage firms. Some of the largest compa- nies XINNIX has assisted over the years include SunTrust Mortgage, Fifth Third Bank, Academy Mortgage, MetLife Home Loans, Envoy Mortgage and Republic Mortgage Home Loans. Dodd-Frank Act Despite XINNIX’s attempts to instill high performance stan- dards in its program partici- pants, Casey says she has always felt “challenged by some of the unethical loan officers that have represented our industry. “There’s so many wonderful people in the mortgage industry, but there are those that have abused the sys- tem, and that has now impacted all of us,” she says. In the wake of the financial crisis, Congress sought to reform many aspects of the financial markets to both address the problem of institutions being too big to fail, and to better protect consumers. The Dodd-Frank Wall Street Reform and Consumer Protection Act was created on July 21, 2010, representing a paradigm shift in the way American financial markets could operate in the future. One component of the new law changed origina- tor compensation methods and prohibited originators from getting paid extra-high commissions for directing borrowers to loans with higher-than-market rates. The change in originator compensation requires a more skilled work force in the future, Casey says. “They must be able to self-source and generate busi- ness, so lenders are reaching out to us to help teach the strategies and tactics to help them be more successful and incrementally increase their units.” From a professional ethics standpoint, as far as origi- nation practices go, Casey says, XINNIX has always stood firm, pre-dating the Dodd-Frank Act. “We train participants to approach the customer with the right solution—not based on their compensation or fees, but based on what’s the right advice for the cus- tomer,” she says. Republic Mortgage’s Mott, whose company worked with XINNIX in the past, says the standards set by the business were exceptional. “By systematically training our existing and new employees [with XINNIX], we were setting the stage for highly ethical practices and future lending success,” Mott says. The industry as a whole has forced loan officers to become more accountable, “but XINNIX has always been very passionate about taking care of the customer . . . from the start,” he says. ‘True and blue’ Casey was sitting in her office in 1995, when there was a knock at the door. A loan officer at the time, she was con- sidered one of her company’s top producers with Home- Banc in Atlanta. When she answered the door, she met Rob, who was then a financial consultant with Merrill Lynch. “I had a loan I needed to place and nobody would buy it,” Casey recalls. “Our depart- ment told me there was a guy from Merrill Lynch who needed three packages on the loan.” Rob still smiles when he hears Casey tell the story. “At the time, he had just recently come from flight school in the Air Force,” she says. “He asked me, ‘What kind of training did you have in order to get where you are?’ “You sort of have to figure it out,” Casey told Rob. Rob’s experience with military training, Casey says, laid the foundation for many of the ideas later realized through XINNIX. “We took the regimen training philosophy of his back- ground and my expertise in the mortgage field and blended it,” she says. “It gave us a very unique vantage point that a lot of people do not have.” The husband-and-wife team established XINNIX just four months after the events of Sept. 11, 2001. “I knew we started out at a time when there was tremendous risk, but I knew we had something extremely unique,” Casey says. Rob and Casey created XINNIX literally from scraps of notebook paper. “Within three months, we went national,” she says. “It was, in a sense, a new strategy, saying, ‘Let’s go after something that nobody’s done.’” Nearly a decade after its creation, Casey and Rob say they continue to pursue the highest and best training for program participants. Says Casey: “[The] mortgage [business] is true and blue. I live it, and I breathe it and love every single minute of it. Most of all, I love the fact that I’m able to teach and influence people all over the nation to reach their fullest potential in this industry.” MIB Frank Reddy is a freelance author based in Atlanta. He can be reached at fwredd@hotmail.com. 83MORTGAGE BANKING | JULY 201 1 In order to put trainees into the correct mindset, Rob adds, the trainers must first have “street credibility.”