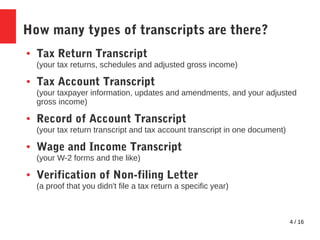

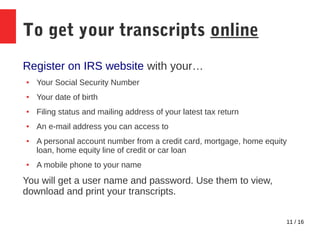

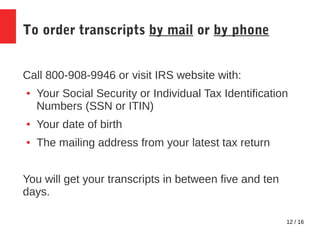

The document provides a comprehensive FAQ about federal tax transcripts issued by the IRS, detailing what they are, their types, and how they can be obtained. It explains that tax transcripts are not copies of tax returns but rather data tables reflecting one's tax situation, available through various methods. Additionally, it outlines who typically requests transcripts and clarifies that obtaining them is free, while obtaining actual tax return copies incurs a fee.