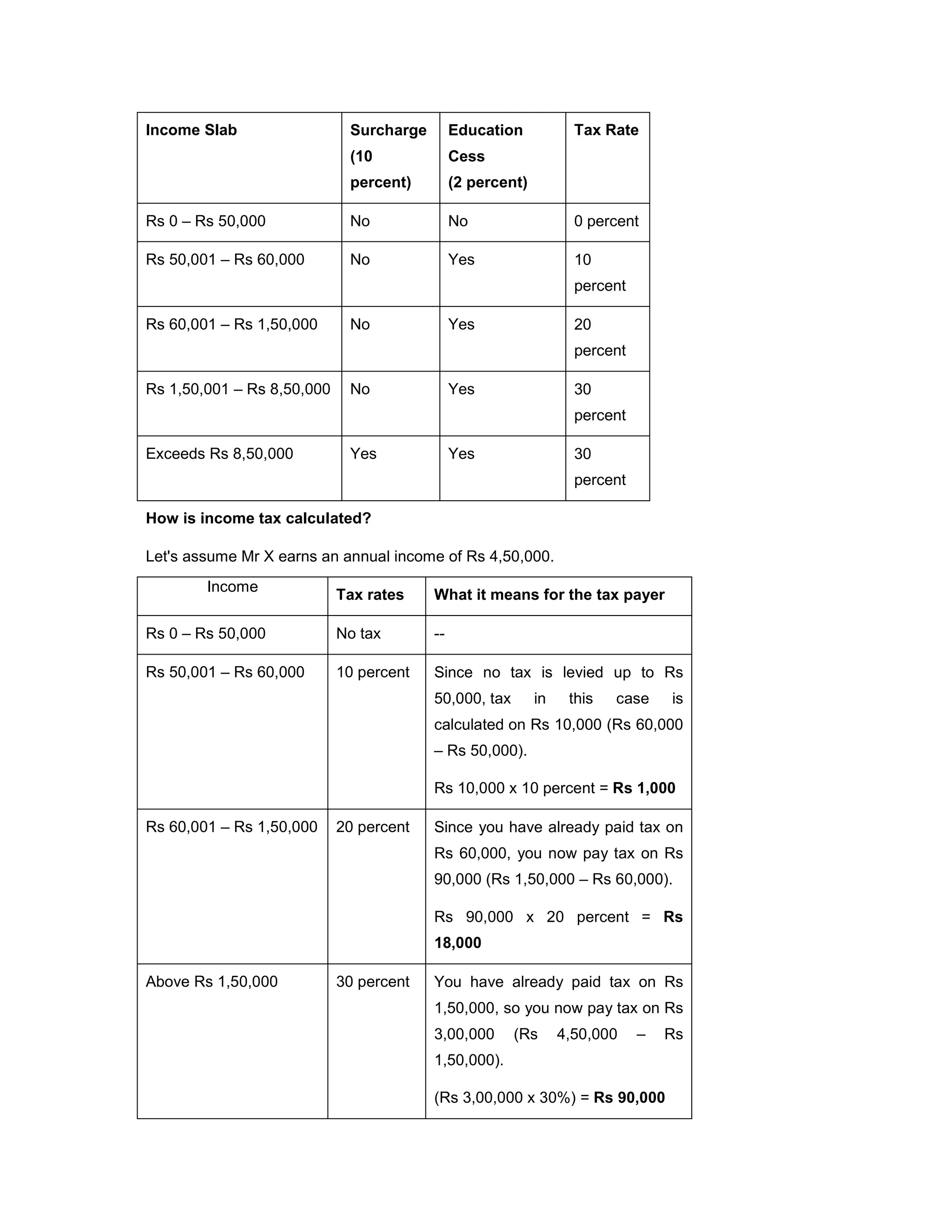

This document outlines India's income tax slab rates and calculates tax owed for two individuals. It shows five tax slabs with rates of 0%, 10%, 20%, 30%, and 30% plus a surcharge. For an income of ₹4,50,000, the individual owes ₹1,11,180 total including ₹1,09,000 in income tax, a 2% education cess of ₹2,180. For an income of ₹9,00,000, the individual owes ₹2,73,768 total, which includes ₹2,44,000 in income tax, a 10% surcharge of ₹24,400,