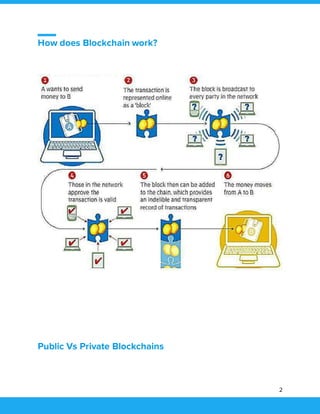

Blockchain technology allows for a distributed ledger of transactions and digital events that is shared among participants in a network. It allows transactions to be verified through consensus, recorded immutably on the blockchain, and provides a verifiable record of all transactions. The document discusses how blockchain works through public and private networks and provides examples of applications in supply chain management, the Internet of Things, tracking origins of goods, and smart contracts. It also covers challenges and opportunities of adopting blockchain technology.