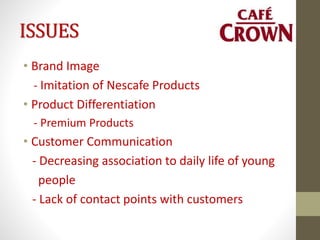

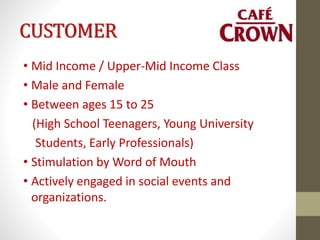

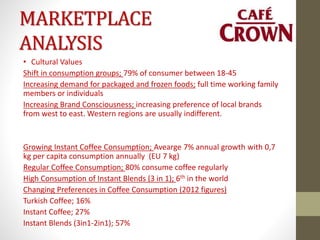

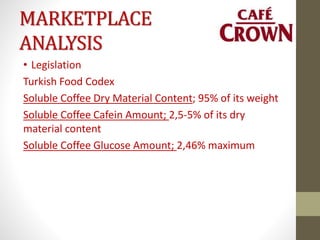

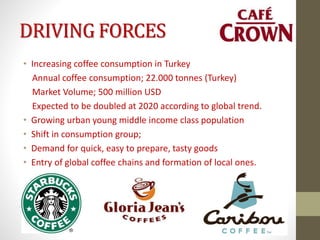

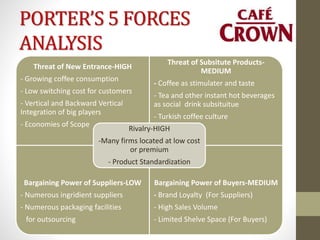

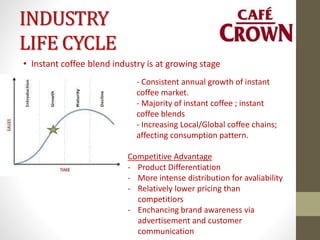

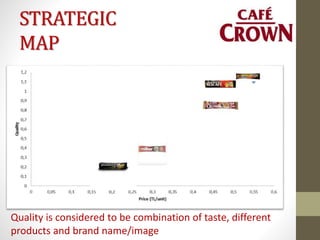

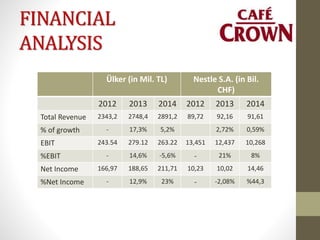

Café Crown is analyzing its brand image, product differentiation, and customer communication issues. It aims to attract the mid to upper-mid income, young Turkish customer between ages 15-25. While affordable and convenient, Café Crown faces imitation from Nescafe and lacks premium products. The Turkish coffee market is growing as urbanization and youth population increases, but economic challenges remain. Café Crown should enhance its brand image, introduce premium products through cobranded lines, and increase customer contact through social media, vending machines, and sponsored events.

![SWOT

ANALYSIS

Strenghts

- Brand Name [KSF]

- Affordable Price [KSF]

- Strong Distribution Channlels [KSF]

- Different Tastes [KSF]

-Brand Loyalty [KSF]

Oppurtunities

- Growing Coffee Consumption [DF, P5F, MA]

- Preference Towards Instant Blends [MA]

- Entrance of global coffee chains [DF]

- Formation of local coffee chains [DF]

- Rapid Urbanization [DF, MA]

- Increasing Young Population [DF, MA]

- Growing Middle Class [MA]

Weaknesses

- Decreasing Customer Communication [KSF,

Issue]

- Brand Image [Issue]

- Lack of Premium Products [Issue]

Threats

- Slowing economic growth [MA]

- Decreasing Purchasing Power [MA]

- Reaction of Turkish Coffee Providers [MA, PF5]

- Legislations limiting product differentiation

[MA]

- Bargainging Power of Buyers [PF5]

- Tea and other instant hot beverages [PF5]

- Growing market; competition [ILC]](https://image.slidesharecdn.com/stratejiv2-150713202032-lva1-app6891/85/Strateji-v2-17-320.jpg)