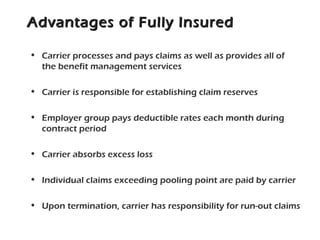

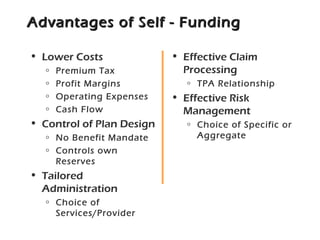

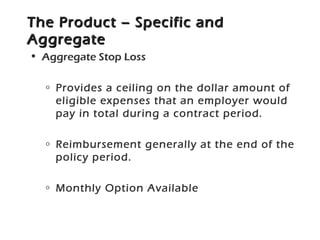

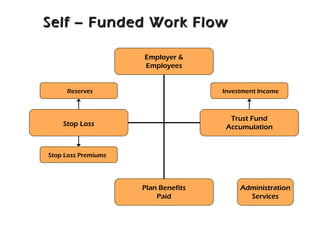

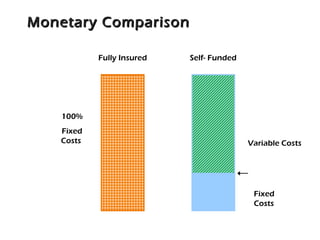

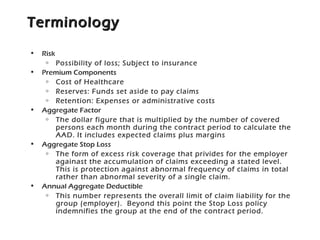

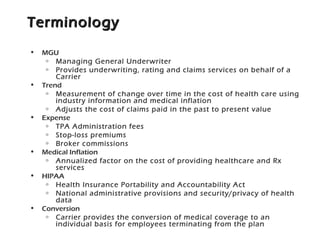

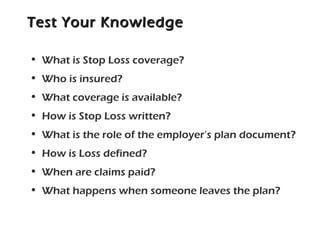

Stop loss coverage is a form of excess risk insurance that protects self-funded employer health plans. It helps manage costs for very large medical claims by having the insurance carrier pay for claims above a certain threshold amount.

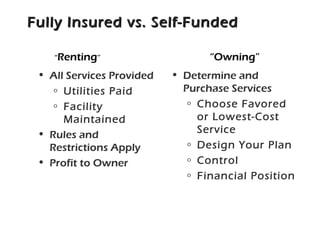

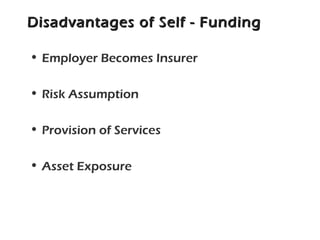

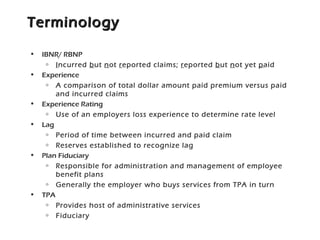

The plan fiduciary is responsible for the administration and management of an employee benefit plan. For a self-funded employer health plan, the employer is generally considered the plan fiduciary since they are responsible for purchasing administrative services, such as from a third party administrator (TPA). The TPA then provides various services on behalf of the employer plan.