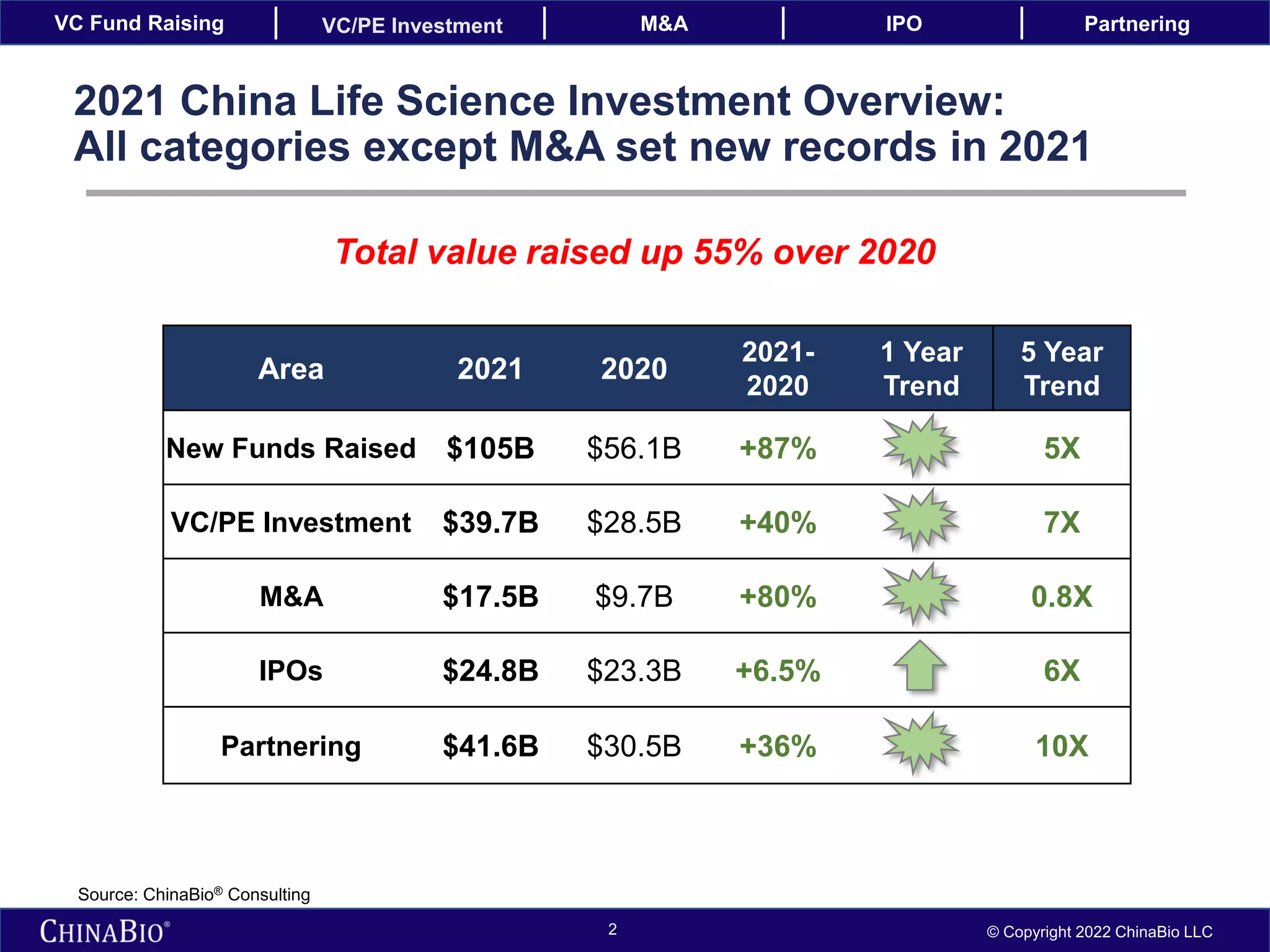

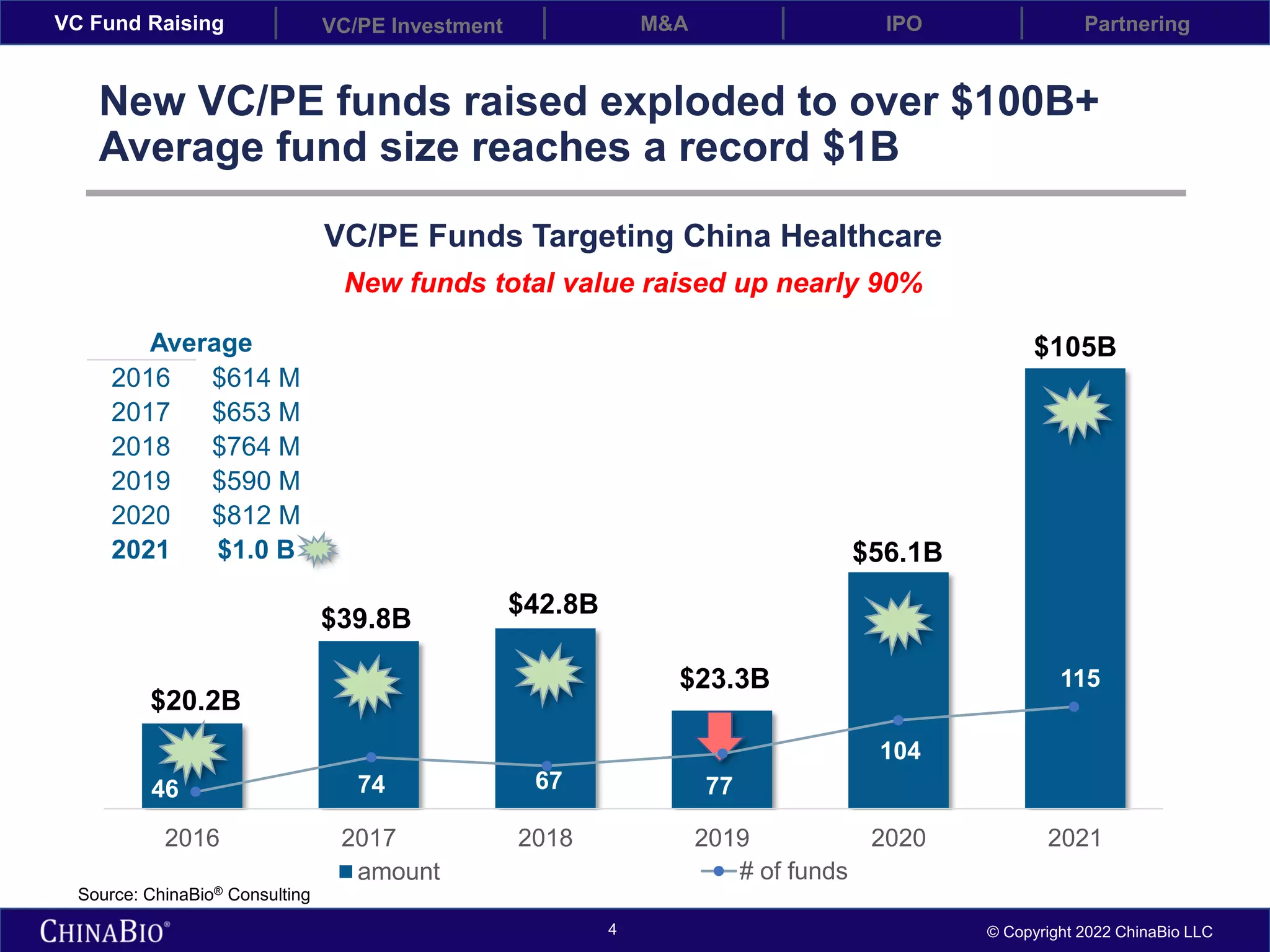

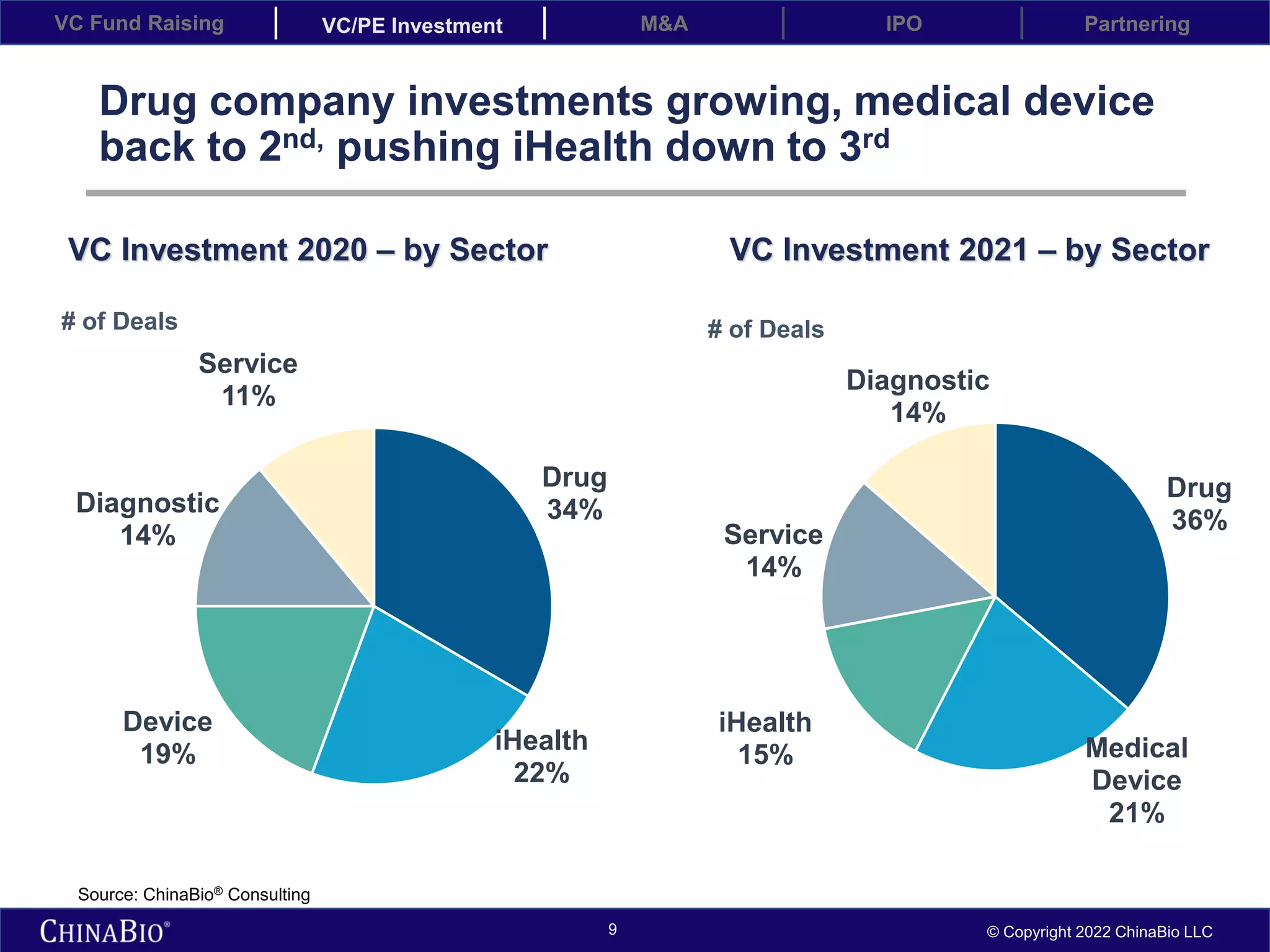

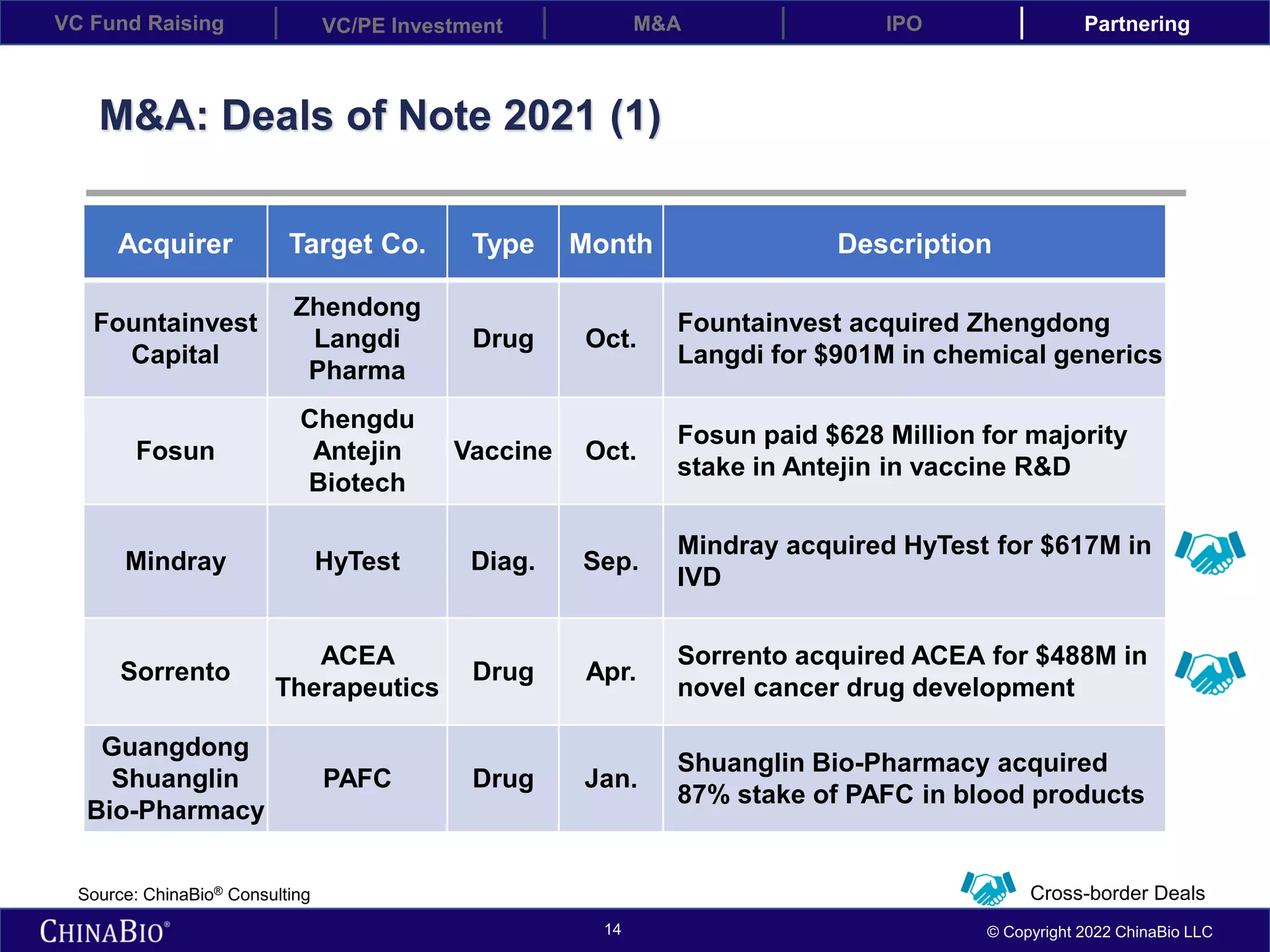

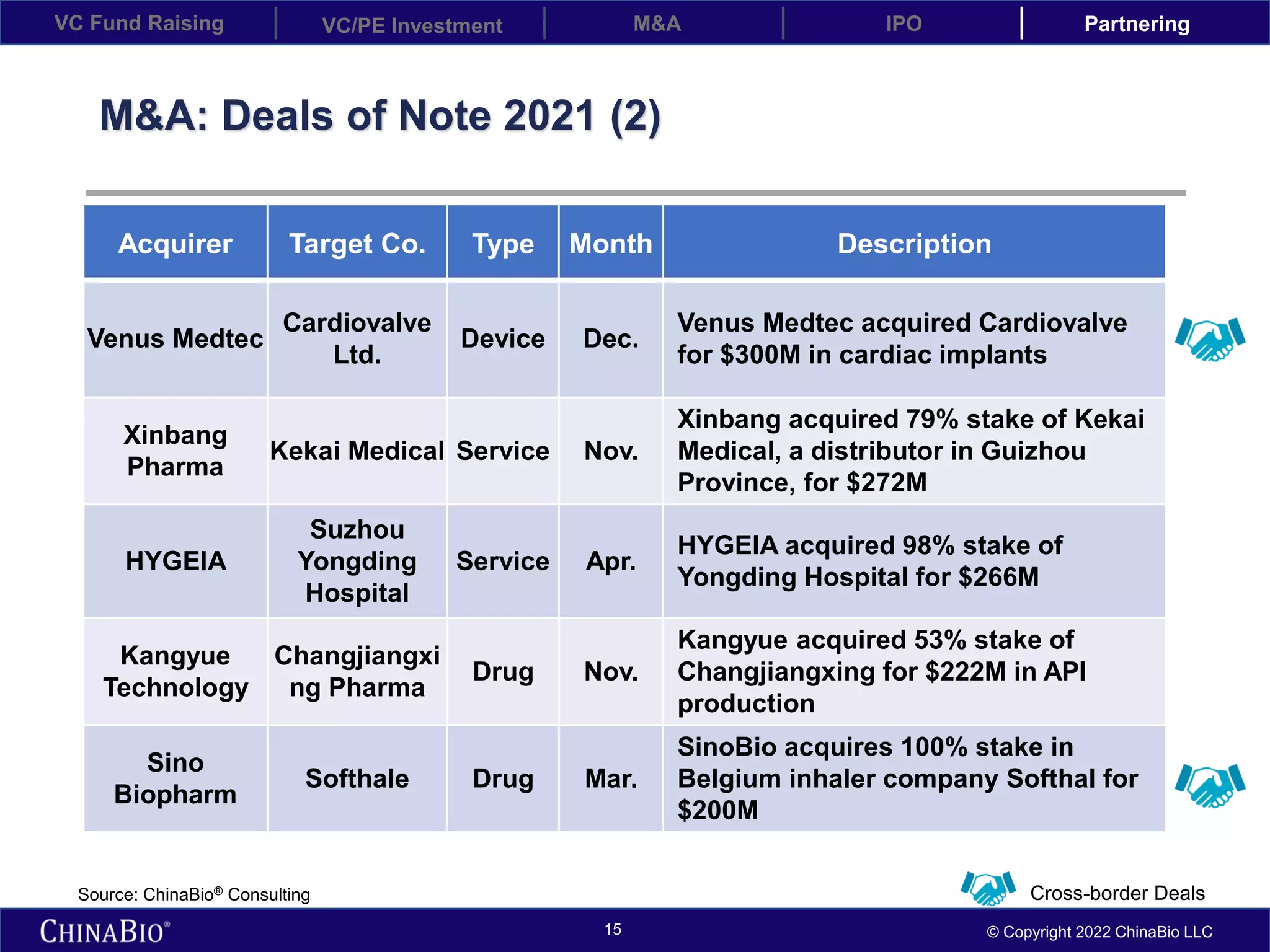

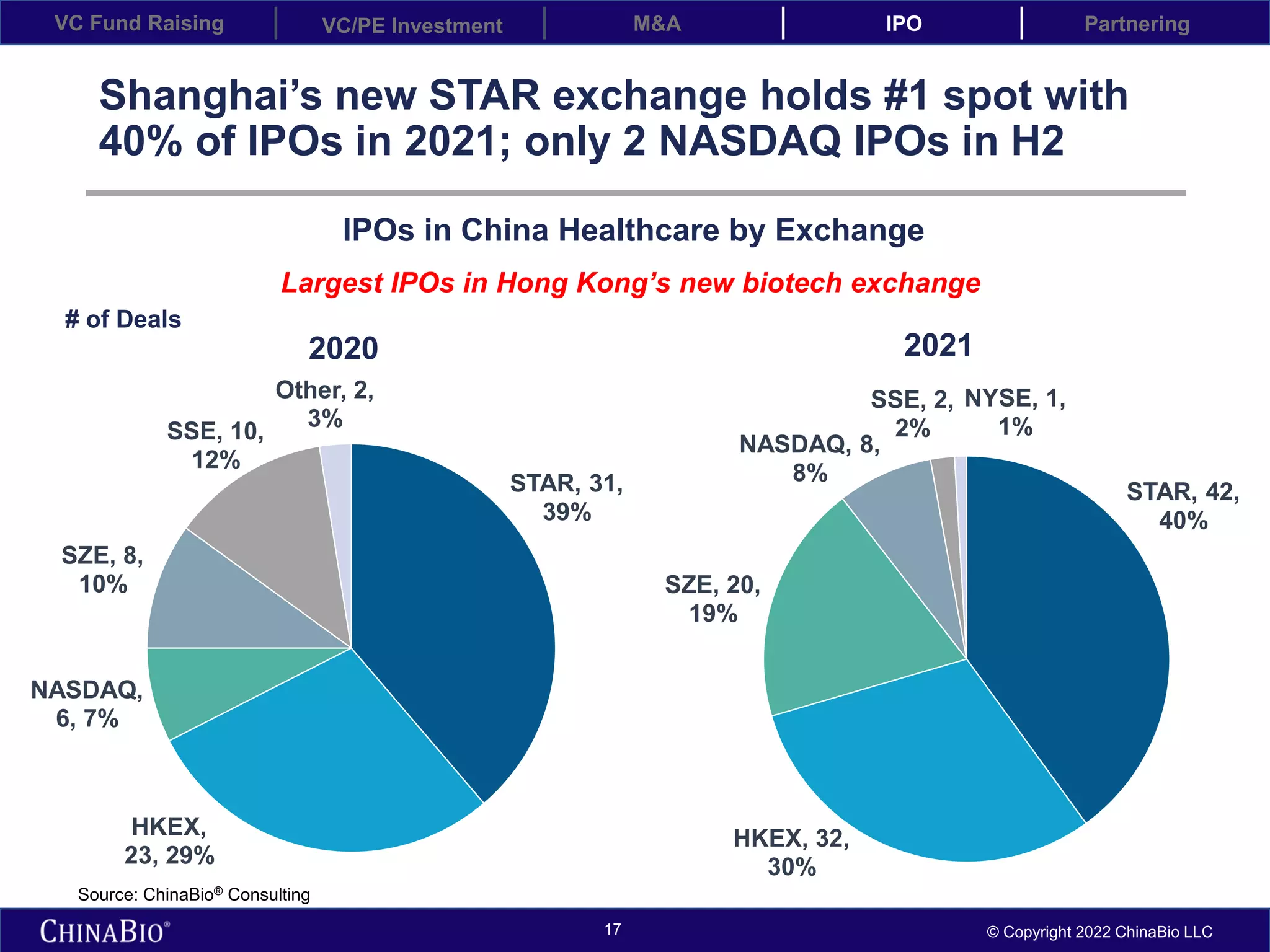

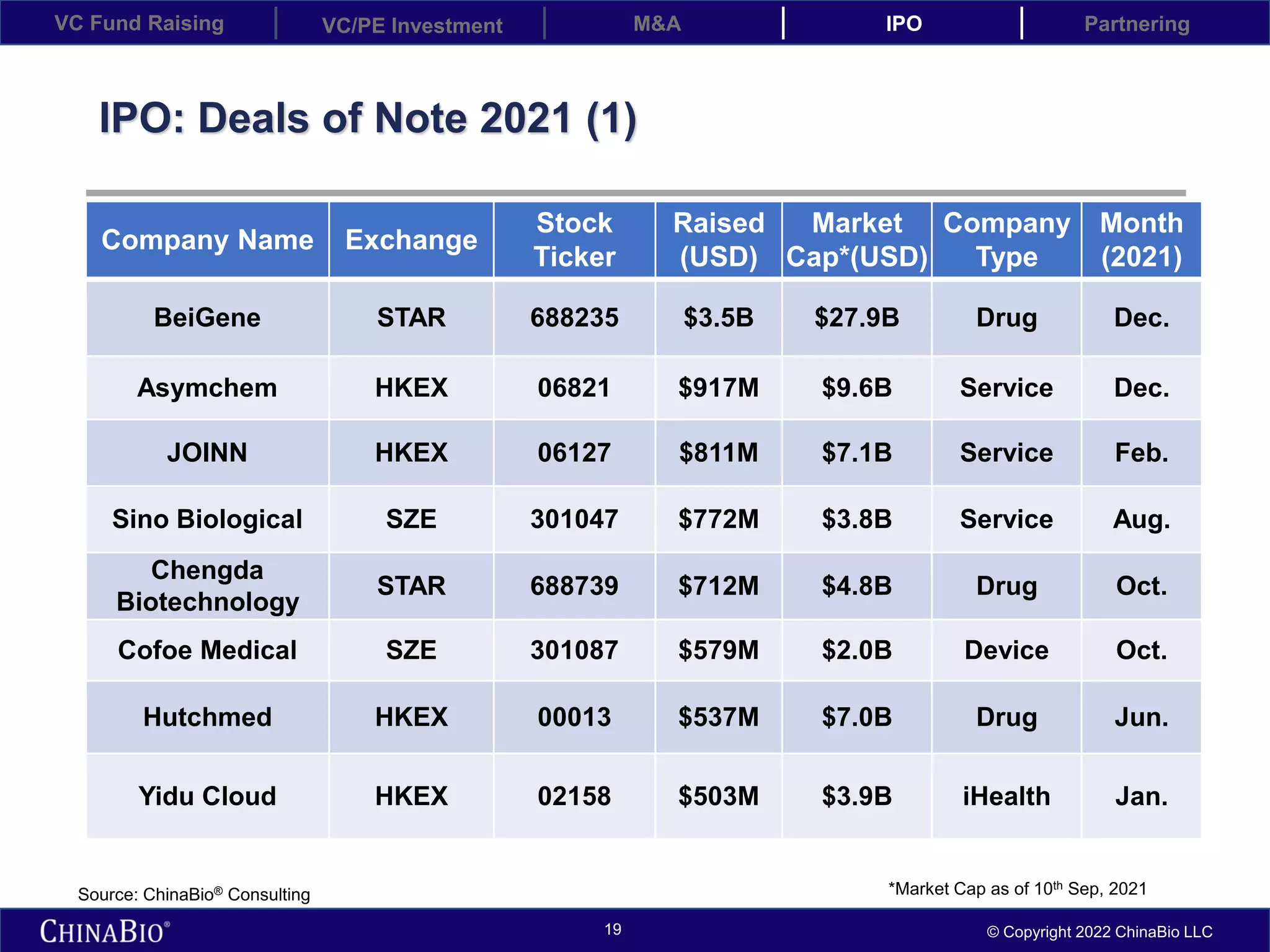

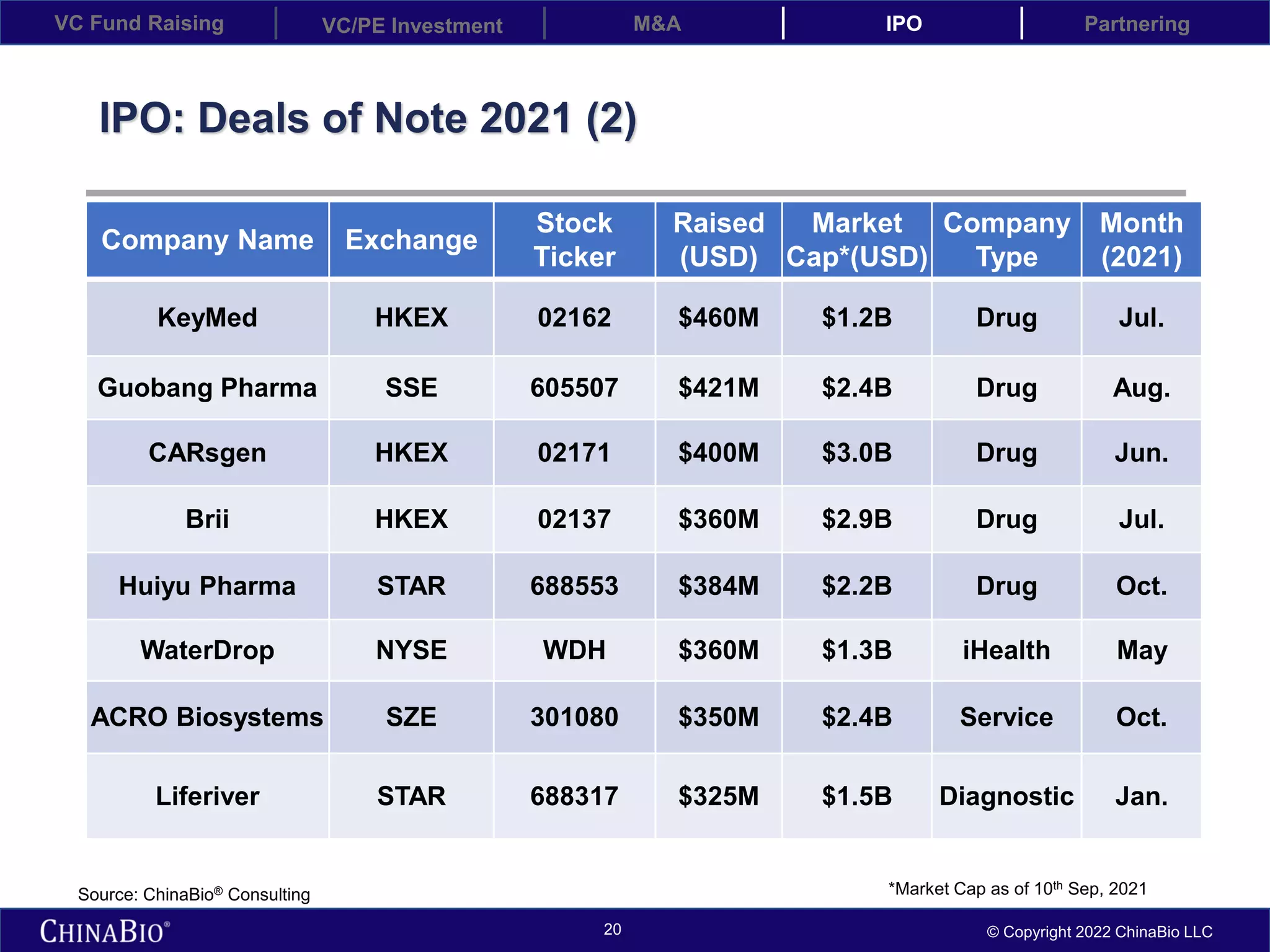

In 2021, China saw record investment levels across all categories except M&A. Total value raised was up 55% over 2020. VC/PE investment and new funds raised both set new records, increasing by 40% and 87% respectively. The top exchanges for IPOs were the Shanghai Stock Exchange STAR board and Hong Kong Exchange, with drug companies still representing the largest segment but devices and diagnostics growing. Major deals highlighted the increasing size and sophistication of investment in China's life science sector.