The document provides an overview of the forex market, including:

1) Forex is the largest market in the world with major currencies traded 24/7, allowing traders to choose their hours. It offers high leverage and liquidity to earn from rising and falling markets.

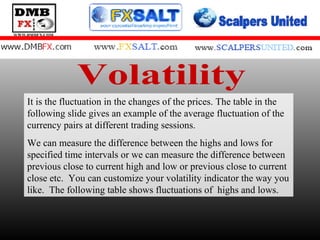

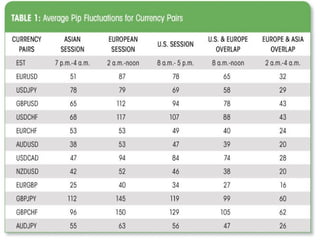

2) As an over-the-counter market without a central exchange, it has no common regulator and increased risks of fraudulent firms. Trading sessions overlap between Asia, Europe, and the US.

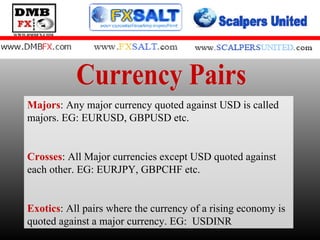

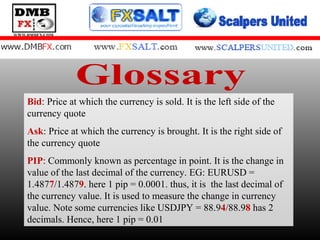

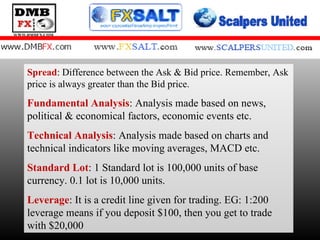

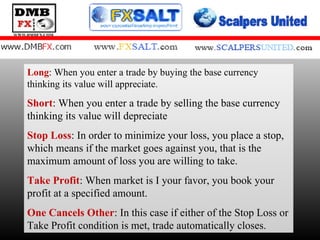

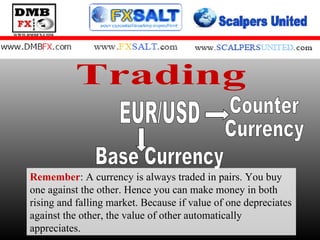

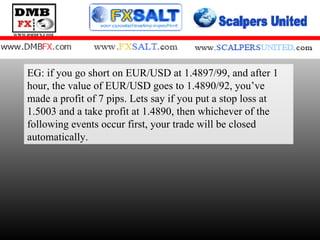

3) Major currency pairs include majors (USD pairs), crosses (non-USD pairs), and exotics (pairs involving emerging markets currencies). Key terms like bid, ask, pip, spread, leverage and position types are also defined

![Conclusion This presentation should help you get started with the trading. Kindly refer to the previous presentation for managing your trades. Furthermore you’ll also have more presentations on some intermediate and advanced modules to help you gain a better grip of the Forex market. For better results, kindly log on to www.fxsalt-in.com open an account and start practicing on the Demo. Meanwhile you can always reach me at [email_address] for any clarification or assistance.](https://image.slidesharecdn.com/forextradingforstarters-step1-091206013408-phpapp02/85/Start-Forex-Trading-Setp-1-15-320.jpg)