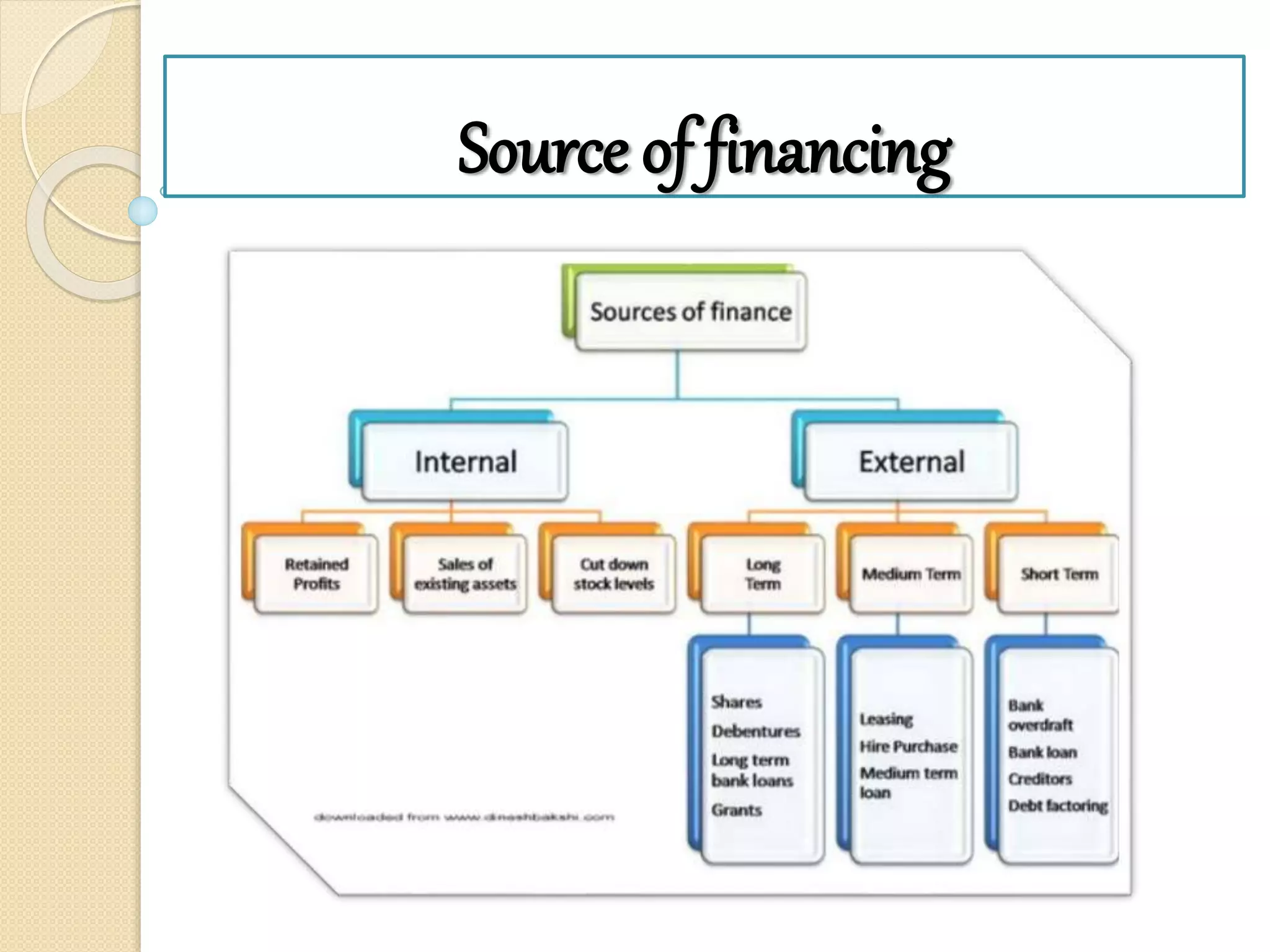

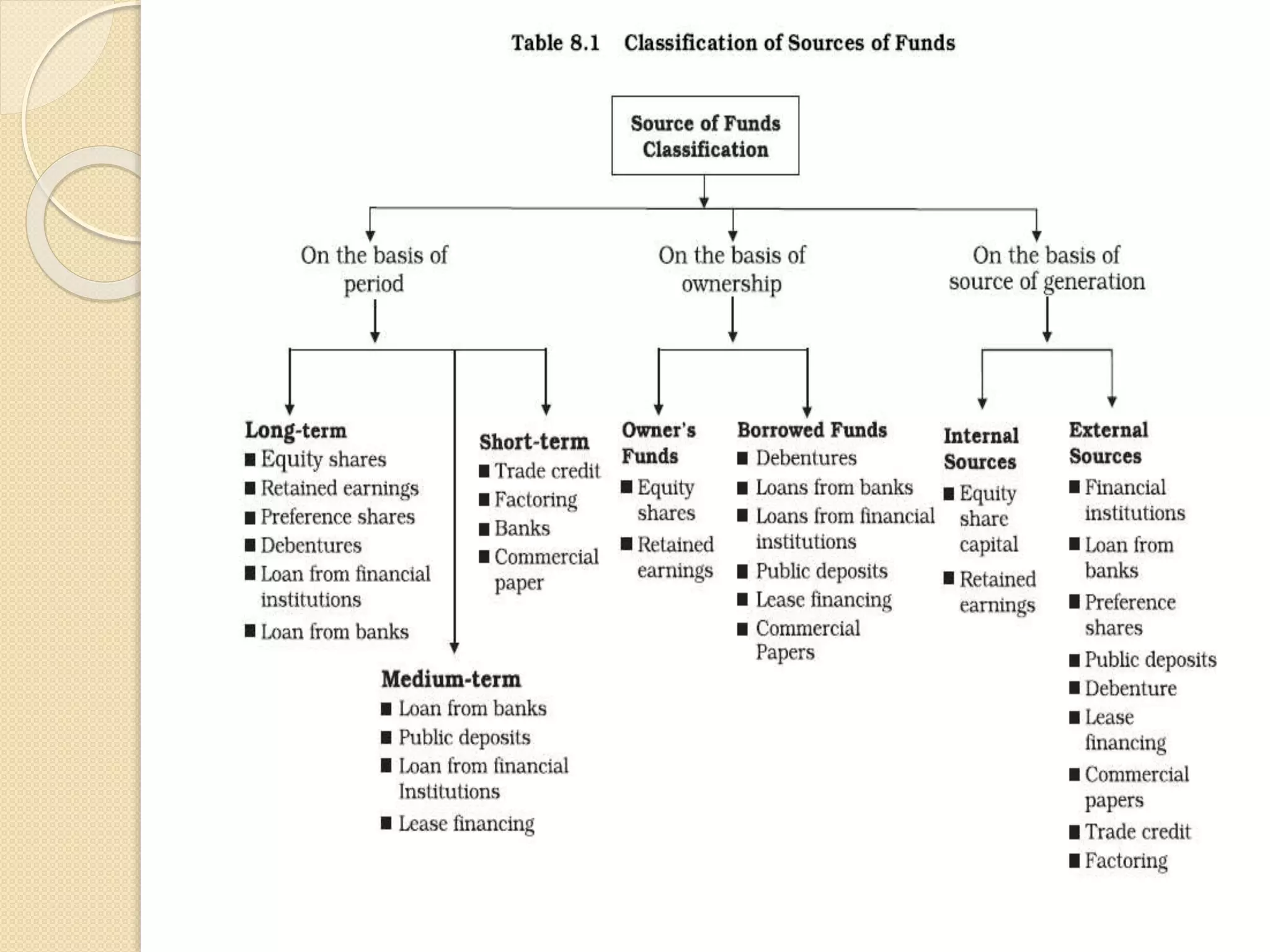

Equity shares represent ownership in a company and are an important source of long-term capital financing. Preference shares have preferential rights to dividends and assets but limited voting rights. Debentures are a form of debt where the company promises to repay the principal along with interest. Other sources of financing discussed include retained earnings, loans from banks and financial institutions, public deposits, trade credit, leasing, factoring, and commercial paper.