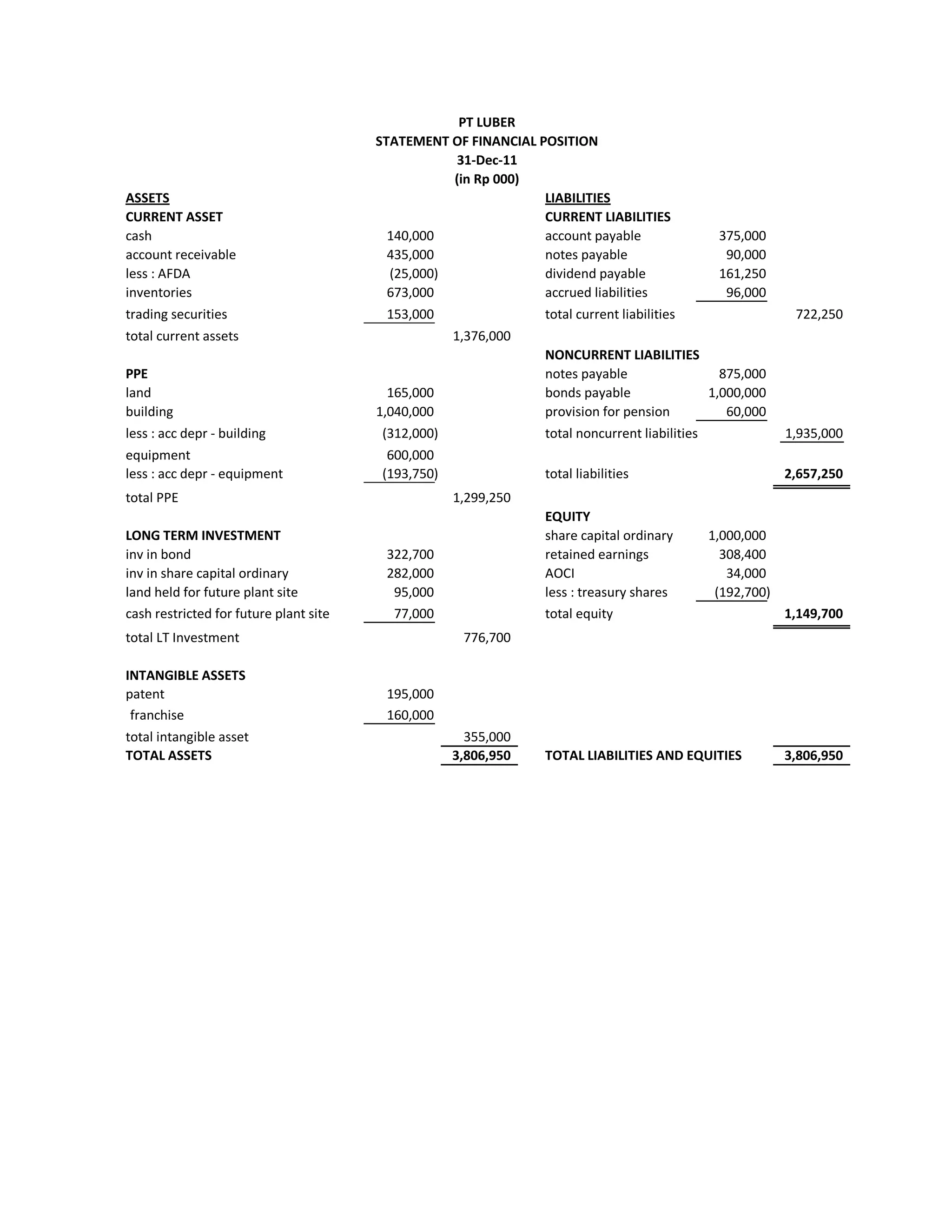

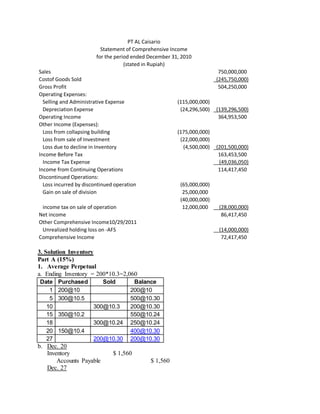

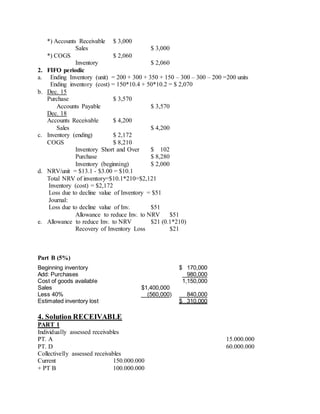

This document presents the statement of financial position and statement of comprehensive income for PT Luber and PT Al Caisario as of 31 December 2011 and 2010 respectively.

The statement of financial position of PT Luber shows total assets of Rp3.8 billion consisting of current assets, property and equipment, long term investments and intangible assets. Total liabilities are Rp2.7 billion comprising current and non-current liabilities. Total equity is Rp1.1 billion.

The statement of comprehensive income of PT Al Caisario for the year ended 31 December 2010 shows net income of Rp86 billion comprising income from continuing and discontinued operations, offset by comprehensive loss of Rp14 billion.