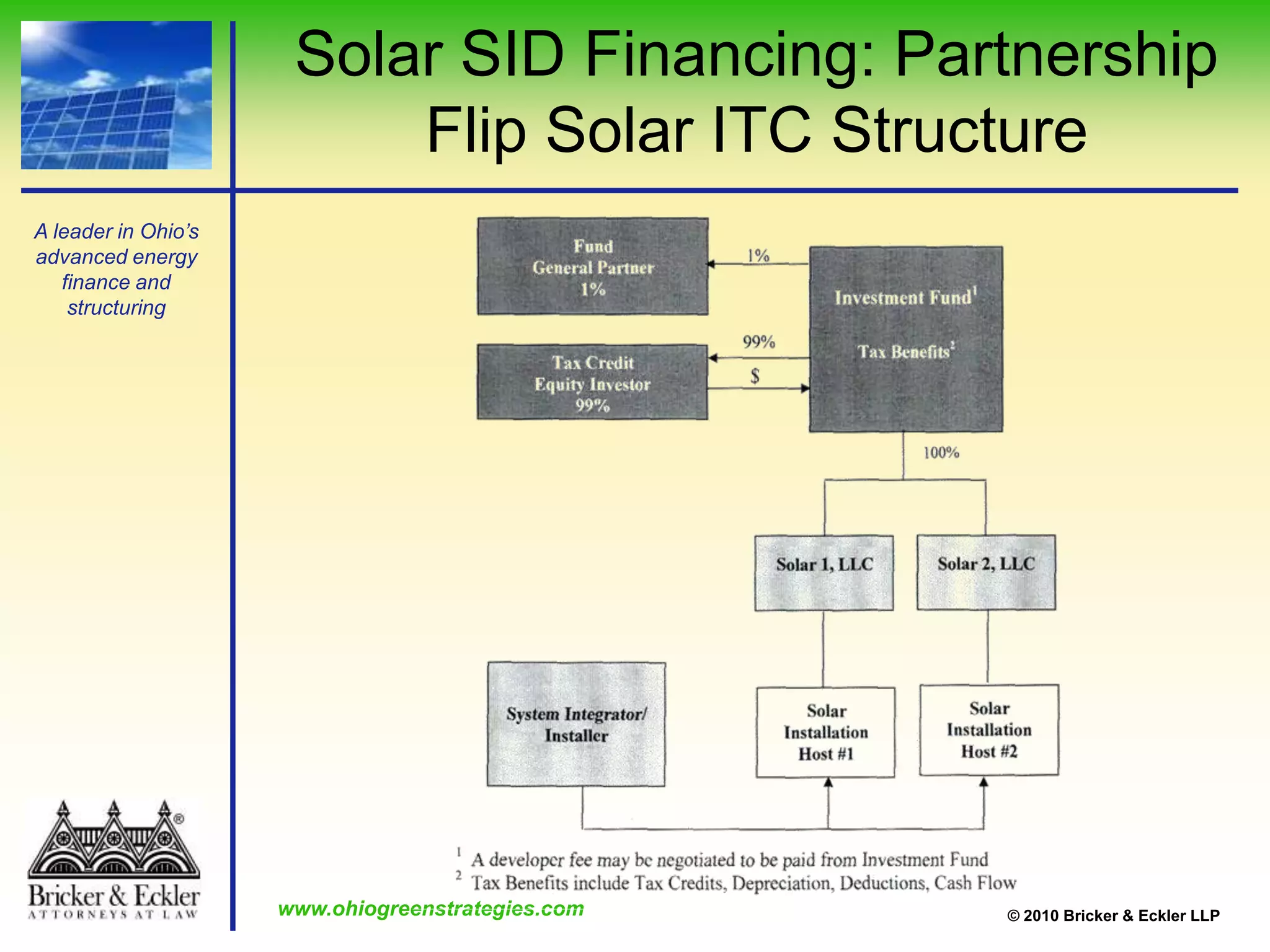

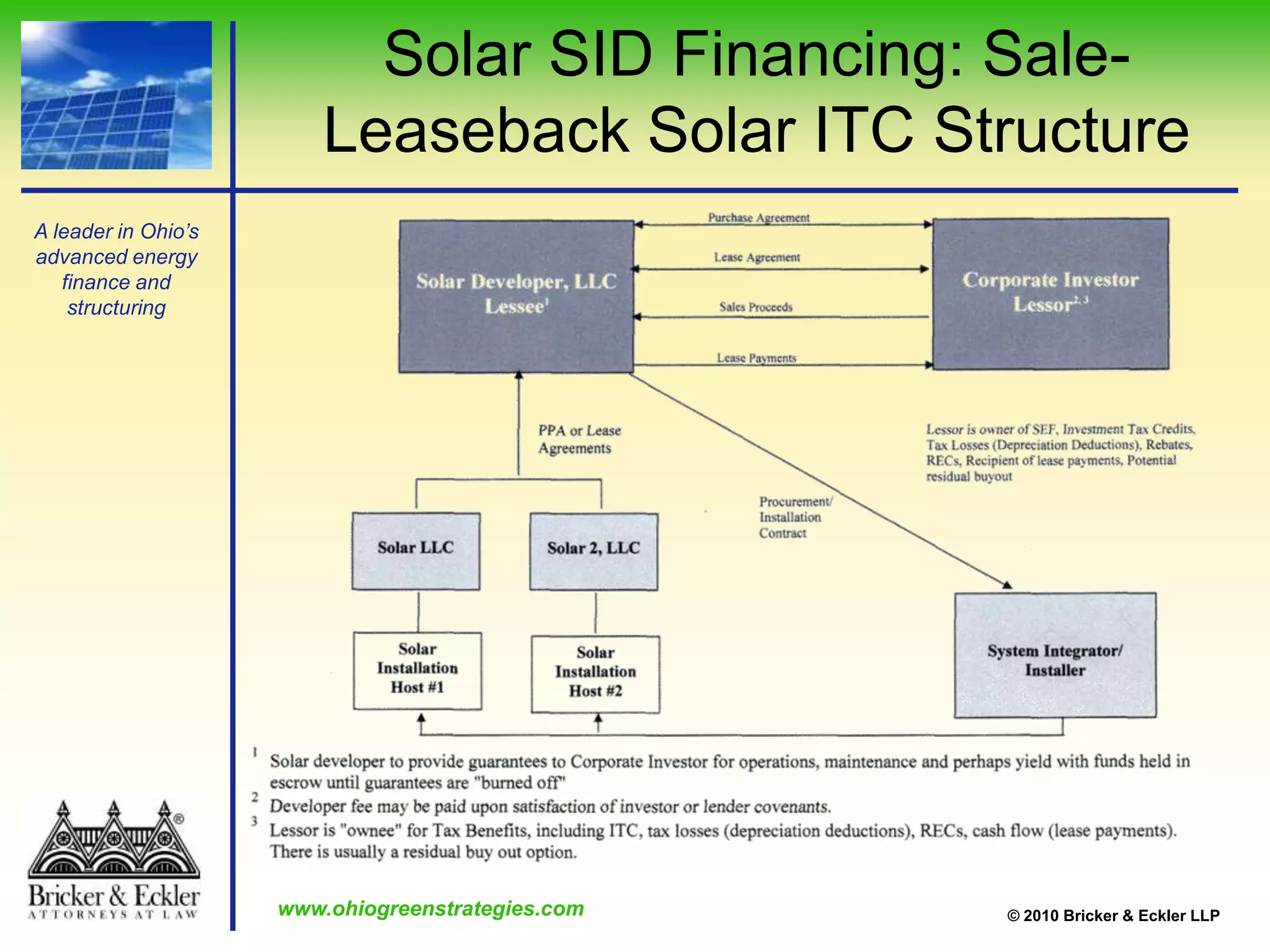

The document discusses solar financing programs and federal incentives in Ohio. It describes Ohio House Bill 1, which allows property assessed clean energy (PACE) financing for solar improvements. This includes the creation of special improvement districts (SIDs) to finance upfront costs through special assessments. The document outlines the SID process and various financing options like bonds, federal tax credits, and Department of Energy loan guarantees. It also discusses Senate Bill 223, which expands SID authority to other energy projects.