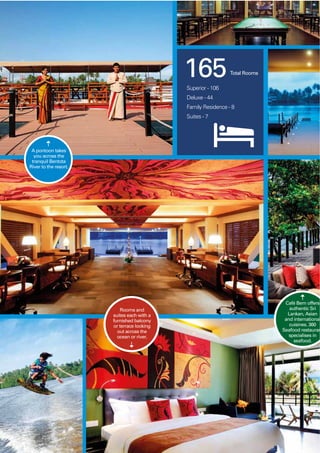

The document provides an overview of Softlogic Holdings PLC, a leading diversified group in Sri Lanka with interests in six business sectors - ICT, Retail, Financial Services, Healthcare Services, Automobiles and Leisure. It discusses Softlogic's vision, core values of integrity, accountability, humility, simplicity, passion and focus on success. The document also highlights some of Softlogic's achievements and developments in 2014/15, including the opening of its first resort Centara Ceysand Resort & Spa, launching an online retail store and introducing new brands like Tommy Hilfiger to Sri Lanka.

![100

Softlogic Holdings PLC

Audit Committee Report

SCOPE

The responsibilities of the Committee

are set forth in the written Terms of

Reference (TOR), a revised version of

which was adopted by the Board on 8

July 2015.

The Committee will not engage directly

with Group companies covered by other

audit committees established under

mandatory regulatory requirements; it

receives briefings on the activities of

these committees as necessary.

COMPOSITION

The Committee was chaired by

Desamanya P D Rodrigo until his

resignation from the Board on 30 June

2014, and thereafter by R A Ebell, who

was appointed a Director on 20 March

2014 and a member of the Committee

on 19 June 2014. Other members of

the Committee are:

Dr. S Selliah

Mr. W M P L De Alwis, PC

Mr. G L H Premaratne (appointed w.e.f.

19 June 2014)

Softlogic Corporate Services (Pvt) Ltd.,

served as Secretary of the Committee up

to 30 June 2014. Mr D Vitharanage, Chief

Risk Officer Chief Internal Auditor (CRO/

CIA) served as Secretary thereafter.

ACTIVITY & FOCUS

The Audit Committee has primarily

focused during the year on its

responsibilities for monitoring:

• integrity of the Company’s and

Group’s financial statements,

including the reasonableness of

assertions made in their preparation,

the appropriateness of accounting

policies used and the adequacy of

presentation and disclosures made;

• effectiveness of internal control

over financial reporting;

• the work and performance of the

internal auditors;

• the Company’s relationship with

its External Auditors, auditor

independence and performance, and

the management’s responsiveness

to external audit; and

• procedures in place to examine,

regularly, the Company’s ability to

continue as a going concern in the

foreseeable future.

The Committee meets quarterly to

review and make recommendations

on the quarterly and annual financial

statements before they are considered

and approved by the Board for release

to shareholders and the public. It also

meets at other times to consider

matters arising from its review of the

financial statements and other subjects,

including internal audit findings and

reviews of specific businesses and

change initiatives.

The Committee has reviewed the plan for

reducing the number of External Auditors

deployed across the Group and reassigning

audits to improve audit cohesiveness. It has

also provided inputs in the determination of

KPIs and evaluation of performance of the

CRO / CIA.

MEETINGS & REPORTING

The Committee met fourteen [ 14 ]

times during the year.

Attendance at these meetings has been

as follows:

Name Meetings

attended

Desamanya P D Rodrigo 2 / 2

Mr. R A Ebell 13 / 13

Dr. S Selliah 14 / 14

Mr. W M P L de Alwis, PC 12 / 14

Mr. G L H Premaratne 12 / 14

The Chief Financial Officer attends

all meetings by invitation, and other

members of Senior Management attend

meetings by invitation as required.

The External Auditors attend meetings

by invitation when their presence is

necessary; discussion of their major audit

and review findings is a key component

of those meetings. The Committee

further meets with the External Auditors,

with no members of management

present, to cover contentious matters

and matters they wish to discuss in

confidence with the Committee.

The Committee makes written

reports to the Group Chairman /

Managing Director, for dissemination

to the Board, following each

quarterly meeting at which financial

statements are reviewed prior to

a recommendation being made on

them. These draw attention to matters

requiring consideration and action.

The Committee also briefs the Group

Chairman /Managing Director from time

to time on matters of concern, at ad

hoc meetings or at meetings scheduled

by him with the Non-Executive

Directors.

REAPPOINTMENT OF EXTERNAL

AUDITORS

The Audit Committee has proposed

to the Board of Directors that

the incumbent auditors, Ernst &

Young, Chartered Accountants be

recommended for re-appointment for

the year ending 31 March 2016 at the

upcoming Annual General Meeting.

R A Ebell

Chairman (w.e.f. 1 July 2014)

Audit Committee

31 July 2015](https://image.slidesharecdn.com/d0224a0d-65da-4440-bc53-708e4d79a916-160528111301/85/Softlogic-Holdings-PLC-102-320.jpg)