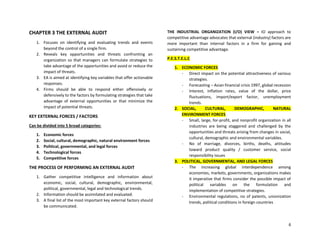

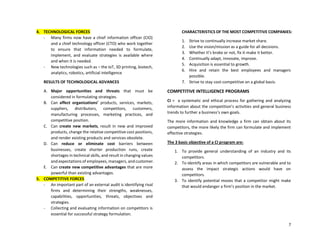

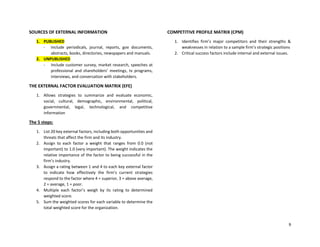

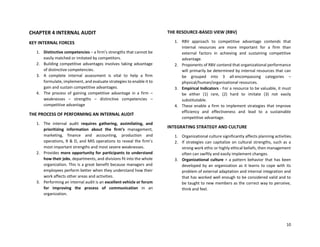

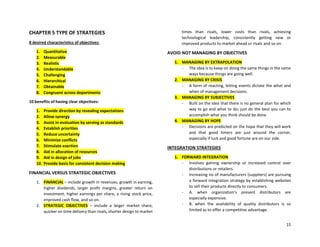

Strategic management involves formulating, implementing, and evaluating cross-functional decisions to achieve organizational objectives. It integrates various business functions to achieve success. There are three stages: strategy formulation, implementation, and evaluation. Strategy formulation develops the vision, assesses strengths/weaknesses and opportunities/threats, and establishes objectives and strategies. Implementation requires establishing policies and allocating resources to execute strategies. Evaluation reviews factors, measures performance, and takes corrective actions. A clear vision and inspiring mission provide direction and motivate employees by clarifying the organization's purpose.