This document provides an overview and guide to mobile commerce. It discusses how mobile is impacting business and society globally and outlines opportunities for various industries, including banking, retail, and telecommunications, to engage customers and build loyalty through mobile commerce strategies in both developed and emerging markets. The guide contains insights from industry experts on topics such as mobile payments, digital money, mobile banking, financial inclusion, and harnessing mobile technologies to connect with consumers.

![161160 Mobile Commerce Guide Engage Customers and Build Loyalty in Developed and Emerging Markets

between you and your customers. But be

careful not to get distracted, or overwhelmed

by technology. Your strategy must be

customer-focused first. As technology

changes, the principles of loyalty marketing

remain the same, and so does the require-

ment to court the customer with care.

Article inspired from insights contained in

Gary’s new book, Fast Shopper, Slow Store:

A Guide to Courting and Capturing the

Mobile Consumer.

Gary Schwartz has been named the Mobile

Commerce Evangelist of the Year 2013.

Schwartz has been at the frontlines of the

mobile industry for over a decade and is the

author of two books including The Impulse

Economy. Schwartz is also a chair at

emeritus mobile for the Interactive Advertising

Bureau and the Mobile Entertainment Forum

NA. As president of Impact Mobile for

the past 12 years, he has helped retailers

leverage mobile technology to advance their

marketing goals.

By creating a frictionless small-screen

experience for the shopper, national retailers

such as Hot Topic, specialized in music and

pop culture inspired fashion, have repeatedly

harnessed mobile in the mix to achieve

measurable increases in store-based and

cloud-based checkout. In 2011, for example,

Hot Topic managed to generate nearly ten

times (!) the incremental sales off its loyalty

community by leveraging the mobile channel.

Hot Topic believes that adding mobile

messaging to existing CRM / email marketing

programs can produce a significant return

on its marketing investment, especially

during holiday marketing efforts. Indeed,

Hot Topic concludes that mobile messaging,

deployed in addition to email, increases

overall purchase intent and activity.

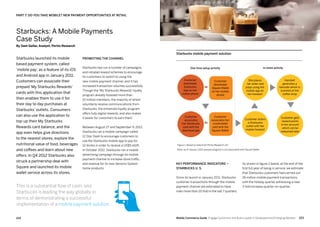

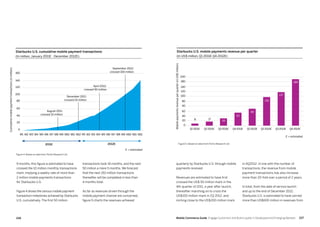

But it’s not just retailers like Hot Topic.We see

the same strategy deployed by My Starbucks

Rewards [See article: Starbucks: A Mobile

Payments Case Study] by using a clear SMS

activation channel on its push advertising.

Messaging, mobile apps, QR codes, NFC —

these and more can and must belong to your

toolbox of capabilities. Get ready to evolve

your strategy to enable direct interaction

However, mobile-optimized Websites also

have many advantages, allowing retailers to

address the needs of all their customers, not

just smartphone owners. From the customer

perspective, the mobile Web experience also

provides additional comfort (user-friendly

and familiar interface) and confidence,

in many cases taking the hassle out of

researching products and inputting data

to complete the transaction.

So, should a retailer build mobile apps into

their arsenal of capabilities? Or should they

focus efforts on ensuring their mobile Web

presence is optimized to remove the

friction from finding and buying online and

on the move?

It’s not a case of ‘either-or’. To get to the real

answers you need to think about what your

customers really want out of their mobile

commerce experience. The customer must

be your starting point.

So, let’s begin with an examination of

the mobile commerce use cases that are

relevant to your business.

Mobile apps vs. mobile Web is

the topic of heated debate in

the industry today. But could it

be that the question, and the

discussion around it, misses

the point completely? After all,

commerce is about customers,

not just technology. A closer

examination of the components

key to delivering an integrated

experience to customers shows

that a successful approach is

one that uses mobile apps and the

mobile Web in the right combination

to make shopping across all

channels seamless and personal.

A heated debate rages in the industry, one

that has spread to mobile commerce. The

avalanche of mobile apps have indeed whet

consumers’ appetite for apps that can assist

them every step of the shopping journey,

allowing them to make orders, check prices

or put together shopping lists at the

moment of inspiration.

Survival Guide: Evaluating

The App Vs. Web Debate

By Panagiotis Papadopoulos, Retail Mobile Lead, SAP

PART 5: RETAIL, CONSUMER PRODUCTS: MASSIVE OPPORTUNITIES AT THE INTERSECTION](https://image.slidesharecdn.com/b4faa761-b5a3-485c-ae7c-777c0330c22f-150526162608-lva1-app6892/85/SAP-mCommerce-Guide-2013-82-320.jpg)

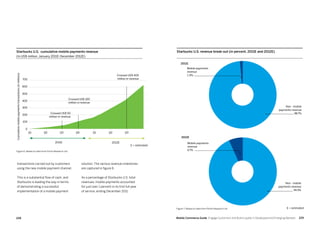

![233232 Mobile Commerce Guide Engage Customers and Build Loyalty in Developed and Emerging Markets

Near Field Communications (NFC)

is an interesting new technology

enabling the exchange of data

between two machines. It remains

to be seen, however, if NFC will

become the standard for mobile

payments. Mobile payments with

NFC and the Secure Element was

designed many years ago, before

wide adoption of smartphones,

ubiquitous, unlimited 3G and

4G networks, and public Wi-Fi

networks. More importantly, NFC

payments fail to accomplish the

single greatest need of merchants,

which is reducing transaction fees.

Also, there are other payment

methods that have evolved that

are far more focused on harness-

ing the unique capabilities of

mobile to enable payments and

— ultimately — encourage

engagement. This evaluation of

the alternative mobile payment

technologies outlines the benefits

and drawbacks, to conclude

that the ideal solution may be a

combination of 'all of the above'.

Simply put, NFC is a wireless technology

to exchange data between two machines

that are close to each other. NFC is much

easier to use and more secure than existing

versions of Bluetooth or other wireless

technologies. NFC opens many exciting

scenarios for shoppers such as the ability

to tap a product and see a video, interact

with a smart poster, or even pay for goods

and services. These scenarios, as well as

many others unrelated to mobile retailing,

will help to drive widespread adoption of

NFC over time.

Several years ago, banks, mobile operators,

and technology companies defined the

Secure Element1

to securely store private

data (such as credit cards) on a mobile

device and transmit that data using NFC.

The aim was to enable customers to store

credit cards on their mobile phones instead

of in their wallets, thus requiring minimal

changes to the existing payment ecosystem.

Unfortunately, when NFC payments were

designed, merchants and retailers were

absent from the discussion. Most retailers

were waiting for widespread smartphone

adoption before worrying about mobile

payments. Others did not understand the

sweeping changes that mobile payments

could bring. If retailers and merchants had

been part of the discussion, they would have

insisted that any payment solution should

decrease the costs and risks of plastic

credit and debit cards, such as transaction

fees, PCI compliance costs, POS costs, and

credit card dispute resolution overhead.

NFC is a good technology for some mobile

payment scenarios, especially when the

payer and the payee are not connected to a

network, such as when paying for tickets at

a subway station. However, there are many

other payment scenarios that NFC cannot

support, such as prepayment, money

transfer and omni-channel payments.

In addition, many merchants and retailers

have their own private label credit cards

that they want to encourage customers

to use because they have low transaction

costs. NFC effectively blocks merchants

from getting these cards to the top of the

wallet, which tends to discourage rather

than encourage use. Merchants are also

concerned that NFC payment solution

providers would serve up advertisements

for products from competitive retailers.

Interestingly, several industry executives

have recently voiced these concerns.

• Mike Cook, VP and Assistant Treasurer

of Wal-Mart, stated …I don't think [NFC

is] becoming a technology that will

handle payments.

• Keith Rabois, COO of Square, points out

that NFC has no value proposition for

consumers and merchants and stated:

I've never met a single merchant in the

U.S. who says 'I want this NFC thing.

• David Marcus, president of PayPal, also

spoke out at against NFC at the DLD

conference in Germany earlier this

Weighing The Alternatives To NFC

By Mickey Haynes, Global Principal, Mobility Solutions for Retail, SAP

PART 7: DO YOU TAKE MOBILE? NEW PAYMENT OPPORTUNITIES AT RETAIL

FOOTNOTE

1. A secure element (SE) is a tamper-resistant platform (typically a one chip secure

microcontroller) capable of securely hosting applications and their confidential and

cryptographic data (e.g. key management) in accordance with the rules and security

requirements set forth by a set of well-identified trusted authorities](https://image.slidesharecdn.com/b4faa761-b5a3-485c-ae7c-777c0330c22f-150526162608-lva1-app6892/85/SAP-mCommerce-Guide-2013-118-320.jpg)