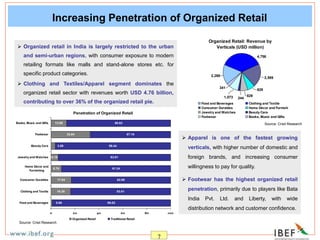

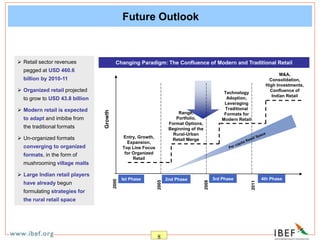

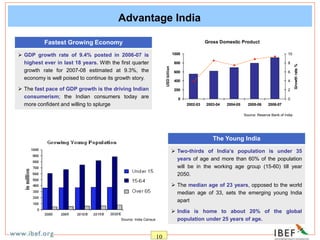

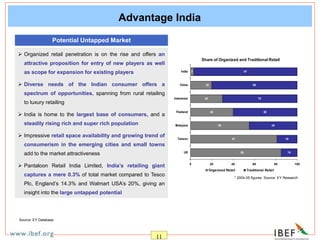

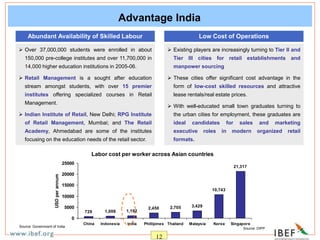

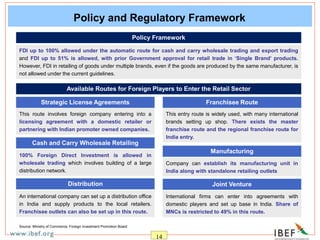

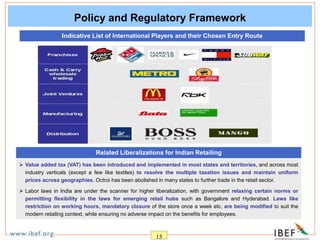

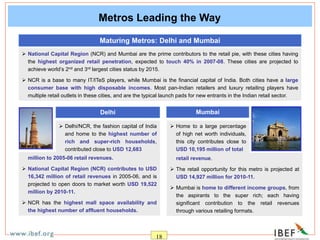

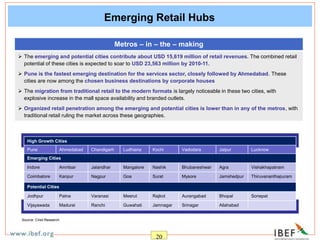

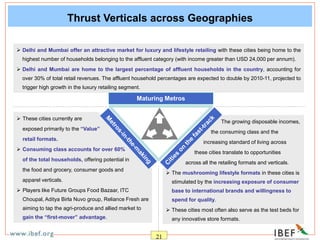

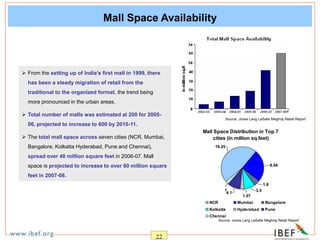

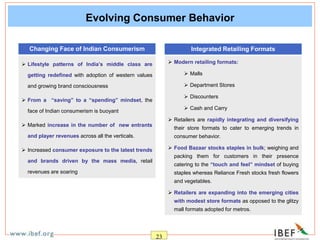

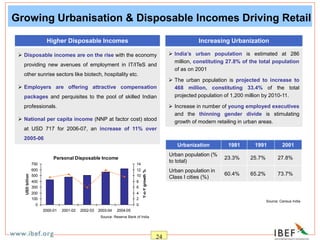

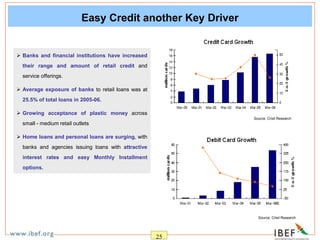

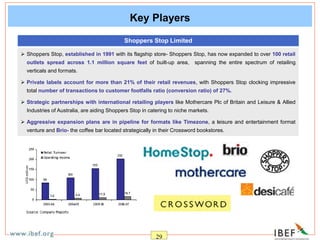

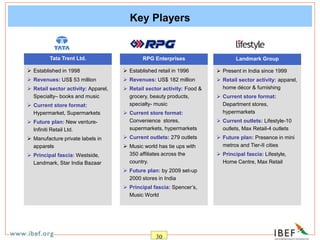

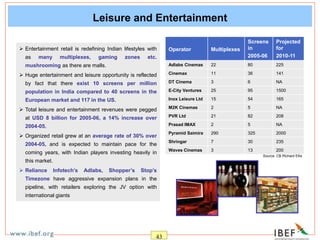

The document provides an overview of the Indian retail sector in October 2007. It notes that India's retail sector is growing rapidly at over 27% in the next 5-6 years, fueled by high GDP growth, rising incomes, and increasing consumerism. Organized retail is a small but growing segment, projected to increase from 4.15% of retail sales in 2005-06 to over 12% by 2010-11. Key trends include the migration from traditional to modern retail formats, dominance of the food and beverages category, and higher penetration of organized retail in major cities like Delhi and Mumbai. The policy environment is also becoming more conducive to retail growth.