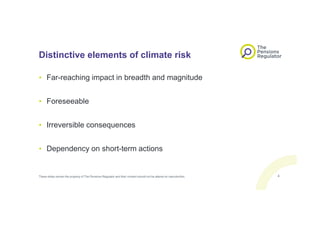

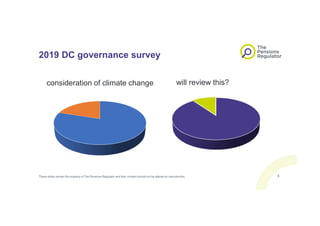

The document discusses new regulations in the UK requiring pension funds to consider climate-related financial risks and opportunities when setting investment strategies. Trustees will need to publish disclosures on their approach by 2022. Climate change poses far-reaching financial risks to investments from physical impacts and the transition to a low-carbon economy. Pension schemes can be affected through impacts on asset values and sponsoring companies. The Pensions Regulator will review whether schemes are properly considering climate change risks in line with their duties.