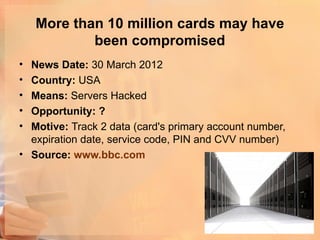

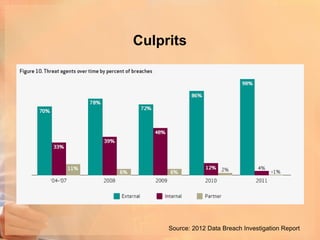

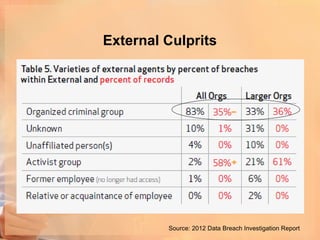

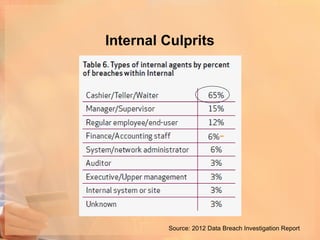

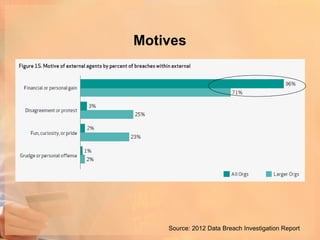

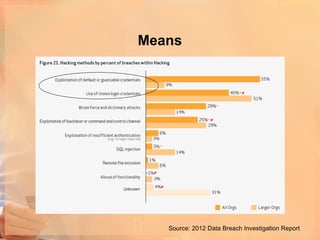

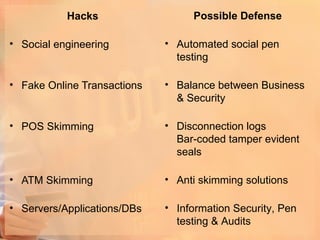

This document discusses recent payment card industry hacks, including international and regional incidents from 2012. It provides statistics on the culprits behind these hacks (both external and internal actors), their motives (usually financial gain), and the means used (including social engineering, skimming devices, and hacking servers or databases). Some possible defenses are proposed, such as implementing social engineering tests, enhancing physical security of POS and ATM machines, strengthening server security through testing and audits, and balancing business needs with security.