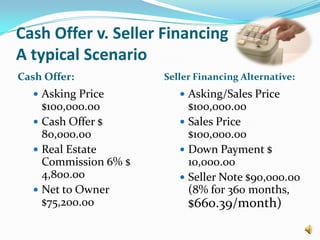

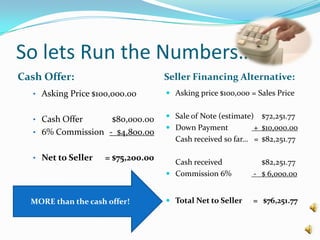

This document provides tips for sellers to finance property sales themselves in order to sell for a higher price and increase realtor commissions. It argues that seller financing will attract more buyers as it is easier to qualify, allow the property to sell at the asking price rather than a reduced price, and increase the realtor's commission which is based on the final sale price. It provides examples of how seller financing could yield a higher net return for the seller than an all-cash offer. It emphasizes the importance of only seller financing deals with buyers who have good credit and payment history to ensure the best terms.