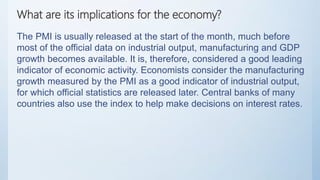

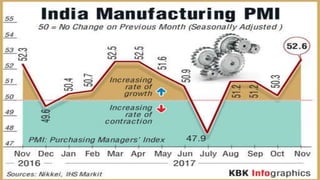

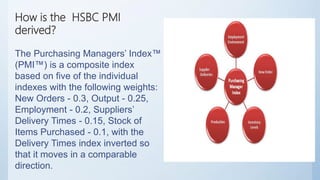

The Purchasing Managers' Index (PMI) is a survey-based measure of business activity in the manufacturing and services sectors. It asks respondents about changes in key business variables from the previous month. A PMI above 50 indicates expansion, while a figure below 50 indicates contraction. The PMI provides an early indicator of economic activity and is watched closely by central banks and financial markets. Recent PMI figures in India have declined due to reforms like demonetization and GST implementation, but are expected to gradually recover as businesses adapt to the new systems.

![• PMI data are presented in the form of a diffusion index, which is calculated

as follows:]

• where:

• P1 = Percentage number of answers that reported an improvement.

• P2 = Percentage number of answers that reported no change.

• P3 = Percentage number of answers that reported a deterioration.

• Thus, if 100% of the panel reported an improvement, the index would be

100.0. If 100% reported a deterioration, the index would be zero. If 100%

of the panel saw no change, the index would be 50.0 (P2 * 0.5).

Formula & calculation](https://image.slidesharecdn.com/purchasingmanagersindex-180325154242/85/Purchasing-managers-index-4-320.jpg)